Description

Disclaimer: Copyright infringement not intended.

Context

- In over seven years since launch, borrowers of Mudra loans – essentially micro and small enterprises – have paid their EMIs (equated monthly instalments) to banks.

- Non-performing assets of banks for Mudra loans – including those extended during the Covid-19 pandemic when small enterprises were the worst hit – are lower than the average NPAs of the sector as a whole, data obtained under the Right to Information Act reveals.

Pradhan Mantri Mudra Yojana (PMMY)

- Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched in 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises.

- These loans are classified as MUDRA loans under PMMY.

- These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.

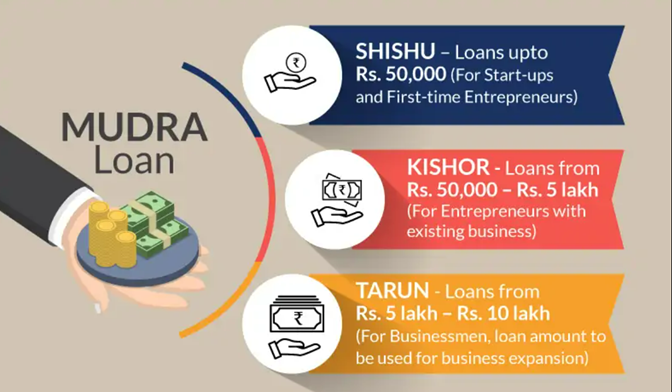

- The borrower can approach any of the lending institutions mentioned above or can apply online through this portal. Under the aegis of PMMY, MUDRA has created three products namely 'Shishu', 'Kishore' and 'Tarun' to signify the stage of growth / development and funding needs of the beneficiary micro unit/entrepreneur and also provide a reference point for the next phase of graduation/growth.

Features of the Pradhan Mantri Mudra Loan:

|

Loan Amount

|

Maximum loan amount Rs. 10 lakh

- Loan of up to Rs. 50,000 under Shishu

- Loan from Rs. 50,001 to Rs. 5 lakh under Kishore

- Loan from Rs. 5,00,001 to Rs. 10 lakh under Tarun

|

|

Processing fee

|

Nil for Shishu and Kishore loan, 0.5% of the loan amount for Tarun loan

|

|

Eligibility Criteria

|

New and existing units

|

|

Repayment period

|

3 – 5 years

|

Benefits of Mudra Loan Under PMMY

- No Collateral Security: The borrowers do not need to furnish any form of collateral to procure these loans. Hence, you don't need to risk your personal or business property in order to secure some funds.

- Easily Available: This loan is easily available to entrepreneurs trying to set up micro-sized enterprises anywhere in India and in almost every industry domain.

- Defaulting Procedure: In case of defaulting the loan legally, due to unforeseen circumstances or for losses due to natural causes, the government bears the responsibility to repay the loan.

- Quick Capital: The loans under the MUDRA scheme are available to micro-sized enterprises in a quick, effortless manner. Loans of up to 10 lakh can be easily availed in this process.

- Empowering Women: Women entrepreneurs have added special concessional benefits to the loans offered under the MUDRA scheme.

- Rural Empowerment: The MUDRA Yojana loans are equally available to small-scale businesses in both rural and urban areas. Besides, rural locales benefit more from such loans due to greater accessibility.

- Flexible Repayments: Although you can choose to repay the loan in a shorter period, the time frame of loan repayment can also be extended for a period of up to 7 years.

- Multiple Credit Possibilities: The MUDRA scheme offers multiple opportunities to expand your micro-unit enterprise with facilities like cash credit, equipment financing, etc.

- MUDRA Card: One can apply for a MUDRA card that provides instant and seamless access to funds and overdraft facilities.

The sectors that are covered under the MUDRA Yojana scheme

- Transport: for purchase of vehicles such as rickshaws, 3 wheelers, small goods vehicles, taxis, etc.

- Personal services like men’s saloons, beauty parlours, gymnasiums, boutiques, dry cleaning, medicine shops, tailoring shops, etc.

- Food products production and packing facilities like papad making, jam making, sweet shops, ice cream making, canteen services, etc.

- Agriculture and allied services like pisciculture, poultry, livestock, Agro-processing, bee keeping, rearing, etc.

- Textile: Handloom, khadi activity traditional embroidery, vehicle accessories, etc.

- Business: Traders, shopkeepers, service enterprises, non-farm income activities, etc.

Significance of mudra loan in Indian Economy

- Micro / Small entrepreneur units are the most important income-generating segment of the Indian economy. These Micro / Small units provide jobs to millions of people living in urban, rural, and even tribal areas. Often, most of these units are forced to borrow funds from informal sources with very high-interest rates leading them to be exploited by those lenders. If they would have formal and regulated funding system, these segments could be performed well in our economy and contributed in a vast manner. To resolve this gap, central Govt. introduced very flexible, easy to access loan scheme - PM MUDRA Loan Scheme. The significance of MUDRA loan is tremendous in both Indian economy as a whole and income generation to individuals / partnership setup and is capable to support their family. Through MUDRA scheme, one can start new ventures or expand existing setup to its advanced level.

- This scheme increases the availability and accessibility of long-term and short-term financing schemes among deserving small-scale enterprises throughout rural and urban India.

- This scheme provides more opportunities for income generation to businesses in the lower rungs of the pyramid. It also uplifts the overall national GDP per capita and the level of employment in our nation quite considerably. This innovative scheme is undertaken by the SIDBI, which also aims to impart financial education to entrepreneurs to empower them financially and socio-economically.

https://indianexpress.com/article/business/banking-and-finance/small-is-good-mudra-loan-npas-at-just-3-3-per-cent-in-7-years-8293362/#:~:text=IN%20over%20seven,Information%20Act%20reveals.