The Tropical Forest Forever Facility (TFFF), led by Brazil, proposes a $125 billion blended-finance fund to provide permanent, performance-based payments for tropical forest conservation, prioritizing Indigenous communities, and ensuring predictable climate finance. It will be launched at COP30 in Belém, Brazil.

Copyright infringement not intended

Picture Courtesy: DOWNTOEARTH

Brazil, hosting the 30th Conference of Parties (COP30) to the United Nations Framework Convention on Climate Change (UNFCCC) in Belém in November 2025, has proposed the Tropical Forest Forever Facility (TFFF).

It is a global finance mechanism advocating by Brazil to incentivize the conservation of tropical forests.

Unlike project-based initiatives, TFFF aims to provide long-term, sustainable funding by raising $125 billion through an integrated finance model.

It will pay tropical forest countries (TFCs) a fixed amount per hectare of standing forest, adjusted for deforestation and degradation, with at least 20% of funds allocated to indigenous peoples and local communities (IPLCs).

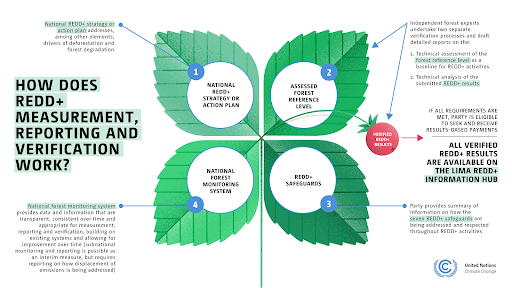

The initiative to complements existing mechanisms like REDD+ and operates through the Tropical Forest Investment Fund (TFIF), which will invest in bonds to generate returns for conservation payments.

Key Features

Tropical forests are critical for global ecosystems and climate stability:

Yet, tropical forests face severe threats:

TFFF addresses this by making conservation financially viable, reducing the economic incentive to clear forests for agriculture or mining.

REDD+: Focuses on reducing emissions from deforestation but relies on carbon credits and project-based funding. TFFF avoids carbon credits, emphasizing long-term payments for standing forests.

Amazon Fund: Targets Amazon conservation with grants from developed nations (e.g., Norway, Germany). TFFF is global, market-driven, and aims for permanence.

TFFF’s Tropical Forest Investment Fund (TFIF) will raise funds from:

The capital will be invested in:

Concern raisedThe dependence on private capital raises concerns about greenwashing, as corporations may use TFFF to offset environmental responsibilities without systemic change. The lack of a credit rating for TFIF creates uncertainty about interest rates and investor confidence. |

India with Forest and Tree cover area of 25.17% of total land area (Source: Forest Survey of India 2023), can benefit from TFFF:

Challenges

|

To succeed, TFFF must:

The Tropical Forest Forever Facility promises inclusive forest conservation but faces risks of market volatility, debt, and equity.

Source: DOWNTOEARTH

|

PRACTICE QUESTION Q. With reference to the Tropical Forest Forever Facility (TFFF), consider the following statements:

Which of the above statements is/are correct? A) 1 only B) 2 only C) Both 1 and 2 D) Neither 1 nor 2 Answer: A Explanation: Statement 1 is correct. The TFFF is a Brazilian-led initiative to be launched at COP30 in Belém, Brazil. Statement 2 is incorrect. The TFFF is a blended-finance mechanism, combining public money with private capital, not a purely public finance model. |

It is a Brazilian-led global fund that uses profits from market investments to provide payments for tropical forest conservation.

To provide a permanent, predictable, and large-scale financial incentive for tropical forest countries to protect their forests.

It is a blended-finance, revenue-generating fund that does not rely on traditional grants and is designed for long-term predictability.

© 2026 iasgyan. All right reserved