Description

Disclaimer: Copyright infringement not intended.

Context

- Securities Exchange Board of India (SEBI) has taken note of the need for sustainable finance in the aftermath of extreme weather events.

- SEBI, in its paper titled ‘Consultation Paper on Green and Blue Bonds as a mode of Sustainable Finance’, deals with debt instruments specifically aimed at raising investments in green projects. SEBI’s paper explores the ecosystem of environmental, social and governance (ESG) investments through green and blue bonds.

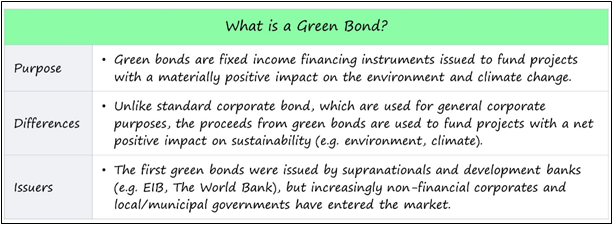

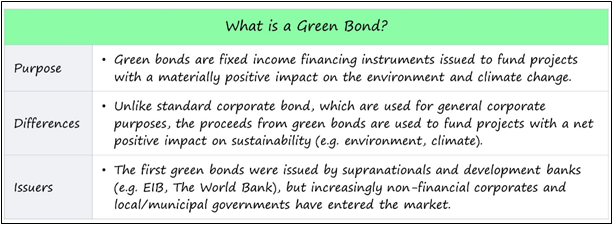

Green Bonds

- A green bond is a fixed-income instrument designed to support specific climate-related or environmental projects.

- The phrase "green bond" is sometimes used interchangeably with "climate bonds" or "sustainable bonds."

- Green bonds can finance various projects, most often related to renewable energy (e.g. wind, solar, hydro), recycling, and clean transportation. More specifically, examples of projects financed with green bonds include: Renewable Energy. Energy Efficiency.

- Green bonds are asset-linked and backed by the issuing entity's balance sheet. They work just like any other corporate or government bond.

- They are used to finance projects aimed at sustainable agriculture, pollution prevention, fishery and forestry, clean water and transportation, along with environment friendly water management projects.

Issuance

- The first green bond was issued in 2007 by the European Investment Bank, followed by the World Bank in 2008.

- The initial issues of such instruments in India were by Indian financial institutions (Yes Bank Ltd., Exim Bank of India) and a corporate entity in 2015.

- Since then, there have been a slew of green bond and sustainability-linked bond issues by Indian companies.

- However, at present most of the green bonds issued in India have been issued by non-financial corporate entities (almost 32% of the green bonds in 2021), mainly those engaged in renewable energy businesses. Indian financial institutions (such as banks) have of late been slower to issue such instruments.

- Foreign investors scout for green bonds issued by growing markets like India as they have attractive valuations and good growth prospects. If marketed correctly, green bonds could bring in a new set of investors to India’s debt market.

Current regulatory framework

- Green bonds are a form of infrastructure financing and the Securities and Exchange Board of India (“SEBI”) had issued a concept paper on the same in 2015. Such instruments were covered within the ambit of general debt securities and were regulated by SEBI as such, along with the related compliances for general debt securities – i.e compliance with provisions of the Companies Act, 2013, mandatory listing as per SEBI regulations, disclosures etc.

- In the 2017 circular, SEBI proposed a definition of ‘green debt securities’ as part of its regulations. A debt security could be considered ‘green’ or a ‘green debt security’ if the funds raised through such issuance were to be utilized for projects/ assets categorized broadly as follows, which list could be added to / changed by SEBI from time to time:

- Renewable and sustainable energy (including wind, solar, bioenergy and other energy sources using clean technology);

- Clean transportation including public/ mass transportation;

- Sustainable water management including clean water, drinking water and water recycling;

- Climate change adaptation;

- Energy efficiency including green buildings;

- Sustainable waste management including recycling, waste disposal, waste to energy;

- Sustainable land use; and

- Biodiversity conservation.

To summarise, in order to issue and list any ‘green bonds’ or ‘green debt securities’, an issuer had to comply with

- Companies Act, 2013;

- SEBI (Issue and Listing of Debt Securities) Regulations, 2008; and

- the SEBI (Listing Obligations and Disclosure Requirements), 2015, all of which apply to debt securities in general, and there were no specific rules or regulations in relation to issuance of green bonds or green debt securities in particular.

Types of Green Bonds in India

Green bonds are majorly divided into three types.

Organization-guaranteed Bonds

- It is also known as general obligation bonds. The bonds credit-worthiness is based on the organization issuing the bond. The Organization-guaranteed bonds can be corporates, government, or public institutions.

Asset-backed bonds

- The credit-worthiness in asset-backed bonds is tied only to the expected revenue from the solar farm and not the other cash flows of the issuer. The solar farm asset is transferred into a separate entity, known as a special purpose entity (SPE) or special purpose vehicle (SPV). This entity holds just this asset. The lenders are repaid only from the earned revenue from the farm.

Hybrid bond

- It is a dual-recourse bond. Hybrid bonds are also popularly as covered bonds. It can be a two-way structure – in the first method if there is the condition of payment default, the lender will have the right over the farm. He /she can claim on other assets if the farm value is not enough to pay the lender. The farm is in an SPE in the second method. In the condition of default, the SPE assets are transferred to the lender. If the farm value is not enough to pay the lender, the hybrid bond holder can claim other assets as well.

Sovereign Green Bonds

- It is issued for an average tenure of 14 years or more. Sovereign Green Bonds is allocated to fund projects associated with climate adaption and climate mitigation. The green bond holders also enjoy tax benefit. Sovereign green bonds are suitable for investors having interest in environment and climate conservation projects.

- Sovereign green bonds are also a secure source for fixed income.

Challenges with green bonds

- Green bonds, although a great alternative to oil bonds, come with a few challenges.

- Firstly, if the government wants to go global to raise funds, India needs to improve its credit rating as all bonds issued globally are closely linked to the credit rating of the issuing country. This could mean close scrutiny of the domestic policies, which the government should be transparent and open to.

- Secondly, the monitoring of such green projects needs to be stringent to ensure better completion rates. Recipients of such funds should be compliant, and a penalty component could be imposed in case of missing a deadline.

- Lastly, the coupon rates of a green bond are not easy to determine as there are constant debates on whether to price them higher or lower than regular bonds with equal arguments on both sides.

The road ahead for green bonds

- Creating green infrastructure would require investment and involvement of multiple stakeholders. Globally the green bond market should have adequate support from both the public and private sectors of all nations and from the institutions like World Bank for capacity building and expertise in green projects.

- A robust green bond market would further require common standards and guidelines for it to be connected to the mainstream capital markets and investors. This will help in channelling the capital towards sustainable development. It makes feasible for governments to promote green bonds over oil bonds in the interest of sustainable economic growth.

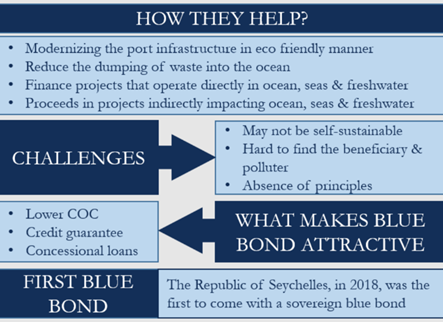

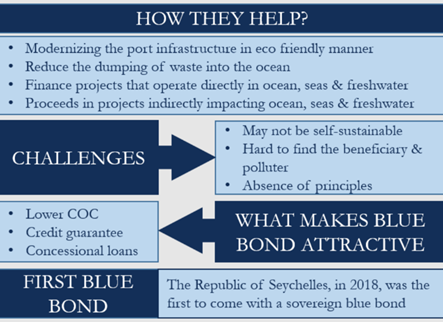

Blue Bonds

- Blue bonds are pioneering financial instruments that are designed to support sustainable marine and fisheries projects. They are a subset of the green bonds.

- The World Bank defines blue bonds “as a debt instrument issued by governments, development banks or others to raise capital from impact investors to finance marine and ocean-based projects that have positive environmental, economic and climate benefits.”

- Back in October 2018, the Republic of Seychelles launched the world’s first sovereign blue bond.

Blue Bonds: Scaling the Opportunity

- The World-Wide Fund (WWF) estimate the value of the ocean assets at $24 trillion and an annual value addition of about $2.4 trillion.

- Investment in blue bonds enables financial savings for the government which can be further invested in the protection of natural resources, biodiversity and livelihoods.

- Blue bonds are a huge opportunity as they truly fit into the current scenario related to our country’s sustainability journey in terms of climate change, loss of coral reefs, extinction of aquatic animals and so on.

Blue Bonds: Transformative Game Changer for India's Blue Economy

Some key benefits of issuing blue bonds in Indian context are as follows:

- Strengthening, restoring and protecting India’s water resources and water ecosystem: For instance, projects like the National Mission for Clean Ganga and Mission SAGARMALA could be supported through blue bonds.

- Increasing productivity of fisheries and agriculture.

- Fulfilling global Sustainable Development Goals (SDG) defined by the United Nations.

- Empowering communities dependent on the marine ecosystems.

- Modernising port infrastructure, wastewater and solid waste management in an ocean friendly manner to avoid pollutant dumping along the coastline.

Challenges

Self-Sustainable

- The biggest challenge with blue bonds is that the projects they fund may not be self-sustainable. And this often results in investors not getting their due money.

Determine Beneficiary and Polluter

- Generally, a project generates revenue by levying charges on the beneficiary or fining the polluter. But, in projects concerning the ocean, it usually gets hard to determine the beneficiary and the polluter.

- The massive size of the ocean and the remote locations of polluters make it hard to find the beneficiary and the polluter. So, many times, it is the aid money that comes into use for paying back to the investors.

Absence of Principles

- Another challenge or drawback of these bonds is the absence of principles that issuers can use. Such principles ensure that issuers reveal all the details of the bonds. These bonds may not have such principles now, being at the early stage. But they will have them as such bonds gain more popularity in the future. Until such bonds have their own principles, issuers can use the green bond principles.

- Also, the UN Global Compact Sustainable Ocean Principles can serve as a guide to set the principles for these bonds.

The road ahead for Blue bonds

- Just like all thematic bonds (e.g., Green Bonds, Climate Bonds, Sustainability Bonds), India, at the strategic level needs to define blue economy sectors and projects that require immediate and large-scale funding.

- Typically, a robust Blue Bond Framework to support blue bond issuance, with a Second Party Opinion duly incorporated, consistent with the “Sustainable Blue Economy Finance Principles” of the United Nation’s Environment Programme Finance Initiative will ensure that a wider set of investors have utmost confidence and transparency in the project selection. In the Indian context, the rise of Blue Economy and Blue Bonds can complement each other.

- Blue Bonds can be an immense value addition to the emerging underwater domain (UD), particularly for the blue economy of India. All the underwater domain (UD), stakeholders, Government of India and Financial Sector should come together collaboratively to make it happen. There are plenty of nationally significant projects within the underwater domain that can be catered to by blue bonds.

|

Some Examples of Successful Blue Bonds

SEYCHELLES SOVEREIGN BLUE BOND

The first blue bond programme in the world was the “Seychelles Sovereign Blue Bond”. The objective of this bond is to save coral on the 115 islands of Seychelles. This issue was enabled by the investors such as World bank and its Global Environmental Facility.

BLUE BOND FOR BAY OF BENGAL

Kalinga International Foundation gave birth to Blue Bonds for Bay of Bengal. The vision of this blue bond is to maintain peace and prosperity in the eastern, north-eastern states of India and the Indo-Pacific region. The foundation brings together, for the first time, the eastern and north-eastern region of India with their proximate neighbouring countries as they have strong ties of history, culture, language and traditions from early times.

|

https://www.downtoearth.org.in/blog/energy/sebi-s-green-and-blue-bonds-are-they-the-sustainable-finance-that-india-needs--85148