China, once India's top supplier of di-ammonium phosphate (DAP), has halted exports, causing a supply squeeze and price surge. This has forced Indian farmers and the industry to adapt by shifting towards alternative complex fertilisers like ammonium phosphate sulphate (APS), which could promote more balanced soil nutrition in the long run.

Copyright infringement not intended

Picture Courtesy: Indian Express

China's decision to cut and eventually halt exports of Di-Ammonium Phosphate (DAP) has created a supply squeeze in the global market, directly impacting India.

Di-Ammonium Phosphate (DAP) is the second most consumed fertilizer in India, after urea.

It is a primary source of Phosphorus (46%) and also contains Nitrogen (18%).

Phosphorus is a crucial nutrient for plants during their early growth stages, essential for strong root and shoot development. Farmers apply DAP at the time of sowing.

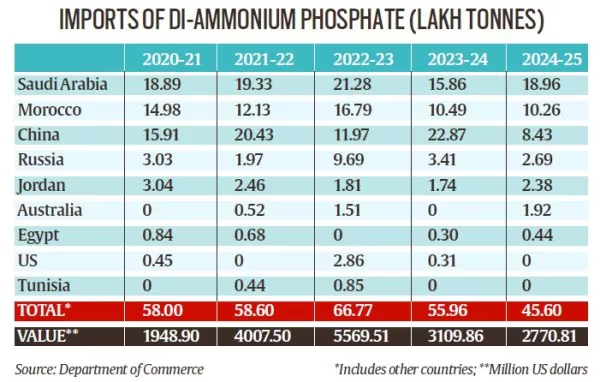

Dominant Supplier => Until 2023-24, China was a major, the top, supplier of DAP to India. Imports from China were 22.9 lakh tonnes (lt) in 2023-24.

Export Restrictions => Since the beginning of 2025, China has completely stopped DAP exports. Imports in 2024-25 plummeted to just 8.4 lt before stopping entirely. Reasons for the Ban:

Depleted Stocks => Opening stocks of DAP for the Kharif season on June 1, 2025, were critically low at 12.4 lt, compared to 21.6 lt in 2024 and 33.2 lt in 2023.

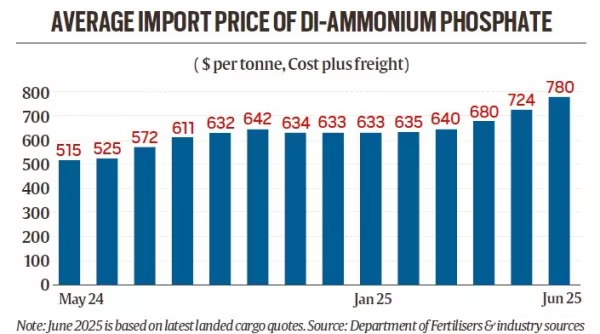

Soaring Prices => The global shortage has pushed up prices significantly. The landed price of imported DAP has increased from $515−525 per tonne in mid−2024 to over $780 per tonne by mid-2025.

Reduced Sales => The supply crunch and high prices have led to a drop in DAP sales, which fell from 108.1 lt in 2023-24 to 92.8 lt in 2024-25.

Copyright infringement not intended

The DAP shortage has encouraged a shift towards more balanced fertilization, a practice long advocated by agronomists.

Problem with Overusing High-Analysis Fertilizers => Fertilizers like DAP (46% P) and Urea (46% N) have a very high concentration of a single nutrient. Over-application can lead to nutrient imbalances in the soil, harming long-term soil health and crop productivity. Most crops require a balanced mix of multiple nutrients.

Rise of Alternative Complex Fertilizers => With DAP becoming scarce and expensive, farmers and the industry have adapted by turning to NPKS (Nitrogen, Phosphorus, Potassium, Sulphur) complexes.

Ammonium Phosphate Sulphate (APS - 20:20:0:13) => This has emerged as India's third most consumed fertilizer. Its sales have skyrocketed, reaching a record 69.7 lt in 2024-25.

Single Super Phosphate (SSP) => Sales of SSP, which contains 16% Phosphorus and 11% Sulphur, have also seen a significant increase.

Copyright infringement not intended

New Market Dynamics

The DAP shortage of around 20 lt, caused by China's exit, is being filled by the alternative fertilizers.

Farmers are adapting to the new reality by applying less DAP and more NPKS complexes.

While the government has informally capped DAP's retail price at Rs 1,350 per bag, it often sells for higher. Alternatives like APS are available at a similar or slightly higher price, making them a viable option.

Long-Term Benefits

Reduced Import Dependency => India has limited domestic rock phosphate reserves, the raw material for DAP. The country is heavily reliant on imports of either finished DAP or its inputs (phosphoric acid, rock phosphate).

Efficient Use of Forex => Capping or reducing DAP consumption promotes a more efficient use of scarce foreign exchange reserves.

Promoting Balanced Fertilization => The crisis is naturally pushing the agricultural sector towards more sustainable and balanced fertilization practices, which is beneficial for long-term soil health and productivity.

China's export ban has created a short-term crisis, it has also provided an opportunity for India to rationalize its fertilizer use, reduce its dependency on a single product, and move towards a more sustainable agricultural model.

Must Read Articles:

Challenges in India's Fertiliser Imports

Reforming India's Food and Fertiliser Subsidies

Source:

|

PRACTICE QUESTION Q. The GOBARdhan scheme promotes the conversion of cattle waste into biogas and fermented organic manure. How can such initiatives contribute to a circular economy and reduce the chemical fertilizer burden? 250 words |

© 2026 iasgyan. All right reserved