Disclaimer: Copyright infringement not intended.

Context

Disinflation

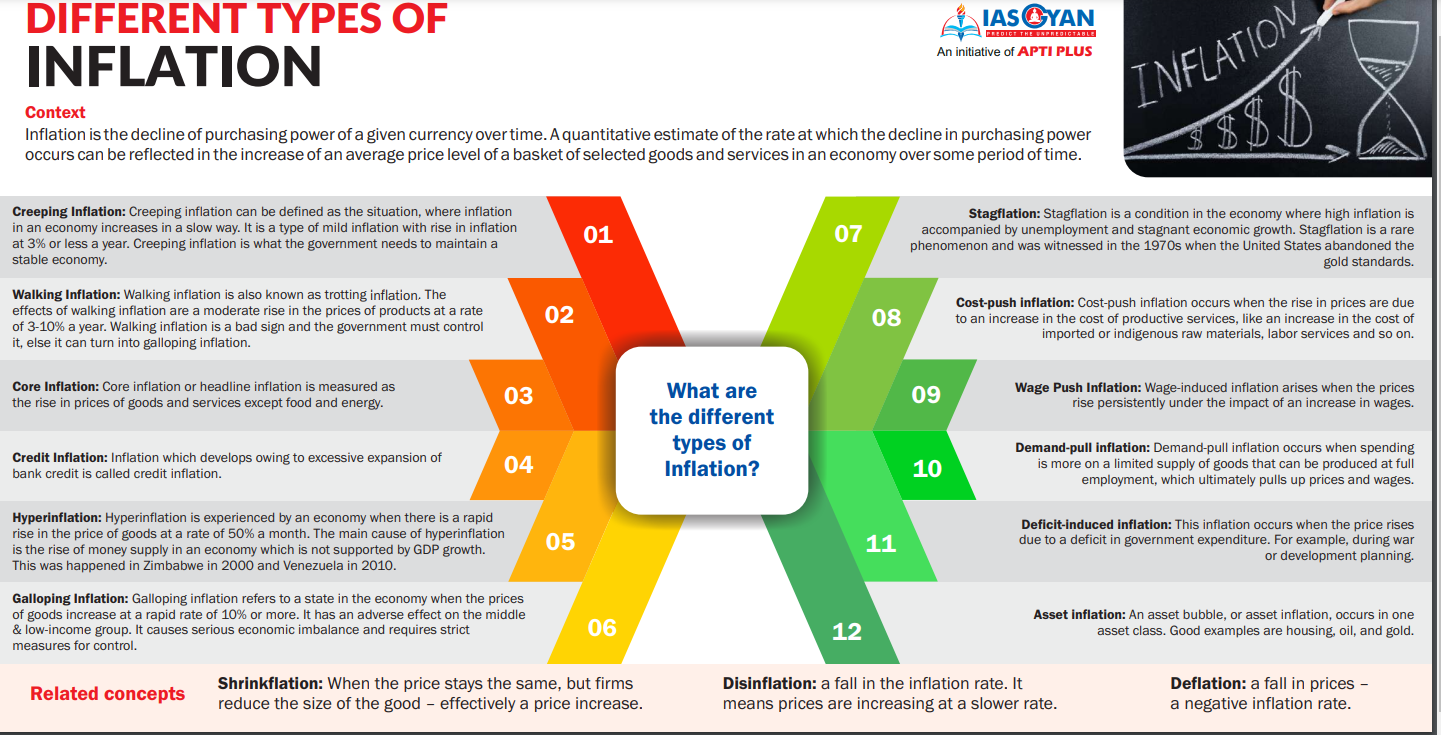

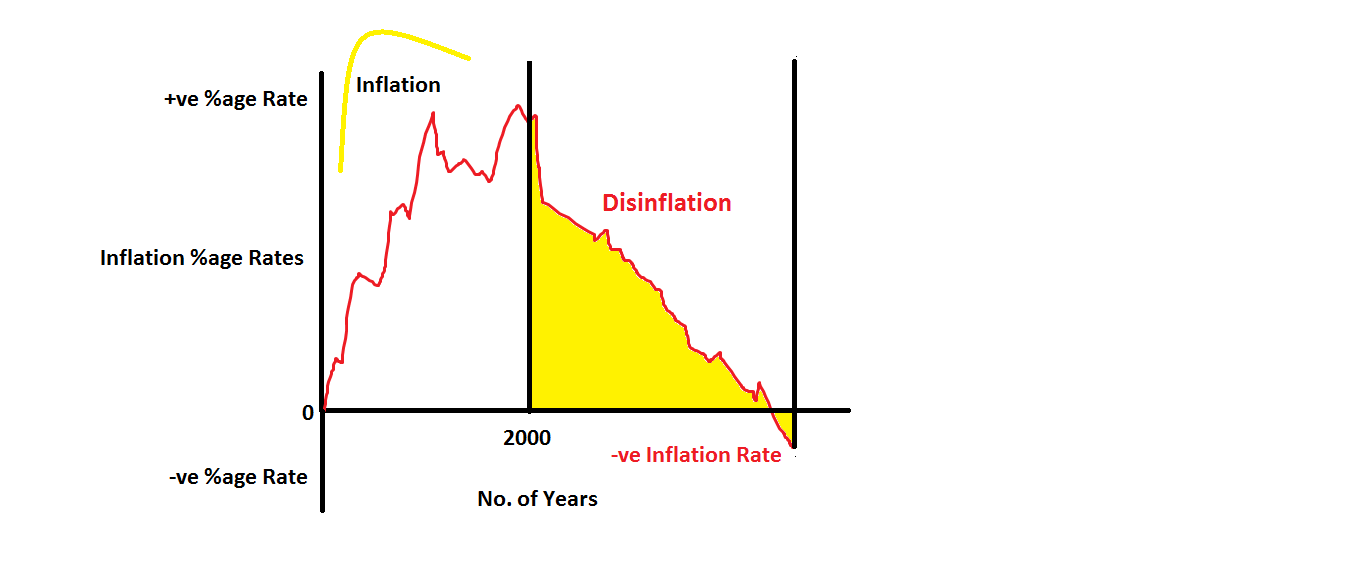

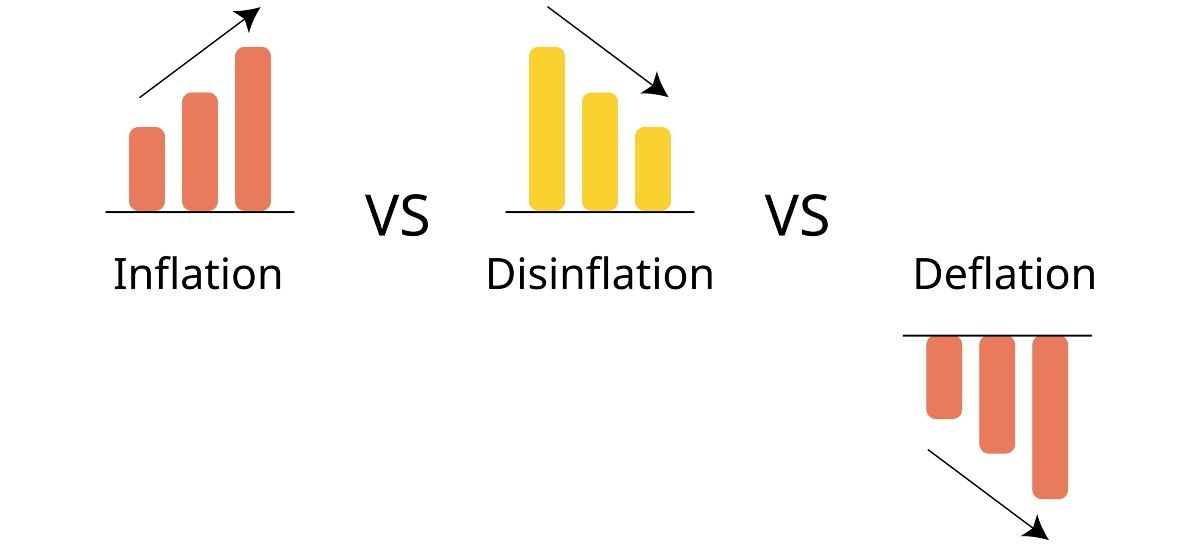

Disinflation refers to a decrease in the rate of inflation, meaning that prices are still rising but at a slower pace. It is not the same as deflation, which is a sustained decrease in the general price level of goods and services. Disinflation is often seen as a positive economic development, as it can help stabilize prices and reduce the impact of inflation on consumers and businesses.

|

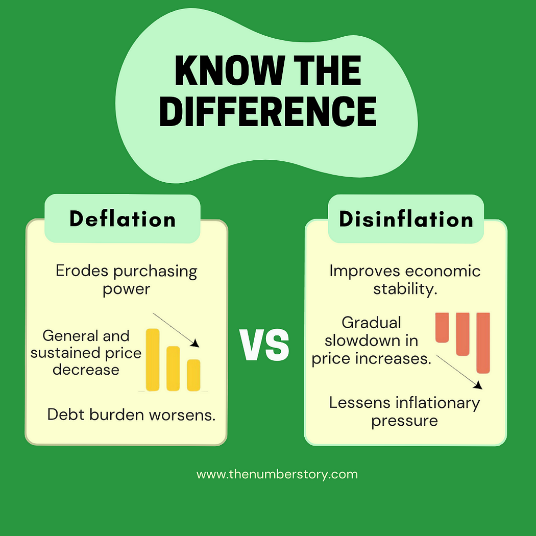

Basis |

Disinflation |

Deflation |

|

Meaning |

A temporary decrease in the rate of inflation |

Fall in the general price level |

|

Frequency |

More frequent |

Less frequent |

|

Factors |

Due to a pull-down in the business cycle, the use of tight monetary policy, and more. |

Drop-in consumer spending, investment, money supply, govt. expenditure and more |

|

Example |

Almost every economy goes through this |

The Great Depression in the 1930s |

|

Stock Markets |

May or may not go down or may gain |

Doesn’t perform well |

|

Employment |

May or not be any change in the employment level |

Employment level is below 100%, or the unemployment rises |

|

Supply & Demand |

Supply and demand are more or less the same |

Supply is usually more, and the demand is less |

|

Economy |

Weaker & negative growth rate |

Positive and stable |

|

Time Period |

Continue until the inflation rate is positive or zero |

Continue until the inflation rate is zero |

|

Value of Money |

The real value of money goes up |

The value of money may depreciate |

MUST READ

ALL ABOUT INFLATION: https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

IMPORTANT ECONOMIC CURVES:

|

PRACTICE QUESTION Q. Disinflation is best described as: A) A rapid increase in the rate of inflation. B) A sustained decrease in the general price level of goods and services. C) A temporary slowdown in the rate of inflation, where prices still rise but at a slower rate. D) A situation where prices remain stable with no change over time. Answer: C) A temporary slowdown in the rate of inflation, where prices still rise but at a slower rate. |

© 2026 iasgyan. All right reserved