Description

Copyright infringement not intended.

Context

- Today the sixth anniversary of the Stand-Up India scheme is being celebrated.

About Stand-up India Scheme

- Stand up India scheme was launched in 2016. The scheme is anchored by Department of Financial Services (DFS), Ministry of Finance, Government of India.

- The scheme was launched to encourage entrepreneurship at the grassroots level especially for promoting economic empowerment and employment generation among SC, ST and women entrepreneurs.

- It does so by helping them to start a greenfield enterprise in manufacturing, services or the trading sector and activities allied to agriculture.

- Stand-Up India Scheme facilitates bank loans between Rs 10 lakh and Rs 1 Crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up a greenfield enterprise.

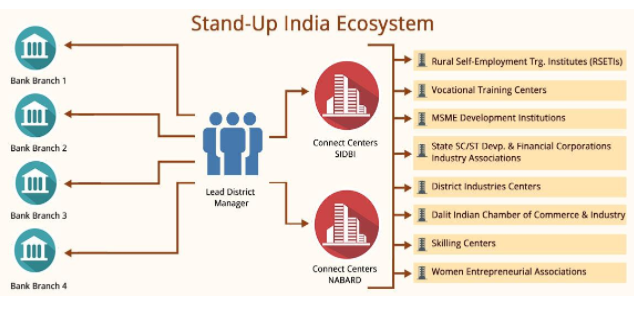

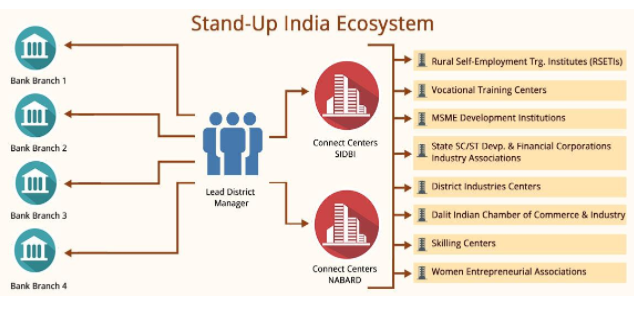

- The scheme endeavors to create an eco-system that facilitates and continues to provide a supportive environment for doing business. The scheme seeks to give access to loans from bank branches to borrowers to help them set up their enterprises.

- The scheme, which covers all branches of Scheduled Commercial Banks, will be accessed in three potential ways:

- Directly at the branch or,

- Through Stand-Up India Portal (www.standupmitra.in) or,

- Through the Lead District Manager (LDM).

Copyright infringement not intended.

Who all are eligible for a loan?

- SC/ST and/or women entrepreneurs, above 18 years of age;

- Loans under the scheme are available for only greenfield projects. Greenfield signifies; in this context, the first time venture of the beneficiary in manufacturing, services or the trading sector and activities allied to agriculture.

- In the case of non-individual enterprises, 51 per cent of the shareholding and controlling stake should be held by either SC/ST and/or Women Entrepreneur.

- Borrowers should not be in default to any bank/financial institution.

- The Scheme envisages ‘upto 15 per cent’ margin money which can be provided in convergence with eligible Central/State schemes. While such schemes can be drawn upon for availing admissible subsidies or for meeting margin money requirements, in all cases, the borrower shall be required to bring in a minimum of 10 per cent of the project cost as own contribution.

Monitoring of Scheme

- Scheme is monitored and its performance is reviewed periodically at various levels such as District Level Consultative Committee (DLCC), State Level Implementation Committee (SLIC), State Level Bankers’ Committee (SLBC), through video conference with banks, etc.

Impact of the Scheme

- Scheme has helped nurture entrepreneurship amongst marginalised sections of the population such as Scheduled Castes (SCs), Scheduled Tribes (STs) and women facing significant hurdles due to lack of advice/mentorship as well as inadequate and delayed credit for setting up greenfield enterprises.

https://newsonair.com/2022/04/05/stand-up-india-scheme-completes-6-years-loans-over-%E2%82%B930160-cr-sanctioned-to-over-133995-accounts/