Foreign Portfolio Investors (FPIs) are key players in India’s capital markets, providing liquidity and linking the country to global finance. Recent data shows a massive FPI sell-off of ₹1.5 lakh crore in 2025, driven by tepid corporate earnings, high valuations, and global economic uncertainties. Such outflows impact market stability, exchange rates, and investment sentiment, highlighting the need for stronger corporate performance, policy reforms, and investor-friendly measures to restore confidence and attract sustainable foreign investment.

As of November 4, 2025, foreign investors have sold ₹1.5 lakh crore of Indian stocks, marking the largest outflow in around 20 years.

Foreign Portfolio Investors (FPIs) are entities or individuals that invest in a country’s financial assets—such as stocks, bonds, and other marketable securities—without seeking direct control or ownership of businesses. Unlike Foreign Direct Investment (FDI), which involves long-term stakes and management participation in companies, FPIs are primarily focused on earning returns through capital gains, dividends, or interest income.

|

Must Read: Foreign Portfolio Investors | FPI in India | RBI reclassification of FPI to FDI | FPI disclosure norms| FPI and Forex Reserve| Difference between FPI and FDI | |

Capital Formation and Market Liquidity: FPIs bring foreign capital into domestic financial markets, enhancing liquidity and depth. This makes markets more efficient, facilitates price discovery, and enables smoother functioning of secondary markets.

Indicator of Global Confidence: FPI inflows reflect international investor confidence in a country’s economic fundamentals, corporate governance, and policy stability. Conversely, sudden outflows signal perceived risks or vulnerabilities.

Impact on Exchange Rates and Monetary Policy: Large FPI inflows can strengthen the domestic currency, while outflows may trigger depreciation and affect inflation. Central banks often monitor FPIs closely to manage liquidity and maintain currency stability.

Facilitating Economic Growth: By channelling capital into equity and debt markets, FPIs support corporate funding and infrastructure development indirectly, complementing domestic savings and investment.

Influence on Corporate Governance and Transparency: FPIs, being global investors, often demand higher disclosure standards, better governance practices, and accountability from companies, thus contributing to improved market practices.

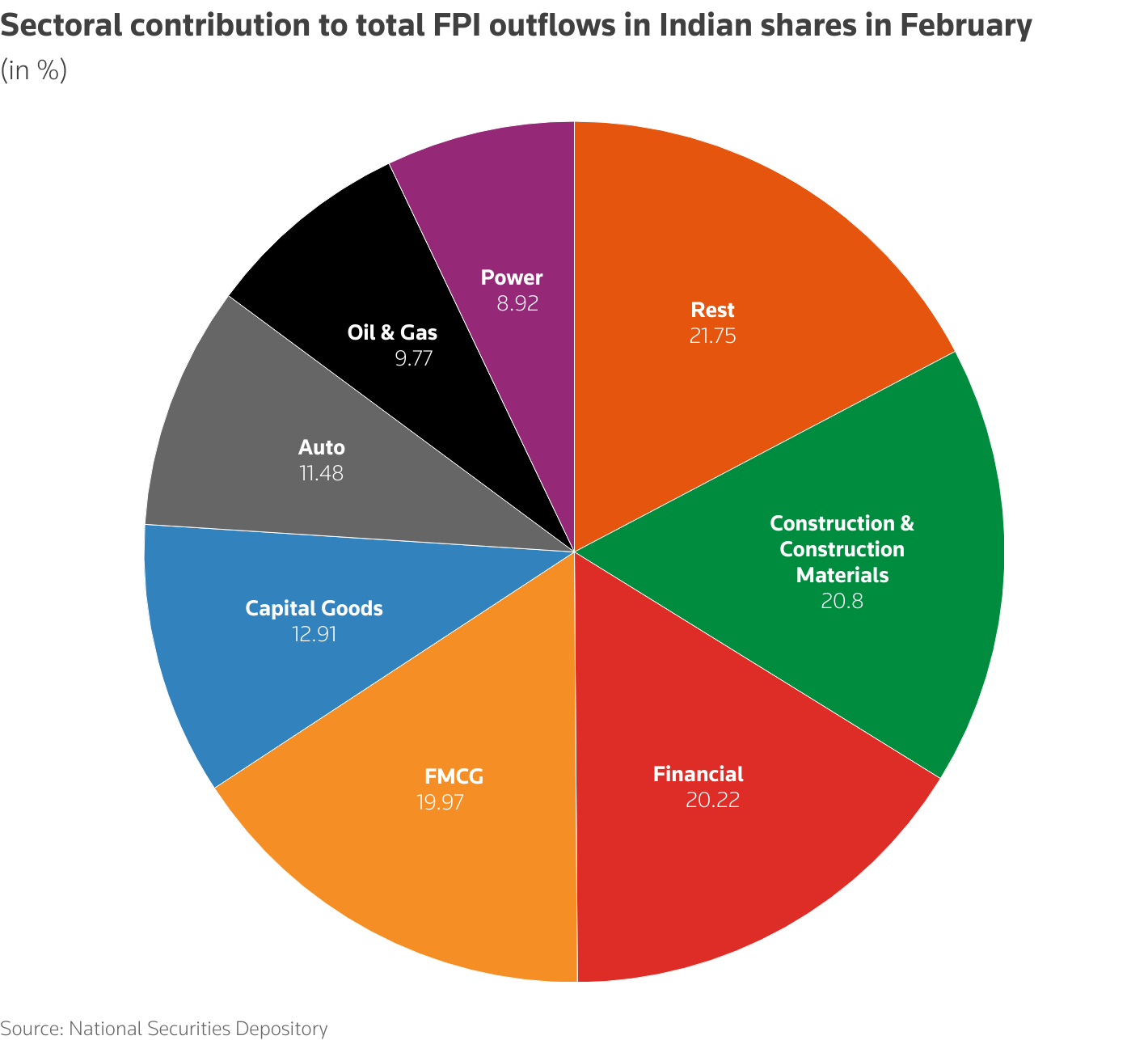

Annual Outflows (2024-25): Foreign Portfolio Investors (FPIs) recorded significant outflows of approximately US$14.6 billion, marking the second-highest annual outflow on record.

Current Year Trends (2025): By September 2025, FPIs have withdrawn around ₹1.58 lakh crore (~US$17.6 billion) from Indian equities, indicating continued selling pressure.

Long-Term Interest: Despite ongoing outflows, India has seen an increase in new FPI registrations, with 287 new FPIs registered in 2025 so far, reflecting sustained long-term investor interest in the Indian market.

Picture Courtesy: Reuters

|

The Price-to-Earnings (P/E) ratio is a key financial metric used to evaluate the valuation of a company’s stock relative to its earnings. Conceptually, it reflects how much investors are willing to pay today for ₹1 of the company’s earnings. |

|

CASE STUDY China — Managing Portfolio Flows: During periods of global turbulence such as the early 2020 Covid-19 shocks, many emerging markets experienced sharp FPI outflows. China, however, managed to maintain relative stability in foreign portfolio investment. Measures Taken: ·Gradual Market Opening: Foreign investors were gradually given access to domestic bond and equity markets, increasing market depth and participation. ·Macroeconomic Stability: Strong foreign exchange reserves, controlled currency volatility, and low inflation reinforced investor confidence. ·Regulatory Safeguards: Partial capital controls and selective liberalization allowed the economy to benefit from inflows while mitigating abrupt outflows. Outcomes: ·Maintained positive FPI flows despite global volatility. ·Increased foreign investor confidence through credible institutions and stable economic policies. |

Interest Rate Adjustments: The Reserve Bank of India (RBI) can tweak policy rates to make Indian assets more attractive to foreign investors. Higher returns on government securities and bonds can reduce outflows.

Simplified Investment Rules: Streamlining registration, reporting, and repatriation norms for FPIs encourages confidence.

Gradual Liberalization: Controlled and phased capital account liberalization prevents sudden withdrawal shocks.

Deepening Domestic Markets: Expanding equity and bond markets improves liquidity and resilience, reducing vulnerability to large sell-offs.

Maintaining Inflation & Fiscal Discipline: Predictable macroeconomic policies reduce perceived risk and make India a safer investment destination.

Foreign Portfolio Investors are crucial for India’s capital markets, providing liquidity and supporting growth, but their flows are volatile and sensitive to global and domestic factors. Recent sell-offs reflect concerns over corporate earnings, valuations, and macroeconomic stability. Strengthening market depth, corporate governance, and regulatory frameworks can stabilize inflows and build investor confidence. Balancing short-term market stability with long-term structural reforms is essential to sustain foreign investment and support India’s economic growth.

Source: The Hindu

|

Practice Question Q. Foreign Portfolio Investors (FPIs) play a significant role in India’s capital markets, yet their volatility poses risks to financial stability. Examine the reasons behind recent FPI outflows from India, their economic implications, and suggest measures to ensure stable foreign investment. (250 words) |

FPIs are investors who invest in a country’s financial assets, such as stocks, bonds, or mutual funds, without taking direct management control. They seek returns through capital gains and dividends, not ownership or operational influence.

FDI involves long-term investment in physical assets or management control of a company, while FPI is mainly investment in financial instruments with the aim of earning returns, making it more liquid and short-term in nature.

FPIs provide liquidity to stock and bond markets, reduce the cost of capital for companies, help in price discovery, and signal global investor confidence in the Indian economy.

© 2026 iasgyan. All right reserved