Indians are losing over ₹1,000 crore every month to cross-border cyber frauds operated mainly from Southeast Asia through scams like fake loan apps, investment traps, and phishing. These crimes are facilitated by weak international enforcement, digital illiteracy, and human trafficking, posing serious economic and national security risks.

Disclaimer: Copyright infringement not intended.

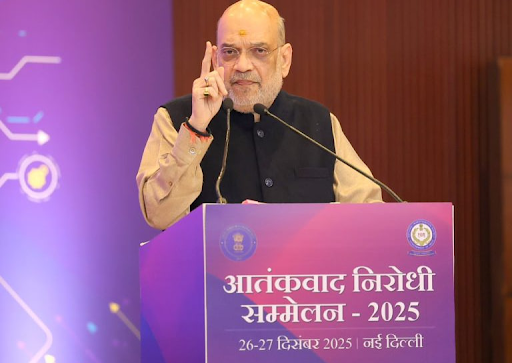

The Ministry of Home Affairs (MHA) has estimated that a significant portion of the cyber scams targeting Indians come from Southeast Asia.

In recent years, India has witnessed a steep rise in cross-border cyber frauds, resulting in significant economic losses and undermining national cybersecurity. A startling revelation from Indian enforcement agencies and intelligence reports indicates that Indians are losing ₹1,000 crore monthly—amounting to ₹7,000 crore in the first half of 2024 alone—to international cybercriminal syndicates, particularly those operating out of Southeast Asia. These developments pose serious concerns for national security, digital governance, and law enforcement capacity.

The scams originate predominantly from countries like Cambodia, Myanmar, and Laos, where cybercrime syndicates operate with high levels of impunity. These frauds involve:

|

Type of Scam |

Modus Operandi |

|

Digital Loan Apps |

Fraud apps offer instant loans, then blackmail users by misusing access to personal data via malware. |

|

Investment Scams |

Fake crypto, forex, or betting schemes lure victims into fraudulent investments. |

|

Job and Romance Scams |

False promises of jobs or relationships are used to manipulate victims into sending money. |

|

Phishing & Remote Access |

Users are tricked via links (SMS, email, social media) to give scammers device access or data. |

Victims are often recruited or targeted via WhatsApp, Telegram, Facebook, and Instagram, and are later manipulated through AI-generated identities, deepfakes, and call center-style operations run by trafficked Indian and South Asian youth.

The challenge of cross-border cyber fraud highlights a new-age national security threat that transcends traditional policing boundaries. India’s response must be multifaceted, encompassing technology, diplomacy, public awareness, and legal reform.

While steps have been taken, a stronger and more coordinated approach is needed to prevent economic losses, safeguard citizens, and assert India’s leadership in global cyber governance.

ALSO READ- https://www.iasgyan.in/daily-current-affairs/e-zero-fir

Source: Indian Express

|

PRACTICE QUESTION Q. The surge in cross-border cyber frauds poses a serious threat to India’s economic and digital security. Examine the causes, implications, and policy measures needed to address this growing menace. (250 words) |

© 2026 iasgyan. All right reserved