Description

Copyright infringement not intended

Picture Courtesy: globalgreenews.com

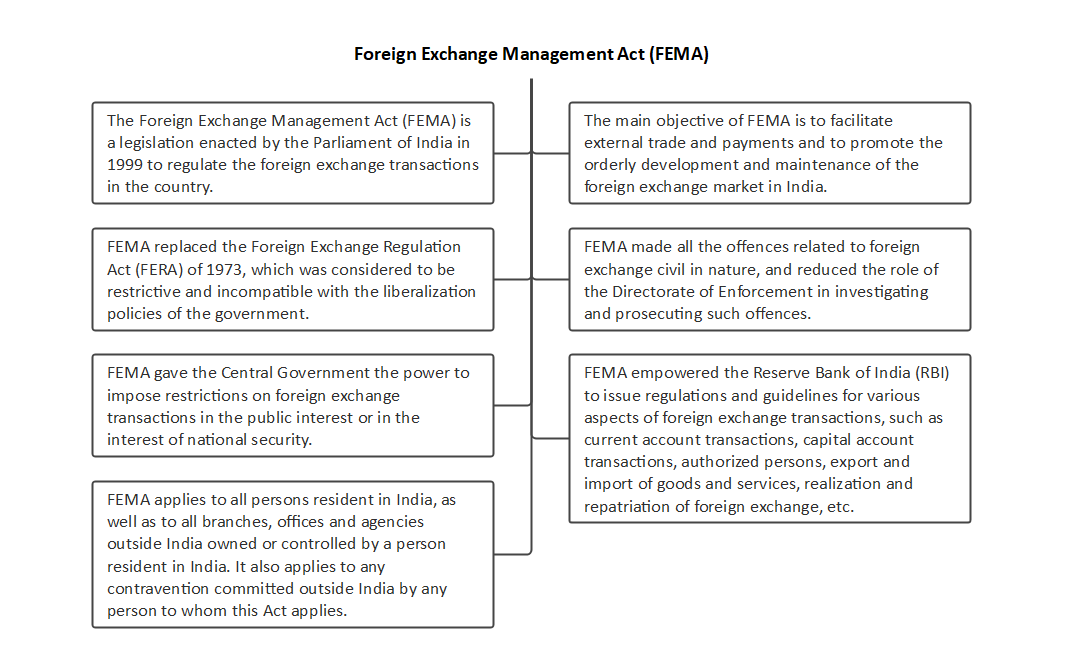

Context: The Reserve Bank of India (RBI) published a proposed 'Licensing Framework for Authorised Persons (APs)' under the Foreign Exchange Management Act (FEMA), 1999. The draft framework aimed to streamline the licensing process and eligibility criteria for entities authorized to deal in foreign exchange transactions.

Draft Licensing Framework Overview

- The Reserve Bank of India (RBI) is updating the licensing framework for Authorised Persons (APs) under the Foreign Exchange Management Act (FEMA), 1999. The previous framework was last reviewed in March 2006.

Forex Correspondent Scheme

- The RBI is introducing a new scheme called the Forex Correspondent Scheme (FCS). This scheme aims to expand the availability of forex services.

- It adopts a principal-agent model where existing Authorised Dealers (AD) Category-I or AD Category-II will act as principals for Forex Correspondents (FxCs).

- FxCs can enter into agreements with these ADs without seeking separate authorization from the RBI.

Perpetual Authorisation

- The RBI is proposing perpetual authorisation for existing AD Category-II entities, subject to meeting revised eligibility criteria. This move is intended to reduce regulatory burdens and enhance the ease of doing business.

Facilitating Trade-Related Transactions

- AD Category-II entities may be allowed to facilitate trade-related transactions up to ₹15 lakh per transaction. This is meant to broaden their scope of business, encourage innovation, and improve the overall customer experience.

Conclusion

- The RBI's proposed changes aim to adapt to the evolving economic landscape, simplify regulations, and promote a more efficient and customer-friendly environment for forex services in India. The focus is on leveraging technology, reducing regulatory burdens, and fostering innovation while maintaining appropriate checks and balances.

Must Read Articles:

FEMA: https://www.iasgyan.in/daily-current-affairs/fema

|

PRACTICE QUESTION

Q. What is the crucial role played by the Reserve Bank of India (RBI) in the country's economic landscape, and how does its monetary policy impact key aspects such as inflation, interest rates, and overall economic stability?

|