Disclaimer: Copyright infringement not intended.

Context

What is RuPay?

Where are RuPay cards accepted?

Benefits of Rupay Card

MSME Rupay Card

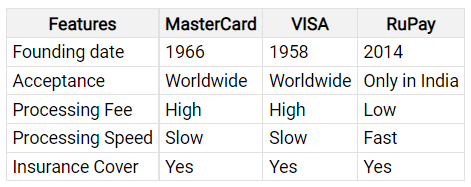

Features

Significance

|

About NPCI National Payments Corporation of India (NPCI) was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India. The National Payments Corporation of India (NPCI) is a pioneer organization in the field of retail payments in India. It is a body promoted by RBI and has presently ten core promoter banks (State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC). NPCI has created a robust payment and settlement infrastructure in the country. It has changed the way payments are made in India through a bouquet of retail payment products such as RuPay card, Immediate Payment Service (IMPS),Unified Payments Interface (UPI),Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC Fastag) and Bharat BillPay. NPCI is focused on bringing innovations in the retail payment systems through the use of technology and is relentlessly working to transform India into a digital economy. It is facilitating secure payments solutions with nationwide accessibility at minimal cost in furtherance of India’s aspiration to be a fully digital society. |

© 2026 iasgyan. All right reserved