Description

Disclaimer: Copyright infringement not intended.

Context

- The Union Cabinet has approved financial support of Rs 820 crore for India Post Payments Bank.

Objectives

The objective of the support is

- To build the most accessible, affordable and trusted bank for the common man;

- Spearhead the financial inclusion agenda by removing the barriers for the unbanked and;

- Reduce the opportunity cost for the under banked populace through assisted doorstep banking.

- The project supplement government of India’s vision of “less cash” economy and at the same time promotes both economic growth and financial inclusion.

What are Payment Banks?

- Based on the recommendations of the Nachiket Mor Committee, Payments Bank was set up to operate on a smaller scale with minimal credit risk.

- The main objective is to advance financial inclusion by offering banking and financial services to the unbanked and underbanked areas, helping the migrant labour force, low-income households, small entrepreneurs etc.

- They are registered under the Companies Act 2013 but are governed by a host of legislations such as Banking Regulation Act, 1949; RBI Act, 1934; Foreign Exchange Management Act, 1999, Payment and Settlement Systems Act, 2007

- India currently has 6 Payment Banks namely:

- Airtel Payment Bank,

- India Post Payment Bank,

- Fino,

- Paytm Payment Bank,

- NSDL Payment Bank and

- Jio Payment Bank.

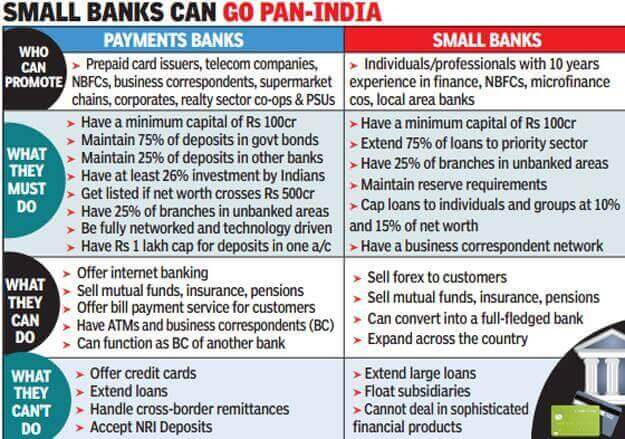

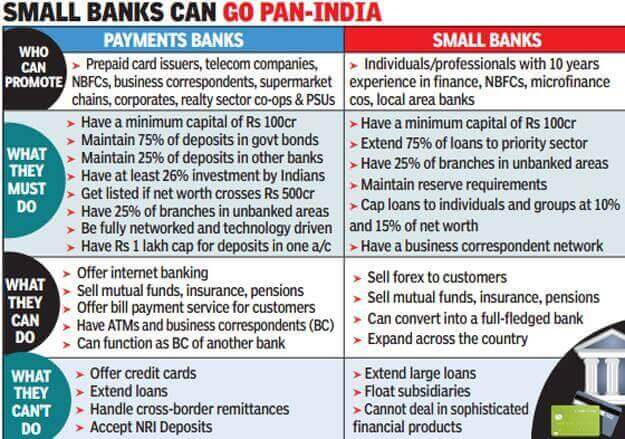

Features of Payment Banks

- They are differentiated and not universal banks.

- These operate on a smaller scale.

- It needs to have a minimum paid-up capital of Rs. 100,00,00,000.

- Minimum initial contribution of the promoter to the Payment Bank to the paid-up equity capital shall at least be 40% for the first five years from the commencement of its business.

Activities that can be performed by Payment Banks

- Payment banks can take deposits up to Rs. 2,00,000. It can accept demand deposits in the form of savings and current accounts.

- The money received as deposits can be invested in secure government securities only in the form of Statutory Liquidity Ratio (SLR). This must amount to 75% of the demand deposit balance. The remaining 25% is to be placed as time deposits with other scheduled commercial banks.

- Payments banks will be permitted to make personal payments and receive cross border remittances on the current accounts.

- It can issue debit cards.

Activities that cannot be undertaken by Payment Banks

- Payment banks receive a ‘differentiated’ bank license from the RBI and hence cannot lend.

- Payment banks cannot issue credit cards.

- It cannot accept time deposits or NRI deposits.

- It cannot issue loans.

- It cannot set up subsidiaries to undertake non-banking financial activities.

Advantages of Payment Banks

- Expansion of rural banking and financial inclusion.

- Expansion of the formal financial system.

- Effective alternative to commercial banks.

- Efficiently deals with low value, high volume transactions.

- Access to diversified services.

Challenges faced

- Lack of awareness among the masses to access these services.

- Lack of incentives for the agents to involve themselves in these activities.

- Lack of infrastructure and access to operational resources.

- Technological hurdles.

IPPB

- India Post Payments Bank, abbreviated as IPPB, is a division of India Post which is under the ownership of the Department of Post, a department under Ministry of Communications.

- Opened in 2018 India Post Payments Bank is a 100% central government-owned entity.

- The Payment bank was started with the vision to build the most accessible, affordable and trusted bank for the common man in India.

- The main objective is to promote financial inclusion in a simple and secure manner at the customers' doorstep.

- It aims to utilize nearly 1,60,000 post offices as access points and 3 lakh postmen and Grameen Dak Sewaks to provide doorstep banking services.

- It delivers simple and affordable banking solutions through innovative interfaces available in 13 languages.

Services offered by the Bank

- It offers savings accounts, money transfers and insurances through the 3d parties, bill and utility payments.

- The Bank offers savings and current accounts up to a balance of ₹2 Lakh.

- Customers can use QR code payments eliminating the need to remember account numbers, PINs and Passwords.

- Unified Payments Interface (UPI)

- Immediate Payment Service

- National Electronic Funds Transfer

- Real-time gross settlement

- Bharat BillPay

- Direct Benefit Transfer

- RuPay Debit Card

- AEPS (Adhaar Enabled Payment Service)

According to the data released in January 2022, the India Post Payment Bank had crossed the landmark of 5 crore customers.

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1820526