Description

Disclaimer: Copyright Infringement not intended.

Context

- Moody’s Investors Service announced its decision to retain India’s sovereign credit rating at ‘Baa3’, the lowest investment grade, and persist with its “stable” outlook on the nation.

What Is a Sovereign Credit Rating?

- A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

- Sovereign credit ratings take the overall economic conditions of a country into account, including the volume of foreign, public and private investment, capital market transparency, and foreign currency reserves.

- Sovereign ratings also assess political conditions such as overall political stabilityand the level of economic stability a country will maintain during times of political transition.

- Institutional investors rely on sovereign ratingsto qualify and quantify the general investment atmosphere of a particular country.

- The sovereign rating is often the prerequisite information institutional investors use to determine if they will further consider specific companies, industries, and classes of securities issued in a specific country.

- In a nutshell, Sovereign credit ratings can give investors insights into the level of risk associated with investing in the debt of a particular country.

- Some Credit Rating Agencies: Moody’s, S & P, Fitch etc

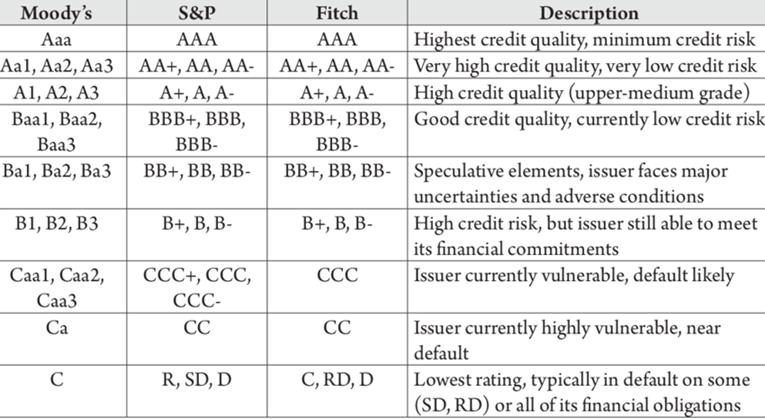

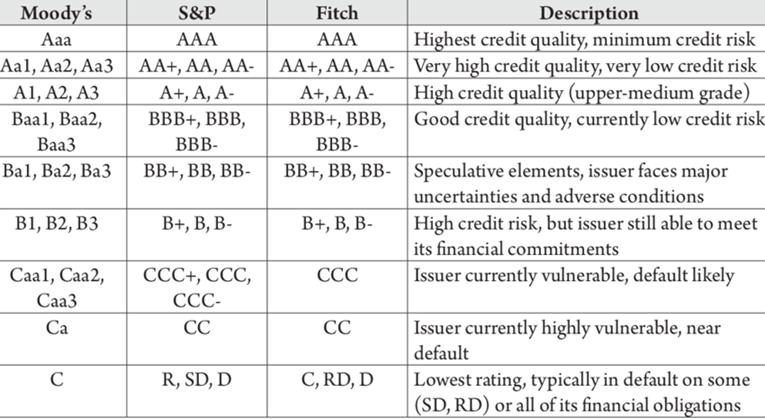

Some Credit Rating Scales

- A credit rating issued by a rating agency is an assessment of the creditworthiness of securities issued by corporations, governments and other entities.

- The ratings given to such securities are mostly represented as AAA, AAB, Ba3, CCC etc.

- It is very similar to a marking system wherein the highest rating AAA is given to a borrower who has the highest probability of paying back.

- In that way, AAA is considered to be one of the safest debt securities to buy.

Importance of Credit Ratings

- Credit rating represents an objectively analyzed assessment of the creditworthiness of the borrower.

So, the scorecard affects the amount that companies or governments are charged to borrow money.

- A downgrade, in other words, pushes down the value of the bonds and raises interest rates.

These, in turn, influence the overall investor sentiment concerning the Borrower Company or Country.

- If a company perceives to have undergone a downturn in fortunes and its rating is lowered, investors might ask for higher returns to lend to it, thereby judging it to be a riskier bet.

- Similarly, if the economic and political policies of a country look gloomy, its ratings are downgraded by global credit agencies thereby influencing the flow of investments in that country.

- On a macroscopic level, these changes affect economic policies of a nation.

An endorsement from a convincing rating agency makes life easier for countries and financial institutions issuing bonds.

It basically tells investors a firm has a track record and indicates how likely it is to be able to pay back the money.

Strength of India’s sovereign rating

- Zero sovereign default history.

- Extremely low foreign currency denominated debt of the sovereign.

- Comfortable size of its foreign exchange reserves that can pay for the short term debt of the private sector as well as the entire stock of India's external debt including that of the private sector.

Criticism of Credit Rating Agencies

- Sovereign credit ratings tend to be reactive, especially for emerging market economies, with significantly higher probability of getting downgradedas compared to developed economies.

- CRAs give higher ratings to developed countries regardless of their macroeconomic situation.

- S&P and Fitch are shown to find it more difficult to upgrade African countries relative to other developing countries, for any given improvement in ability and willingness to repay debts.

- Respective home countries of these agencies, countries with linguistic and cultural similarity, and countries with higher home-bank exposure receive higher ratings not justified by their political and economic fundamentals.

- CRAs are paid by the companies whose securities they rate.These companies benefit from favourable (high) ratings on them or their securities. Therefore, the compensation arrangement leads to a conflict of interest. The heart of the problem lies in the flow of money from issuers to raters.

Registered Credit Rating Agencies in India

- There are a total of seven credit agencies in India:

- Credit Rating Information Services of India Limited (CRISIL)

- ICRA Limited

- Credit Analysis and Research limited (CARE) .

- Brickwork Ratings (BWR)

- India Rating and Research Pvt. Ltd

- Acuite Ratings & Research Limited

- Infomerics Valuation and Rating Private Limited.

All the credit rating agencies in India are regulated by SEBI (Credit Rating Agencies) Regulations, 1999 of the Securities and Exchange Board of India Act, 1992

https://indianexpress.com/article/business/moodys-retains-india-rating-downplays-global-challenges-8135295/