India's sugar and soyabean industries are concerned about a potential US trade deal. They fear that opening markets to US ethanol, GM corn, and soyabean would threaten domestic producers. The sugar industry relies on a protected ethanol market, while the soyabean sector fears competition from cheap imports and lower oil tariffs.

Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

As India and the United States work to finalize a bilateral trade deal, two of India's major agricultural industries, sugar and soyabean, are expressing concern.

The US has "high stakes in corn, ethanol and soyabean" and a "geopolitical need to find a sizable alternative market to China." This drives its pressure on India to "remove restrictions on their imports."

The US is the "world’s top producer as well as exporter of both maize and fuel ethanol" and the "second biggest producer and exporter" of soyabean.

Sugar industry is worried about the government allowing imports of ethanol and genetically modified (GM) corn for fuel blending purposes.

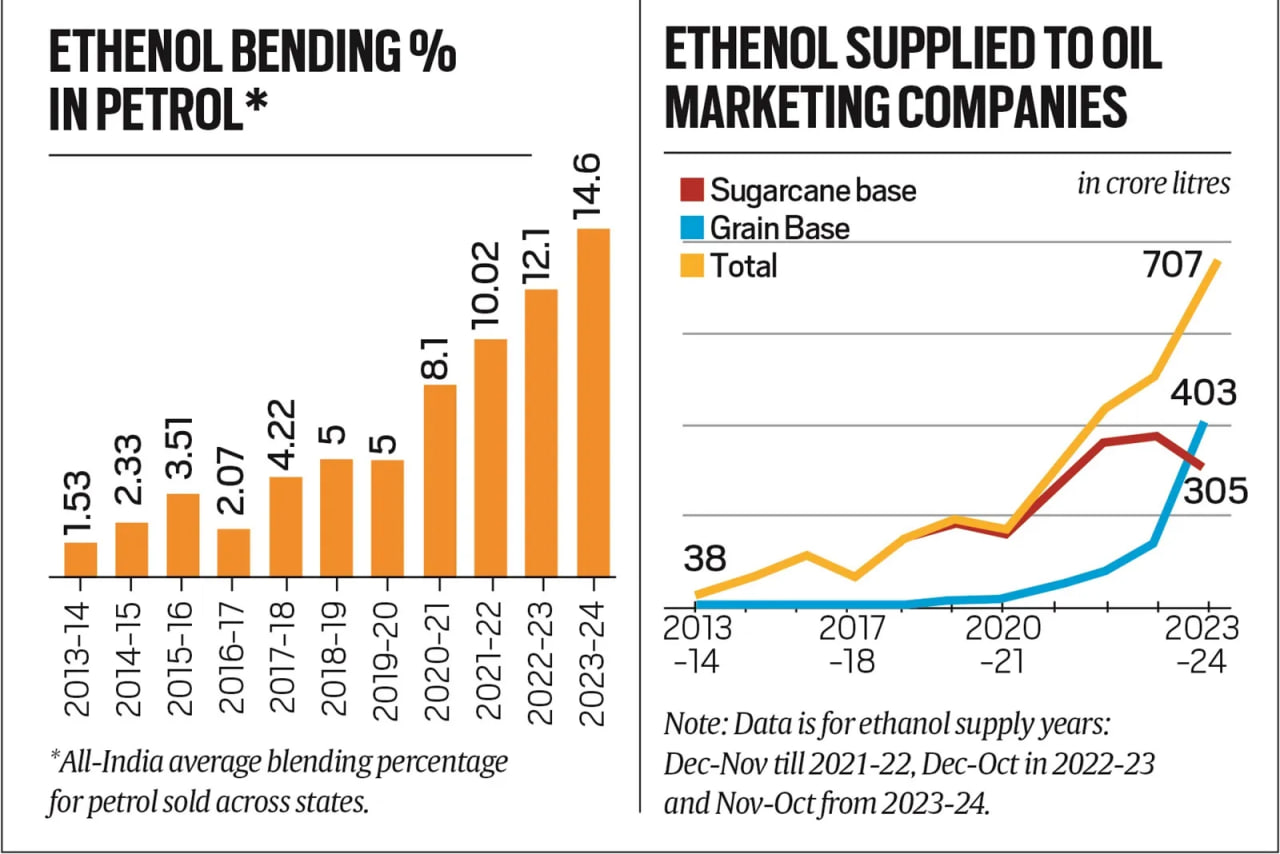

Competition for Ethanol Production => The ethanol-blended petrol program has been a success, with the average blending ratio reaching 14.6% in 2023-24, up from 1.5% in 2013-14. The current blending ratio has even reached 18.8%, nearing the 20% target for 2025-26.

However, there has been a significant shift in feedstock from sugarcane to grains. In 2024-25, almost 68% of ethanol is expected to come from grains, with maize being a major contributor. The industry fears that allowing cheaper imports of US corn or ethanol itself will further marginalize sugarcane as a key feedstock.

With domestic sugar consumption stagnating, the sugar industry sees its future in energy production, such as higher ethanol blends in petrol and diesel, or even sustainable aviation fuel. They fear that import concessions to the US would undermine this potential diversification.

Food v/s Fuel Debate => Sugar millers argue that using sugarcane for ethanol does not create a major "food versus fuel" conflict. They argue that diverting maize, a crucial ingredient for livestock and poultry feed, for biofuel production could lead to shortages and price volatility in the animal feed sector.

Copyright infringement not intended

Copyright infringement not intended

The soyabean processing industry, represented by the Soybean Processors Association of India (SOPA), is against the import of US soyabeans, which are predominantly genetically modified.

Logistical and Economic Hurdles => A significant number of soyabean processing plants are located in the interior regions of states like Madhya Pradesh and Maharashtra, where the crop is grown. Importing soyabeans from ports, processing them, and then re-exporting the de-oiled cake (soya meal) would be economically unviable due to high transportation costs.

Impact on Farmers => The industry supports about 7 million soyabean farmers in India. A surge in cheaper imports could cause domestic prices to fall further below the Minimum Support Price (MSP), forcing farmers to switch to other crops. Currently, soyabean is trading at ₹4,300-4,350 per quintal, which is already below the MSP of ₹5,328.

Threat to Domestic Processors => The Government's recent decision to lower the import tariff on crude soybean and other edible oils has already put pressure on domestic processors by making imported oils cheaper. Allowing seed imports would reduce their margins, forcing them to shut down.

A recent paper from NITI Aayog, has suggested a potential compromise.

As trade negotiations proceed, the Indian government faces the challenge of balancing its trade relationship with the US and protecting the interests of its domestic agricultural industries and millions of farmers.

Must Read Articles:

India-U.S. Trade Agreement and WTO

India, U.S. Tariffs & Trade Talks

Source:

|

PRACTICE QUESTION Q. Discuss the "fuel versus food and feed" dilemma as it relates to ethanol blending programs. Explain how the shift in feedstock has exacerbated this concern and what economic and social implications increased reliance on imported maize for biofuel could have. 250 words |

© 2026 iasgyan. All right reserved