Description

GS PAPER III: Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Context: FATF’s regional body retains Pakistan on ‘enhanced follow-up’ for sufficient outstanding requirements.

Background:

- Pakistan was placed on the grey list in June 2018 and was given a plan of action to complete by October 2019 or face the risk of being placed on the black list.

- The points on which Pakistan failed to deliver included its

- lack of action against the charitable organisations or non-profit organisations linked to the terror groups banned by the UN Security Council; and

- delays in the prosecution of banned individuals and entities like Lashkar-e-Taiba (LeT) chief Hafiz Saeed and LeT operations chief, Zaki Ur Rahman Lakhvi, as well as Jaish-e- Mohammad chief Masood Azhar.

- Only Saeed was sentenced for terror financing and Pakistan government claims the others are “untraceable”. Queries have been raised on efforts made to trace them.

- Pakistan was found non-compliant in cracking down on terror financing through narcotics and smuggling of mining products including precious stones.

- The FATF process also showed concern about the 4,000 names that were on Pakistan’s Schedule-IV list under the Anti-Terrorism Act up to January, but went missing in September 2020.

- The second Follow-Up Report (FUR) on Mutual Evaluation of Pakistan also downgraded the country on one criteria.

- All in all, Pakistan is now compliant or largely compliant with 31 out of 40 FATF recommendations.

|

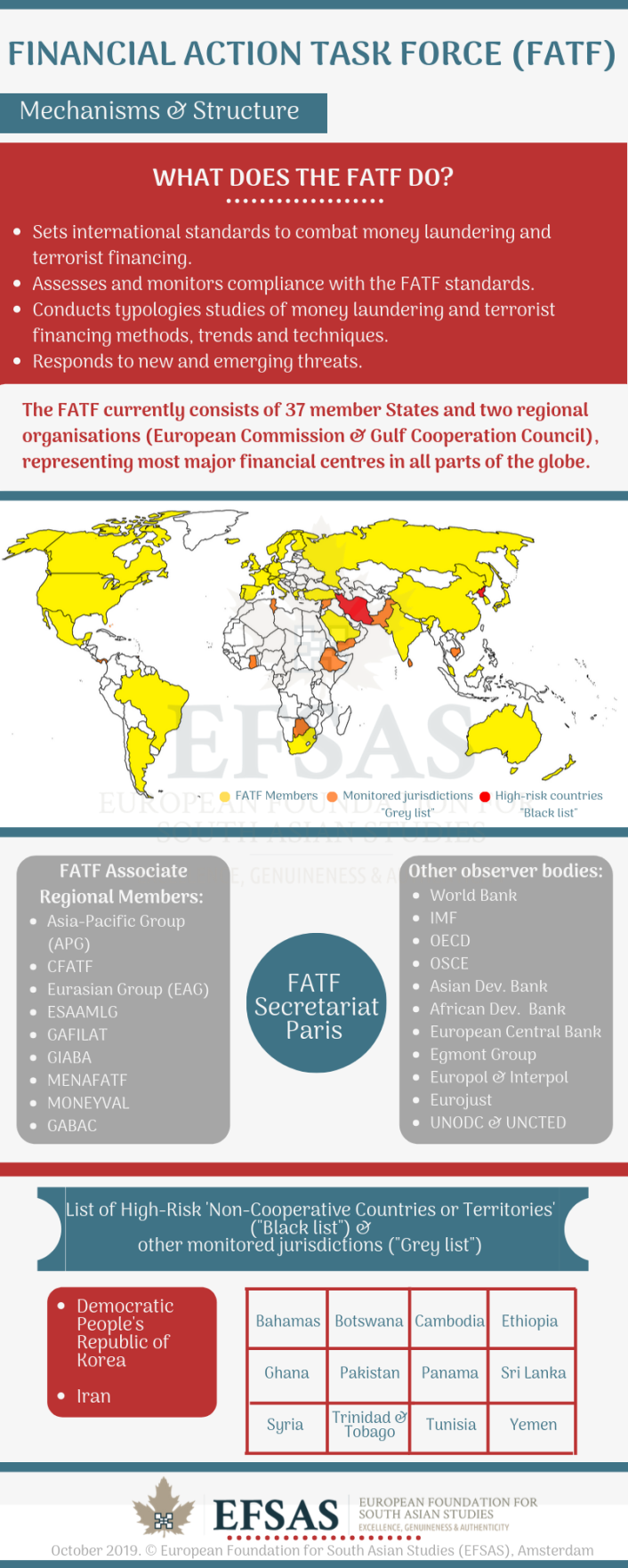

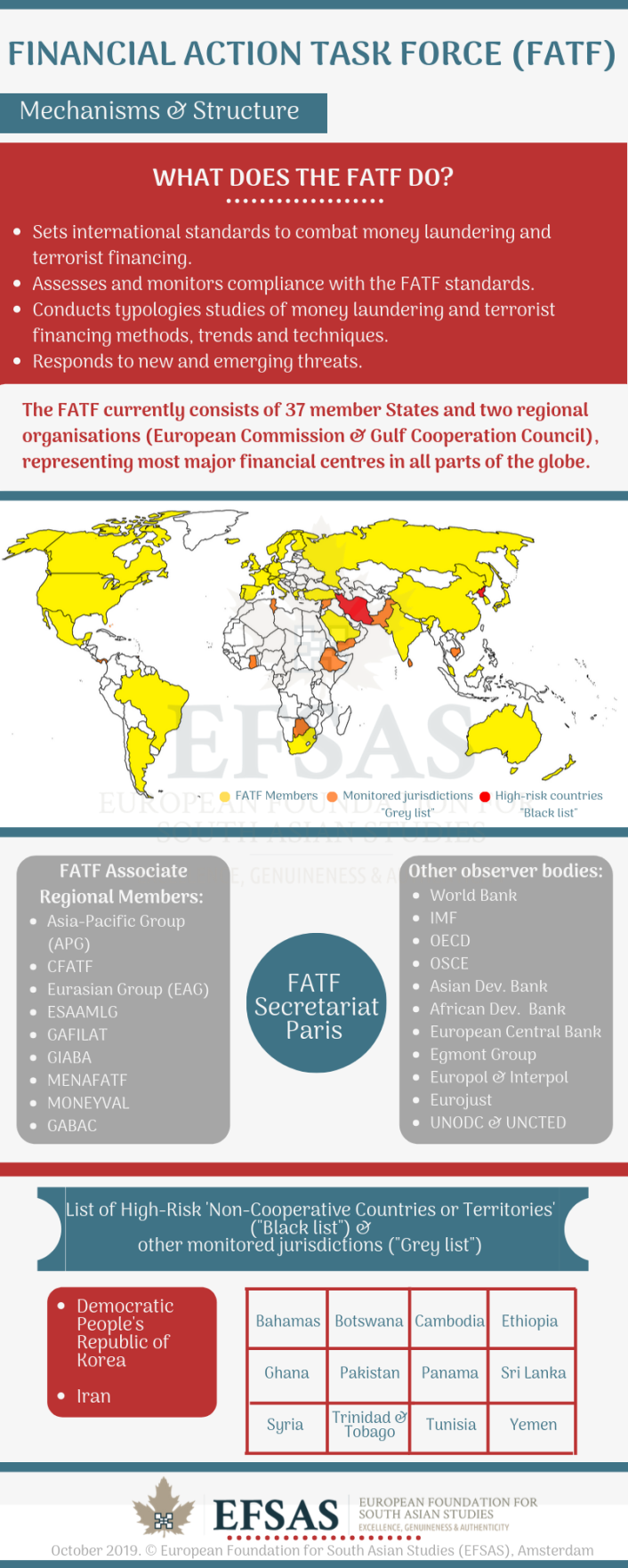

What is FATF?

- The FATF is an inter-governmental body that is now in its 30th year, working to “set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system”.

- The FATF holds three Plenary meetings in the course of each of its 12-month rotating presidencies.

- It currently has 39 members, including two regional organisations — the European Commission and the Gulf Cooperation Council.

- India is a member of the FATF consultations and its Asia Pacific Group.

|

Other countries stand:

- Turkey support: At the FATF Plenary, Turkey proposed that the members should consider Pakistan’s good work and instead of waiting for completion of the remaining six of the 27 parameters, an FATF on-site team should visit Pakistan to finalise its assessment.

- On-site teams are permitted only after jurisdictions complete their Action Plans.

- Normally such a visit is a signal for exit from the grey or black list.

- When the proposal was placed before the 38-member Plenary, no other member seconded the move.

- It was not supported by even China, Malaysia and Saudi Arabia.

- China and Saudi Arabia had joined India, US and European countries, among others, to send Pakistan a stern message to complete the commitments on terrorist financing and money.

India’s stand

- India is a voting member of the FATF and Asia Pacific Group (APG), and co-chair of the Joint Group where it is represented by the Director General of India’s Financial Intelligence Unit (FIU).

- Pakistan had asked for India’s removal from the group, citing bias and motivated action, but that demand has been rejected.

- India was not part of the group that moved the resolution to greylist Pakistan last year in Paris. The movers were the US, UK, France, and Germany; China did not oppose.

What is ‘Grey List’ and ‘Black list”?

- The FATF “greylist” refers to countries that are under “monitored jurisdictions”.

- “Blacklist” refers to those facing a “call to action” or severe banking strictures, sanctions and difficulties in accessing loans.

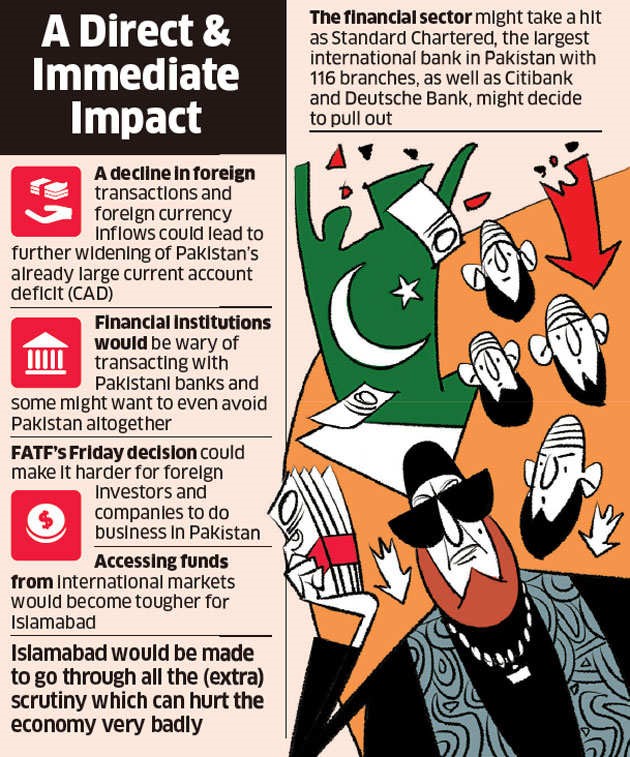

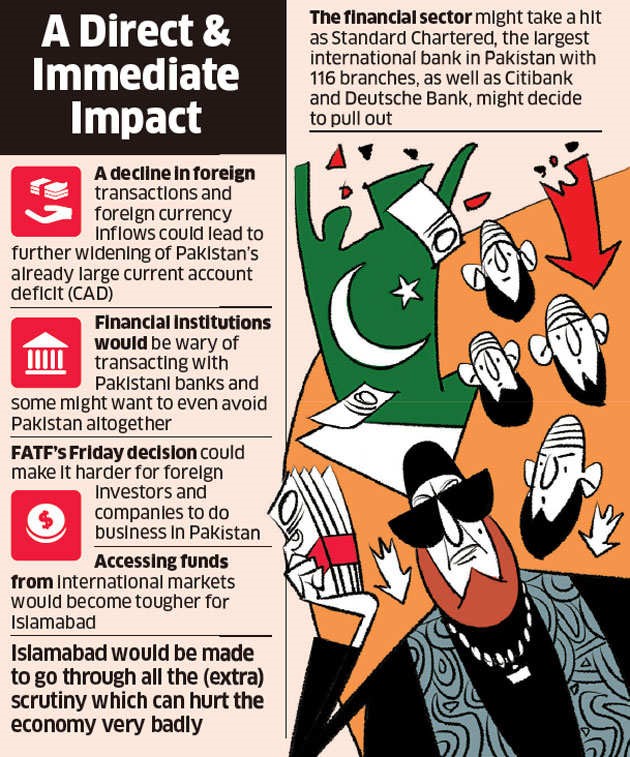

What are the implications of placing a country under grey list?

Why FATF action matters?

- Pakistan faces an estimated annual loss of $10 billion if it stays in the greylist; if blacklisted, its already fragile economy will be dealt a powerful blow.

- Pakistan’s $6 billion loan agreement with the International Monetary Fund (IMF) could be threatened.

- The IMF has asked Pakistan to show commitment against money laundering and terror financing.

https://www.thehindu.com/news/international/fatfs-regional-body-retains-pakistan-on-enhanced-follow-up-for-sufficient-outstanding-requirements/article34734093.ece?homepage=true