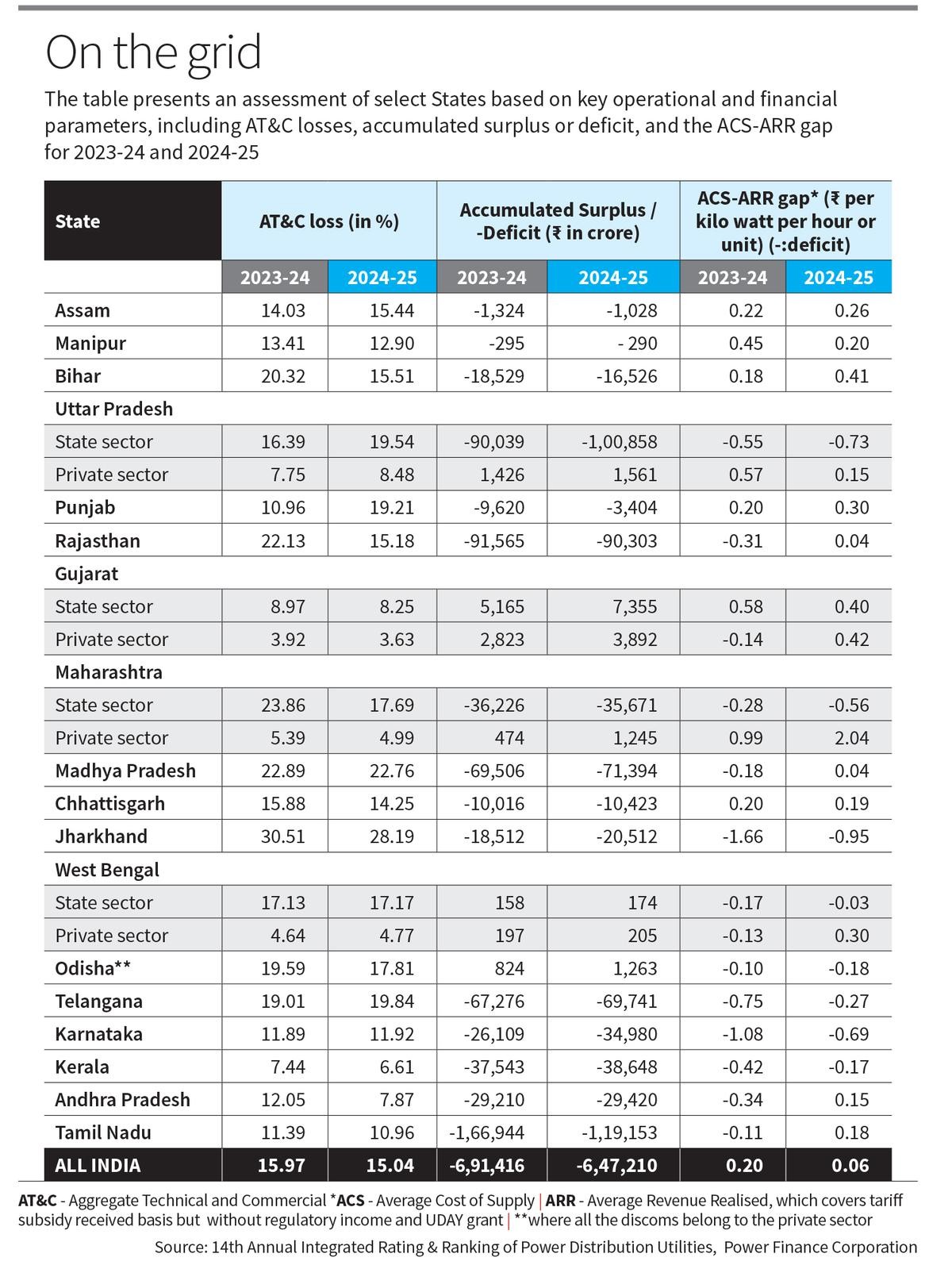

India’s power distribution companies (DISCOMs) have shown notable improvement in recent years, reflected in reduced AT&C losses, a near elimination of the ACS–ARR gap, improved payment discipline, and a return to overall profitability. Government interventions such as the Revamped Distribution Sector Scheme (RDSS) and the Late Payment Surcharge Rules have strengthened operational efficiency and financial management. However, the sector continues to face structural challenges, including high accumulated debt, dependence on State subsidies, non-cost-reflective tariffs, and operational inefficiencies in several States. Sustaining the recent gains will require continued reforms focused on tariff rationalisation, loss reduction, technological adoption, timely subsidy payments, and improved governance to ensure the long-term financial viability of the distribution sector.

Copyright infringement not intended

Picture Courtesy: The Hindu

DISCOMs show improvement in performance, recording a positive turnaround marked by reduced AT&C losses, a narrowed ACS-ARR gap and improved financial discipline.

|

Must Read: STATE OF DISCOMS IN INDIA | PM-KUSUM 2.0 SCHEME | POWER DISCOMS | |

Distribution Companies (DISCOMs) are power utilities responsible for the last-mile delivery of electricity from transmission networks to end consumers such as households, agriculture, industries, and commercial establishments. India currently has 72 DISCOMs in which 44 are state owned, 16 private, and 12 power departments.

Key Functions

ACS–ARR Gap: Indicator of cost recovery

One of the most important indicators of financial health is the gap between the Average Cost of Supply (ACS) and the Average Revenue Realised (ARR). ACS represents the cost incurred by a DISCOM to supply one unit of electricity, while ARR reflects the revenue earned per unit sold. A situation where ACS exceeds ARR indicates under-recovery of costs and operational losses, often caused by non-cost-reflective tariffs and delayed subsidy payments. A narrowing or elimination of this gap signifies improved financial sustainability and better tariff rationalisation.

AT&C Losses: Measure of operational efficiency

Aggregate Technical and Commercial (AT&C) losses reflect the efficiency of the distribution system. These losses include technical losses in wires and transformers, electricity theft, unmetered consumption, billing inefficiencies, and poor collection performance. High AT&C losses reduce revenue realisation and increase the financial burden on DISCOMs, whereas a consistent reduction indicates improved infrastructure, better governance, and stronger energy accounting.

Profitability and Net financial position

The Profit After Tax (PAT) of a DISCOM provides a clear picture of its overall financial performance. Persistent losses indicate structural weaknesses such as tariff underpricing, high power procurement costs, or operational inefficiencies. On the other hand, sustained profitability reflects better cost management, improved billing and collection, and effective financial discipline. However, profitability needs to be assessed carefully, as it may sometimes depend on government subsidies or loss takeovers.

Outstanding debt and liabilities

Rising operational losses often compel DISCOMs to borrow funds, leading to a mounting debt burden. High levels of outstanding debt and accumulated losses indicate financial stress and increase interest obligations, further weakening the balance sheet. Debt reduction and improved liquidity are therefore important indicators of long-term financial stability.

Financial turnaround: The financial position of DISCOMs has shown a notable improvement in recent years, with the sector reporting a Profit After Tax (PAT) of ₹2,701 crore in 2024–25, marking a significant turnaround from a massive loss of ₹67,962 crore in 2013–14. This shift reflects better financial management, improved cost recovery, and the impact of policy interventions aimed at strengthening the distribution segment.

Operational gains: Operational efficiency has improved considerably, as reflected in the reduction of Aggregate Technical and Commercial (AT&C) losses from 22.62% to 15.04%. Lower losses indicate improvements in infrastructure, metering, billing, and collection systems. At the same time, the gap between the Average Cost of Supply (ACS) and the Average Revenue Realised (ARR) has narrowed sharply from 78 paise per unit to just 0.06 paise per unit, signalling near cost recovery and greater tariff efficiency.

Improved payment discipline: Financial discipline across the power value chain has strengthened significantly. Legacy dues of about ₹1.39 lakh crore in 2022 have been reduced to around ₹4,927 crore by January 2026, largely due to structured repayment mechanisms and regulatory measures. As a result, DISCOMs are increasingly clearing their current dues on time, improving liquidity for power generators and enhancing the overall stability of the electricity sector.

Persistent Debt: Despite recent improvements, the financial stress in the distribution sector remains significant. As of 2024–25, the accumulated losses of DISCOMs stood at about ₹6.47 lakh crore, while outstanding debt reached around ₹7.26 lakh crore. The large debt burden increases interest liabilities and limits the ability of utilities to invest in network modernisation and loss reduction.

Continued dependence on state subsidies: Many DISCOMs have reported profits only because of substantial financial support from State governments in the form of tariff subsidies and loss takeovers. For example, Tamil Nadu Power Distribution Corporation Limited (TNPDCL) reported a profit of ₹2,073 crore in 2024–25 only after receiving ₹15,772 crore as subsidy and ₹16,107 crore towards loss takeover. Without this support, the utility would have recorded a loss of ₹14,034 crore.

Non-cost-reflective tariffs and populist policies: Tariffs in many States remain below the cost of supply due to political considerations. Free or highly subsidised electricity for agriculture and certain domestic categories leads to revenue gaps. Universal free power schemes often benefit economically stronger households, increasing the subsidy burden without adequate targeting.

Unmetered agricultural consumption and poor energy accounting: In several States, particularly those with large farm sectors, electricity supplied to agriculture is either unmetered or poorly measured. This makes it difficult to assess actual consumption and leads to inflated subsidy claims.

For example, States like Punjab and Tamil Nadu still rely heavily on unmetered farm supply, highlighting the need for feeder segregation and smart metering.

Picture Courtesy: The Hindu

Revamped Distribution Sector Scheme (RDSS): The Revamped Distribution Sector Scheme (RDSS) has been introduced as a comprehensive reform programme to improve the operational efficiency and financial sustainability of DISCOMs. The scheme focuses on modernising distribution infrastructure, strengthening networks, and reducing technical bottlenecks to enhance the quality and reliability of power supply. A major component of RDSS is the installation of smart prepaid meters, which helps improve billing accuracy, reduce losses, and enhance revenue realisation. The scheme also aims to reduce Aggregate Technical and Commercial (AT&C) losses and narrow the ACS–ARR gap, thereby strengthening the financial position of utilities. Importantly, the release of central funds is linked to performance milestones, ensuring accountability and encouraging States to undertake structural reforms.

Late Payment Surcharge (LPS) Rules, 2022: The Late Payment Surcharge (LPS) Rules were introduced to address the issue of mounting dues owed by DISCOMs to power generation and transmission companies. The rules allow utilities to clear their legacy dues in instalments of up to 48 equated monthly instalments (EMIs), thereby easing immediate financial stress. This structured repayment mechanism has significantly reduced outstanding liabilities and improved payment discipline. As a result, liquidity conditions have improved across the entire power value chain, enabling generators to maintain fuel supplies and sustain uninterrupted power generation.

Regulatory and policy reforms: The Union government has also undertaken amendments to the Electricity Rules to improve transparency, accountability, and financial discipline in the distribution segment. These reforms aim to ensure timely tariff revisions, strengthen regulatory oversight, promote energy accounting, and enhance financial monitoring of DISCOM performance. Greater regulatory scrutiny is expected to reduce inefficiencies and encourage more responsible financial management by utilities.

Feeder segregation for better energy accounting: Separating agricultural feeders from non-agricultural feeders enables accurate measurement of electricity supplied to different consumer categories. This helps in realistic subsidy assessment and improves demand management. Feeder segregation has shown positive results in States such as Gujarat and Rajasthan and should be expanded to States where unmetered agricultural supply remains widespread.

Smart metering and digitalisation: The large-scale deployment of smart meters and digital monitoring systems can significantly reduce electricity theft, eliminate billing inefficiencies, and improve collection efficiency. Real-time data on consumption and outages enables better load management, demand forecasting, and operational planning, thereby improving both financial and service outcomes.

Promotion of solar pumps in agriculture: Encouraging the use of solar-powered irrigation pumps can reduce the dependence of the agricultural sector on grid electricity. This lowers the power procurement burden on DISCOMs and reduces the subsidy requirement. As highlighted by NITI Aayog, decentralised solar solutions can also support rural energy security and contribute to clean energy goals.

Tariff rationalisation and targeted subsidies: Moving towards cost-reflective tariffs is essential for the long-term financial viability of DISCOMs. Instead of universal free electricity schemes, subsidies should be targeted to economically weaker sections through direct benefit mechanisms. Rational pricing will improve revenue recovery and reduce the fiscal burden on State governments.

Timely release of subsidies: Ensuring the timely payment of government subsidies is critical for maintaining cash flow and reducing the need for short-term borrowing. Delays in subsidy disbursement often create liquidity stress and increase interest costs, undermining financial discipline.

India’s DISCOMs are showing encouraging signs of improvement through reduced losses, better cost recovery, and stronger payment discipline. However, the gains remain fragile due to continued dependence on State subsidies, structural inefficiencies, and tariff distortions. Sustained reforms focused on operational efficiency, cost-reflective tariffs, technological adoption, and improved governance are essential to ensure the long-term financial viability and reliability of the power distribution sector.

Source: The Hindu

|

Practice Question Q. The financial health of India’s power distribution companies (DISCOMs) has shown improvement in recent years, but structural challenges continue to persist. Examine. (250 words) |

DISCOMs (Distribution Companies) are utilities responsible for the last-mile delivery of electricity to consumers, including households, agriculture, industries, and commercial establishments. They procure power from generators, distribute it through local networks, and manage billing and revenue collection.

DISCOMs are often financially stressed due to high AT&C losses, non-cost-reflective tariffs, delayed subsidy payments, electricity theft, and political interference in tariff decisions. Their weak finances affect the entire power value chain.

Subsidies compensate DISCOMs for supplying electricity at concessional or free rates to certain consumer categories. However, excessive dependence and delays in subsidy payments create cash flow problems and weaken financial sustainability.

© 2026 iasgyan. All right reserved