Description

Disclaimer: Copyright infringement not intended.

Context

- The success story of India in creation of digital assets (DBT, JAM trinity, NPCI etc) can be an example from which not only ‘developing’ but also ‘developed’ countries may learn -said Union Minister of State for Electronics & Information Technology while speaking about the successful model of Digital Payments and Direct Benefit Transfer (DBT), which is benefiting millions of Indian citizens.

Success in stats

- More than Rs 24.8 lakh crore has been transferred through DBT mode since 2013.

- Rs 6.3 lakh crore in FY 2021-22 alone; on an average >90 lakh DBT payments are processed daily (in FY 2021-22).

- Under the 11th installment of PM Kisan Samman Nidhi Yojana, around Rs 20,000 crore was transferred directly into bank accounts of more than 10 crore beneficiaries (more than 10 crore transactions at click of a button on a single day).

- As far as Digital Payments are concerned, more than 8,840 crore digital payment transactions performed during 2021-22 and nearly 3,300 crore in FY 2022-23 (upto 24th of July 2022); on average 28.4 crore digital transactions are performed in a day.

Direct Benefit Transfer

Definition

- The process of directly transferring the subsidy amount and making other transfers directly into the account of beneficiaries rather than providing it to government offices is known as DBT. In this context, transfer can be defined as the payment that the government makes directly to the beneficiary without receiving any returns. Some of the examples of transfers are scholarships and subsidies.

Scheme

- Direct Benefit Transfer (DBT) was introduced on 1 January 2013.

- The main aim was improving the Government's delivery system and redesigning the current procedure in welfare schemes by making the flow of funds and information faster, secure, and reduce the number of frauds.

- From 2015, matters relating to the DBT Mission were placed in the Cabinet Secretariat under the Co-ordination & PG Secretary.

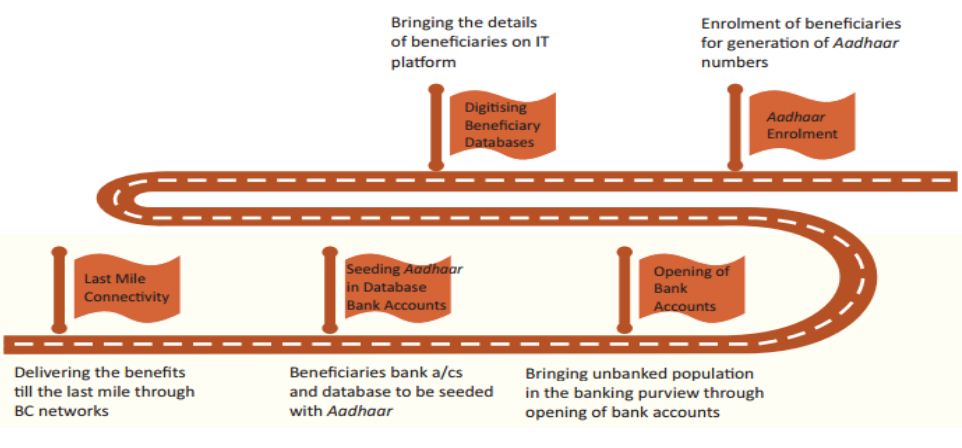

- The Indian Government focuses highly on the DBT scheme. DBT brings about accountability, transparency, effectiveness, and efficiency in the Government of India system. The DBT enablers are Jan Dhan, Aadhaar, and Mobile (JAM); RBI’s Business Correspondents (BC) Infrastructure; Payments Bank; Mobile Bank etc.

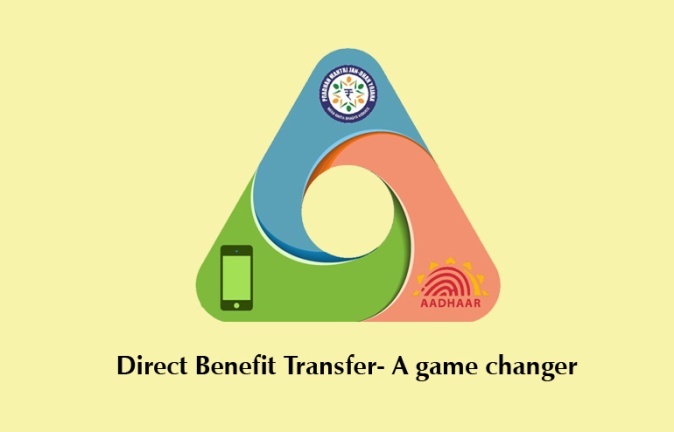

Pre-Requisites for DBT

Benefits of the DBT scheme

- The DBT scheme prevents fraud. The Government sends the funds straight to the beneficiaries’ account, which removes the possibility of fraud through a middleman.

- The beneficiaries can be recognized with the use of their Aadhaar number. Because Aadhaar is a universal ID, the Government can easily verify the beneficiaries using their Aadhaar details.

- DBT promotes accountability in subsidy distribution. As a result, it aids in the elimination of inconsistency and delay in payments.

- DBT aids in the distribution of subsidies to deserving applicants living below the poverty level. It helps the Government reach out to the intended beneficiaries with ease.

- The scheme eliminates pilferage in the distribution of money and reduces the misuse of public funds.

- DBT is a powerful transaction and settlement technology that works with multiple organisations.

- DBT has proven to be an effective technique for connecting with people to distribute relief funds.

What is the current level of Central Government subsidy and to what extent is it under DBT?

- In the fiscal year 2021-22 Union Budget, the Centre provided around Rs 3.70 lakh crore (over 10 per cent of the total budget size of Rs 35.83 lakh crore) for 38 types of subsidies, of which food, fertiliser and fuel are the important ones.

- All the subsidies are part of DBT. Also, not only subsidies, but different types of scholarships/ stipends and cash assistance are also covered under DBT.

- 312 schemes, including key subsidies being run by 54 Central Government Ministries and Departments, are part of DBT.

- The Public Distribution Scheme (PDS) saw the maximum gains with deletion of 3.99 crore duplicate and fake/ non-existent ration cards (between 2013 and 2020) and that resulted in an estimated saving of over Rs 1 lakh crore.

- MGNREGS saw 10 per cent savings on wages on account of deletion of duplicate, fake/ non-existent, ineligible beneficiaries. That apart, 4.11 crore duplicate, fake/ non-existent, inactive LPG connections have been eliminated.

In the 2014-15 edition of the Economic Survey, the chapter titled, ‘Wiping every tear from every eye: The JAM Number Trinity Solution’, used the term leakage to describe subsidised goods that do not reach households. Leakages, it said, not only have the direct costs of wastage, but also the opportunity cost of how the government could otherwise have deployed those fiscal resources. Converting all subsidies into direct benefit transfers is therefore a laudable goal of government policy.

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1856116