NITI Aayog’s report urges India to decriminalize minor tax offences, remove mandatory jail terms, and restore judicial discretion. It calls for distinguishing genuine errors from fraud, adopting global best practices, and building a fair, trust-based tax system that promotes compliance, transparency, and equity.

Copyright infringement not intended

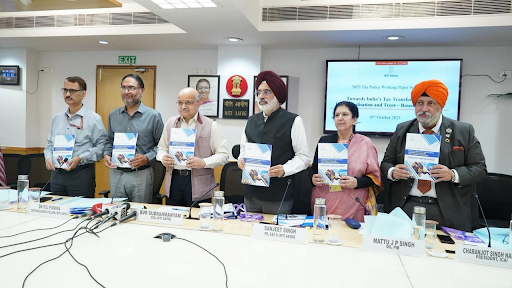

Picture Courtesy: devdiscourse

NITI Aayog released the working paper under the NITI Tax Policy titled “Towards India’s Tax Transformation: Decriminalisation and Trust-Based Governance.”

The report identifies the "persistent over-criminalisation" within the direct tax framework as a major obstacle to building a trust-based system.

Legacy Issues

Old Income Tax Act, 1961, criminalised 54 different actions, many of which were minor procedural or technical lapses. While the new Income-tax Act, 2025, is an improvement (decriminalising some offences), it still criminalises 35 actions.

Mandatory Minimum Imprisonment

For 25 of the 35 offences, the Act prescribes mandatory minimum jail terms, removing judicial discretion to impose lesser sentences based on the specific circumstances of a case.

Reverse Burden of Proof

The Act presumes guilt by assuming a culpable mental state, placing the burden of proving innocence on the accused—a deviation from standard criminal law principles.

Report proposes that Criminal law should only be used when:

Complete Decriminalisation

Of the 35 criminal offences identified, 12 should be fully decriminalized. These are primarily administrative and technical defaults that pose no real risk to fiscal security. They should be handled through civil or monetary penalties alone.

Selective Criminalisation

17 offences should be partially decriminalized. Criminal liability should be retained only for fraudulent or malafide intent. This would distinguish genuine, good-faith procedural lapses from deliberate fraud.

Retention for Serious Misconduct

6 core offences involving deliberate, high-value, and injurious misconduct (such as orchestrated tax evasion or fabrication of evidence) should remain criminal, but with proportionate punishments.

Removal of Mandatory Minimum Imprisonment

Mandatory minimum jail terms should be removed for most offences. This would restore judicial discretion, allowing courts to decide punishments based on the individual circumstances and culpability in each case.

Omission of Reverse Burden of Proof

Presumption of a "culpable mental state" should be removed. The burden of proof should be restored to the prosecution, which must prove willful or fraudulent intent beyond a reasonable doubt, in line with standard criminal law principles.

Drafting Reform and Periodic Review

Offence definitions should be simplified for clarity, and a mechanism should be established for the regular review of criminal provisions to eliminate obsolete or redundant offences over time.

Adopt International Best Practices

The report highlights that mature tax systems in countries like the United States, United Kingdom, and Germany reserve criminal prosecution for only the most egregious violations.

NITI Aayog's working paper provides a clear and actionable roadmap for aligning India's direct tax regime with global best practices and the national vision of a modern, fair, and trust-based governance system, to create a tax architecture that is not only efficient but also equitable and citizen-centric.

Source: PIB

|

PRACTICE QUESTION Q. Evaluate the role of NITI Aayog as a policy think tank in shaping India's economic reforms. 150 words |

In India, taxes are broadly categorized into Direct Taxes and Indirect Taxes. Direct taxes are levied directly on income and wealth (e.g., Income Tax, Corporate Tax, Wealth Tax - though largely abolished). Indirect taxes are levied on goods and services (e.g., Goods and Services Tax (GST), Customs Duty).

GST is a single, destination-based tax levied on the supply of goods and services across India. It replaced multiple indirect taxes like excise duty, VAT, service tax, etc. GST has four main components: CGST (Central GST), SGST (State GST), IGST (Integrated GST for inter-state supplies), and UTGST (Union Territory GST).

MAT is a provision under the Income Tax Act to ensure that companies with substantial profits but nil or negligible tax liability due to various exemptions and deductions pay a minimum amount of tax.

© 2026 iasgyan. All right reserved