Disclaimer: Copyright infringement not intended.

Context

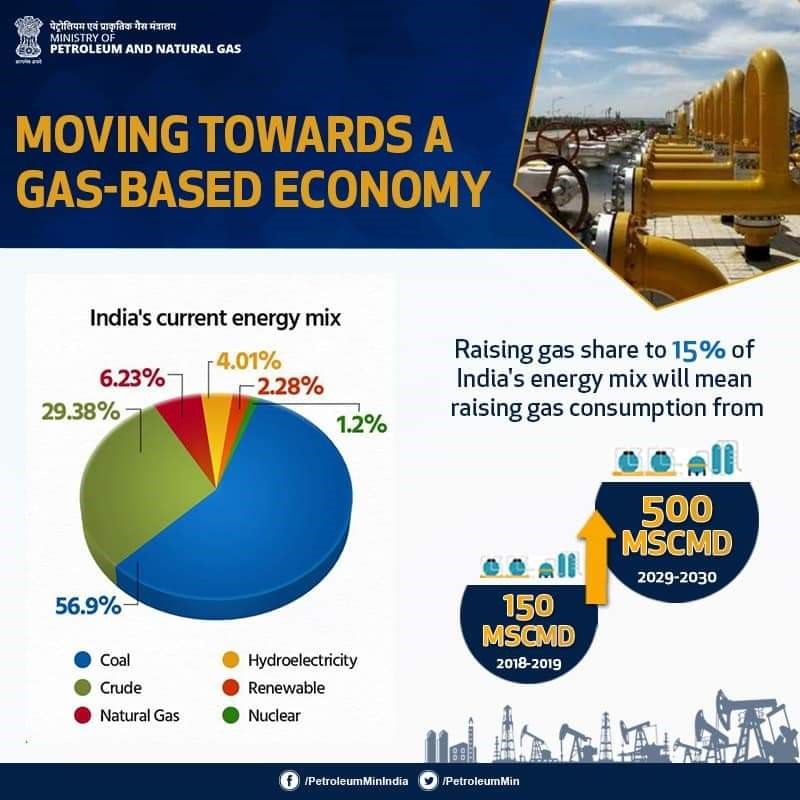

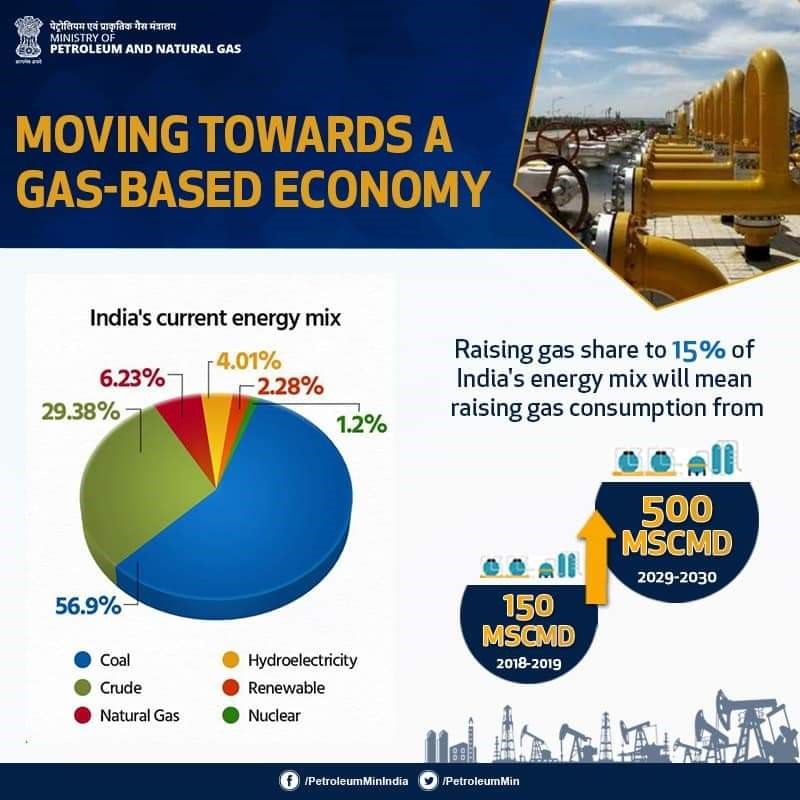

- Government of India has set a target to increase the share of gas in the energy mix up to 15% in 2030 to make India a Gas-based economy .

India’s Energy Sector: A background

India Energy Outlook Report

- India is the world’s third‐largest energy-consuming country after China and USA as per India Energy Outlook 2021, published by International Energy Agency (IEA).

CO2 Emitter

- India happens to be the third largest emitter of carbon dioxide by volume, although its per capita emissions are lower than the world average.

Global Energy needs

- As per the BP Statistical Review of World Energy published in June 2022, around 82 percent of global energy needs in the year 2021 were met through fossil fuels and 89 percent in the case of India.

- These fossil fuels; coal, oil and gas upon burning release large amounts of carbon dioxide (CO2) into the air which is a greenhouse gas (GHG) primarily responsible for global warming.

.jpeg)

Dominated by Fossil Fuels

- India's electricity sector is dominated by fossil fuels, in particular coal, which produced about three-quarters of the country's electricity.

Need for Energy Transition

- The climate-related disasters happening all over the world will not stop until the rise in global temperature is checked through energy transitione. involving more and more renewable energy sources in place of fossil fuels.

- Around 130 countries of the world have pledged to achieve Net-Zero by 2050e. the condition at which the addition of GHG emissions is equal to the amount taken away from the atmosphere.

- China and India have declared to achieve such targets by 2060 and 2070 respectively.

- The task to achieve Net-Zero by 2070 by India will be an uphill task as 89 percent of our energy requirement is met from fossil fuels in which coal has the largest share.

Renewable Energy (RE) – Not adequate for Energy Transition:

- India is increasing its RE capacity, solar and wind, at a brisk pace over the last 7-8. But solar/ wind power sources cannot generate power round the clock as its wind-generated power depends on wind speeds while solar power depends on the amount of sunlight falling on its panels at a given time. Such an intermittency feature brings instability to the power grid.

- Large battery storage can help in supplying electricity when solar/ wind sources are not generating power but such requirements are huge as well as cost prohibitive.

Gas Based Economy

- In Gas-based economies, gas is the primary source of commercial energy in the energy mix and Natural gas forms a major part of this type of economy.

Natural Gas

- Natural gas is a mixture of gases that are rich in hydrocarbons.

- All these gases (methane, nitrogen, carbon dioxide etc) are naturally found in the atmosphere.

- Natural gas reserves are deep inside the earth near other solid & liquid hydrocarbon beds like coal and crude oil.

- Natural gas is not used in its pure form; it is processed and converted into cleaner fuel for consumption.

- Many by-products are extracted while processing of natural gas like propane, ethane, butane, carbon dioxide, nitrogen etc, which can be further used.

How did natural gas form?

- Millions to hundreds of millions of years ago, the remains of plants and animals (such as diatoms) built up in thick layers on the earth’s surface and ocean floors, sometimes mixed with sand, silt, and calcium carbonate.

- Over time, these layers were buried under sand, silt, and rock. Pressure and heat changed some of this carbon and hydrogen-rich material into coal, some into oil (petroleum), and some into natural gas.

Where is natural gas found?

Conventional Natural Gas

- In some places, natural gas moved into large cracks and spaces between layers of overlying rock. The natural gas found in these types of formations is sometimes called conventional natural gas.

Unconventional Natural Gas

- In other places, natural gas occurs in the tiny pores (spaces) within some formations of shale, sandstone, and other types of sedimentary rock. This natural gas is referred to as shale gas or tight gas, and it is sometimes called unconventional natural gas.

Associated Natural Gas

Coalbed Methane

- Natural gas deposits are found on land, and some are offshore and deep under the ocean floor. Natural gas found in coal deposits is called coalbed methane.

Advantage of Natural Gas

- Natural gas is an essential energy source in many parts of the world because it emits almost 50% less carbon dioxide than other forms like coal or diesel when burned for power generation or vehicles, respectively.

- Thus, making it more environmentally friendly than conventional sources such as diesel or coal-fired thermal plants used across sectors. The country is now rapidly moving towards a gas-based economy.

- Government of India has set a target to increase the share of gas in the energy mix up to 15% in 2030 to make India a Gas-based economy. Presently we are importing around 50% of our requirement of Natural gas. Speedy expansion of CBG will help in meeting our additional requirement from domestic resources.

Building the Gas Ecosystem

- Realising the importance of natural gas in the energy transition, Govt. of India has laid an ambitious vision to make India a gas-based economy by enhancing the share of natural gas in its energy basket to 15 percent by 2030, which is at present 6.3 percent against world average of 24.42 percent.

- Currently, oil & gas fields located in Western and South Eastern areas viz. Hazira basin, Mumbai offshore & KG basin as well as North East Region (Assam & Tripura) are the primary sources of domestic natural gas.

Government Policies in place to turn India into a Gas based Economy

Sustainable Alternative Towards Affordable Transportation (SATAT) Scheme

- Under SATAT initiative various waste streams such as animal dung, agricultural residues, MSW (Municipal Solid Waste), sewage water and industrial wastes such as press mud, spent wash from sugar industry, food processing industry etc. is being looked into as feedstock for the production of Biogas/CBG.”

Commercial plants

- India’s has the ambitious target to set up 5,000 commercial plants by 2024- 25 and produce 15 MMT of CBG which would replace other gaseous fuels being used in the country.

- India had commissioned 46 compressed biogas plants under SATAT Scheme and there were 100 outlets currently dispensing the compressed biogas across the country.

Triple Bottom Line Policy

- The Government has been persistent in developing a conducive ecosystem in order to promote sustainability for all actors of the Triple Bottom Line (environment, society and economy).

- The Government has formulated policies, developed schemes providing support through Central Financial Assistance, etc to support the adoption of green energy in any form.

- Government is engaging with other departments and ministries to simplify the regulations further, resulting in easier adoption and implementation of projects.

-min.jpg)

Amrit Kaal Budget 2023

- Amrit Kaal Budget 2023 gives a huge boost to India's Bio-Gas and clean energy revolution:

- With special attention given to CBG projects and announced establishment of 200 CBG projects under the umbrella of the GOBARdhan scheme.

- Five percent CBG mandate will be introduced for all organizations marketing natural and bio gas.

- To avoid cascading of taxes on blended compressed natural gas, excise duty on the amount of GST paid on compressed biogas contained in the blended CNG has been exempted.

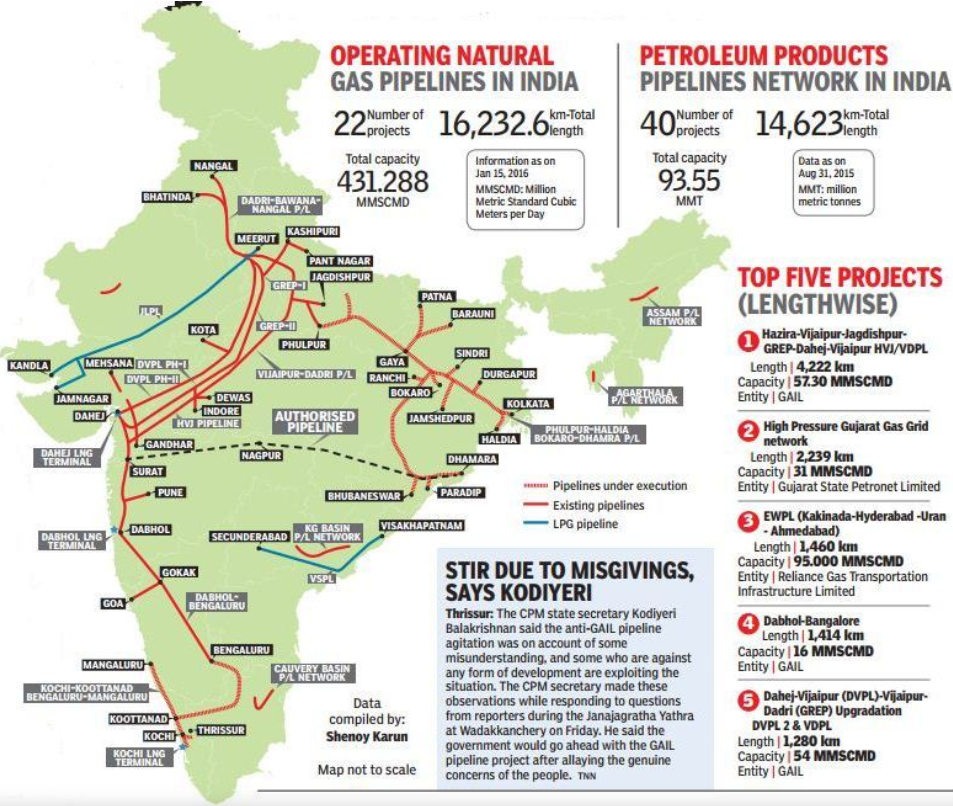

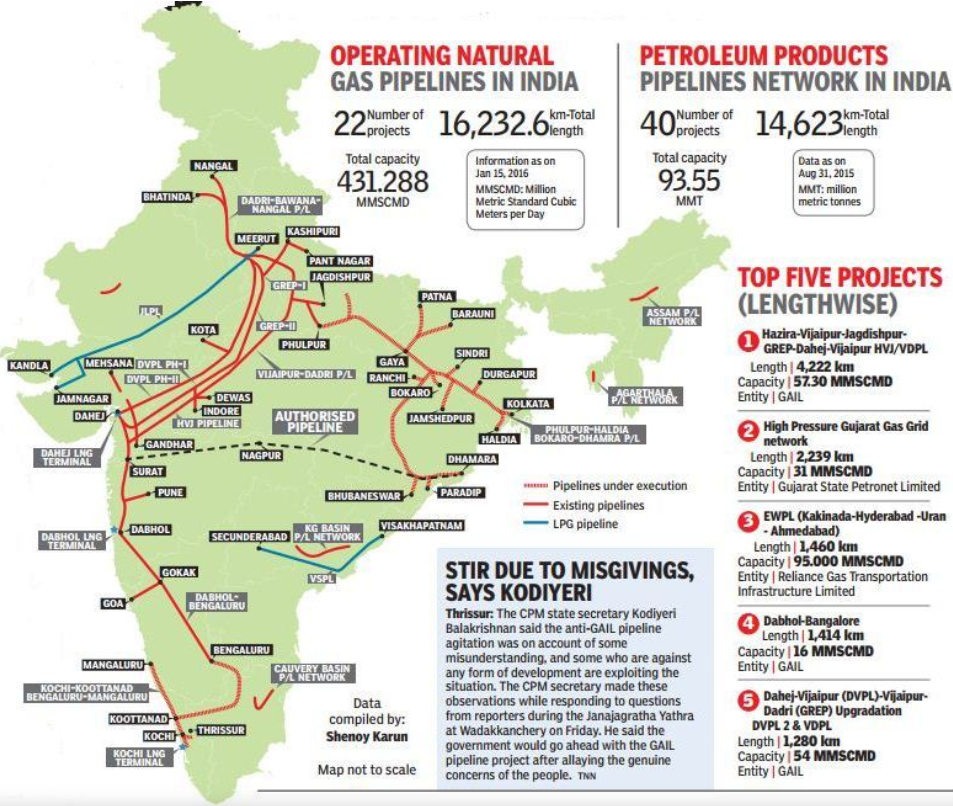

Gas Pipeline infrastructure

- Gas Pipeline infrastructure plays an important role in defining the structure of the gas market and its development.

- Given that it is an economical and safe mode of transporting natural gas, it can help ensure adequate availability and equitable distribution of natural gas in all parts of the country.

- During the launch of the Kochi-Mangalore pipeline, Prime Minister Modi said that the natural gas pipeline network in India will be doubled in 5-6 years to about 32,000 kms. Also, CNG stations will be increased to 10,000, from the current 1,500.

- In addition, the Government has also prioritised the development of CGD network to boost domestic gas allocation to PNG (Domestic) and CNG (Transport) segments. Today, 7.2 million households have access to piped natural gas connections for using the fuel for cooking purposes, up from 2.5 million in 2014.

Note: CITY GAS DISTRIBUTION (CGD) BIDDING

- Petroleum and Natural Gas Regulatory Board (PNGRB) formed under the Petroleum and Natural Gas Regulatory Board Act, 2006, grants authorization for setting up of City Gas Distribution (CGD) network in the cities / geographical areas of the country through open bidding process.

- Supply of domestic PNG to households, setting up of CNG stations for vehicles, providing PNG to small industries and commercial establishments can be carried out only by the authorised entity.

NATIONAL GAS GRID

- The Government of India has identified the requirement of development of additional 15000 Km of Gas Pipeline and various pipeline sections to complete the Gas Grid. The status of new pipeline projects being implemented by Govt. PSUs that are part of the National Gas Grid are as under:

- Jagdishpur – Haldia&Bokaro – Dhamra Pipeline Project (JHBDPL):The 2655 km. pipeline project will cater to the energy requirements of five states, namely Uttar Pradesh, Bihar, Jharkhand, Odisha and West Bengal.

- Barauni to Guwahati Pipeline: Pipeline from Barauni to Guwahati is being implemented as an integral part of JHBDPL project to connect North East Region (NER) with the National Gas Grid.

- North East Gas Grid:A joint venture of five oil and gas CPSEs i.e. GAIL, IOCL, OIL, ONGC and NRL named as “Indradhanush Gas Grid Ltd” (IGGL) has been entrusted for the development of Natural Gas Pipeline Grid in North-East, i.e. North East Gas Grid (NEGG), in all North Eastern States i.e. Assam, Sikkim, Mizoram, Manipur, Arunachal Pradesh, Tripura, Nagaland and Meghalaya, in a phased manner.

- Kochi-Koottanad- Bangalore-Mangalore Pipeline Project (KKBMPL): Kochi-Kottanad-Managlore-Bangalore pipeline (KKBMPL) and Ennore-Thiruvallur-Bengluru-Puducherry-Nagapatinam-Madurai-Tuticorin Pipeline (ETBPNMT) in the southern part of the country.

Recent regulation by Petroleum and Natural Gas Regulatory Board (PNGRB)

- The PNGRB’s recent regulation on uniform transmission tariff and gas exchange regulation, are in the right direction.

- Further, the PNGRB has also notified access codes for new city gas distributors. This would help city gas distribution companies to transport, distribute and price natural gas in new cities. This is likely to increase gas consumption, thereby, stimulating demand for competitively priced gas which, in turn, increases the importance of gas markets.

Steps taken to boost Domestic Gas Exploration in India

Further, the Government has taken several steps to enhance domestic natural gas production through several policy initiatives such as:

(i) Policy to grant relaxation, extension, and clarifications at development and production stage for early monetization of hydrocarbon discoveries

(ii) Marginal Field Policy- Discovered Small Field Policy

(iii) Uniform Licensing Policy-Hydrocarbon Exploration and Licensing Policy

(iv) Policy for Grant of Extension to small and medium sized discovered fields

(v) Policy for Marketing Freedom for Gas Produced from Deepwater and Ultra Deepwater areas etc.; and

(vi) Policy on testing requirements for discoveries made under New Exploration and Licensing Policy (NELP) Blocks.

- To incentivize gas production from difficult areas, Government has granted marketing, including pricing, freedom for the gas produced from difficult areas.

- Marketing freedom has also been provided under Discovered Small Field bidding round as well as under Hydrocarbon Exploration and Licensing Policy (HELP) under which acreages will be provided in future.

- The implementation of these policy initiatives and other reform initiatives is expected to enhance domestic natural gas production from the fields.

Bio CNG scheme

- This Programme, inter alia, supports setting up of plants for generation of BioCNG from urban, industrial and agricultural waste by providing central financial assistance (CFA).

City Gas Distribution (CGD) network

- City Gas Distribution (CGD) networks are an interconnected system of underground Natural Gas pipelines for supplying Piped Natural Gas (PNG) and Compressed Natural Gas (CNG) to domestic-commercial and industrial customers.

- With a view to further promote Compressed Natural Gas (CNG) vehicles and Piped Natural Gas(PNG) used in households, the Ministry of Petroleum and Natural Gas has decided to raise the share of domestic gas to 100 % of the requirement for CNG (transport) and PNG (domestic). This would lead to a reduction in the price of CNG (transport) and PNG (domestic) across the country (except in those City Gas Distribution(CGD) entities that are already getting 100% domestic gas).

Open Acreage Licensing Policy-OALP:

- It provides uniform licences for exploration and production of all forms of hydrocarbons, enabling contractors to explore conventional as well as unconventional oil and gas resources.

- Fields are offered under a revenue-sharing model and throw up marketing and pricing freedom for crude oil and natural gas produced.

- Under OALP, companies are allowed to carve out areas they want to explore oil and gas in.

Pooling of Gas in Fertilizer (Urea) Sector

- The domestic is pooled with Re-gasified liquefied Natural Gas (R-LNG) to provide natural gas at uniform delivered price to all Natural Gas Grid connected Urea manufacturing plants for the purpose of manufacturing of Urea.

Recent changes in the Petroleum and Natural Gas Regulatory Board Act

- The Petroleum and Natural Gas Regulatory Board Act initiatives have increased private players’ participation in natural gas. The government has developed policy guidelines for onshore and offshore exploration, production, and testing under the New Exploration and Licensing Policy (NELP) Blocks.

- The revenue sharing model adopted by the government has helped monetize marginal fields of National Oil Companies (NoCs) under Discovered Small Fields (DSF) Policy, with policy for grant of extensions to medium fields.

- The policies for uniform licensing in hydrocarbon exploration and marketing freedom for gas produced from deep water are significant steps towards a sustainable future.

- Significant progress has been made in operationalizing stranded R-LNG power plants and developing gas-consuming markets for a cheap supply of raw materials such as fertilizers to the farmers.

- In a rare scenario, the government has also decided to give a capital grant as VGF to GAIL for pipeline infrastructure development. This will help connect the eastern parts of India with the National Gas Grid.

- These reforms come as a part of the series of new policy initiatives such as LPG cylinders subsidy, EoI to procure Compressed Bio Gas (CBG), and the recently announced policy for exploration of coal bed methane resources to leverage India’s potential. Consequently, India’s primary energy mix is expected to comprise approximately 15% natural gas by 2030, as per “Vision 2030: Natural Gas Infrastructure in India” of the Petroleum & Natural Gas Regulatory Board.

100% FDI in the Exploration and production (E&P) Efforts

- India’s natural gas Exploration and Production (E&P) industry has evolved phenomenally since the 2000s, with the capacity to trap reserves up to 3 km below sea level.

- The government has also approved 100% FDI in the E&P efforts. With the government trying to make the process of bidding and marketing for natural gas more transparent and accessible, it is a matter of time before India completely shifts towards a gas ecosystem.

Adoption in various Sectors

- Natural gas is being adopted rapidly by sectors for power generation, especially heavy industries like steel production, because it’s cheaper than diesel and can be used in industrial processes incompatible with the fuel.

- India is aiming to be self-sufficient in energy products, in addition, to becoming a net exporter of other commodities.

Market Reforms

- The government is also pushing for multiple market reforms to facilitate transparency in pricing and to provide a levelised field for competitive adoption across natural gas consumer sectors.

- The recently launched India Gas Exchange and the proposed unified pipeline tariff system are intended to make the gas market open for constructive competitiveness.

Key insights

Affordability Issues

- Despite previous reform measures, prices for the greater part of India’s gas supplies are still government controlled and set arbitrarily rather than determined by market forces. This leads to affordability issues – the number one challenge in Indian energy policy.

- Indexing Indian upstream gas prices with international markets with different dynamics may not be as effective as using opportunity costs linked to liquefied natural gas (LNG) import parities or weighted average of fuel oil and coal in bringing prices closer to the market’s ability to afford them. But the delivered cost of gas includes taxes that make its use uneconomical in India for power generators and other users.

- ‘Postage stamp’ transportation pricing could introduce simplicity and encourage more homogeneous economic growth and market development in the short term, although the resulting long-term distortions would have to be addressed in the future.

Lower domestic gas production

- Power and fertilizer manufacturing have remained the country’s two anchor gas-consuming sectors. Lower domestic gas production than expected and higher international LNG prices have rendered the use of gas uneconomical for power generation. The growth of a gas-based economy would require expansion to industry, transport, and households.

Conflicts between multiple regulators

- Progress has been hampered by jurisdictional conflicts between multiple regulators. This can be streamlined by strengthening the role of the Petroleum and Natural Gas Regulatory Board as a market operator in the midstream/downstream segment and assigning greater upstream regulating power to the Directorate General of Hydrocarbons.

Limited to regions

- Gas pipelines are currently limited to regions where domestic gas production and LNG import terminals are located. Realizing the vision of a gas-based economy in India will require a clear roadmap and coherent planning approach.

Path Forward

- India has recently forayed into gas markets, however, the country’s ambition to develop gas markets towards building a gas-based economy will need more elaborate policy reforms.

- This would mean bringing in reforms such as adopting a more market-based mechanism for the discovery of APM gas prices through gas-to-gas competition within India, bringing the fuel under a nationwide tax, creating a Transmission and System Operator, unbundling of marketing and transmission, etc.

- Fiscal policies other than taxation may also be used to encourage switching over to production and consumption processes favouring the use of gas particularly by subsidising non-polluting technologies.

- On the supply side, both domestic production of gas and import of gas on favourable conditions require to be promoted. As gas supply increases, its related infrastructure covering storage and distribution would need to be expanded at an accelerated pace.

- There is a need to bring natural gas under uniform Goods and Services Tax (GST) regime to have a unified natural gas market in the country. At present, levies on natural gas vary from state to state, ranging as high as 24%, a major deterrent to making it a people’s fuel.

Learning from other mature gas markets

- There are several learnings from other mature gas markets that are maintaining a large share of gas in their energy mix. In markets like the US and Europe, gas trading hubs have been pivotal in the expansion of gas industry.

- Globally, Henry Hub of US and Europe’s National Balancing Point (NBP) and Title Transfer Facility (TTF) are considered benchmark hubs for determining gas pricing.

- There have been some aspects that have greatly contributed to the success of the respective gas markets that include open access to infrastructure, system operator, market-friendly transport access and tariff among others.

Closing Thoughts

- India should clear up the existing complexity and, other than for producers of gas from nomination blocks, permit all producers of gas to determine prices through arms-length, direct and transparent negotiations with different consumer segments. The concern that this will lead to price gouging or unaffordable prices is exaggerated as producers can only sell in the Indian market.

- There are no liquefaction facilities for the export of LNG in Subsidies should be provided.

- India has made impressive progress towards clean energy. It has, however, a long way to go before it can fully wean itself off fossil fuels. During this transitional phase, gas producers should be granted unfettered marketing and pricing freedom. Only then might gas provide a solid bridge.

|

PRACTICE QUESTION

Q. A rapid expansion of gas-based economy is a must to become an ‘Atmanirbhar Bharat’ (Self-reliant India). Elucidate. Enlist the steps being taken by the Government to to turn India into a Gas based Economy.

|

https://newsonair.gov.in/News?title=Govt-to-increase-share-of-gas-in-energy-mix-up-to-15%25-in-2030-to-make-India-Gas-based-economy%3A-Union-Minister-Hardeep-Singh-Puri&id=459497#:~:text=8%3A48PM-,Govt%20to%20increase%20share%20of%20gas%20in%20energy%20mix%20up,Union%20Minister%20Hardeep%20Singh%20Puri&text=Petroleum%20and%20Natural%20Gas%20Minister,net%20zero%20and%20import%20reduction.