India, with the world's fifth-largest rare earth reserves, faces challenges in domestic production due to complex extraction, radioactive elements, and atomic minerals classification. A shift in policy and investment is needed to leverage resources.

Copyright infringement not intended

Picture Courtesy: ECONOMICTIMES

Geological Survey of India (GSI) report reveals that North-East India holds over 70 million tonnes of untapped rare earth elements (REEs) and critical minerals, including lithium, graphite, and vanadium.

|

Read all about: CRITICAL MINERAL l GEOLOGICAL SURVEY OF INDIA |

Rare Earth Elements (REEs) are a group of 17 metallic elements vital for many advanced technologies, while Critical Minerals are elements and materials essential for modern economies and national security, whose supply chains are vulnerable to disruption. REEs are a subset of critical minerals.

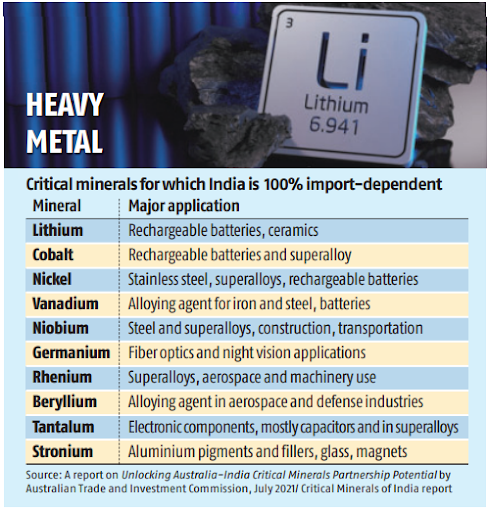

India heavy import dependence—100% for lithium, cobalt, and nickel—exposes it to geopolitical risks, particularly China’s dominance (70% of global REE production and 90% of refining).

Unique properties

REEs possess unique magnetic, phosphorescent, and electrochemical properties that are vital for high-tech applications.

Abundance vs concentration

Despite their name, REEs are relatively abundant in the Earth's crust. However, they are rarely found in high concentrations in a single location, making their extraction difficult and costly.

Divisions

REEs are categorized into Light REEs (LREEs) and Heavy REEs (HREEs). HREEs are less abundant, harder to extract, and therefore more critical.

Radioactivity

Many REE-bearing ores, such as monazite, contain radioactive elements like thorium, posing environmental challenges during extraction and processing.

Applications

Electronics: Essential for smartphones, hard disk drives, flat-screen displays, and LEDs.

Green energy: Creating high-performance, permanent magnets used in electric vehicles (EVs) and wind turbines.

Defense: Used in satellite communications, advanced guidance systems, and other specialized military equipment.

Medical technology: Applications include MRI contrast agents, medical lasers, and nuclear medicine imaging.

Petroleum refining: Lanthanum is used as a catalyst in this industry.

Arunachal Pradesh

Holds 24.8 million tonnes of high-quality natural flake graphite, ideal for lithium-ion battery anodes and aerospace composites.

Assam

The Jashora Alkaline Complex in Karbi Anglong contains 28.6 million tonnes of REEs, including neodymium for EV magnets.

Meghalaya

Sung Valley in West Jaintia and East Khasi Hills hosts an ultramafic-alkaline-carbonatite complex with laterite-hosted REEs.

Nagaland

The Mollen-Washello area in Phek district has nickel-cobalt-chromium deposits, critical for battery supply chains.

Manipur

Nickel and cobalt in ophiolite belts, requiring advanced beneficiation for extraction.

Pakke Kessang (Arunachal)

Near the Pakke Tiger Reserve, Lodoso holds 2.2 million tonnes of REEs, including neodymium.

Reducing Import Dependence

India imports 100% of neodymium magnets and 70% of lithium from China. Domestic production can lower import bills.

Clean Energy Transition

Supports India’s goal of 50% non-fossil power by 2030 and 30% EV penetration.

Economic Growth

Mining and processing can transform the North-East into an economic hub, creating jobs and infrastructure.

National Security

REEs are critical for defence technologies like missiles and radar, reducing reliance on China amid border tensions.

Geopolitical Leverage

A robust supply chain could position India as a counterweight to China, which controls 70% of global REE mining and 90% of processing.

Complex Extraction

REEs are tied to radioactive thorium and uranium, making extraction costly and complex.

Limited Processing Capacity

India lacks facilities for producing alloys and magnets, relying on China for 90% of global REE refining.

Regulatory Constraints

REEs are classified as atomic minerals, restricting mining.

Environmental Concerns

Mining generates toxic waste, risking air, water, and soil contamination. Coastal Regulation Zone (CRZ) norms and forest cover in the North-East add restrictions.

Geopolitical Risks

Proximity to China’s border raises security concerns, especially for lithium brine in Arunachal Pradesh.

Underdeveloped Infrastructure

Lack of roads, power, and skilled workforce in the North-East delays mining operations.

National Critical Mineral Mission (NCMM)

Launched in January 2025 with ₹34,300 crore (₹16,300 crore from the government and ₹18,000 crore from PSUs), to secure critical mineral supply chains across exploration, mining, processing, and recycling.

Policy Reforms

The Ministry of Mines proposes reclassifying REEs to allow private sector mining, easing restrictions.

KABIL

Khanij Bidesh India Ltd (KABIL) is acquiring lithium assets in Argentina and exploring opportunities in Africa.

Recycling Initiatives

₹1,500 crore allocated under NCMM to recycle 270 kilotonnes of e-waste and battery scrap annually.

Processing Hubs

Indian Rare Earths Limited operates plants in Odisha and Kerala, planning to double neodymium production to 900 tonnes by 2030.

Enable Private Sector Participation

Reclassify REEs as non-atomic minerals to allow private companies to mine, while ensuring thorium and uranium are handled by state entities.

Develop Processing Infrastructure

Establish alloy and magnet production facilities in the North-East with Production Linked Incentives (PLI) and global partnerships, like Toyotsu Rare Earths India.

Address Environmental Concerns

Adopt green extraction technologies and enforce strict waste management to minimize ecological damage.

Enhance Regional Infrastructure

Invest in roads, power, and training programs to support mining operations in remote North-East areas.

Strengthen Geopolitical Strategy

Secure Arunachal’s lithium brine through robust border management and international alliances like the US-led Mineral Security Partnership.

Build Strategic Reserves

Create Rare Earth Strategic Reserves to buffer against global supply shocks, similar to petroleum reserves.

Boost R&D

Fund research into sustainable extraction and substitution technologies (e.g., sodium-ion batteries) via NCMM’s Centres of Excellence.

North-East India’s REEs and critical minerals offer a transformative opportunity to reduce import dependence, drive clean energy, and strengthen national security. However, complex extraction, limited processing capacity, and environmental challenges must be addressed.

Source: ECONOMICTIMES

|

PRACTICE QUESTION Q. Despite being the fifth-largest rare earth reserves globally, India's domestic production is negligible. Critically analyze. 150 words |

Rare Earth Elements are a group of 17 chemical elements on the periodic table, including the 15 lanthanides, plus scandium and yttrium.

Mining and processing REEs can be highly polluting, generating radioactive waste, toxic sludge, and acidic wastewater that can contaminate soil and water sources.

This mission aims to build a resilient supply chain for critical minerals, including REEs, through domestic exploration and international partnerships.

© 2025 iasgyan. All right reserved