The RBI transfers a record ₹2.69 lakh crore surplus to the government for 2024-25, exceeding budget expectations. Profits from seigniorage, interest earnings, forex sales, and liquidity management, despite a higher 7.5% Contingent Risk Buffer, reduce the fiscal deficit to 4.2% of GDP, balancing financial stability and government funding needs.

Copyright infringement not intended

Picture Courtesy: THE HINDU

The Reserve Bank of India’s Central Board announced to transfer ₹2.69 lakh crore to the Central government as a surplus for the year 2024-25.

The Reserve Bank of India (RBI) generates profits from its operations and transfers a portion of these earnings to the Central government.

This massive surplus strengthens the government’s finances, potentially reducing the fiscal deficit by 20–30 basis points, from 4.5% to about 4.2% of GDP, according to SBI estimates.

|

The Reserve Bank of India Act, 1934, mandates that after covering expenses, provisioning for bad debts, and setting aside funds for reserves like the Contingent Risk Buffer (CRB), the RBI transfers the remaining profits to the Central government. |

Seigniorage from Currency Issuance => The RBI earns seigniorage, which is the profit from printing money. When it issues a ₹500 note, commercial banks buy it at face value (₹500), but the cost to produce it is much lower—sometimes just a few rupees. This difference becomes revenue. For example, printing a ₹500 note might cost ₹10, leaving a profit of ₹490 per note.

Interest from Lending => The RBI lends money to the Central government, State governments, and commercial banks, charging interest. These interest payments add to its income. For example, when the government borrows to fund its budget, the RBI earns interest on those loans.

Foreign Exchange Operations => The RBI holds foreign exchange reserve (around $650 billion in 2024). It invests these reserves in foreign bonds, earning interest. Fluctuations in exchange rates can also lead to valuation gains. For 2024-25, higher foreign exchange sales increased profits, as the RBI sold dollars at favorable rates.

Liquidity Management Tools => The RBI manages liquidity in the economy through tools like the Repo Rate (lending rate to banks) and open market operations (buying/selling government securities). Higher interest rates in 2024-25, both domestically and globally, increased earnings from these activities. For example, when the RBI sells bonds or adjusts rates, it generates income.

The CRB serves as a safety net during financial stability crises. It ensures the bank has enough reserves to handle crises, such as economic downturns, banking failures, or currency instability. The Bimal Jalan Committee (2018) established the Economic Capital Framework (ECF) to guide how much the RBI should hold in reserves.

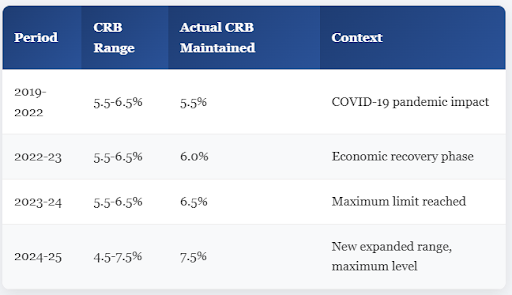

During 2018–22, the RBI kept the CRB at 5.5% due to economic challenges like the COVID-19 pandemic. It then raised it to 6% in 2022-23 and 6.5% in 2023-24. For 2024-25, the RBI widens the CRB range to 4.5–7.5% and sets it at the upper limit of 7.5%. A higher CRB means more funds are reserved, reduce the transferable surplus, but the RBI’s robust profits still allow the record ₹2.69 lakh crore transfer.

Increased Foreign Exchange Sales => The RBI’s selling of foreign exchange reserves, particularly dollars, generates profits due to favorable exchange rate movements.

Higher Interest Earnings => Rising global and domestic interest rates boost income from the RBI’s investments in foreign bonds and loans to banks and governments.

Revised Economic Capital Framework => The RBI’s review of the ECF allows a wider CRB range (4.5–7.5%). While the RBI sets the CRB at 7.5% for 2024-25, its high profits ensure a large surplus remains for transfer. Without the increased CRB, the surplus could have reached ₹3.5 lakh crore.

Strong Financial Performance => The RBI’s investments and liquidity management tools perform exceptionally well, driven by high interest rates and forex gains.

2018 Tensions: In 2018, the government reportedly pressured the RBI for larger transfers, leading to friction. Then-RBI Deputy Governor Viral Acharya warned that undermining the RBI’s independence could harm India’s economy.

Balancing Act: The government often seeks higher transfers to fund welfare programs or reduce the fiscal deficit, while the RBI prioritizes financial stability through adequate reserves. The Bimal Jalan Committee’s ECF in 2019 resolved some disputes by setting clear guidelines for the CRB and surplus transfers.

Market Expectations: In 2024-25, markets expected an even higher transfer (up to ₹3.5 lakh crore), but the RBI’s decision to raise the CRB to 7.5% capped the payout. This reflects a cautious approach to ensure long-term stability over short-term gains.

Must Read Articles:

About RBI Surplus Transfer Explained

Source:

|

PRACTICE QUESTION Q. What does the term 'seigniorage' represent in the context of the Reserve Bank of India (RBI)? A) The profit earned by printing currency notes B) The cost incurred by minting coins C) The interest earned on government securities D) The difference between the face value of currency and its production cost Answer: D Explanation: The RBI earns seigniorage by issuing currency notes. Seigniorage represents the difference between the face value of currency (what the note is worth) and the cost of producing it. For example, if the RBI issues a ₹2,000 note costing ₹5 to produce, the RBI earns ₹1,995 as seigniorage. This directly contributes to the RBI’s surplus because the RBI transfers this profit to its revenue account. |

© 2026 iasgyan. All right reserved