Copyright infringement not intended

Picture Courtesy: INDIAN EXPRESS

The United States is pressing India to cut Russian oil imports and buy U.S. and Venezuelan crude by linking tariff relief to energy sourcing, forcing New Delhi to balance energy security with foreign policy independence.

About India-Russia Relations

India faces a complex diplomatic challenge in balancing its "special and privileged strategic partnership" with Russia (key for affordable energy) and its growing economic ties with the US, complicated by a diplomatic standoff and new American tariffs.

The Surge in Russian Oil Imports

India shifted its energy import strategy post-Russia-Ukraine conflict, driven by economic logic and the availability of discounted crude oil.

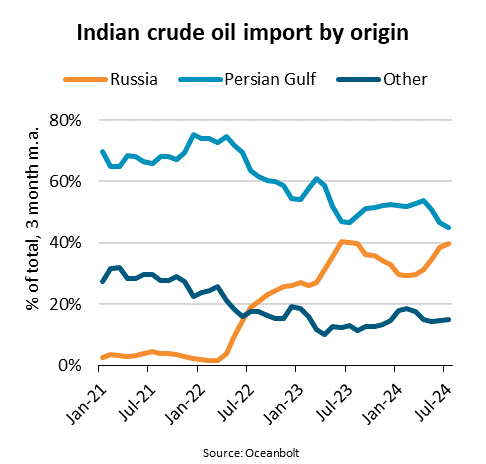

Pre-Conflict Scenario: Before February 2022, Russian crude oil constituted a negligible 1% of India’s total oil imports.

Post-Sanctions Opportunity: After Western sanctions on Russia, India capitalized on heavily discounted oil. By 2025, Russian oil imports surged to nearly 40% of the total energy basket.

India's Rationale: Necessary measure to control imported inflation and contribute to the stability of global oil prices.

US Pressure and India's Recalibration

US Pressure and India's Recalibration

The US imposed punitive 25% tariffs on India, leading to a recalibration of India's import policy.

The Shift: In December 2025, Russian oil imports to India fell to a 38-month low, decreasing Russia's share in India's crude oil imports from 34% to 24% in 1 month, as India diversifies its sources.

Diplomatic Framing: While the US claims India "agreed to stop buying Russian oil," India maintains this is a strategic "diversification based on market conditions" to protect its economic interests and diplomatic dignity.

The trade dynamic is heavily skewed towards energy, resulting in a considerable and problematic trade imbalance.

|

Metric |

Value |

Source |

|

Bilateral Trade |

$68.7 billion |

Department of Commerce Data, 2025 |

|

Russian Imports to India (Mainly Oil) |

$63.8 billion |

Department of Commerce Data, 2025 |

|

Indian Exports to Russia |

$4.9 billion |

Department of Commerce Data, 2025 |

The large trade deficit is jeopardizing the "Rupee-Ruble" trade mechanism, as Russia has accumulated billions of Indian Rupees that it cannot easily repatriate or spend.

Defence

Defence remains the historical bedrock of the India-Russia relationship.

Legacy Dependence: Nearly 60-70% of India's legacy military equipment (tanks, aircraft, etc.) is of Soviet/Russian origin, relying on Russian spares and maintenance.

Strategic Diversification: India has diversified defence procurement, reducing new Russian platform share to less than 40%. (Source: SIPRI Report)

Shift to "Make in India": The buyer-seller dynamic is evolving into co-production, exemplified by the Indo-Russia Rifles Private Limited facility in Amethi, UP, which produces AK-203 assault rifles.

|

Case Study: S-400 Triumf and Strategic Autonomy India's purchase of the Russian S-400 Triumf air defence system, despite potential US CAATSA sanctions, highlights dedication to strategic autonomy and urgent need to strengthen air defence, especially on the China border. |

The Russia-China "no limits" partnership challenges India's relationship with Moscow.

Russia's Junior Partner Status: Western sanctions are driving Russia toward a deeper alignment with China, a development India worries could undermine Russia's neutrality in a Sino-Indian conflict.

India's Strategic Counter: With 50,000 troops on the LAC, India works to create a "wedge" with Moscow to prevent Russia's full alignment with China in regional disputes.

Diplomatic Tools: Restarting Russia-India-China (RIC) trilateral forum, dormant since the 2020 Galwan clash and the pandemic, could be a key diplomatic step for managing complex relations among the three nations.

India needs a nuanced and balanced strategy to navigate the polarized global order without joining any single bloc.

Differentiate Policy Areas: Treat energy relations as transactional, focusing on securing the most affordable resources, while keeping defence ties strategic but diversified.

Accelerate Indigenisation: Reliance on Russian spares highlights the urgency of achieving self-reliance in defence.

Leverage Economic Clout: India must use its market power strategically: seek tariff waivers through creative diplomacy, adhere to global standards, and protect its interests.

India's oil purchases test its Strategic Autonomy, requiring a multi-alignment approach to engage the US for technology while maintaining a vital partnership with Russia as a continental counter-balance to China.

Source: INDIAN EXPRESS

|

PRACTICE QUESTION Q. Analyze the potential impact of India’s reduced economic engagement with Russia on the Eurasian balance of power. 150 words |

As of the 2024-25 fiscal year, bilateral trade reached a record $68.7 billion, largely driven by India's increased imports of Russian oil. Both nations have set an ambitious target to reach $100 billion in trade by 2030.

The trade ratio is about 13:1 in favor of Russia, with India importing over $63 billion worth of goods while exporting less than $5 billion. This has led to billions of Indian Rupees accumulating in Russian accounts (Vostro accounts), which Russia finds difficult to spend or convert for international transactions due to Western sanctions.

India maintains a policy of strategic autonomy, refusing to join Western sanctions against Russia while simultaneously deepening security ties with the US through the Quad. However, this balance faces pressure, such as a 25% additional penalty tariff on certain Indian exports to the US scheduled for August 2025 due to continued Russian oil purchases.

© 2026 iasgyan. All right reserved