Description

Disclaimer: Copyright infringement not intended.

Context

- The Insolvency and Bankruptcy Board of India (IBBI) has amended its regulations to allow sale of one or more assets of an entity undergoing insolvency resolution process, besides other changes.

- IBBI has amended the regulations with the "objective to maximise value in resolution"

Must Read: Comprehensive article on-

Insolvency and Bankruptcy Code : https://www.iasgyan.in/daily-current-affairs/insolvency-and-bankruptcy-code-39

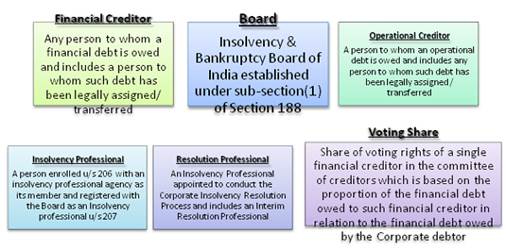

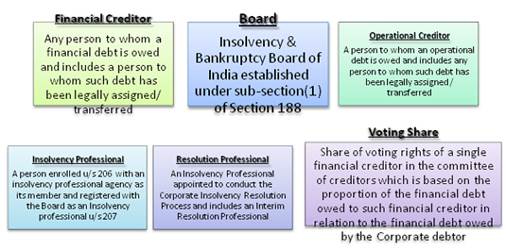

Insolvency and Bankruptcy Board of India (IBBI)

- The Insolvency and Bankruptcy Board of India (IBBI) is the regulator for overseeing insolvency proceedings and entities like Insolvency Professional Agencies (IPA), Insolvency Professionals (IP) and Information Utilities (IU) in India.

- It was established in 2016 and given statutory powers through the Insolvency and Bankruptcy Code, which was passed by Lok Sabha in 2016.

- It covers Individuals, Companies, Limited Liability Partnerships and Partnership firms.

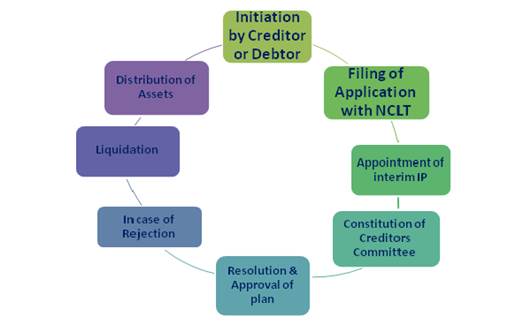

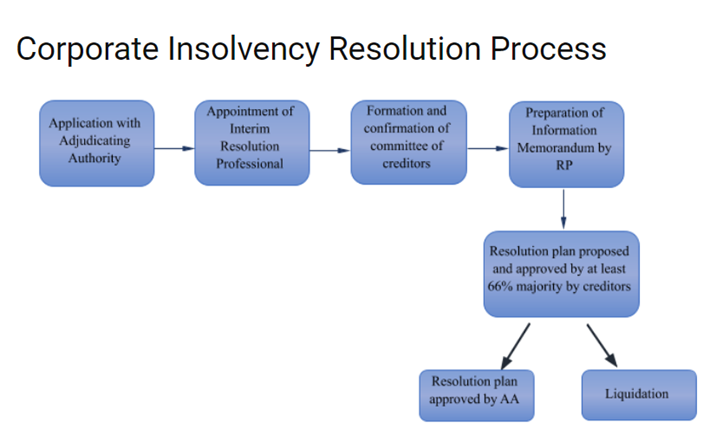

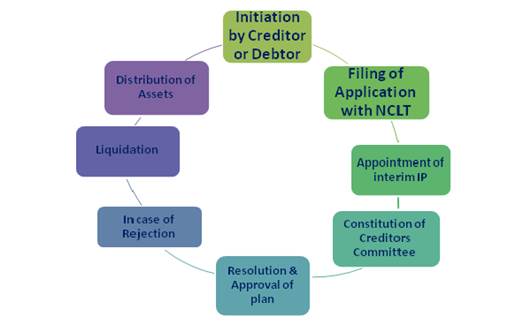

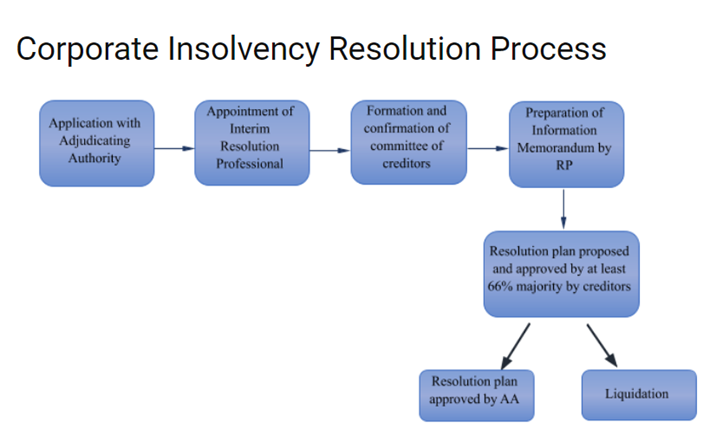

- The new code will speed up the resolution process for stressed assets in the country. It attempts to simplify the process of insolvency and bankruptcy proceedings. It handles the cases using two tribunals like NCLT (National company law tribunal) and Debt recovery tribunal.

IBBI Governing Board

- IBBI will have 10 members, including representatives from the Ministries of Finance, Law and corporate affairs, and the Reserve Bank of India.

- IBBI regulates a process as well as a profession. IBBI has regulatory oversight on Insolvency Professionals , Insolvency Professional Agencies, Insolvency Professional Entities and Information Utilities.

Changes made through new amendment

- The Committee of Creditors (CoC) can now examine whether a compromise or an arrangement can be explored for a corporate debtor during the liquidation period.

- IBBI has permitted a resolution professional and the CoC to look for sale of one or more assets of the corporate debtor concerned in cases where there are no resolution plans for the whole business.

- With new amendments marketing of assets of a corporate debtor can be done that will help in wider dissemination of information to a wider and targeted audience of potential resolution applicants.

- The amendment also enables a longer time for the asset in the market.

- From now onwards, a resolution professional will have to actively seek claims from known (based on the books of accounts) creditors of the company concerned. This movewill help in making available a clearer picture about the debt.

- Details of any applications filed for avoidance of transactions will be made available to resolution applicants before submission of resolutions plans and can be addressed by the applicants in their plans.

- The information memorandum is required to contain material information which will help in assessing its position as a going concern, and not only information about its assets, thereby addressing a critical need of the market.

Significance

- The amendments will ensure that better quality information about the insolvent company and its assets is available to the market, including prospective resolution applicants, in a timely manner.

https://economictimes.indiatimes.com/news/economy/policy/ibbi-amends-regulations-to-boost-value-of-stressed-companies/articleshow/94302856.cms