Description

Context:

- Last week, the Monetary Policy Committee (MPC) of India’s central bank, the Reserve Bank of India, met and decided that it would neither increase nor decrease the benchmark interest rates in the economy.

- It did not even change its “stance” (or the approach to making policy decisions).

About Policy Rates:

- every two months, the RBI evaluates the outlook on economic growth and inflation.

- For inflation, it has a well laid out target — maintaining retail inflation at 4% with a leeway of 2 percentage points on either side.

Evolution of RBI decisions:

RBI (or for that matter any central bank) cannot actually “target” a particular level of GDP growth. All it can do is to “prioritise” supporting growth as against containing inflation.

Since late 2018, the RBI has been prioritising supporting growth over curbing inflation.

This strategy involved signalling a cut in the interest rates prevailing in the economy; the RBI does this by cutting the repo rate, which is the rate at which it lends money to the banks.

since late 2019, retail inflation has been either almost 6% or more. This, in turn, incapacitated the RBI to cut interest rates further — even when a Covid-induced “technical” recession demanded the RBI to do whatever it could.

Decisions of RBI to manage inflation while maintaining the growth level:

- Unable to cut rates itself, the RBI did the second best thing: Flood the market with lots of money (often referred to as liquidity).

- The key questions before the RBI were: Should it raise the repo rate to curb inflation or should it continue to keep them down in a bid to support economic recovery?

- it stayed put with the repo rate.

- it opened up the window to suck some money out of the market via the reverse repo window.

- it retained its stance as “accommodative” but, unlike in the recent past, this time the decision was not unanimous.

Impact of Excess liquidity

- But excess liquidity in the market also fuels inflation, which was already running quite high. Moreover, data shows that the banks have parked a large part of these funds back with the RBI. The banks do this using the “reverse repo rate”. It is the interest rate that banks earn when they park their money with the RBI.

Why Banks are not lending the easy liquidity:

- thanks to enormously high levels of non-performing assets (NPAs or “bad” loans or loans that did not get repaid), banks have become quite risk-averse and, as such, did not want to extend new loans at a time when they are not sure if the borrower will be able to repay them.

- Two, the overall credit demand among businesses is at a historic low because they do not see any reason to invest in new capacities; most are already saddled with unsold inventories.

MPC on inflation:

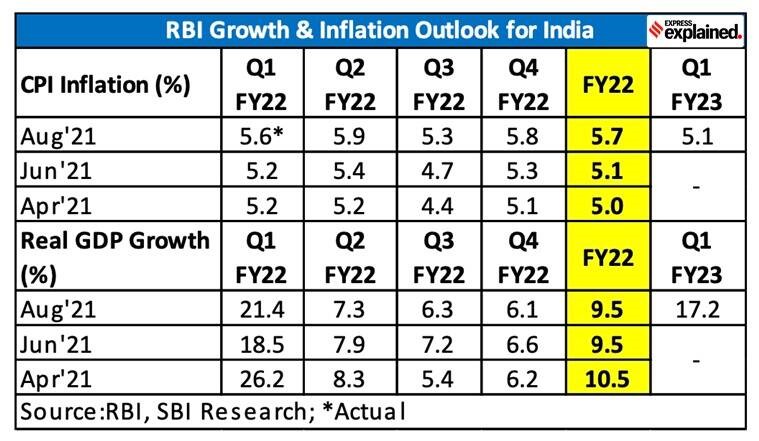

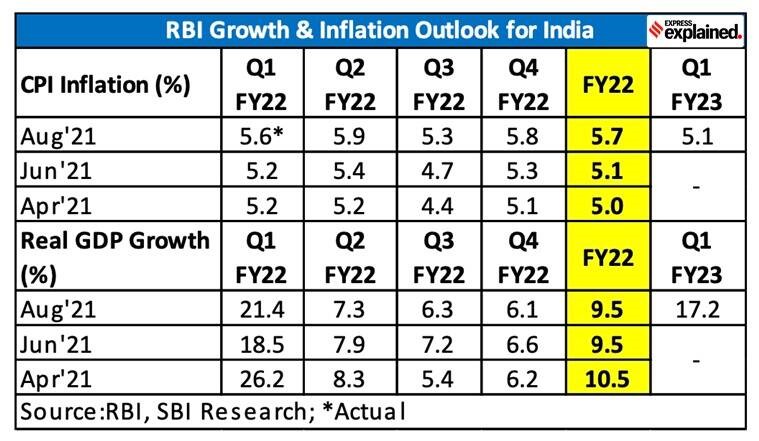

On the back of high retail inflation — the last two data points for May and June were over 6% — the RBI has increased its forecast for inflation.

Impact of High Inflation

- the most worrisome aspect of high levels of inflation (which is the rate at which prices rise) in India this year is that the current price rise is on the back of high inflation last year.

- this price rise is happening when the overall demand in the economy is still quite depressed; as and when demand picks up, inflation will likely rise further.

- For each passing month that inflation stays high, fewer people are convinced by the RBI’s contention that this streak of high inflation is just a passing (or “transitory”) phenomenon.

- if inflation does not come down, the RBI will be forced to raise interest rates either by December 2021.

- the persistence of high inflation — RBI expects retail inflation to be 5.1% in the first quarter (April to June) of 2022-23 — means that the government can no longer expect the RBI to do the bulk of the work to boost economic growth.

MPC on Economic Growth:

- the RBI’s latest forecast for GDP growth in the current financial year is the same — 9.5% — as it was in the last policy review in June.

- The RBI has dialled down the GDP growth estimates for each of the three remaining quarters in 2021-22.

On RBI’s policy overall stance

- In every policy, the RBI announces (or reiterates) its stance. The stance provides guidance to everyone in the economy on what the RBI is trying to achieve. Monetary policy is most effective if it is transparent and predictable.

- The RBI stated that it maintains its “accommodative” stance. In other words, it will continue to be in the mode where it will do “whatever it can” to support growth.

- Unlike the recent past when all six members of the MPC were behind this decision unanimously, this time around there was one dissenting voice.