Description

Disclaimer: Copyright infringement not intended.

Context

- Inflation in India’s wholesale prices hit a four-month high of 14.55% in March.

- This is driven by price rise across all categories of goods, with fuel and power as well as primary articles.

What is Inflation?

- Inflation refers to a sustained increase in the general price level of goods and services in an economy over a period of time.

- It is the rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc.

- Inflation measures the average price change in a basket of commodities and services over time.

- The opposite and rare fall in the price index of this basket of items is called ‘deflation’.

- Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency. This is measured in percentage.

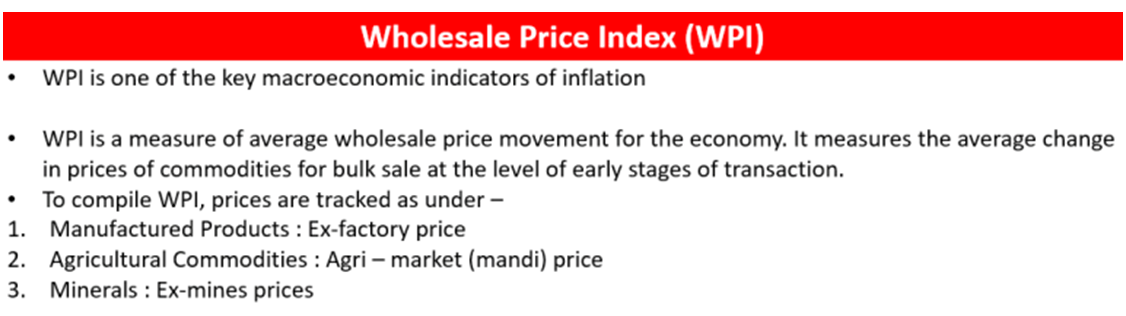

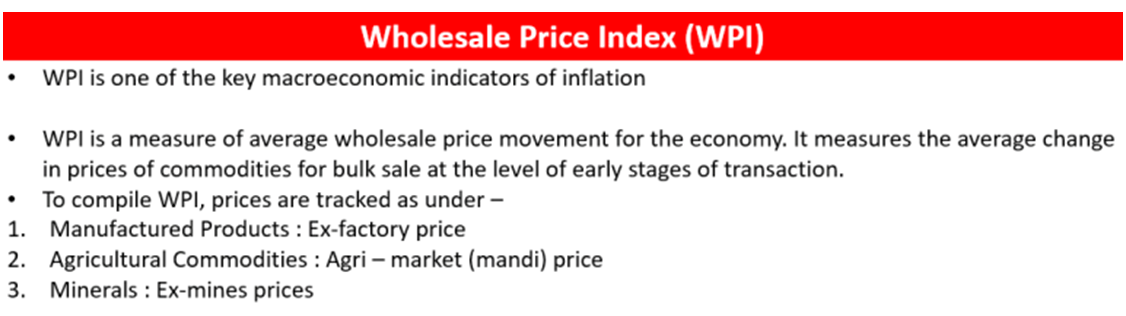

Wholesale Price Index

- The Wholesale Price Index (WPI) reflects changes in the average prices of goods at the wholesale level — that is, commodities sold in bulk and traded between businesses to other businesses or entities rather than goods bought by consumers.

- Thus, WPI is the price that wholesalers (factories) pay. A rise in the index means that factories have to pay more for raw materials.

Who publishes WPI in India and what does it show?

- WPI is released by the Economic Advisor in the Ministry of Commerce and Industry.

- The index basket of WPI categorises commodities under three groups — primary articles, fuel and power manufactured products.

- The purpose of WPI is to inspect movement in prices of goods that reflect supply and demand in industry, construction and manufacturing.

- An upward surge in the WPI indicates inflationary pressure in the economy and vice versa.

- The quantum of rise in the WPI month-after-month is used to measure the level of wholesale inflation in the economy.

- Base year: 2011-12. (In the calculation of an index the base year is the year with which the values from other years are compared).

- WPI is extensively used for short-term policy intervention as it is the only index that is available on a weekly basis.

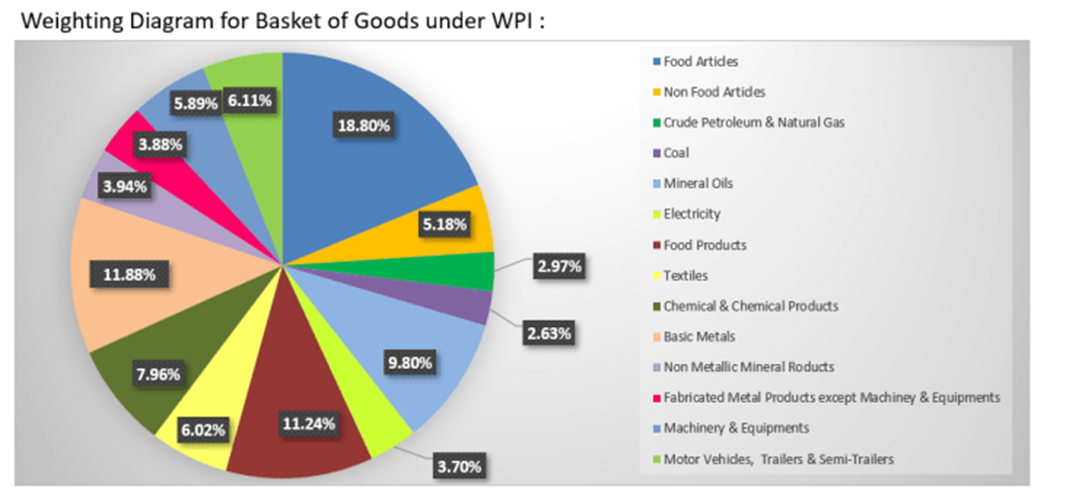

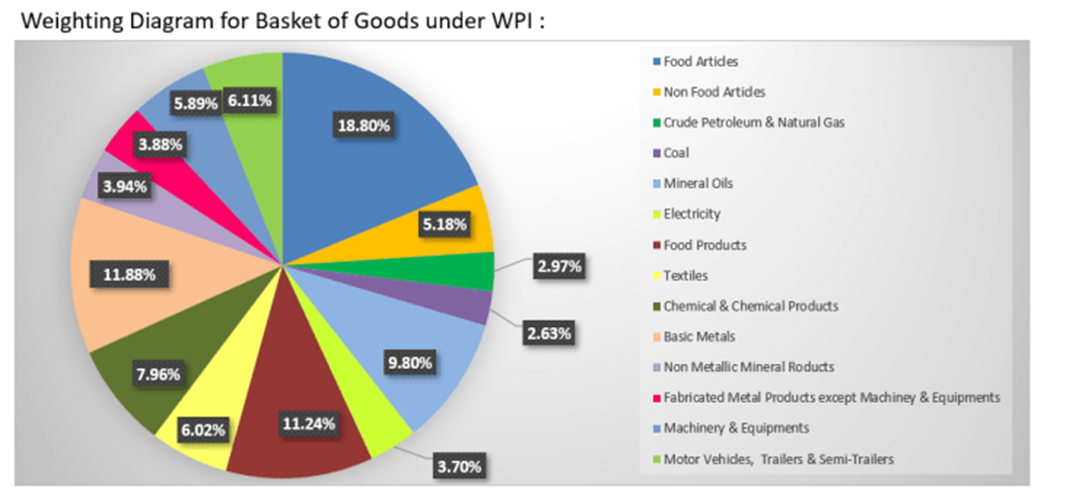

Major components of WPI

- Primary articles is a major component of WPI, further subdivided into Food Articles and Non-Food Articles.

- Food Articles include items such as Cereals, Paddy, Wheat, Pulses, Vegetables, Fruits, Milk, Eggs, Meat & Fish, etc.

- Non-Food Articles include Oil Seeds, Minerals and Crude Petroleum

- The next major basket in WPI is Fuel & Power, which tracks price movements in Petrol, Diesel and LPG

- The biggest basket is Manufactured Goods. It spans across a variety of manufactured products such as Textiles, Apparels, Paper, Chemicals, Plastic, Cement, Metals, and more.

- Manufactured Goods basket also includes manufactured food products such as Sugar, Tobacco Products, Vegetable and Animal Oils, and Fats.

Limitations of WPI

- There are certain limitations in using WPI as a measure for inflation, as WPI does not consider the price of services, and it does not reflect the consumer price situation in the country.

- Thus, WPI is used as a key measure of inflation in some economies; but RBI no longer uses it for policy purposes, including setting repo rates.

- RBI currently uses CPI or retail inflation as a key measure of inflation to set the monetary and credit policy.

WPI and its Significance

- WPI helps in measuring macroeconomic and microeconomic conditions of the economy.

- WPI provides estimates of inflation at the wholesale transaction level for the economy overall. It also helps in timely intervention by the government to monitor inflation before the price hike spills over to retail prices.

- The WPI-based inflation is used by the government in preparation of fiscal, trade, and other economic policies.

- Business organizations, policymakers, accountants, and statisticians use WPI as an indexing tool to formulate price adjustment clauses.

- Rise in WPI indicates inflationary pressure in the economy, and vice versa. The extent of rise in WPI is used to measure the level of wholesale inflation in the economy.

The recent rise in Wholesale Inflation: Findings

- The high inflation is attributed ‘primarily to rise in prices of crude petroleum and natural gas, mineral oils, basic metals, etc. owing to disruption in global supply chain caused by Russia-Ukraine conflict’ - the Office of the Economic Adviser, Department for Promotion of Industry and Internal Trade.

- The jump in crude oil prices was the biggest contributor to the rise in inflation, followed by fuels and core items.

- Core inflation, which excludes volatile energy and food prices, hardened by 2.2% in March over February 2022 to hit 10.9%.

- Only four of the 21 sub-groups of the core index escaped a month-on-month rise in March 2022, namely beverages, other transport equipment, wearing apparel and pharmaceutical products..

- Manufactured products inflation moved up from 9.84% to 10.71%.

What are the implications of WPI for the economy, industry, investor and consumer?

- WPI hits the productive sector: factories mostly. It has on equity investors in the sense margins of companies take a hit when they don’t pass on high raw material prices to consumers. WPI has a delayed impact on consumers, if it persists.

How can government control high WPI?

- Government can control the WPI only through taxes: customs duties and GST.

- In the event of a steep rise in crude oil GOI can cut excise on fuels. But there is a limit to which governments can cut taxes. They too have salaries to pay.

Should the RBI go back to using WPI as the benchmark for setting interest rates?

- World over CPI is the index targeted by monetary authorities, because that’s the index affecting the common man for better or worse.

- India up until 2008 was following WPI because the consumer affair ministry put it out weekly. CPI was announced by the Ministry of Statistics and Programme Implementation (MOSPI), on a monthly basis. This led to serious distortions in policy making and in market reaction.

- The government and RBI got together, ensure WPI is changed from weekly to monthly announcements, and then via the Urjit Patel committee on inflation targeting, ensure that monetary policy only speaks to CPI.

- This move from WPI to CPI as the policy anchor has brought us to global best practices. Going back to WPI would be regressive and uncalled for.

To Read a Comprehensive Article decoding every aspect of Inflation, Visit: https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

https://www.thehindu.com/business/Economy/wholesale-price-rise-accelerates-to-1455-in-march/article65331436.ece