Description

Disclaimer: Copyright infringement not intended.

Context

- India is considering entering into a Preferential Trade Agreement (PTA) with Oman.

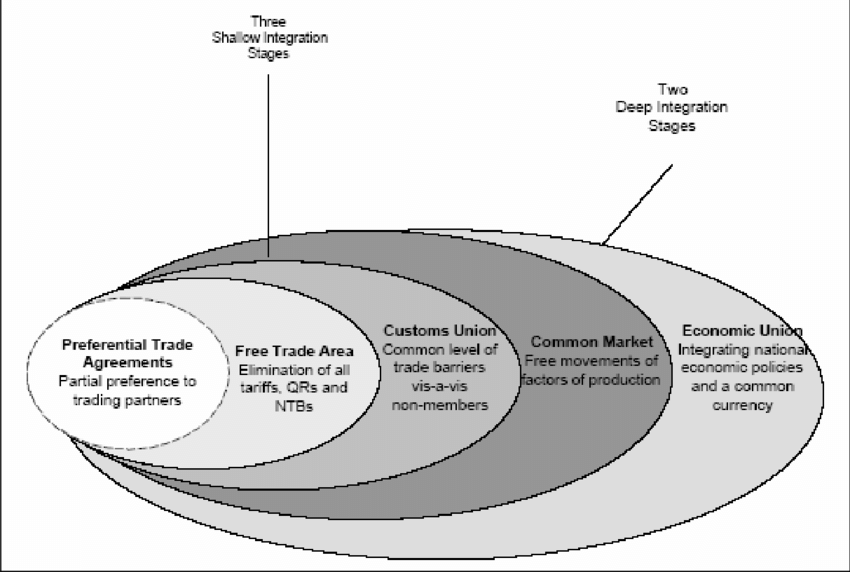

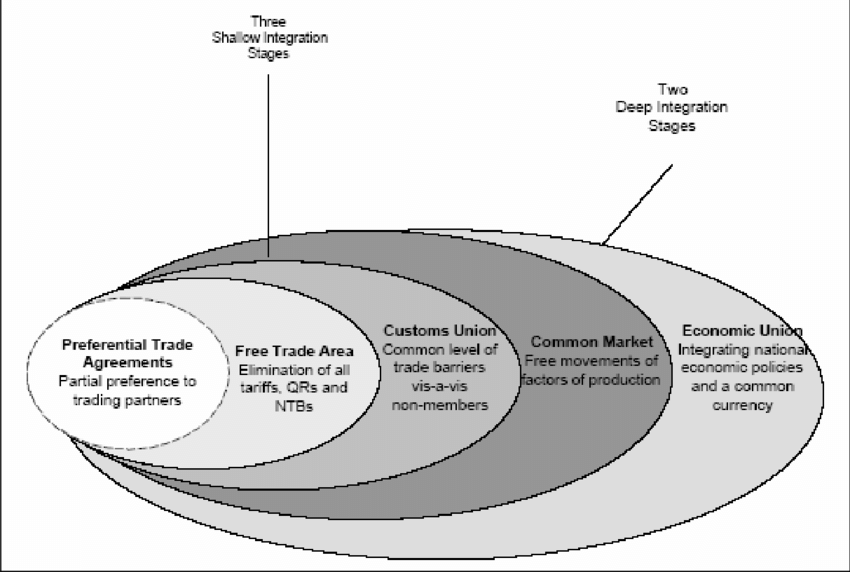

Preferential trade arrangements (PTAs)

- This is the term used in the WTO for trade preferences, such as lower or zero tariffs, which a member may offer to a trade partner unilaterally.

- In this type of agreement, two or more partners give preferential right of entry to certain products. This is done by reducing duties on an agreed number of tariff lines. Here a positive list is maintained i.e. the list of the products on which the two partners have agreed to provide preferential access. Tariff may even be reduced to zero for some products even in a PTA. Example: India signed a PTA with Afghanistan.

- These also include the Generalized System of Preferences schemes, under which developed countries grant preferential tariffs to imports from developing countries.

- They also include non-reciprocal preferential schemes granted through a waiver by the General Council, meaning the member has been exempted from applying the most favoured nation (MFN) principle.

Trade agreements

- Trade agreements are an accord between two or more countries for a specific terms of trade, commerce, transit or investment. They mostly involve mutually beneficial concessions.

- Depending on the terms and concession agreed on by the participating bodies, there are several types of trade agreements-

Free Trade Agreement

- A free trade agreement is an agreement in which two or more countries agree to provide preferential trade terms, tariff concession etc. to the partner country.

- Here a negative list of products and services is maintained by the negotiating countries on which the terms of FTA are not applicable hence it is more comprehensive than preferential trade agreement.

- India has negotiated FTA with many countries e.g. Sri Lanka and various trading blocs as well e.g. ASEAN.

Preferential Trade Agreement

Comprehensive Economic Partnership Agreement

- Partnership agreement or cooperation agreement are more comprehensive than an FTA. CECA/CEPA also looks into the regulatory aspect of trade and encompasses and agreement covering the regulatory issues.

- CECA has the widest coverage. CEPA covers negotiation on the trade in services and investment, and other areas of economic partnership. It may even consider negotiation on areas such as trade facilitation and customs cooperation, competition, and IPR.

- India has signed CEPAs with South Korea and Japan.

Comprehensive Economic Cooperation Agreement

- CECA generally covers negotiation on trade tariff and TQR rates only. It is not as comprehensive as CEPA. India has signed CECA with Malaysia.

Framework agreement

- Framework agreement primarily defines the scope and provisions of orientation of the potential agreement between the trading partners.

- It provides for some new area of discussions and set the period for future liberalisation. India has previously signed framework agreements with the ASEAN, Japan etc.

Early Harvest Scheme

- An Early Harvest Scheme (EHS) is a precursor to an FTA/CECA/CEPA between two trading partners. For example early harvest scheme of RCEP has been rolled out.

- At this stage, the negotiating countries identify certain products for tariff liberalization pending the conclusion of actual FTA negotiations. An Early Harvest Scheme is thus a step towards enhanced engagement and confidence building.

Customs Union (CU)

- A customs union (CU) is a free-trade agreement in which members apply a common external tariff (CET) schedule to imports from nonmembers.

Common Market (CM)

- A common market is a customs union where movement of factors of production is relatively free amongst member countries.

Economic Union (EU)

- An economic union is a common market where member countries coordinate macro-economic and exchange rate policies.

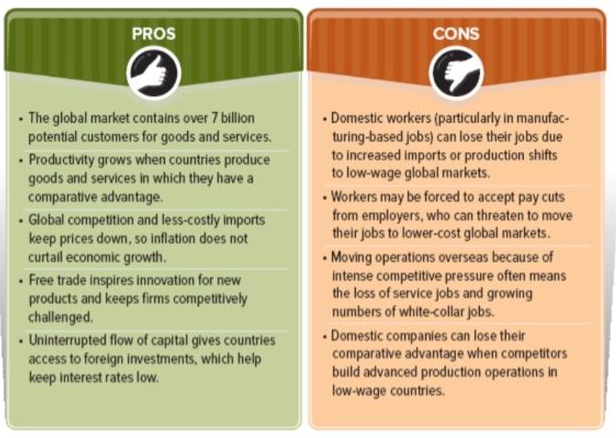

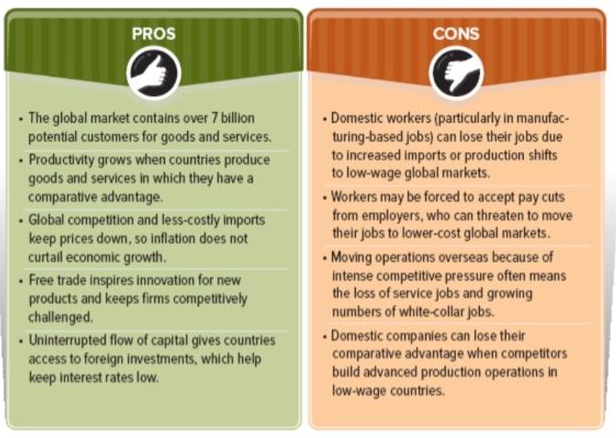

Advantages of Trade Agreements

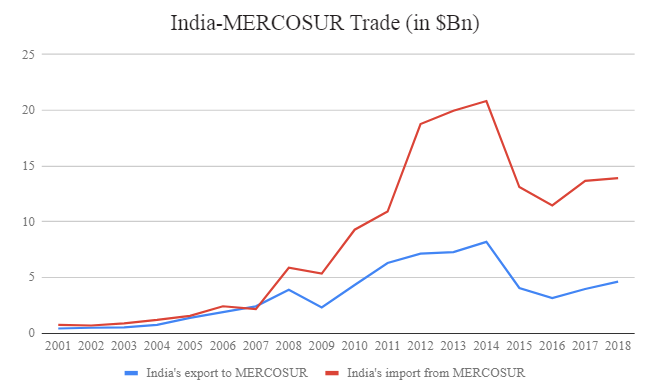

- Tariff reduction –Widely known benefit of an FTA or PTA is reduced tariff for the offered product list for example in India-MERCOSUR PTA, MERCOSUR offered preferential tariff reduction ranging from 10% to 100% on 450 listed products. It allows exporters to access the market at lower tariff hence provides competitive final prices for the exporters of a partner country.

- Access to new markets –Trade with MERCOSUR saw a significant growth post the FTA. The FTAs give easier and competitive access to the exporters as well as importers in the partner countries. For example copper wires import from Malaysia saw a sudden spike post the signing of India –ASEAN FTA in 2010. It not just leads to trade creation as in the case of bituminous coal import from Indonesia but also causes trade diversion from one country to other.

- Trade risk diversification –Increasing the diversification in terms of product basket and diversification countries help in hedging the unfavorable consequences on global and national trade due to geopolitical turmoil e.g. Oil crisis after Iran imbroglio, rift in GCC and incidental issues that are on rise in 21st century.

- Innovation and competition –Generally better market integration tend to enhance competition thereby it pushes the industry towards innovation benefitting consumers in long run.

- Technology transfer and increased integration – Increased trade leads to better integration of market and also facilitate transfer of skills and technology.

- Catch-up effects. Countries joining a rich trading block can benefit from inward investment and increased trade opportunities. Countries in Eastern Europe have made considerable progress in catching up with average income levels in Western Europe.

- Gravity theory of trade suggests that trade with countries in close proximity is the most important due to lower transport and similar cultural and economic ties.

- Gives small countries a greater say in global trade agreements.

Disadvantages of Trade Agreements

- Joining a customs union may lead to increased import tariffs – This leads to trade diversion. For example, when the UK joined the EEC customs union, it required higher import tariffs on imports from former Commonwealth countries. This led to switch in demand towards higher-cost European countries and caused loss of business for Commonwealth countries

- Increased interdependence on economic performance in other countries in trading block. If Eurozone goes into recession, it will affect all countries in the Eurozone. However, this is almost inevitable even if countries are not formally in a trading block due to a close relationship between trade cycles in different countries.

- Loss of sovereignty and independence. A trading block needs to make decisions for the whole area. This may go counter to the particular wishes of a country.

- Increased influence of multinationals. In a bilateral deal Free trade may come at the price of allowing free movement of capital. This can have benefits in terms of inward investment. But, can also have costs for higher-cost domestic producers. Free trade can lead to structural uemployment as resources shift from uncompetitive industries to newer industries.

India’s concerns on Trade Agreements

- India has not been able to evidently gain from the trade agreements vis a vis its trade partners.

Reasons for a peculiar trend of relatively higher increase in imports than exports with the trade partner post the signing of a trade agreement:-

Larger tariff reduction by India

- Economic Survey 2016-17 opines that since India has to undergo larger tariff reduction as compared to the FTA partner, the change in exports for the partner has seen an exponential rise as compared to India.

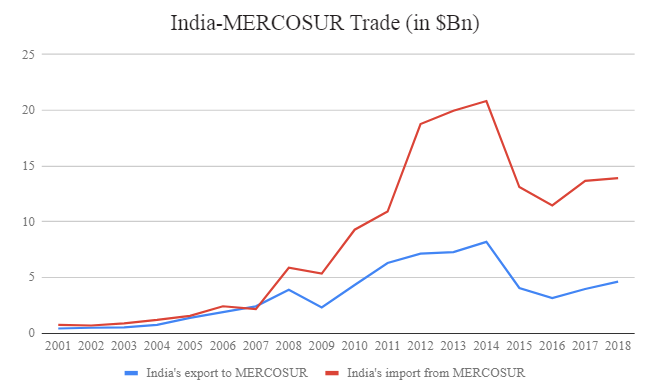

- Case in point is- India-MERCOSUR trade PTA which came into effect in 2009.

Agreements favour partners with excess capacity

- Most of the nations have focused on creating massive capacities to take advantage of economies of scale.

- However with slowing demand, the search for newer markets has always been the priority of the nations with excess capacity like Korea, Japan, and China etc. while India’s export are primarily led by MSMEs which have limited capacity and hence the trade favors the country with surplus capacity.

Feigned trade rules

- Non-tariff barriers, re-routing of commodities to avail the benefit of a trade agreement e.g. steel from China are re-routed through ASEAN, lack of transparency in the rules of origin certification process requires a focused approach to address the underlying shift in trade dynamics.

- Recently a paper released by the Ministry of Commerce and Industry to understand difference in the competitiveness of the pharmaceutical industry in terms of manufacturing of API vis a vis China revealed that the time taken in granting registration is a significant contributor to poor competitiveness of India API manufacturing industry.

- Such cases are prevalent in addressing trade tariff and competiveness issues through proxy measures.

Rise in protectionism

- Developed countries are growing wary of free trade.

- The biggest markets i.e. developed countries for the products positioned at the lower end of the value chain are shunning the developing countries by blocking access to markets.

- This has led to glut in the global market and search for newer economies to absorb the capacity.

Recommendations

Commodity focused RTAs

- FTAs should be product focussed and a post facto analysis must be done to analyze whether the FTA brought the anticipated effect on the export of said commodity or not.

Regular stock-taking of proxy issues

- A comparative study of time taken to grant RoO certificate by the competent authorities of the partner country must be undertaken to assess the unapparent impediments to fructification of an FTA.

- Rules of origin define the minimum local content or value addition for manufactured goods to enjoy the duty benefits under a trade agreement. It varies from country to country. For example, as per the India- Thailand trade agreement RoO rules – Minimum value addition requirement is 40% while in case of India-Singapore FTA, minimum value addition requirement is 60%.

Timed response to measures consistent with the WTO

- India needs to pursue a policy and strengthen ability to respond to trade measures consistent with the World Trade Organization, such as anti-dumping and conventional duties and safeguard measures which has been misuses by different countries in absence of transparent NTB norms.

Incentivizing economies of scale

- The growth of exports of products manufactured by MSME units has registered an export growth. However the focus of MSME has been domestic market centric since the domestic market size has been able to sustain the growth of MSME so far.

- Hence the need for export focused growth of the industry has remained largely absent in Indian context. Another issue is the limited capacity of firms engaged in exports which are unable to gain from economies of scale.

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1824773