India’s fintech sector has rapidly evolved through digital innovation, government support, and growing internet access—transforming payments, lending, and financial inclusion—while facing challenges like regulation, data privacy, and cybersecurity.

Copyright infringement not intended

Picture Courtesy: PIB

Prime Minister Shri Narendra Modi addressed the Global Fintech Fest 2025 in Mumbai, Maharashtra where he thanks to the efforts of India's fintech community and also talks about India's approach is based on three key principles - Equitable access, Population-scale skilling and Responsible deployment in the field of AI.

Financial Technology, or fintech, involves the use of technology to improve and automate the delivery of financial services.

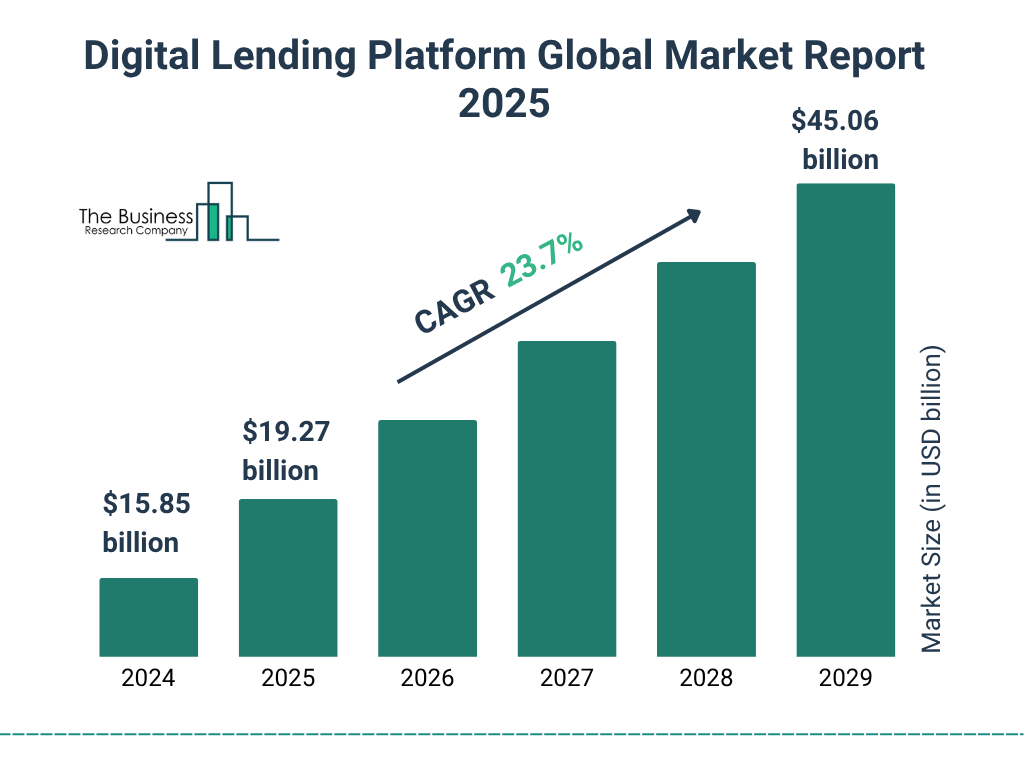

Picture Courtesy: The Business Research Company

Source: PIB

|

Practice Question Q. Critically examine the evolution, growth drivers, and key challenges of India’s fintech sector. Suggest policy measures to ensure its sustainable development. |

Fintech refers to the use of technology to offer innovative financial services such as digital payments, lending, insurance, wealth management, and banking.

UPI (Unified Payments Interface) is a real-time payment system developed by NPCI.

© 2026 iasgyan. All right reserved