Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

Context

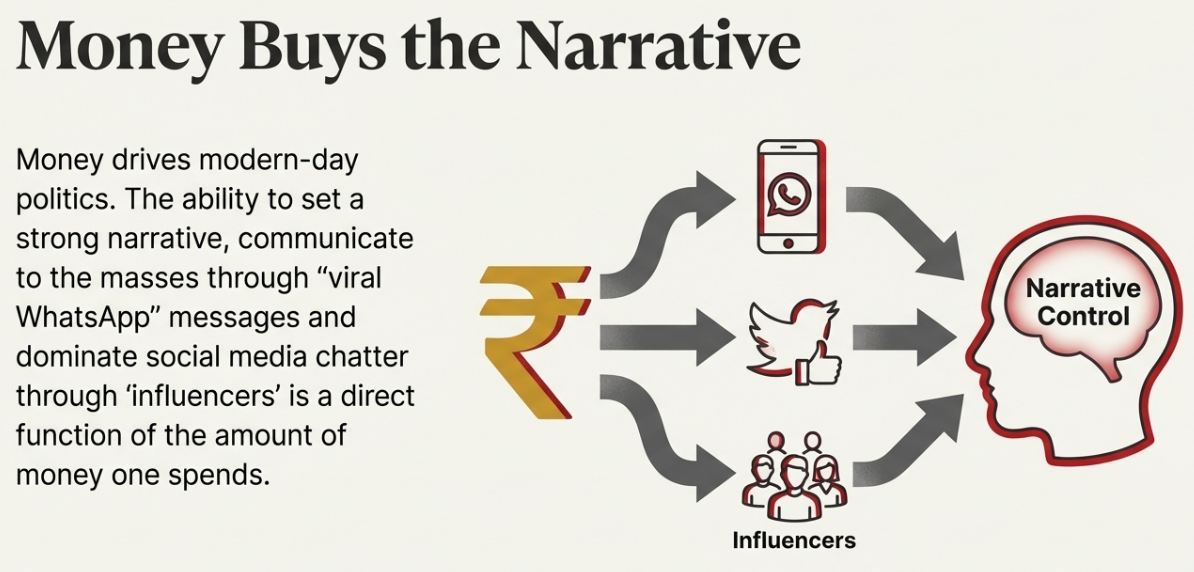

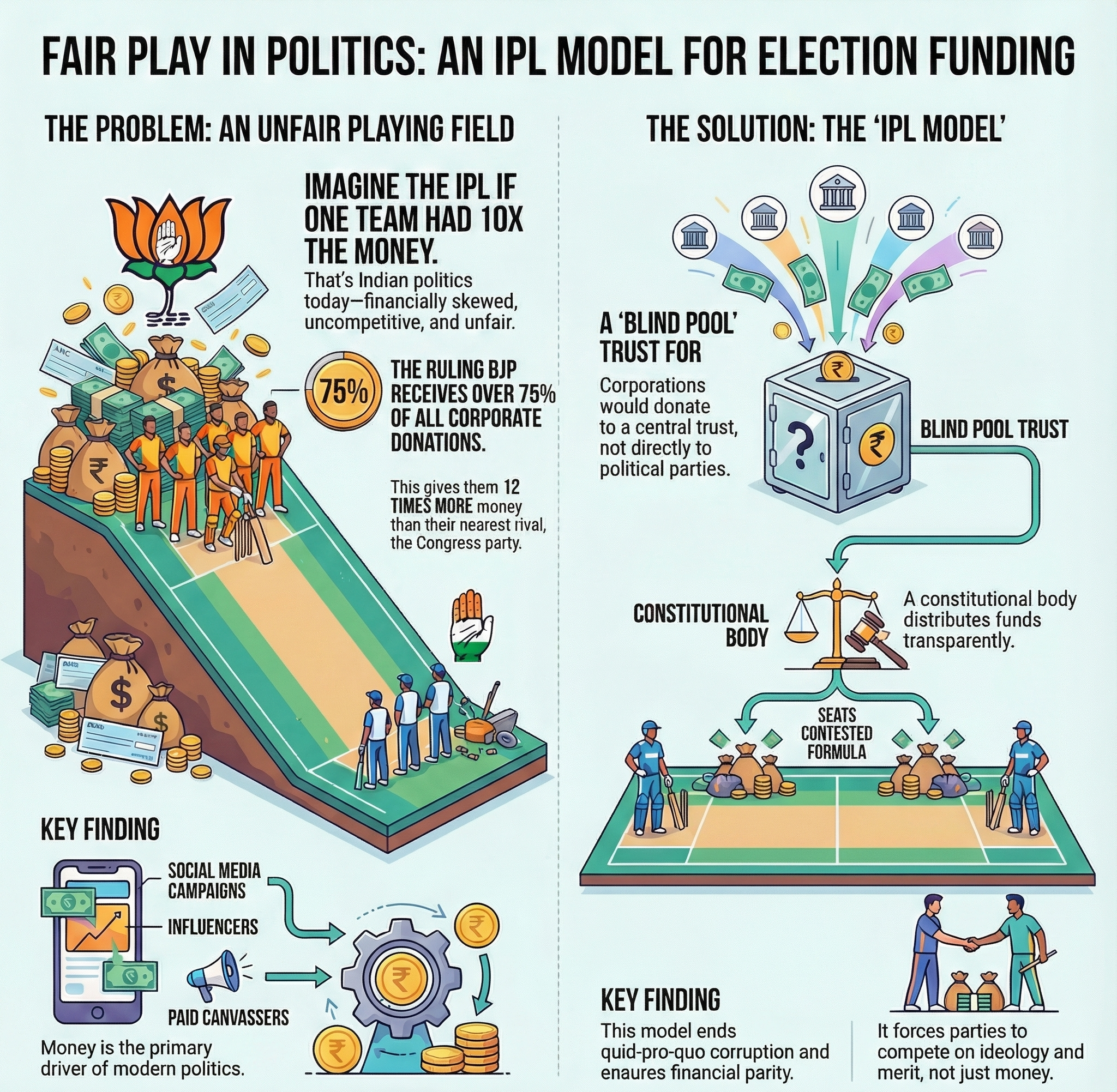

Lack of transparency in political funding, driven by large corporate donations favoring ruling parties, causes inequity and a "quid pro quo" crisis.

|

Read all about: WHY NEED ELECTORAL REFORM IN INDIA l REGISTERED UNRECOGNISED POLITICAL PARTIES l WHY DYNASTIC POLITICS REMAINS DEEPLY ROOTED IN INDIA l INDIA'S POLITICAL FUNDING REGULATION STRUGGLES |

Political funding refers to the methods through which political parties raise money for their election campaigns and general activities.

Fair and transparent funding is crucial for a healthy democracy as it directly impacts electoral competition, policy formulation, and public trust in the political system.

Opaque funding mechanisms can lead to corruption and cronyism, undermining the principle of 'free and fair elections'.

Representation of the People Act (RPA), 1951

Section 29B: Allows registered political parties to accept voluntary contributions from any person or company, except a Government company or a foreign source.

Section 29C: Mandates that parties must report all contributions above ₹20,000 to the Election Commission of India (ECI) annually.

Income Tax Act, 1961

Section 13A: Grants 100% tax exemption to political parties on their income from house property, voluntary contributions, and capital gains, provided they maintain audited accounts and report donations over ₹20,000.

Anonymous cash donations are restricted to a maximum of ₹2,000.

Section 80GGB/80GGC: Allows 100% tax deduction for companies and individuals, on contributions made to political parties through any means other than cash.

Companies Act, 2013

Section 182: Following the scrapping of electoral bonds, the original provisions are reinstated. Companies can contribute up to 7.5% of their average net profits of the preceding three financial years.

Companies must disclose the total amount contributed and the name of the recipient political party in their Profit & Loss statements.

Foreign Contribution (Regulation) Act (FCRA), 2010

Broadly prohibits political parties from accepting any foreign contributions.

An amendment allowed donations from Indian subsidiaries of foreign companies, which was a point of contention.

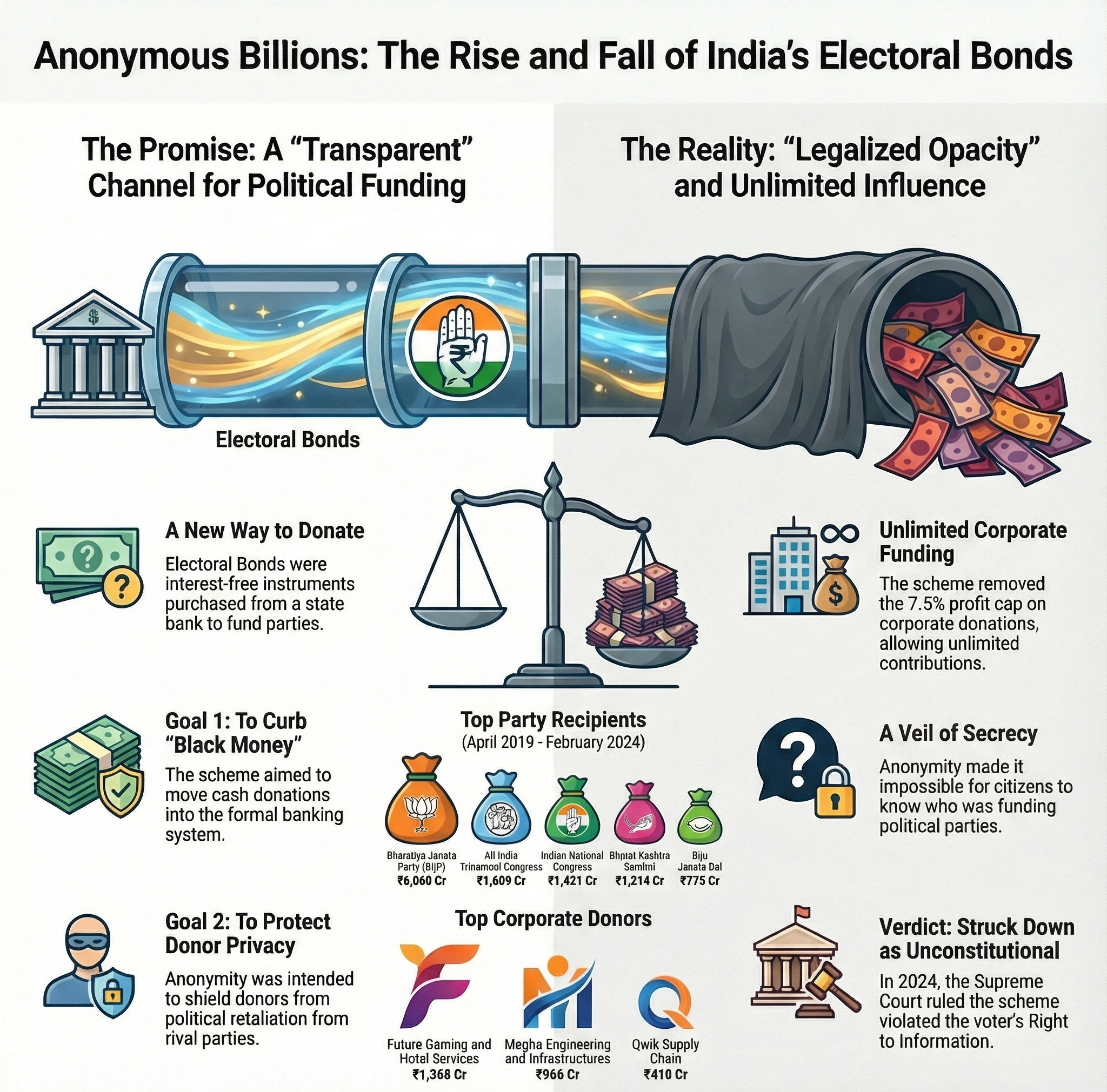

Electoral Bonds Scheme (Now Scrapped)

Influence of Corporate Funding

Influence of Corporate Funding

Problem of Black Money

Persistent "Unknown Sources" of Income

Despite the ban on electoral bonds, a large portion of political funding remains untraceable. Key loopholes contributing to this are:

Rise of Electoral Trusts

Following the ban on electoral bonds, Electoral Trusts have become a major channel for corporate donations. While they offer more transparency than bonds, challenges remain in tracking which specific company's funds go to which party.

Escalating Election Costs and Illicit Funding

Rising election costs fuel the need for "black" money among candidates and parties.

Distorted Electoral Playing Field

Distorted Electoral Playing Field

Financial gaps between major and smaller parties, and wealthy and ordinary candidates, compromise free and fair elections.

Global Best Practices in Political Funding

Global Best Practices in Political Funding

India can draw lessons from various democratic models worldwide to create a hybrid system suited to its own needs.

|

Country |

Key Features of Funding Model |

|

Germany |

|

|

United Kingdom |

|

|

USA |

|

Enhancing Transparency and Accountability

Disclosure Obligations

Mandate full public disclosure of all individual and corporate political contributions to candidates and parties. Donors and recipients must report complete details (names, addresses, PANs) to the ECI and Income Tax authorities.

Digital and Real-Time Disclosure

All political donations, regardless of the amount, should be made through digital means and disclosed on a public portal in real-time.

Strengthening Audits

The accounts of political parties should be audited by a panel of auditors approved by the Comptroller and Auditor General (CAG) to ensure impartiality and thoroughness.

Partial State Funding of Elections

Indrajit Gupta Committee (1998)

This committee endorsed partial state funding, recommending it be provided in-kind (e.g., free airtime, fuel, office space) to recognised national and state parties to create a level playing field.

Law Commission's 255th Report (2015)

While not recommending full state funding due to fiscal constraints, it strongly advocated for comprehensive legal reforms to regulate party finances as a prerequisite.

Rationale

Partial state funding can reduce parties' dependence on private corporate donors and curb the use of black money.

Legal and Institutional Reforms

National Election Fund

As suggested by former Chief Election Commissioner S.Y. Quraishi and endorsed by bodies like the Law Commission, a National Electoral Fund could be established where all donors contribute.

Funds would be allocated to parties based on their electoral performance, ensuring donor anonymity from parties but not from the public.

Expenditure Cap for Parties

Impose a ceiling on the election expenditure of political parties, similar to the limit on candidates.

Empower the ECI

Grant the ECI powers to de-register political parties for persistent non-compliance with financial disclosure norms.

The Supreme Court's verdict striking down Electoral Bonds mandates urgent systemic electoral reform, shifting from opacity to transparency and accountability. Combining robust disclosure, partial state funding, and strict ECI enforcement is essential to safeguard electoral integrity and restore public trust.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. In the context of ensuring a level playing field, critically evaluate the proposal for state funding of elections in India. 150 words |

The main sources include voluntary contributions from individuals and corporations, and indirect state funding. Donations can be routed through direct bank transfers, cheques, or via electoral trusts.

The Supreme Court declared the Electoral Bond scheme unconstitutional in February 2024, ruling that anonymous funding violates a citizen's right to information. The scheme has been struck down and no further bonds can be issued.

An electoral trust is a non-profit entity that collects donations from companies and individuals and then distributes the funds to political parties. They are regulated by the Election Commission of India (ECI) and the Income Tax Department.

© 2026 iasgyan. All right reserved