Description

Disclaimer: Copyright infringement not intended.

Context

- Recently, the National Institution for Transforming India ("NITI Aayog") has released a discussion paper titled Digital Banks A Proposal for Licensing & Regulatory Regime for India ("Licensing Framework").

Details

- The Discussion Paper has tried to resolve some of the above issues by the introduction of a full-stack digital bank license proposal that would mitigate the gaps in the existing Neo Bank Model.

- The proposed Licensing Framework creates an enabling environment for Digital Banks to overcome the limitations by allowing them to offer a full suite of banking services including issuing deposits and making loans. This would enable Digital Banks to offer innovative and efficient products and services with unique user experiences.

- The framework also would enhance regulatory oversight over Digital Banks, prevent uncontrolled replication of business models and protect the interest of the consumers.

Digital Banking

- Banking that is done through the digital platform without any paperwork is referred to as digital banking.

- Digital Banking is the automation of traditional banking services. Digital banking enables a bank’s customers to access banking products and services via an electronic/online platform. Digital banking means to digitize all of the banking operations and substitute the bank’s physical presence with an everlasting online presence, eliminating a consumer’s need to visit a branch.

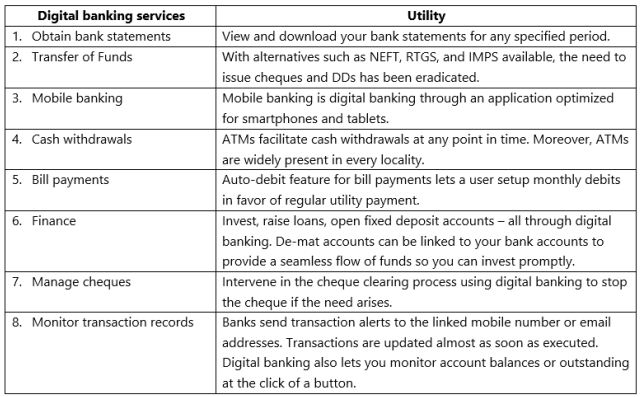

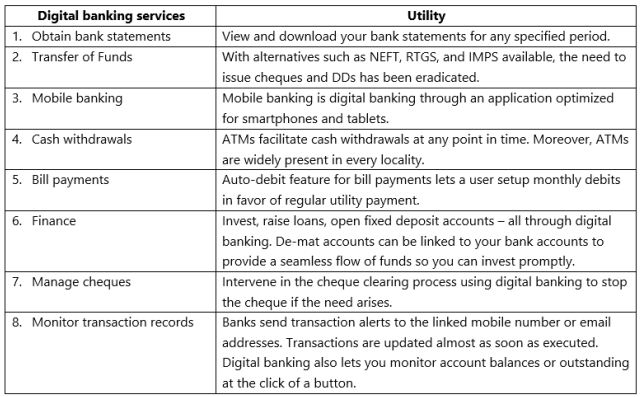

Digital Product services

Benefits of Digital Banking

Digital banking aims to make life easier for the customers of a bank. Some of its benefits are

- The convenience of banking from the comforts of home

- 24*7 availability of access to banking functions

- Paperless banking

- Enables set up of automatic payments for regular utility bills

- Facilitates online payments for online shopping etc

- Extends banking services to remote areas

- Reduces the risk of counterfeit currency with digital fund transfers

- Strengthens privacy and security for customers

- Allows misplaced credit cards to reported and blocked instantly

- Restricts the circulation of black money

- Lowers the minting demands of currency

Digital bank license roadmap in India

- In the first phase, a restricted digital bank license should be given to an applicant with restrictions in terms of volume/value of customers serviced and the like.

- In the second stage, the licensee will be put in a regulatory sandbox framework by the RBI.

- Finally, issue of a ‘full-scale’ digital bank license will be contingent on satisfactory performance of the licensee in the regulatory sandbox, including salient, prudential and technological risk management.

https://www.financialexpress.com/industry/banking-finance/niti-aayog-suggests-three-step-process-for-full-stack-digital-banks/2600859/

1.png)