SEBI has relaxed norms for merchant bankers, now permitting them to engage in unregulated activities such as advisory and consultancy without a separate legal entity. This reversal of a previous decision is anticipated to enhance their profitability by creating additional sources of revenue from non-fund-based activities, a welcome move for the industry.

Copyright infringement not intended

Picture Courtesy: THE HINDU

The Securities and Exchange Board of India (SEBI) has introduced changes to the regulations governing merchant bankers.

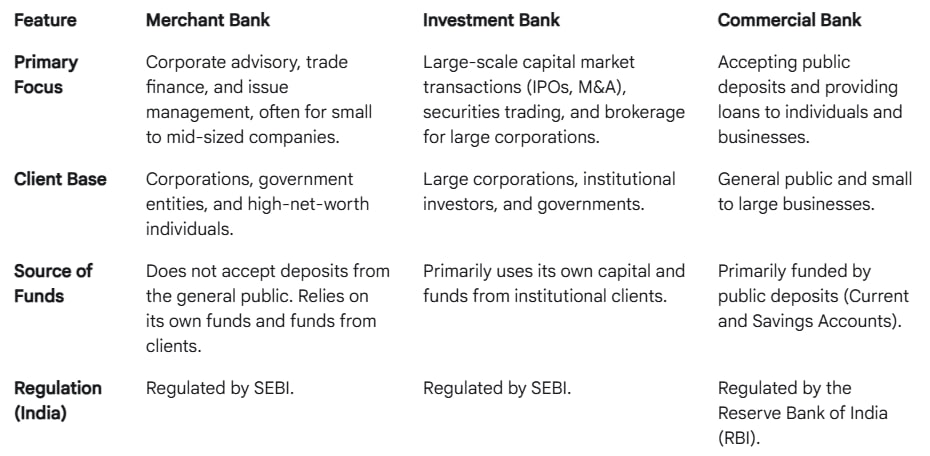

A merchant bank is a financial institution that provides a combination of banking and consultancy services to its clients, primarily corporations, high-net-worth individuals, and government entities.

They act as intermediaries between companies and investors, providing a range of services, including:

In India, no entity can operate as a merchant banker without obtaining a certificate of registration from the Securities and Exchange Board of India (SEBI).

In India, no entity can operate as a merchant banker without obtaining a certificate of registration from the Securities and Exchange Board of India (SEBI).

To ensure financial stability, SEBI prescribes a minimum net worth requirement for merchant bankers, which currently stands at five crore rupees.

"Hiving Off" Requirement

Previous Rule => In a December 2024 meeting, SEBI had mandated that merchant bankers must create a separate legal entity to carry out activities not regulated by SEBI.

New Rule => After receiving feedback from market participants, SEBI has reversed this decision. Merchant bankers can now conduct unregulated activities, such as advisory and consultancy services, within the same legal entity.

Permitted Unregulated Activities

Merchant bankers can now engage in activities that are either regulated by other financial sector regulators or are fee-based and do not involve the direct use of their own funds.

SEBI has also categorized merchant bankers based on their net worth:

Must Read Articles:

SEBI's Startup and PSU Reforms

Source:

|

PRACTICE QUESTION Q. In the context of an Initial Public Offering (IPO), what does the term "underwriting" by a merchant banker refer to? A) Writing the company's history in the offer document. B) Guaranteeing a minimum level of subscription by agreeing to buy unsold shares. C) Auditing the financial statements of the issuing company. D) Setting up the online portal for IPO applications. Answer: B Explanation: When a merchant banker underwrites an issue, they enter into a formal agreement with the company to take on the risk of the issue not being fully subscribed. If the public does not buy all the shares offered in the IPO, the underwriter is legally obligated to purchase the shortfall of shares. This guarantees that the company will raise the minimum amount of capital it needs from the offering. For this service of taking on risk, the underwriter charges a fee or commission. |

© 2026 iasgyan. All right reserved