Description

Disclaimer: Copyright infringement not intended.

Context

- The LIC IPO is set to sail helping the Centre meet about a third of its disinvestment target for the year.

Disinvestment

- Disinvestment means sale or liquidation of assets by the government, usually Central and state public sector enterprises, projects, or other fixed assets.

- The government undertakes disinvestment to reduce the fiscal burden on the exchequer, or to raise money for meeting specific needs, such as to bridge the revenue shortfall from other regular sources.

- In some cases, disinvestment may be done to privatise assets. However, not all disinvestment is privatisation. Some of the benefits of disinvestment are that it can be helpful in the long-term growth of the country; it allows the government and even the company to reduce debt.

- Disinvestment allows a larger share of PSU ownership in the open market, which in turn allows for the development of a strong capital market in India.

Main objectives of Disinvestment in India:

- Reducing the fiscal burden on the exchequer.

- Improving public finances.

- Encouraging private ownership.

- Funding growth and development programmes.

- Maintaining and promoting competition in the market.

- Reducing the financial burden on the government.

- Improving public finances.

- Encouraging an open share of ownership.

- Introduction, competition, and market discipline.

- Depoliticizing essential services.

- Upgrading the technology used by public enterprises to become competitive.

- Rationalizing and retraining the workforce.

- Building competence and strength in R&D.

- Initiating the diversification and expansion programmes.

Importance of Disinvestment

The importance of disinvestment lies in utilisation of funds for:

- Financing the increasing fiscal deficit

- Financing large-scale infrastructure development

- For investing in the economy to encourage spending

- For retiring Government debt- Almost 40-45% of the Centre’s revenue receipts go towards repaying public

- debt/interest

- For social programs like health and education

What is the disinvestment policy followed in India?

- A separate team under the Ministry of Finance handles all the disinvestment-related tasks called the Department of Disinvestment. The department is now made a separate entity called the Department of Investment and Public Asset Management.

- The targets of the department are set in every Union Budget and may vary every year. Since the 1990s, all the successive governments have been setting a disinvestment target to raise funds by selling a stake in PSUs.

- The government inspects several factors, such as the government’s existing stake in a company, the private sector’s interest in ownership of the enterprise, market conditions, expected value realisation, before deciding in disinvesting a company.

Types of Disinvestment

- Minority Disinvestment: The Government wishes to retain managerial control over the company by maintaining the majority stake (equal to or more than 51 percent). Because public sector enterprises cater to the citizens, the Government needs to be able to influence company policies to further the interests of the general public. The Government generally auctions the minority stake to potential institutional investors or announces an offer for sale (OFS) inviting participation by the public.

- Majority Disinvestment: The Government gives up the majority stake in a government-held company. After the disinvestment, the government is left holding a minority stake in the company. Such a decision is based on strategic grounds and policies of the Government. Typically, majority disinvestments are done in the favor of other public sector enterprises. For example, Chennai Petroleum Corporation Limited, formerly known as Madras Refineries Limited is a group company of Indian Oil Corporation after disinvestment by the Government. The idea is the consolidation of resources in a company which ultimately leads to operational efficiency.

- Strategic Disinvestment: Strategic disinvestment would imply the sale of substantial portion of the Government shareholding of a central public sector enterprise (CPSE) of upto 50%, or such higher percentage as the competent authority may determine, along with transfer of management control. The government sells off a PSU to usually a non-government, private entity. The intention is to transfer the ownership of a non-performing organization to more efficient private players in the market and reduce on the financial burden on the government balance sheet.

- Complete Disinvestment/Privatization: 100 percent sale of Government stake in a PSU leads to the privatization of the company, wherein complete ownership and control are passed onto the buyer.

Means of Disinvestment

Disinvestment of a minority stake in a Government-owned entity is done in one of the following ways:

- Initial Public Offering(IPO)

- Follow On Public Offer (FPO)

- Offer For Sale (OFS)

- Institutional Placement – Government stake is auctioned off to select financial institutions

- Exchange-Traded Funds(ETFs) – Monetize shareholding simultaneously across multiple sectors and companies that form a constituent of the ETF. For example, Bharat-22 is an ETF comprising of 22 companies (19 PSUs) with a Government stake in them.

- Cross-holding – Listed PSUs are allowed to buy a Government stake in another PSU

Disinvestment v/s Divestment

- Divestment and disinvestment are terms used interchangeably. However, there is a slight point of difference between the two.

- Disinvestmentin an asset, or division, or stake is typically carried out without the intent of reinvesting capital back into the same entity. Divestment, on the other hand, is generally done temporarily to deal with say, tight finances, or social/political pressures that may arise as a result of certain business activities. While disinvestment might also mean selling off the entity in its entirety, divestment only means the reduction of investment.

Disinvestment v/s Privatization

- Privatization is the partial or complete sale of Government-owned assets to a privately held firm or a group of individuals where the Government gives up majority control to the buyer of assets. Privatization can be done by:

- Stake sale of Government-owned equity in PSUs.

- Lifting regulations restricting private participation in Government-regulated industries.

- Offering public services contracts to private corporations.

- Offering subsidies on various business activities.

|

Point of Difference

|

Strategic Disinvestment

|

Privatization

|

|

Control

|

Dilution of ownership, Government retains control

|

Transfer of ownership, control changes hands

|

|

Shareholding threshold

|

More than 50 percent

|

Less than 50 percent

|

|

Purpose

|

To ease public finances and increase productivity of Government capital

|

Strategic in terms of achieving operational efficiency

|

Disinvestments in India

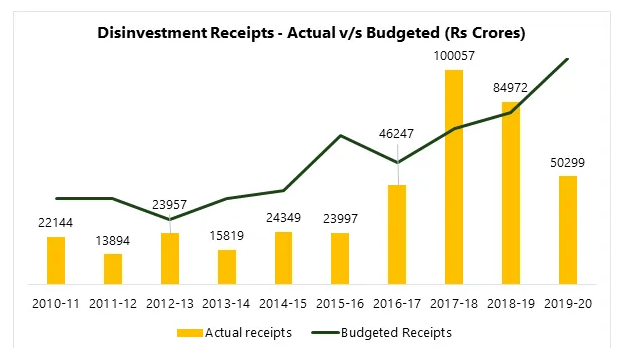

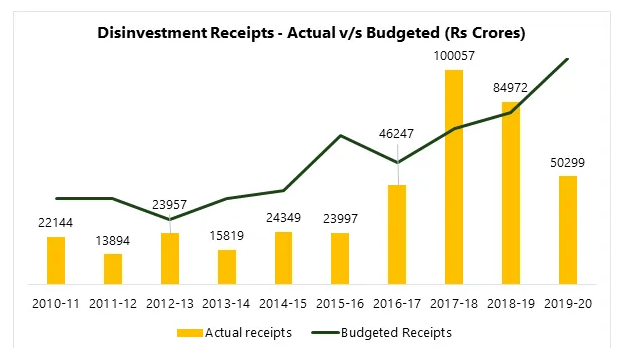

The government has set its disinvestment target for next fiscal i.e 2023 at Rs 65,000 crore.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GR29PTJE0.1&imageview=0