The Union Cabinet approved ₹15,640 crore for the Modified Interest Subvention Scheme (MISS) in 2025-26, enabling farmers to access Kisan Credit Card loans up to ₹3 lakh at 7% interest, or 4% with timely repayment. The Kisan Rin Portal enhances transparency, supporting affordable credit for agriculture, animal husbandry, and fisheries.

Copyright infringement not intended

Picture Courtesy: CMV.360

The Union Cabinet approved the continuation of the Interest Subvention (IS) component under the Modified Interest Subvention Scheme (MISS) for the financial year 2025-26.

It is a Central Sector Scheme launched in 2006–07, to help farmers access affordable short-term loans through the Kisan Credit Card (KCC).

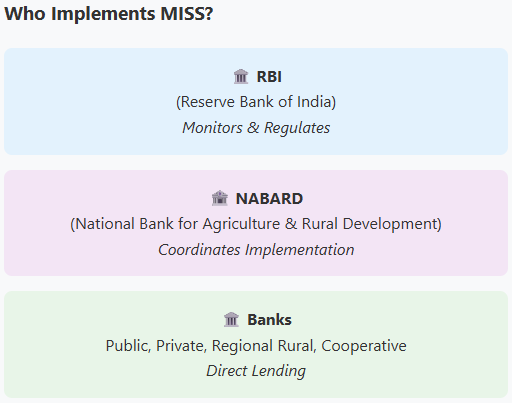

The Reserve Bank of India (RBI) and the National Bank for Agriculture and Rural Development (NABARD) oversee its implementation, working with banks like public sector banks, regional rural banks, cooperative banks, and private banks in rural and semi-urban areas.

In May 2025, the Union Cabinet approved the continuation of the Interest Subvention (IS) component of the MISS for the financial year 2025-26, and allocated ₹15,640 crore to support this scheme.

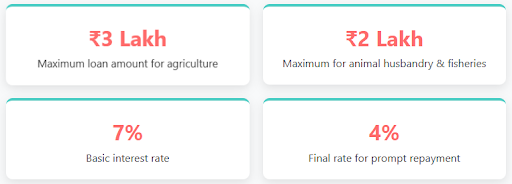

Loan Amount and Interest Rate

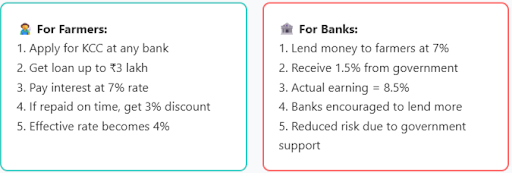

Farmers can borrow up to ₹3 lakh for short-term agricultural needs (like buying seeds or fertilizers) through Kisan Credit Cards at a subsidized interest rate of 7%. The government provides a 1.5% interest subvention to banks, which lowers the cost for farmers.

For farmers who repay their loans on time, an additional 3% Prompt Repayment Incentive (PRI) applies, reduce the effective interest rate to 4%. This encourages timely repayment and saves farmers money.

For loans related to animal husbandry or fisheries, the interest subvention applies to loans up to ₹2 lakh.

How Does It Work?

Kisan Rin Portal (KRP)

Launched in August 2023, this digital platform has improved transparency and efficiency in processing subsidy claims. This is part of the Digital India initiative applied to agriculture.

|

Kisan Credit Card (KCC) was launched in 1998, and acts like a debit card, allowing farmers to withdraw cash or pay for farming expenses. It is designed to provide timely credit so farmers don’t rely on high-interest moneylenders. The loan limit was increased from ₹3 lakh to ₹5 lakh in the Union Budget 2025-26, with ₹3 lakh for crop-related expenses and ₹2 lakh for other agricultural activities like allied farming. |

Must Read Articles:

Kisan Rin Portal was launched to help farmers

Source:

|

PRACTICE QUESTION Q. Consider the following statements about Modified Interest Subvention Scheme (MISS): 1. It provides 1.5% interest subvention to lending institutions 2. The maximum loan limit is ₹5 lakh for all agricultural activities 3. It is implemented by RBI and NABARD Which of the above statements is/are correct? A) 1 and 2 only B) 2 and 3 only C) 1 and 3 only D) 1, 2 and 3 Answer: C Explanation: Statement 1 is correct: The Government of India provides an interest subvention of 1.5% to lending institutions (like Public Sector Banks, Private Sector Banks, Rural Regional Banks, and Cooperative Banks) for short-term agricultural loans up to ₹3 lakh provided to farmers at an interest rate of 7% per annum. Statement 2 is incorrect: The primary focus of the MISS for the 1.5% interest subvention to lending institutions and the 7% interest rate to farmers (further reducible to 4% on prompt repayment) is for short-term crop loans up to ₹3 lakh. Statement 3 is correct: The scheme is formulated by the Government of India (Ministry of Agriculture & Farmers Welfare). The operational guidelines for the implementation of the scheme are issued by the Reserve Bank of India (RBI) to commercial banks and by the National Bank for Agriculture and Rural Development (NABARD) to Cooperative Banks and Regional Rural Banks. |

© 2026 iasgyan. All right reserved