Description

Copyright infringement not intended

Picture Courtesy: Indian Express

Context:

The Employees’ Provident Fund Organisation (EPFO) has revealed worrying trends about how frequent withdrawals during employment are reducing the retirement savings of workers. This depletion of funds is a major reason behind the recent changes proposed by the EPFO, including introducing a minimum balance requirement.

What are EPFO Accounts?

EPFO accounts refer to the Employees’ Provident Fund Organisation accounts, which are savings accounts opened for employees working in the organized sector in India. These accounts are part of the Employees’ Provident Fund (EPF) scheme, a government-managed retirement savings plan designed to help employees accumulate funds during their working years for financial security after retirement.

Here’s what EPFO accounts involve:

- Contributions: Both the employee and employer contribute a portion of the employee’s salary every month to the EPF account.

- Savings Growth: The contributions earn interest, helping the savings grow over time.

- Withdrawals: Employees can withdraw money from their EPF accounts under certain conditions such as retirement, unemployment, or specific needs like illness, education, or housing.

- Pension Benefit: Linked to the EPF is the Employees’ Pension Scheme (EPS), which provides pension benefits to members after a minimum of 10 years of contributions.

- Universal Account Number (UAN): Every EPFO member is assigned a unique UAN, which helps track and manage their EPF accounts across jobs.

Current Trends:

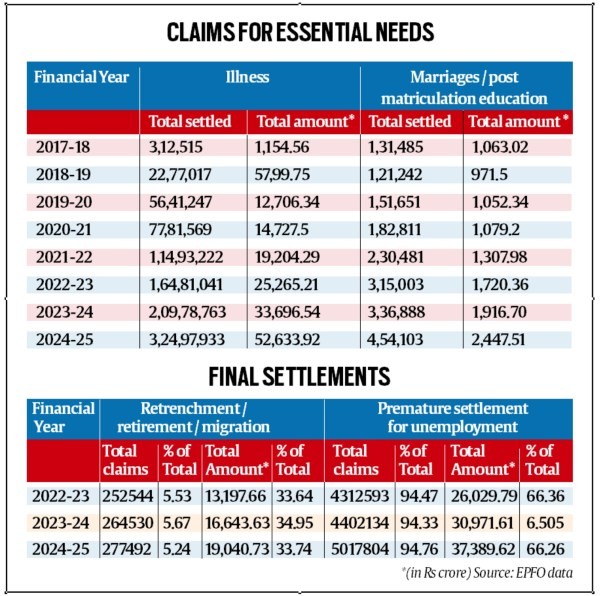

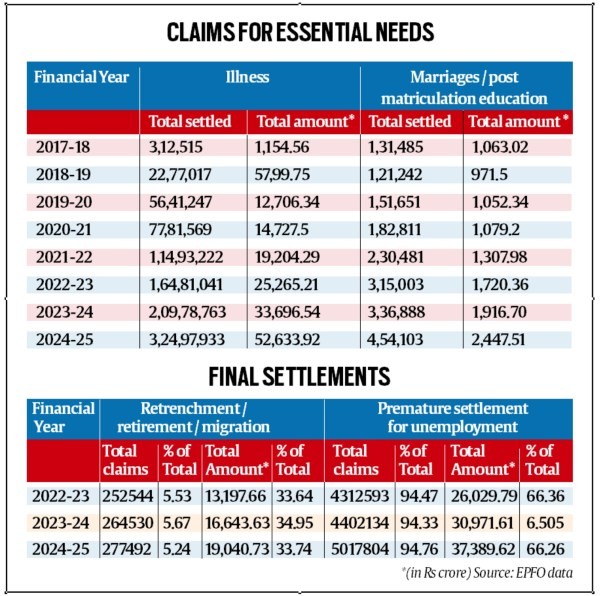

- Record Claim Settlements: Total Claims Processed: Over 08 crore claims settled, amounting to ₹2.06 lakh crore, marking a significant increase from the previous year. (Source: Upstox - Online Stock and Share Trading)

- Enhanced Automation: Auto-Settled Claims: Doubled to 87 crore claims processed within three days, thanks to streamlined procedures. (Source: Upstox - Online Stock and Share Trading)

- Formal Job Creation Decline: Net New Jobs: Only 9 million new formal jobs created in FY25, indicating a slowdown in formal employment growth. (Source: The Times of India)

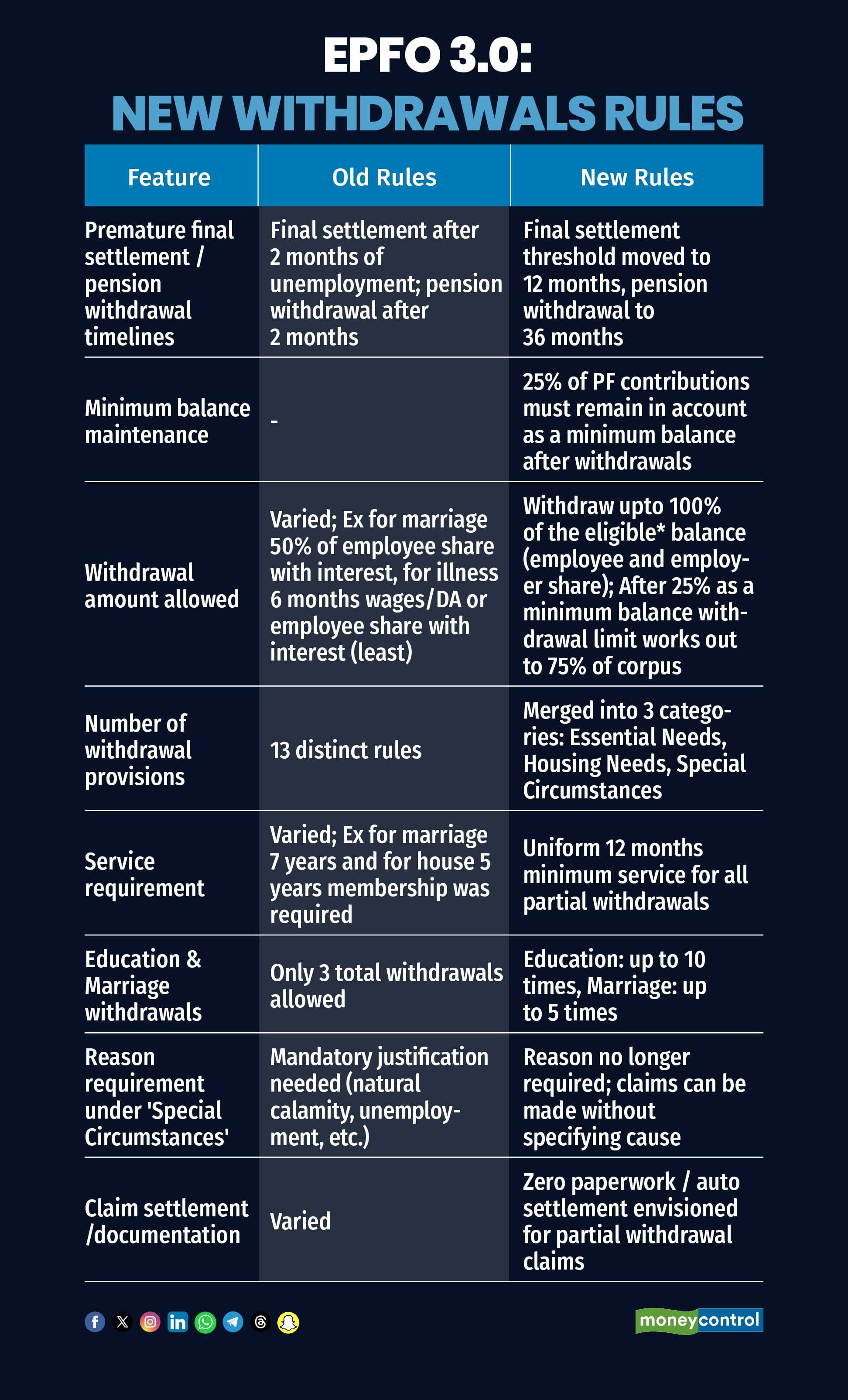

- Increased Withdrawal Limits: Advance Claim Limit: Raised to ₹5 lakh under auto-settlement for emergencies like illness, education, marriage, and housing. (Source: The Economic Times)

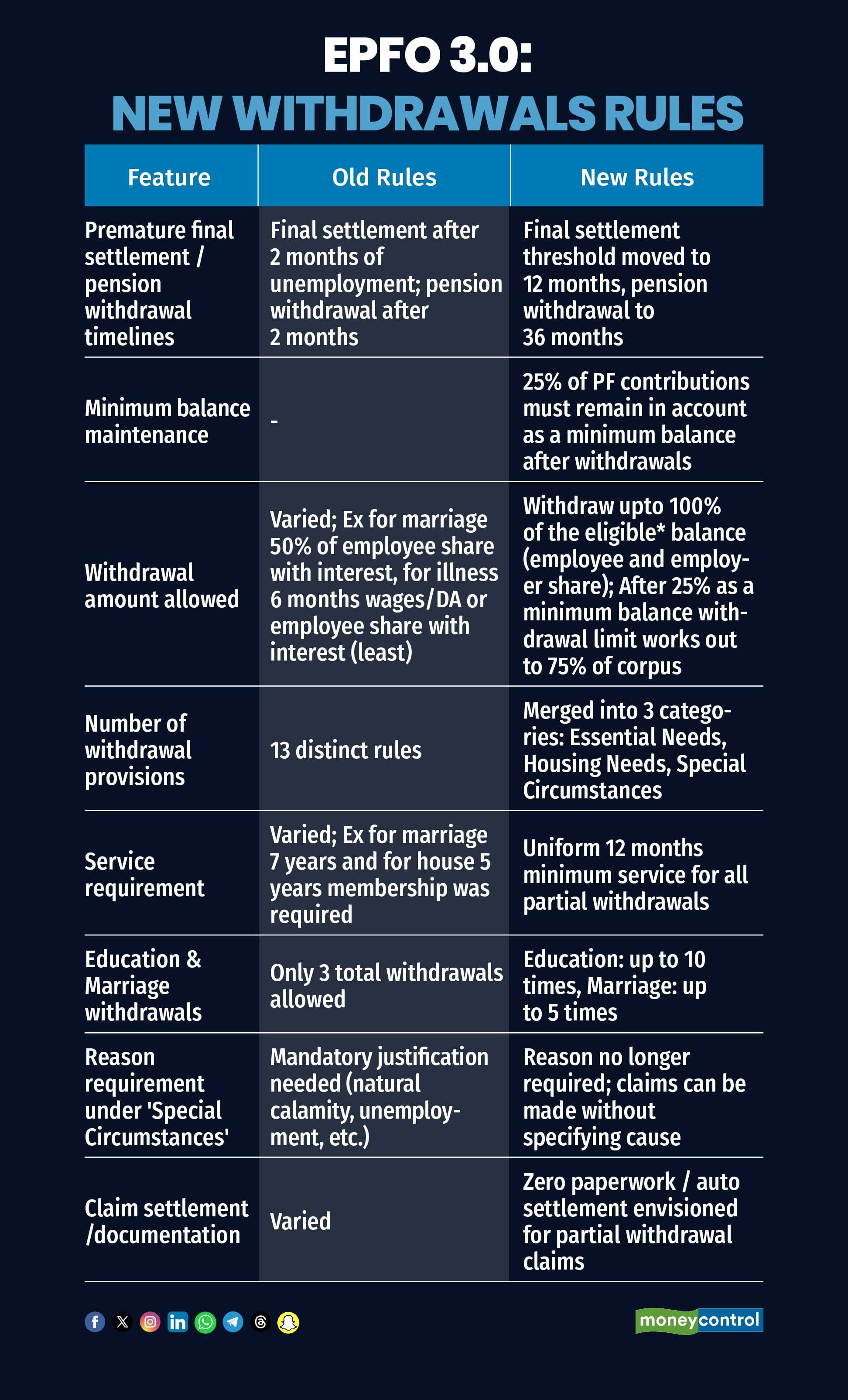

- Simplified Withdrawal Categories: Consolidation: 13 withdrawal categories merged into 3: Essential Needs, Housing Needs, and Special Circumstances. (Source: The Economic Times)

- Minimum Balance Requirement: New Rule: Members must maintain a 25% minimum balance in their EPF accounts to ensure adequate retirement savings.

Picture Courtesy: Indian Express

Picture Courtesy: Indian Express

Picture Courtesy: Money Control

Picture Courtesy: Money Control

Evolution of EPFO:

|

Year

|

Key Event / Development

|

Description

|

|

1952

|

Establishment of EPFO

|

Founded under the Employees' Provident Funds and Miscellaneous Provisions Act to manage EPF.

|

|

1995

|

Introduction of Employees’ Pension Scheme (EPS)

|

Pension scheme added to provide post-retirement pension benefits.

|

|

2014

|

Launch of Universal Account Number (UAN)

|

UAN introduced for portability and easier management of EPF accounts online.

|

|

2017

|

Relaxation of withdrawal rules

|

Removal of documentary proofs for partial withdrawals, easing access to funds for members.

|

|

2020-22

|

Covid-19 pandemic impact

|

Surge in partial withdrawals, especially for illness and emergencies, with auto-processing introduced.

|

|

2025

|

Recent reforms and minimum balance introduced

|

Withdrawal categories simplified; minimum 25% balance required to protect retirement corpus.

|

|

Present

|

Large-scale coverage and corpus

|

Over 30 crore accounts, 7 crore+ active members, corpus exceeding ₹26 lakh crore (USD 320 billion).

|

Challenges:

- Frequent Premature Withdrawals: EPFO data reveals that about 95% of final settlement claims are premature withdrawals made shortly after unemployment, often within just two months. (Source: EPFO data, 2024-25, The Indian Express)

- Low Corpus at Final Settlement: Nearly 50% of EPFO members have less than ₹20,000 at the time of their final settlement, while 75% have less than ₹50,000. This indicates that many workers exit the system with insufficient retirement savings. For instance, 22% of members receive only ₹10,000-20,000, which accounts for just 3% of the total settlement amount. (Source: EPFO data, 2024-25, The Indian Express)

- Breaks in Membership: EPFO records show that around 46% of members who withdraw prematurely subsequently rejoin the fund after a gap, causing breaks in their membership. (Source: EPFO board meeting agenda, 2025)

- Dominance of Low-Wage Contributors: Over 65% of EPFO members contribute based on monthly wages of ₹15,000 or less—the mandatory wage ceiling for EPF contributions. Only about 35% contribute voluntarily beyond this wage bracket. (Source: Senior EPFO official, The Indian Express)

- Balancing Liquidity with Retirement Security: The EPFO recently introduced a 25% minimum balance requirement to ensure a retirement corpus is preserved. However, this has sparked concerns, especially among lower-income workers who rely on withdrawals during unemployment. (Source: Ministry of Labour and Employment clarification, October 2025)

- Data Management and Technological Challenges: With over 30 crore accounts and 7 crore active contributors, maintaining accurate records and smooth processing of claims is a massive logistical challenge. The surge in partial withdrawal claims, particularly for illness (over 3.25 crore claims worth ₹52,633 crore in 2024-25), further strains EPFO’s operational capabilities. (Source: EPFO annual data, 2024-25)

- Awareness and Outreach: Many members, particularly from informal sectors, lack full awareness of EPFO’s benefits and withdrawal rules. This limits their ability to make informed decisions and take full advantage of social security provisions. (General observation based on sector studies)

Way forward:

- Strengthen Retirement Corpus Preservation: Encourage members to minimize premature withdrawals by raising awareness about long-term benefits. Implement stricter rules to protect the retirement corpus, ensuring sufficient funds at retirement age.

- Improve Financial Literacy: Conduct widespread financial education campaigns focused on the importance of provident fund savings, pension benefits, and disciplined contributions to build a secure post-retirement life.

- Enhance Digital Infrastructure: Continue upgrading EPFO’s digital platforms for faster processing, easier access, and transparent tracking of accounts. Expand mobile app capabilities and multilingual support to reach diverse member groups.

- Flexible Withdrawal Norms with Safeguards: Balance members’ need for financial flexibility with safeguards to prevent excessive withdrawals that erode retirement savings. Introduce smart algorithms to detect and flag frequent withdrawals for counseling.

- Expand Coverage and Inclusion: Extend EPFO’s reach to informal sector and gig economy workers through innovative contribution models and partnerships with employers and fintech companies.

- Strengthen Pension Benefits: Encourage longer membership durations and introduce incentives for members to stay invested to qualify for pension schemes, ensuring financial stability in old age.

- Policy Review and Member Feedback: Establish regular feedback mechanisms with stakeholders to assess the impact of policies and make data-driven adjustments to withdrawal limits and procedures.

Source: Indian Express

|

Practice Question

Q. “Frequent premature withdrawals from the Employees’ Provident Fund (EPF) are undermining the retirement security of India’s workforce. Examine the challenges posed by this trend and suggest policy measures to strengthen the provident fund system for ensuring social security.” (250 words)

|

Frequently Asked Questions (FAQs)

The Employees’ Provident Fund Organisation (EPFO) is a government body that manages the mandatory retirement savings scheme for salaried employees in India.

Employees working in establishments with 20 or more employees are mandatorily covered under EPF, and voluntary participation is allowed for others.

Premature withdrawal refers to withdrawing the EPF corpus before retirement, often during employment breaks or unemployment, which reduces the retirement savings.

Picture Courtesy: Indian Express

Picture Courtesy: Indian Express Picture Courtesy: Money Control

Picture Courtesy: Money Control