Description

Disclaimer: Copyright infringement not intended.

Context

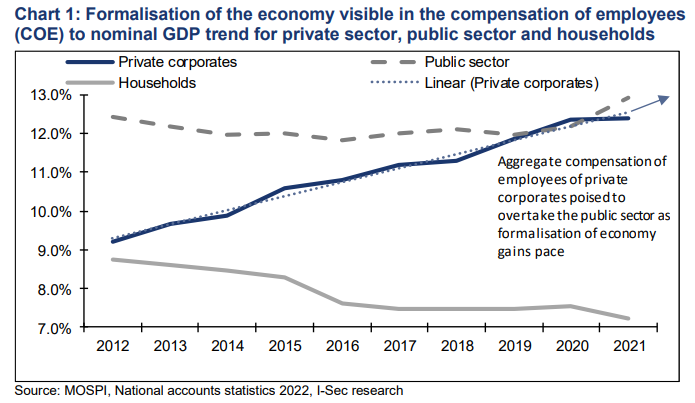

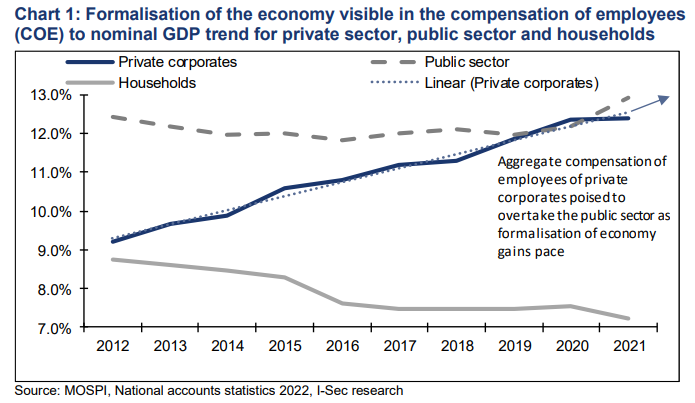

- The pay of private sector employees is growing at par with the public sector and is expected to outpace them. This shows signs of formalization of the economy - ICICI Securities said in a recent report.

Understanding Formalization

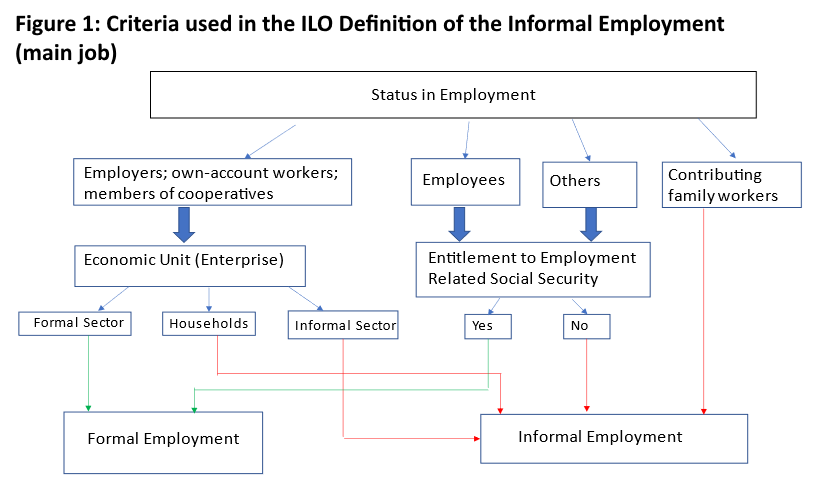

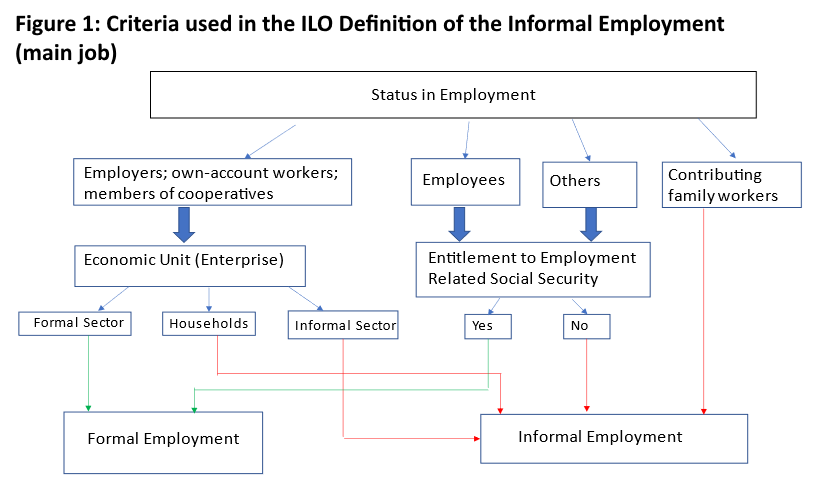

- According to International Labour Organization (ILO) the informal sector consists of all private unincorporated enterprises owned by individuals or households that are not separate legal entities and for whom no complete accounts are available.

- Informal employment includes not just persons working in informal enterprises, but also includes certain types of employment outside informal enterprises. For instance, persons working in formal enterprises who are not covered by social protection at their work are categorized as informal workers.

- Domestic workers, casual day laborers, and family workers are not covered by social security provided by their employers.

Status of Informal Sector in India

2011-2016 Data

- Around 93 per cent of India's workforce is part of the informal economy (NSSO 2014).

- According to ILO India Labour Market Update (2016) and NSSO data (2011-12), more than 90 percent of the employment in the agricultural sector and close to 70 percent in the non-agricultural sector falls under the informal category.

2022 Data

- 89 per cent of total workforce in the country is still part of the informal sector ICICI 2022 Report.

- It includes very low-value-added activities in the informal sector, such as rickshaw pulling, barbershops on pavements, domestic service, and street traders.

- The informal sector describes all those activities that are not formally regulated by the government because they do not come under any legal regulatory frameworks.

Clearly, the informal sector is not the residual sector of the economy. In reality, it is the dominant sector.

Findings of the recent ICICI Securities Report

- The compensation of private sector employees as a percentage of GDP stood at 12 per cent, an upward trajectory from around 8 per cent in FY 2012.

- Faster than nominal GDP expansion of the private corporate sector indicates clear sign of formalization of the economy and improving productivity.

- Pick-up in employee pay and job creation could be credited to various factors such as:

- Reopening post Covid restrictions in contact-intensive sectors,

- Pick-up in real estate construction activities,

- Infrastructure development,

- Manufacturing driven by export demand and PLI,

- Digital service professionals and

- Natural progression of formalization seen over the past decade.

Implications

- This “significantly high per capita income” of this segment, is positive for the gross savings rate and discretionary consumption within the formal corporate sector.

Advantages and Disadvantages of Informal Sector

Advantages

- Some employers pay well because company owners do not have many tax obligations. Employee effort is directed towards achieving profit rather than satisfying irrelevant routines.

- There can be a close and direct relationship with the employer, therefore making it easy to get permission when in need of time off.

- There’s no red tape when it comes to dealing with personnel issues which are expressly handled either by the employer him/herself, or a senior manager.

- Sometimes employment is done on the spot with little emphasis on attending lengthy job interviews and countless aptitude tests.

- According to the Report of the Committee on Unorganized Sector Statistics, the informal economy makes a considerable contribution to the economy and caters to the requirements of the formal economy. However, its negative repercussions cannot be ignored.

Disadvantages

- Little or no job security.

- Unprotected by labour laws.

- Odd working hours.

- No pension, insurance or health insurance scheme.

- Summary dismissals.

- Difficult to make any savings due to low wages.

- A brief illness or injury or injury can mean no financial means to survive.

- Impacts the government in terms of revenue foregone (This leads to low tax GDP ratio).

At present, only 10% of India’s over 470 million workforces is in the formal sector. In other words, 90% of India’s workers do not have the privileges—like social security and workplace benefits—enjoyed by their counterparts who are formally employed.

Hence, the informal sector is detrimental to the interests of the working population, the government and in the long run, even to the employer.

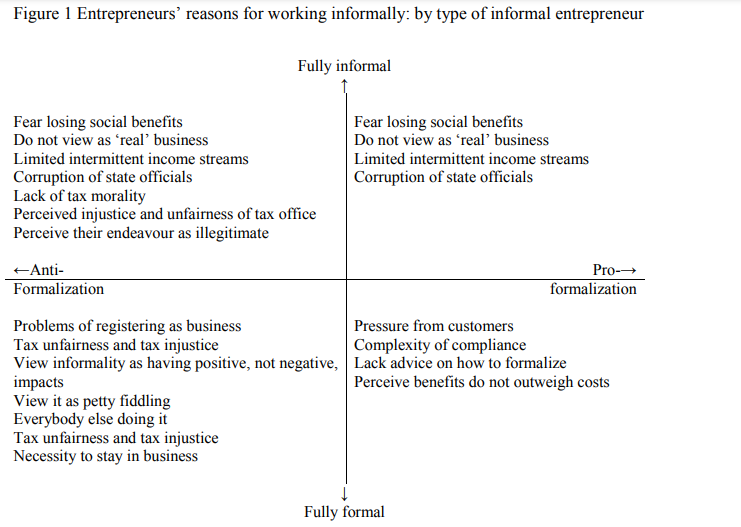

Reasons behind Informalization

- Restrictive labour laws – which promote contract hiring in order to circumvent rigid hiring and firing provisions?

- Predominance of service-sector led growth – which requires skilled labour that was available with a miniscule section of the population.

- Absence of thrust on manufacturing – which can lead to creation of formal employment for millions looking to move away from agriculture.

- Market-mechanisms and competition led to closure of obsolete industries such as textile mills, reducing formal jobs. The newer industries were capital intensive rather than labour intensive, thus absorbing lesser workforce than what they laid to retrenchment of.

- Lack of an exit mechanism such as insolvency and bankruptcy laws has led to firms remaining small, barely breaking even, and not scaling up. Such small firms can circumvent formal sector laws such as mandatory registrations with the EPFO etc. rendering them informal.

- Advent of the Fourth Industrial Revolution and automation poses even more dangers to present formal sector jobs since workers with current skills will be rendered obsolete unless they undergo skill reorientation.

- India, with increasing integration into global economy, also suffered during various global crises such as the Southeast Asian crisis, Gobal Financial Crisis in 2008 and the Eurozone crisis in 2011. This shelved corporate expansion plans and led to closure of several industries, reducing formal sector employment.

Impact of Informalization on Economy and Society

- Informal workers lack proper wages. Lower wages lead to increasing inequality, which is detrimental to development.

- Low wages lead to a low savings rate, which is detrimental for the credit cycle and further lending, hampering development.

- Informal workers lack welfare benefits such as healthcare, insurance, and education facilities. This leads to increased out of pocket expenditures on those things >> increases poverty and inequality >> detrimental to development.

- Contract labour has no affinity or loyalty towards the company, thus hampering productivity and economic development.

- Informal sector workers usually lack financial literacy, depriving them of access to institutional credit, thus reducing domestic consumption and harming development.

- Productivity of the economy decreases as a whole since companies lose the incentive to skill the employees, so that they can better reorient themselves to the demands of the economy.

- Lack of formal sector benefits such as maternity leaves etc leads to improper development of the child >> hampers human resource development.

- Informal sector is predominantly cash-based. This is a major source of generation of black money and tax evasion. Size of Indian black economy is estimated at nearly 24% of GDP. This deprives the State of legitimate taxes, hampering development.

- A low tax base due to low formal sector >> low tax revenue >> increased government borrowing (for counter-cyclical purposes) >> higher fiscal deficit >> higher inflation >> affects the low-wage informal workers the most, thus perpetuating a vicious cycle and hampering development.

- High inflation lead to credit downgrades and lead to outflow of foreign investments due to macroeconomic instability. This is catastrophic for a capital-starved country like India.

Need of the hour

- Rise in Exports: Most large companies are flooded with orders, so much so that they have started taking the help of the ancillary units (in the informal sector) to fulfil their commitments. While some of the smaller units did suffer initially, things are improving now.

- Skilling the labor: Unless the labor force is not skilled and educated, they will not be accommodated in the formal sector and the efforts to formalization will result in unemployment.

- Social security: Investing in social security schemes like Atal Pension Yojna, PM Jeevan Jyoti Yojana, Rashtriya Swasthya Bima Yojana, Aam Aadmi Bima Yojana can help improve the condition of workers. The mention of Universal Basic Income in Economic Survey 2016-17 is a positive step in this direction.

- Financial support: Giving financial support to help small-scale industries stand on their own is a crucial step in bringing them to the organized sector. Schemes like MUDRA loans and Start-up India are helping the youth carve a niche in the organized sector.

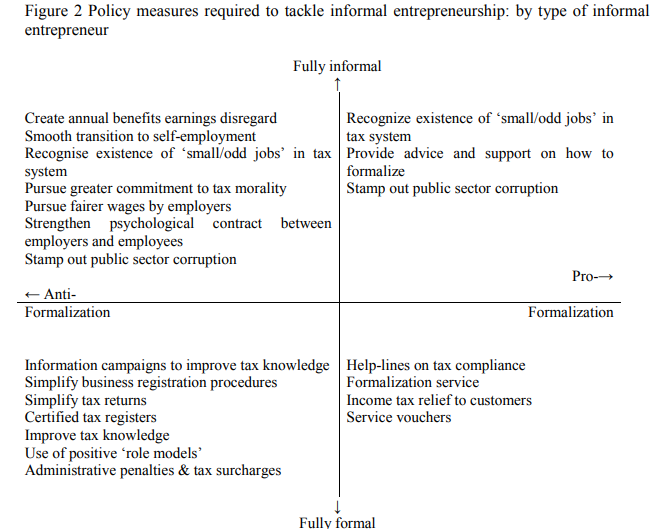

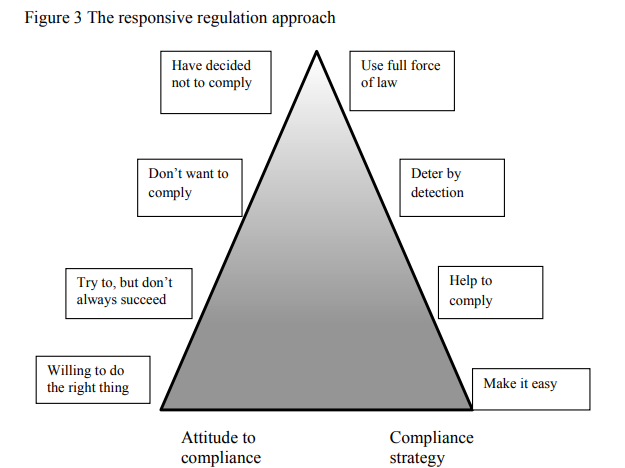

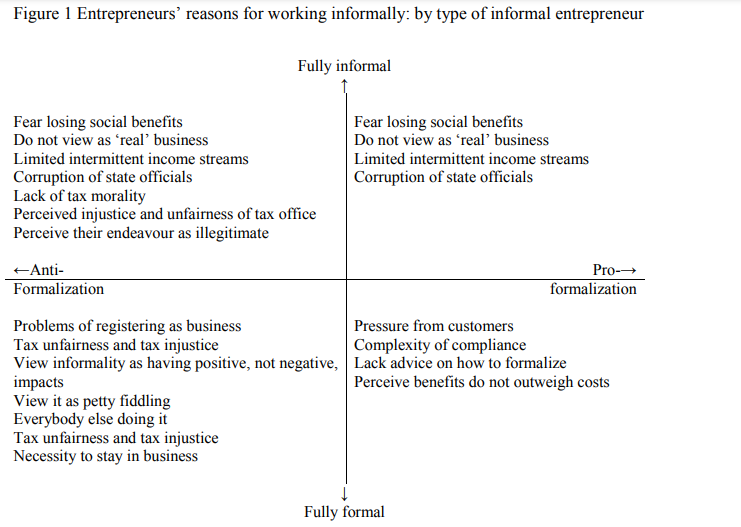

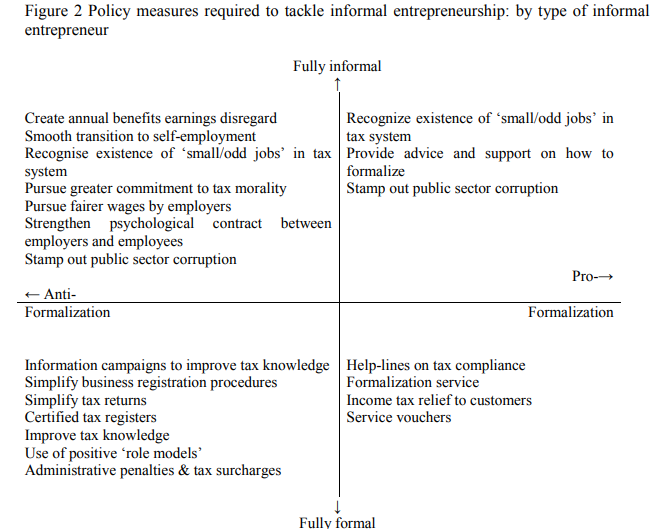

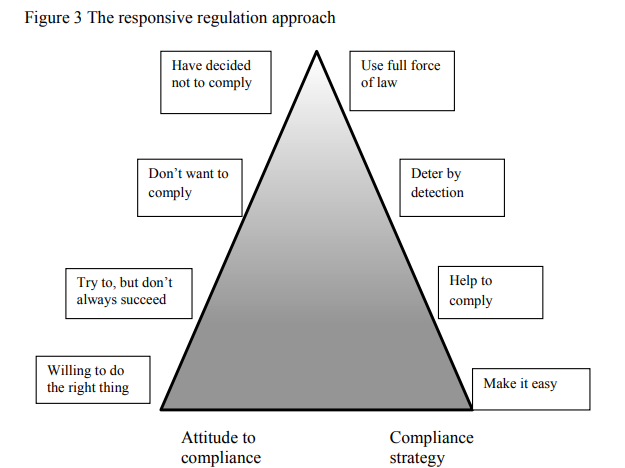

- Policy reforms: The structural policies designed to promote formality should be implemented with caution, aimed at encouraging formalisation rather than explicitly discouraging informal activity.

- Social security architecture for informal sector workers as recommended by National Commission for Enterprises in the Unorganized Sector (NCEUS)

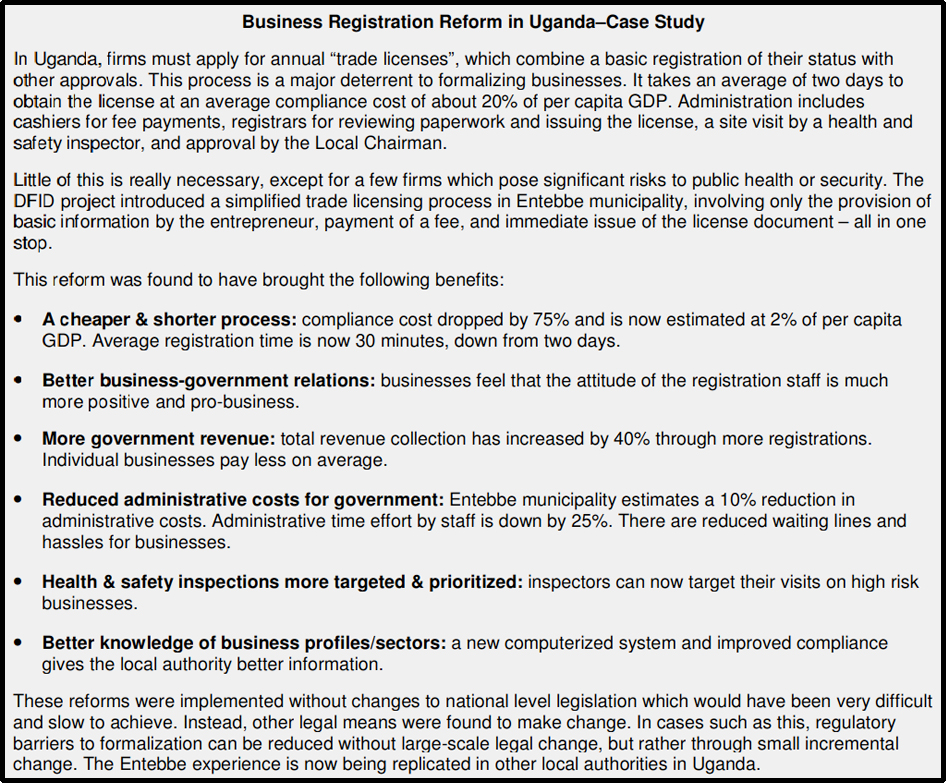

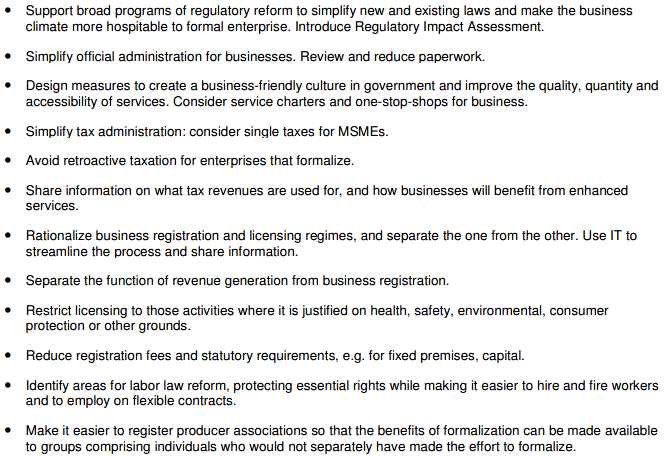

Reducing barriers to Formalization

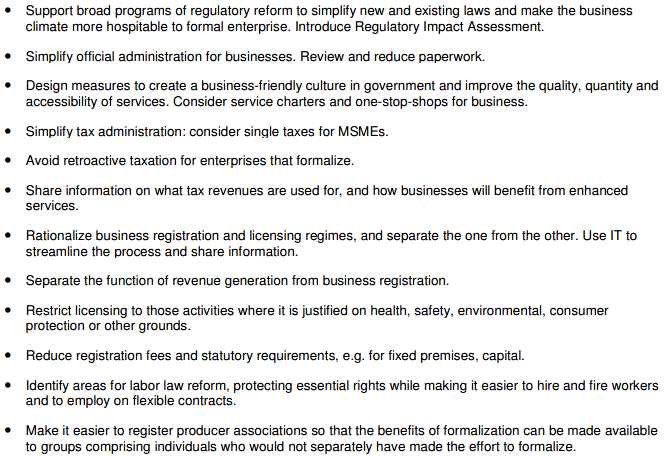

Other Recommendations

- Simplify tax administration.

- Consider single taxes for MSMEs.

- Avoid retroactive taxation for enterprises that formalize.

- Share information on what tax revenues are used for, and how businesses will benefit from enhanced services.

- Rationalize business registration and licensing regimes, and separate the one from the other.

- Separate the function of revenue generation from business registration.

- Restrict licensing to those activities where it is justified on health, safety, environmental, consumer protection or other grounds.

- Consider alternatives to licensing.

- Reduce registration fees and statutory requirements, e.g. for fixed premises, capital.

Final Thoughts

- With India at the cusp of a demographic transition and adding a million workers to its workforce every month, there is a dire need to create formal sector jobs.

- Government initiatives like Make in India, Skill India, labour reforms, Insolvency code et all have to work in tandem to ensure that this workforce is formalized and the fruits of development accrue equitable to all workers within the country.

A Different Perspective on Formalization: Read: https://theprint.in/ilanomics/how-indias-informal-economy-is-shrinking-and-why-thats-good-news-in-the-long-term/761659/

https://www.financialexpress.com/economy/formalising-of-indian-economy-private-sector-pay-set-to-outpace-public-sector-says-report/2531130/