Description

Copyright infringement not intended.

Details:

- Credit growth to micro and small industries accelerated to 19.9 per cent to Rs 4.84 lakh crore from 3.1 per cent.

MSME

- MSME stands for Micro, Small, and Medium Enterprises. It was introduced by the Government of India in agreement with the MSMED (Micro, Small, and Medium Enterprises Development) Act of 2006.

- As per this act, MSMEs are the enterprises involved in the processing, production, and preservation of goods and commodities.

- In 1961, with the merger of the Ministry of Small Scale Industries and the Ministry of Agro and Rural Industries; the Ministry of Micro, Small, and Medium Enterprises (M/o MSME) was formed.

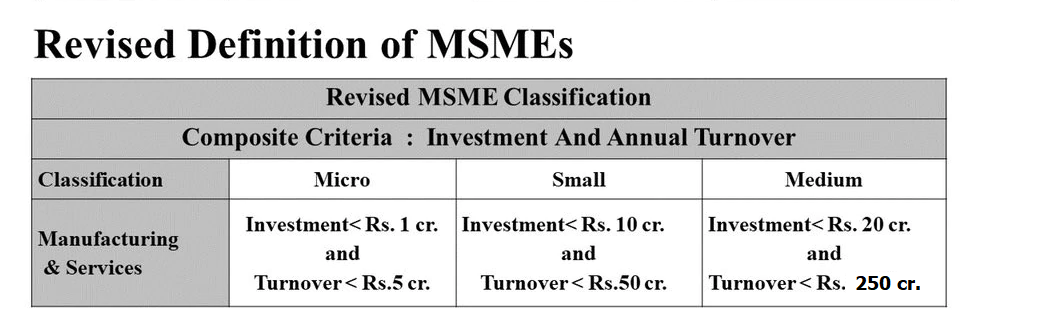

Types of MSME

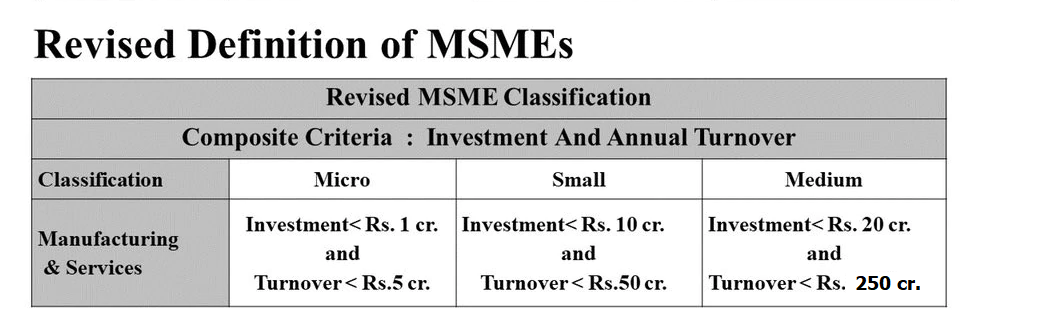

- According to the provisions of the MSMED (Micro, Small & Medium Enterprises Development) Act of 2006, MSMEs are classified into two classes i.e. Manufacturing Enterprises and Service Enterprises. (Now merged under one entity)

- The enterprises are categorized based on annual turnover and investment in equipment.

Copyright infringement not intended.

Importance of MSME Sector

- MSME sector is the backbone of the country's economy, contributing 30 percent of India's GDP and 40 percent of exports.

- They are also accountable for one-third of India's manufacturing output.

- It contributes about 11% of GDP from manufacturing and 24.63% of GDP from service activities.

- According to 2018-19 Annual Report of Department of MSMEs, there are 6.34 crore MSMEs in the country. Around 51 per cent of these are situated in rural India. 99.5 per cent of all MSMEs fall in the micro category.

- These MSMEs employ more than 11 crore people. MSMEs are recognized for having the highest rate of economic growth.

- They account for approximately 45% of India's total exports.

- MSMEs have propelled India to new heights due to their low investment requirements, flexibility in operations, and ability to develop suitable native technology.

- MSMEs promote inclusive growth by creating job opportunities, especially for people from lower socioeconomic backgrounds in rural areas.

As per International Council for Small Business, formal and informal MSMEs male up to 90% of total firms, 70% of employment and 50% of world GDP.

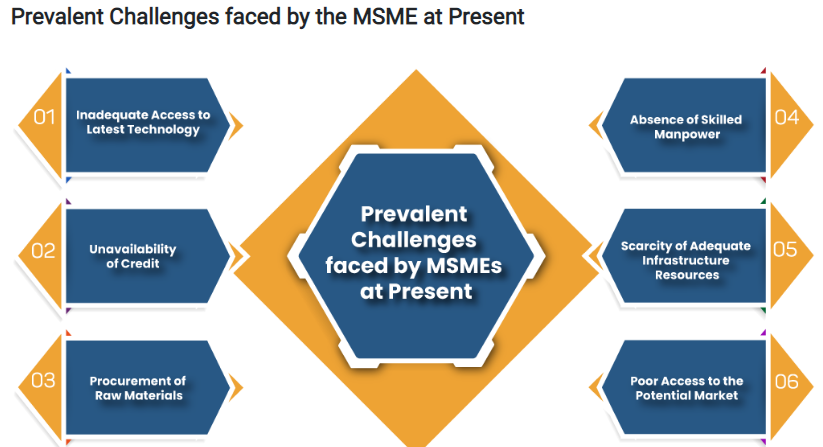

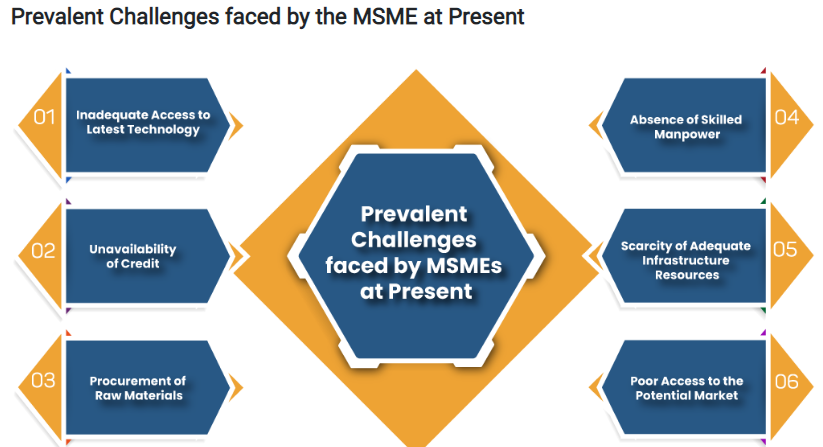

Challenges faced by MSMEs

Copyright infringement not intended.

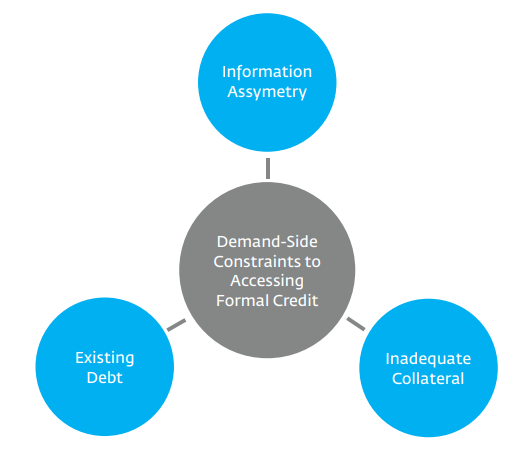

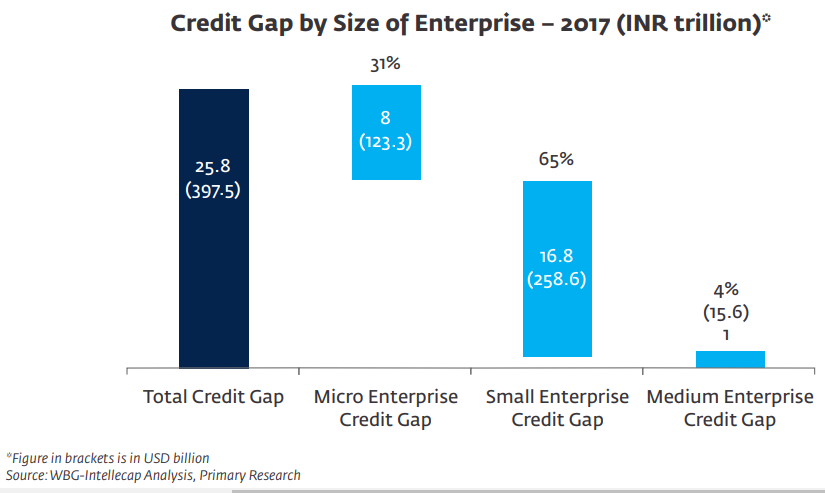

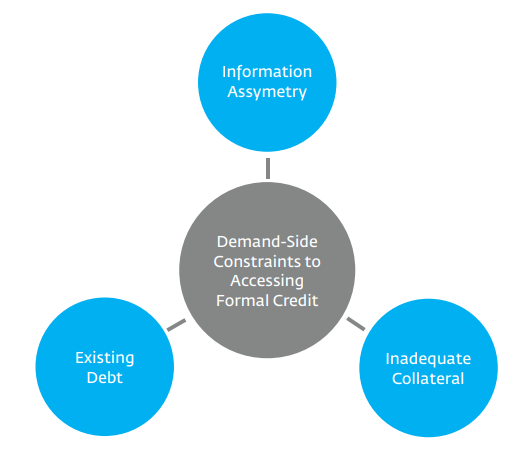

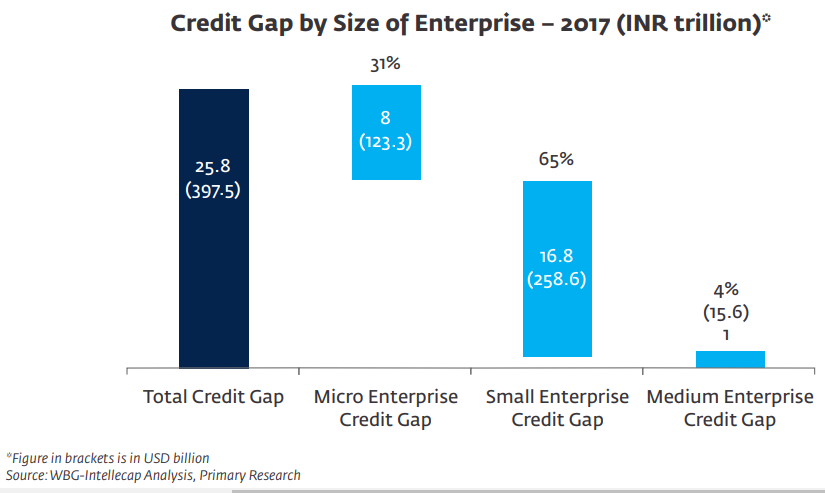

Credit Constraints

- Out of some 58 million MSMEs in India, more than 40 percent lack access to formal sources of finance.

Copyright infringement not intended.

Copyright infringement not intended.

- Being a supplier to large firms, the majority of MSMEs are dependent on the success of large firms as well as credit payments from these firms. Delays in payments from large firms or stoppages of operations from large firms reduce cash inflow to MSME, leading to liquidity issues. MSMEs usually face the problems of bad debt or late repayment from debtors as they do not comprise suitable recovery mechanisms that eventually affect their working capital availability.

- The unavailability of timely and adequate finance is a major constraint in MSME’s existence. Even though MSMEs account for a large share of economic activity, banks are a bit apprehensive about lending capital to this sector. This has made it difficult for MSMEs to opt for a loan and repeal their dreams of financial independence.

Other

- Procurement of raw materials is done within local territory due to their financial limitations.

- MSMEs are either located in industrial estates or are operational in urban areas or have come up in an unorganized manner in rural areas of the country.

- MSMEs have struggled to have access to the market due to a number of reasons like inadequate capital, inadequate use of marketing tools, etc.

- Although India is having a big pool of human resources, the industry still faces a deficit in manpower with the skills set required for manufacturing, marketing, etc.

- Lack of managerial skills, knowledge, and technology-intensive education to run a competent MSME.

Copyright infringement not intended.

Copyright infringement not intended.

Impact due to COVID

- The MSME sector was among the most pandemic afflicted sectors.

- Thousands of MSMEs either shut down or became sick after the government announced a nationwide strict lockdown in March 2020 in the wake of the Covid pandemic.

- To revive activity, the RBI and the government introduced several measures.

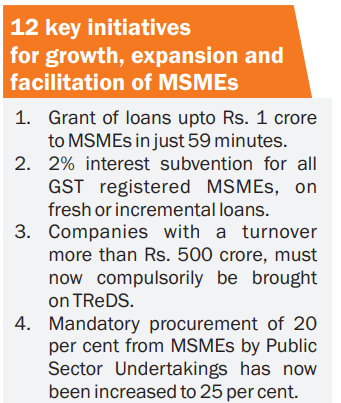

Measures taken to revive the sector

- Emergency Credit Line Guarantee Scheme (ECLGS).

- Scheme of one-time restructuring of loans to MSMEs without an asset classification downgrade.

- Permitted bank lending to NBFCs (other than MFIs) for on-lending to agriculture, MSMEs and housing to be classified as priority sector lending (PSL).

- Scheduled Commercial Banks were allowed to deduct credit disbursed to new MSME borrowers from their net demand and time liabilities (NDTL) for calculation of the cash reserve ratio.

- RBI permitted lending institutions to review the working capital sanctioned limits, based on a reassessment of the working capital cycle, margins, and so on, as a one-time measure.

- Union Budget 2021-2022 brought relief to the capital-starved MSMEs, with the government infusion of Rs 15,700 crore for the sector.

- The decision to incentivize the incorporation of One Person Companies (OPCs) was taken to feed the MSME ecosystem.

- Redefining MSME, the central government and Ministry of MSMEs brought in a large number of micro and small units under the sector, benefitting them with their measures, schemes and concessions.

- The government initiated numerous measures under Atmanirbhar Bharat Abhiyan. The measures include Rs 20,000 crore subordinate debt for MSMEs and Rs 50,000 crore equity infusion through MSME funds of funds.

- The collateral free automatic loan for businesses has been a major support to the sector.

- The rationalization of taxes and duties (for various products from steel and alloys to garments and leather) to favour the domestic manufacturers and boost the MSME sector.

- Merger of Manufacturing and Service MSMEs.

- Repayment Tenure up to 60 months

- 100% Credit Guarantee, for several loan schemes

- Secured loans of up to Rs. 500 crore (Lease rental discounting)

- Moratorium period offered is 12 months, can exceed as per bank

Could the measures revive the sector?

- Owing to the strong government support and the resilience shown by MSMEs, the sector has been able to take-off, scripting a revival story.

- However, amidst the economy being in technical recession, the sector still needs a much stronger policy thrust to maximize its potential.

- The sector finds itself grappling with long-standing challenges of unavailability of working capital, complex regulatory and licensing mechanism, stringent loan disbursal policies, numerous compliances requirements, nascent digital adoption, and a complicated taxation system.

Findings

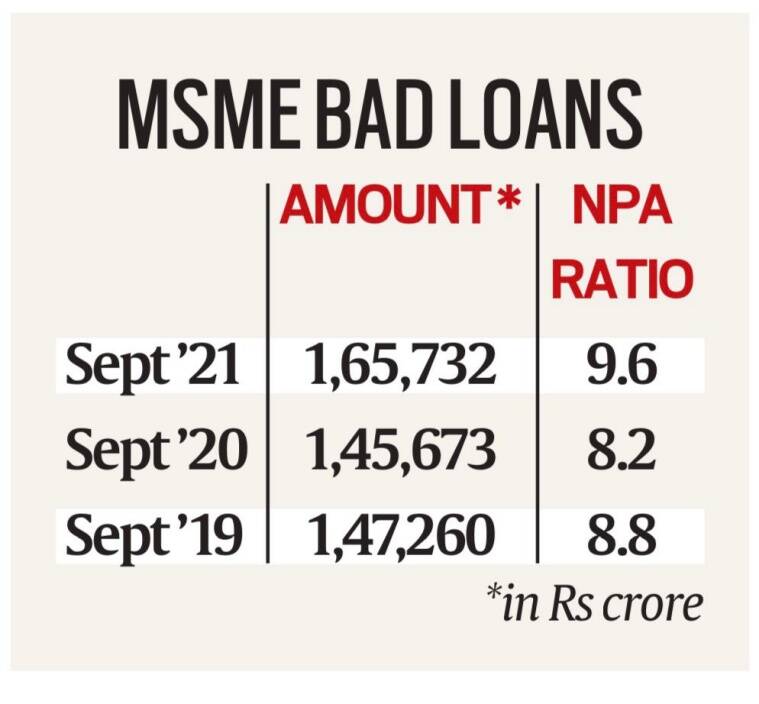

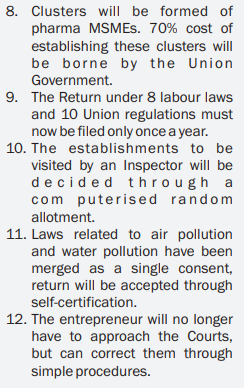

- MSME bad loans had declined from Rs 1,47,260 crore (8.8 per cent of advances) in September 2019, only to pick up again in 2021.

- According to the RBI, bad loans of MSMEs now account for 9.6 per cent of gross advances of Rs 17.33 lakh crore as against 8.2 per cent in September 2020.

- The restructuring schemes and packages didn’t benefit thousands of units which were already in default- Banks.

- This is because to be eligible under the ECLGS scheme, borrower accounts were to be less than or equal to 60 days.

Copyright infringement not intended.

- The single-biggest hurdle facing the MSMEs: lack of financing.

- Further, most of the MSME funding comes from informal sources. A key reason why banks dither from extending loans to MSMEs is the high ratio of bad loans.

- The other big issue plaguing the sector is the delays in payments to MSMEs.

|

Most MSMEs are unable to avail the measures of loan disbursal owing to the amount of paperwork, documentation, non-existing credit history, and non-availability of adequate collateral, especially for a first-time borrower. The cost of compliance, covering all licenses, and complex taxation take a huge toll on the enterprises. The challenges of running a business amidst pandemic and slump in demand add further complications to the stressed sector.

|

Silver Lining

- Credit growth to micro and small industries too rose 20.5 per cent in December 2021 from 1.3 per cent a year ago.

- This reflects effectiveness of various measures taken by the Government and the RBI to boost credit flow to the micro, small and medium enterprises (MSME) sector- Economic Survey.

- The launch of Government’s Emergency Credit Line Guarantee Scheme (ECLGS) in May 2020 and its subsequent expansions benefitted the credit growth to MSMEs. It helped push the credit to micro and small industries to 19.9% in February 2022 from 3.1% a year ago and to medium industries to 71.4% from 30.6% a year ago.

- 50% of the rated companies with a turnover of less than Rs 250 crore have availed the ECLGS facility. This has helped to ease the liquidity scenario for MSMEs apart from lowering the cost of borrowings to an extent.

Way Ahead

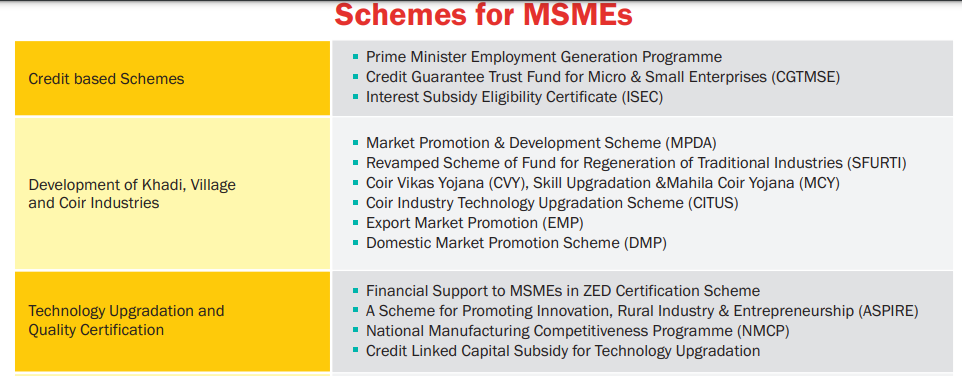

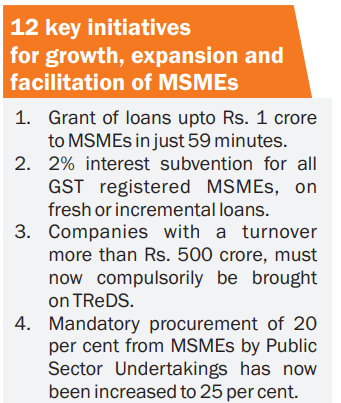

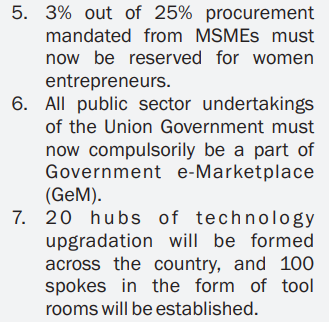

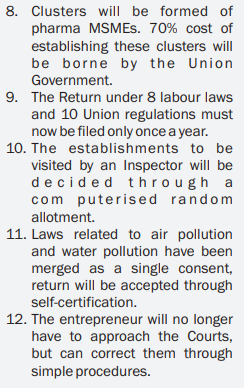

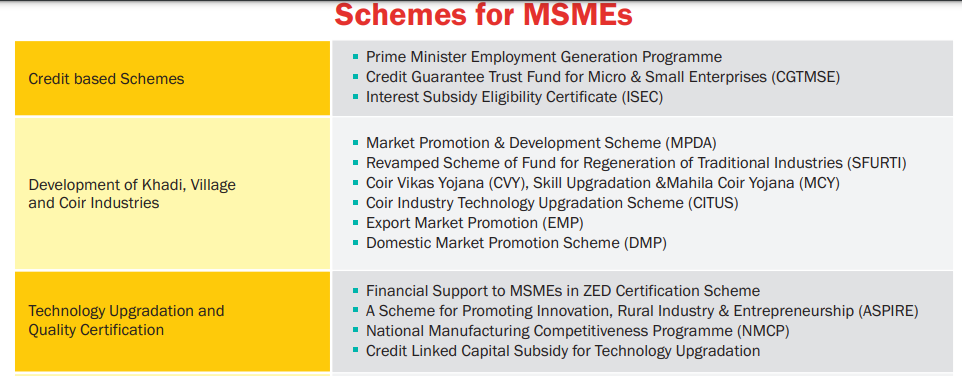

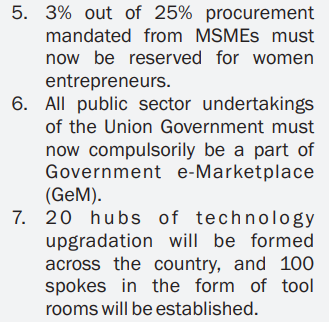

- The five key aspects facilitates the MSME sector: Access to credit, Access to market, Technology upgradation, Ease of doing business, Social security for employees.

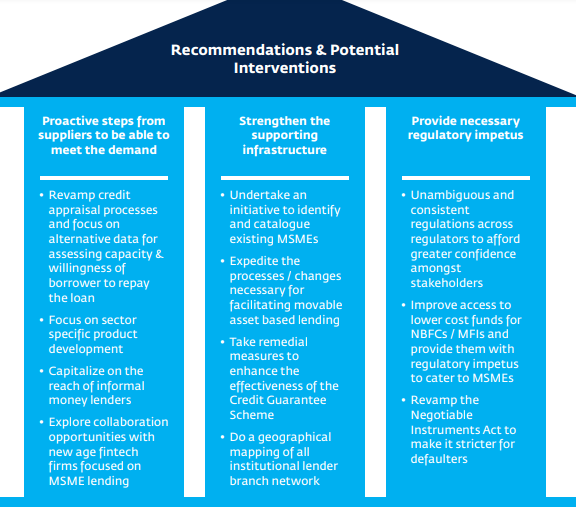

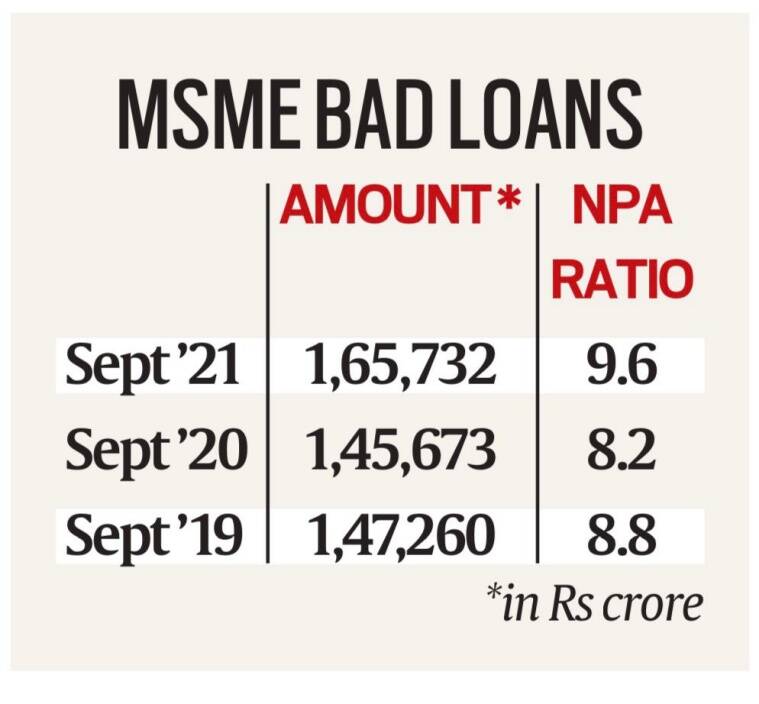

Potential Interventions in the MSME Credit Ecosystem

Copyright infringement not intended.

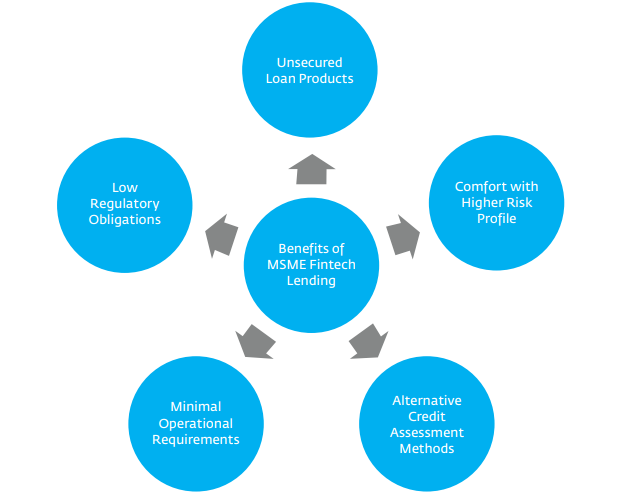

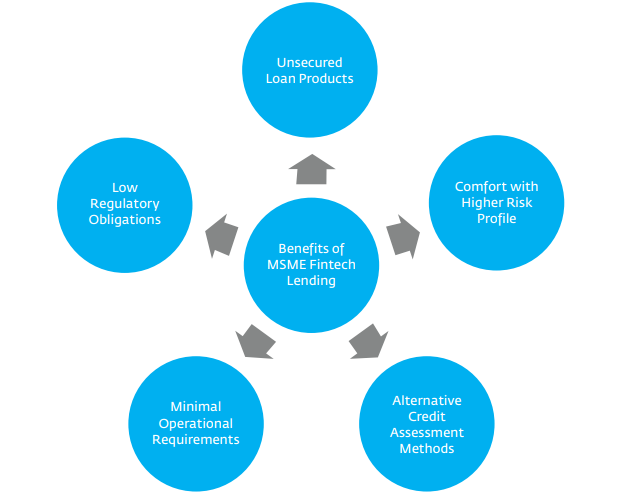

- Strengthening of Fintech Business Models can offer benefits fuelling the rise and growth of MSME Sector.

Copyright infringement not intended.

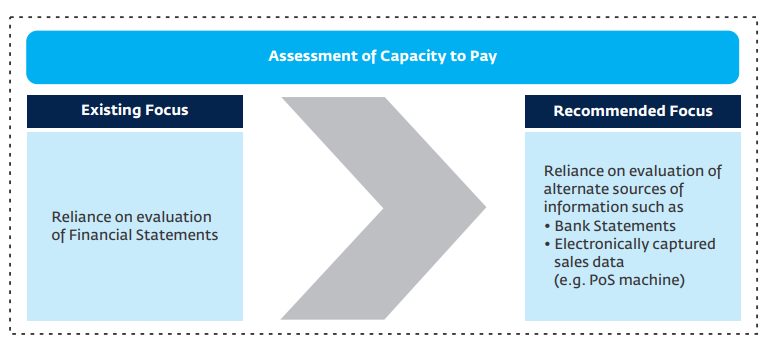

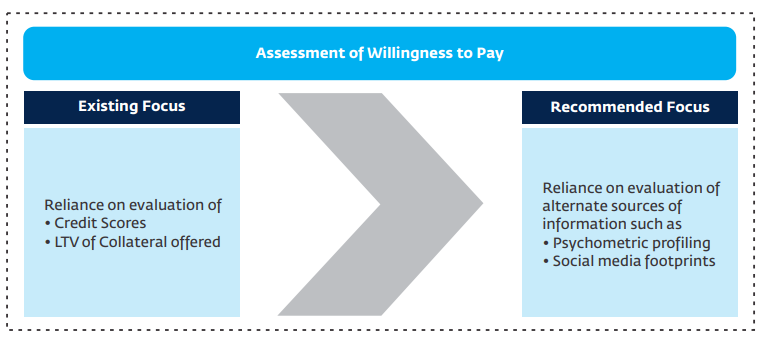

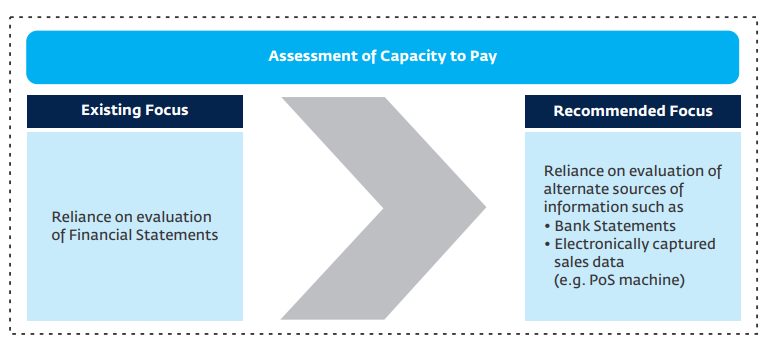

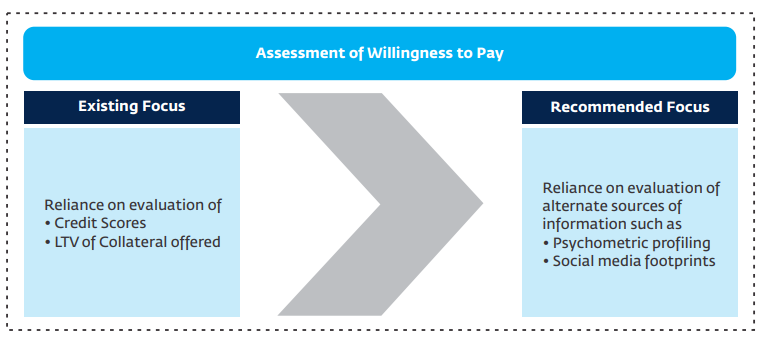

- Alternative Methods in Credit Assessment.

Copyright infringement not intended.

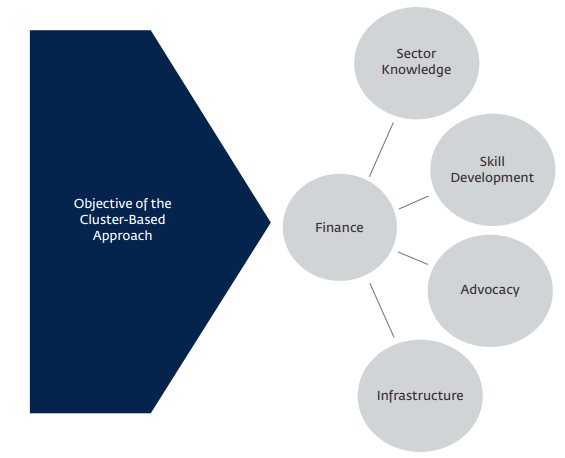

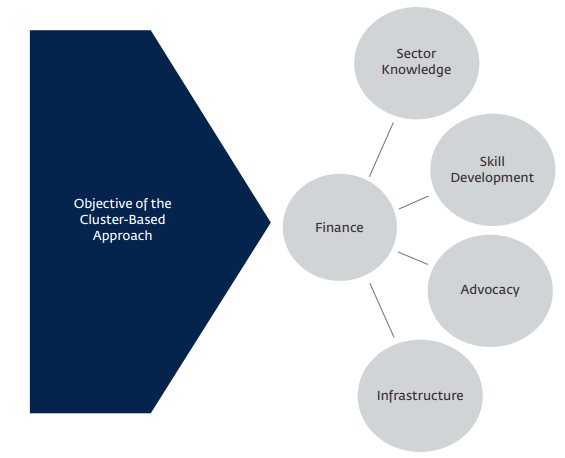

- Cluster-Specific Financing Schemes: SIDBI found that the link between access to technology and access to credit is often not well understood. Clusters need assistance with deciphering how to leverage technology to meet their specific financing needs. Accordingly, SIDBI launched a platform that is available to 15 clusters and highlights tailored policy and technology recommendations to improve credit access for clusters. For instance, in the Kolhapur textile cluster (Maharashtra), this platform has encouraged the consolidation of units and enabled the NPA-free cluster to receive increased subsidies for power looms for micro and small enterprises.

Copyright infringement not intended.

- In terms of access to capital, pending or delayed payments to MSMEs should be accelerated.

- Close monitoring of payments to MSMEs through TReDS should be done at a central level.

|

The government is already encouraging MSMEs to on-board TReDS platform. TReDS is an electronic platform that allows auctioning of trade receivable. The process is also commonly known as 'bills discounting'. A financier, typically a bank, buys a bill (trade receivable) from a seller of goods before it is due or before the buyer credits the value of the bill. The discount is the interest paid to the financier.

|

- MSMEs should be nudged to go digital and raise all invoices in TREDS to ease liquidity pressure on their working capital.

- Need of the hour: Making credit and capital easily accessible to MSMEs. The lending ecosystem therefore needs to be eased and strengthened by leveraging digital technologies for a seamless lending process and for assessing credit risk of potential borrowers.

- Other Policy Changes required:

- Incentivizing digital adoption within the sector

- Promoting digital literacy

- Addressing skilling challenges

- Reducing GST

- Easing various licensing and compliance regulations

- Making interventions that would guide the sector to wider markets, through e-commerce.

Final Thought

- The MSME sector is next to agriculture in terms of providing employment.

- In the making of Atmanirbhar Bharat, its role is instrumental.

- Unleashing a new wave of bolder and well-directed reforms would thrust the industry to soar higher.

- It is imperative that the government bolsters its reforms and introduces some game changing measures for the sector.

https://indianexpress.com/article/business/economy/retail-msmes-push-credit-growth-rate-to-near-double-digits-7865069/