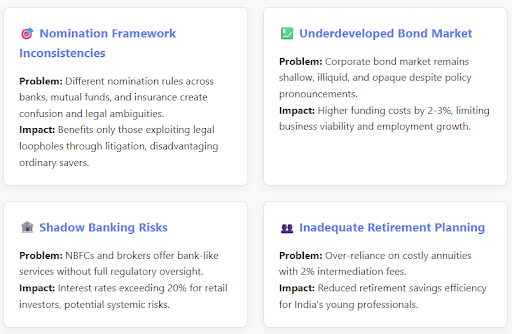

India's financial sector needs structural reforms. Key issues include inconsistent nomination rules, a weak corporate bond market, costly retirement planning, and risky shadow banking. Proposed reforms include unified nomination laws, stronger bond market transparency, zero-coupon bonds for retirement, and tighter NBFC regulations to enhance stability, transparency, and investor protection.

Copyright infringement not intended

Picture Courtesy: THE HINDU

Indian financial sector stands at a critical juncture, requiring comprehensive structural reforms beyond incremental changes.

The Indian financial sector is a vast and complex system, made up of various institutions and markets that help facilitate financial transactions and support the economy.

It includes several key segments: the banking sector, insurance market, capital markets, money markets, and non-banking financial companies or NBFCs.

The banking sector is dominated by commercial banks, which include public sector banks, private sector banks, and foreign banks. They play a crucial role in accepting deposits and providing loans. Then there are also cooperative banks and regional rural banks serving specific regions.

The insurance sector covers both life and non-life insurance, regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

Capital markets, which include stock exchanges like the NSE and BSE, facilitate the raising of funds for companies and investment for individuals and institutions. The money market deals with short-term funds, while NBFCs provide various financial services outside the traditional banking system.

The Reserve Bank of India (RBI) is the primary regulator for banks and NBFCs, controlling monetary policy. SEBI regulates the capital markets.

Harmonizing Nomination Rules

Banks, mutual funds, and insurance companies follow different guidelines for nominating beneficiaries. Experts demand a single, clear nomination framework across all Banking, Financial Services, and Insurance (BFSI) sectors to simplify processes and protect savers. A unified law would ensure clarity and fairness, reducing courtroom battles over inheritance.

Strengthen the Corporate Bond Market

The Indian corporate bond market is weak, illiquid, and hard to navigate. Unlike stock markets, where shares are actively traded, bonds—where companies borrow money by issuing debt. This matters because a strong bond market lowers borrowing costs for businesses by 2-3%, making them more competitive and creating jobs.

The Reserve Bank of India (RBI) once asked the National Stock Exchange (NSE) to build a vibrant secondary bond market, but progress stalled.

Experts suggest stock trading, especially through complex algorithms, is more profitable for exchanges, raising questions about transparency. For example, the NSE once sued a journalist for exposing malpractices, only to face court criticism.

India struggles to track who truly owns bonds due to weak Ultimate Beneficial Owner (UBO) disclosure rules. The Securities and Exchange Board of India (SEBI) recently pushed two Mauritius-based funds to reveal their shareholders, but they resisted, showing how loopholes allow investors to hide their identities. Tightening UBO rules, as required by the Financial Action Task Force (FATF), would boost trust and attract more investment.

Improving Retirement Planning

Retirement planning in India is expensive and inefficient. Most people rely on annuities—insurance products that pay out over time but charge high fees, eating into savings.

Experts propose a better option: long-dated zero-coupon government bonds. These bonds pay no interest during their term but are sold at a discount and redeemed at full value later, offering a low-cost, secure way to save for retirement.

Removing the 2% fees charged by insurance companies could save retirees huge sums over 30 years. Building a retirement system based on these bonds would help young professionals plan for the future without losing money to middlemen.

Controlling Shadow Banking

Shadow banking is a growing threat. Non-banking financial companies (NBFCs), brokers, and margin lenders act like banks but escape strict regulation.

They offer loans disguised as “margin funding” to retail investors, often at sky-high interest rates above 20%. Investors may not even realize they’re being charged so much.

Experts warn that shadow banking could trigger a financial crisis, like the 2008 global meltdown caused by unregulated financial products.

The RBI introduced a scale-based regulatory framework for NBFCs in 2022 to curb risky practices, however, but more action is needed. The European Union already tracks shadow banking data closely; India must do the same to protect investors and ensure transparency.

Source:

|

PRACTICE QUESTION Q. Evaluate the performance of the Pradhan Mantri Mudra Yojana (PMMY) in fostering entrepreneurship among small businesses. 150 words |

© 2026 iasgyan. All right reserved