Description

Copyright infringement not intended

Picture Courtesy: en.wikipedia.org

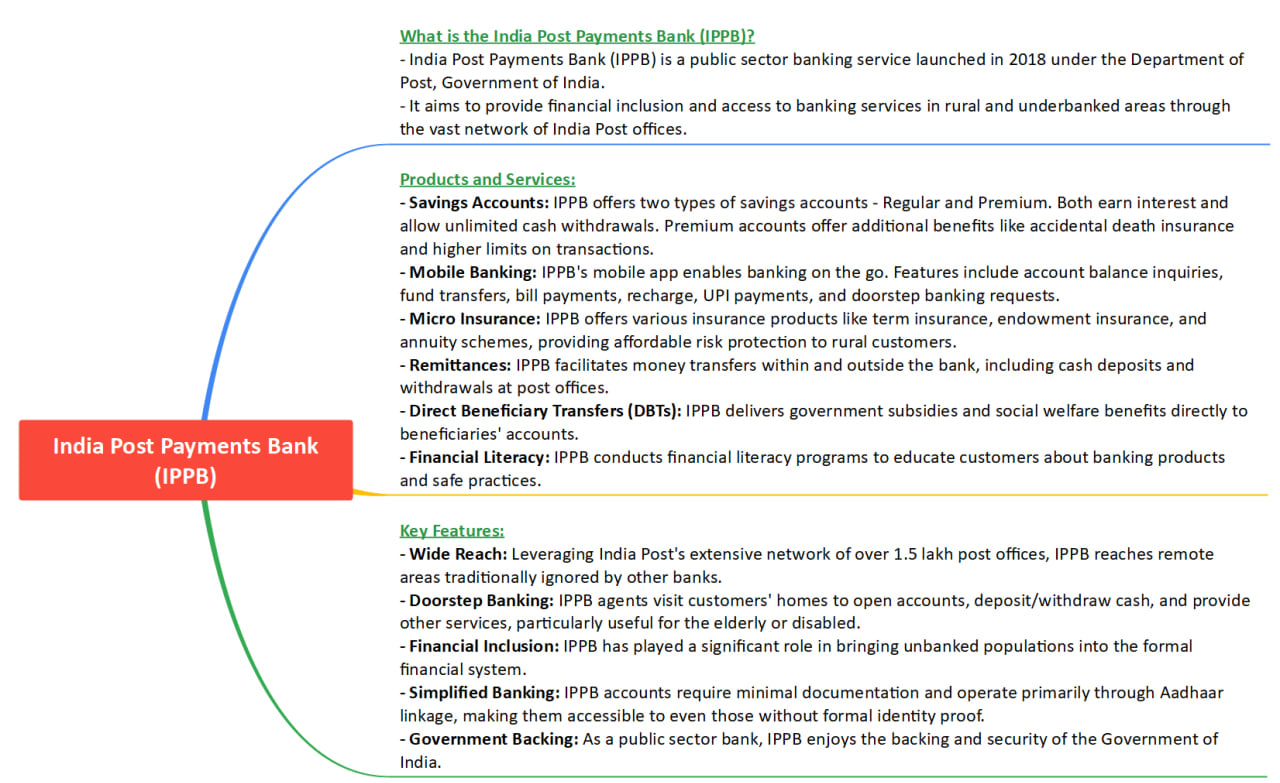

Context: India Post Payments Bank (IPPB) announced that it has achieved a significant milestone with eight crore customers benefiting from its innovative and inclusive financial services.

Key Points from the announcement include:

- IPPB was established to bridge the financial gap, empowering the underserved population, and promoting financial inclusion through a mix of traditional and digital banking services.

- IPPB has. This approach has facilitated seamless transactions, making banking services accessible to a wider spectrum of the population, including those in remote and underserved areas.

- IPPB, established under the Department of Posts, Ministry of Communication, is 100% owned by the Government of India. Launched on September 1, 2018, it aims to be the most accessible, affordable, and trusted bank for the common man. Leveraging the extensive postal network, IPPB operates on the principles of Paperless, Cashless, and Presence-less banking.

- The IPPB's operating model is built on the key pillars of India Stack, focusing on enabling paperless, cashless, and presence-less banking through a smartphone and biometric device, integrated with a CBS (Core Banking Solution) system.

- IPPB is committed to contributing to the vision of Digital India and promoting a less cash economy.

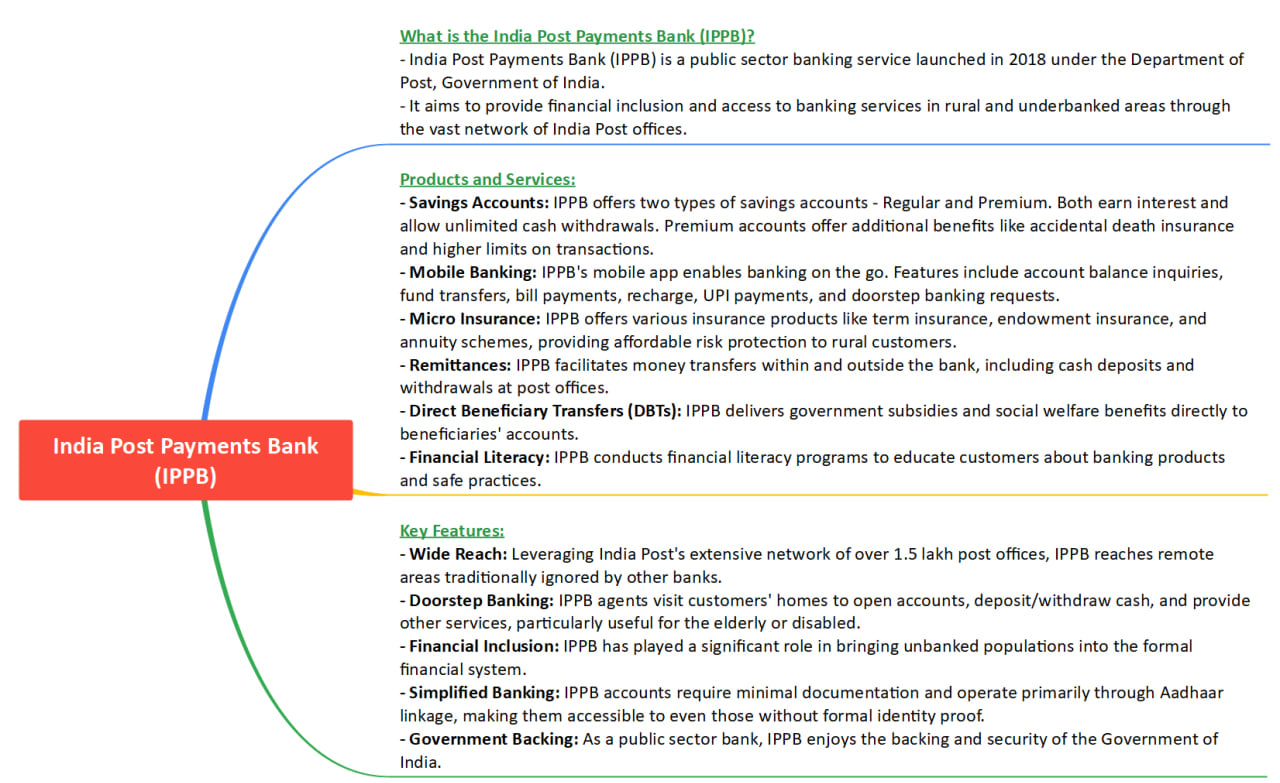

India Post Payments Bank

- India Post Payments Bank (IPPB) is a payments bank that operates under the Department of Post, Ministry of Communications.

- It was launched by the Prime Minister in 2018 to provide accessible, affordable and trusted banking services to the unbanked and underbanked sections of the society.

- They are different from regular banks in that they can accept deposits up to Rs 2 lakh, offer remittance services, mobile payments, bill payments, ATM cards, debit cards, net banking and third-party product distribution. However, they cannot issue credit cards or lend money.

- It leverages the vast network of over 1.55 lakh post offices and nearly 4 lakh postmen and Gramin Dak Sevaks (GDS) to deliver banking services at the doorstep of the customers. It also has a digital platform that enables customers to access their accounts through mobile banking, internet banking, QR cards and biometric devices.

Key features of IPPB

- It offers zero-balance accounts with no minimum balance requirement.

- It provides an interest rate of 4% per annum on savings accounts.

- It enables money transfer to any bank account in India through IMPS, NEFT and UPI.

- It facilitates direct benefit transfers (DBT) of various government schemes such as PM-KISAN, PMJJBY, PMSBY, etc.

- It allows customers to link their IPPB accounts with their Post Office Savings Accounts (POSA) and seamlessly transfer funds between them.

- It offers a range of third-party products and services such as insurance, loans, mutual funds, pensions, etc. through its partners such as HDFC Bank, Bajaj Allianz, SBI Mutual Fund, National Pension System (NPS), etc.

- It provides an Aadhaar-enabled payment system (AePS) that allows customers to withdraw cash using their Aadhaar number and biometric authentication.

- It issues QR cards that can be used for transactions without requiring a PIN or signature.

- It supports digital life certificates (Jeevan Pramaan) for pensioners.

- It enables Aadhaar-mobile updates and child Aadhaar enrolment through its network.

Significance

- It reaches out to the rural and remote areas where banking facilities are scarce or absent.

- It empowers marginalized groups such as women, farmers, migrant workers, etc. by providing them access to formal banking channels and financial products.

- It enhances the efficiency and transparency of government welfare schemes by ensuring the timely and direct delivery of subsidies and benefits to the beneficiaries.

- It promotes digital literacy and financial awareness among the masses by offering simple and user-friendly solutions.

- It creates employment opportunities for the postal staff and GDS who act as banking correspondents for IPPB.

- It boosts the revenue and viability of the postal department by diversifying its services and increasing its customer base.

|

Steps Taken to Support and Strengthen IPPB

●The government has allowed IPPB to use Aadhaar for e-KYC verification of its customers.

●The government has exempted IPPB from service tax on basic services such as account opening, cash deposit, cash withdrawal, etc.

●The government has integrated IPPB with various government portals such as UMANG, DigiLocker, Bharat Bill Pay, etc. to enable the seamless delivery of public services.

●The government has launched various initiatives such as Aarohan, Fincluvation, DakPay, etc. to enhance the capacity building, innovation and digital transformation of IPPB.

|

Challenges

- The low awareness and adoption of IPPB among the target customers due to lack of financial literacy, trust issues, preference for cash transactions, etc.

- The competition from other payment banks and fintech players who offer similar or better services at lower costs or higher returns.

- The regulatory constraints that limit the scope and scale of IPPB's operations such as deposit cap, lending prohibition, interoperability issues, etc.

- The operational difficulties that arise due to inadequate infrastructure, connectivity, security, manpower, training, etc. in the postal network.

- Financial sustainability depends on the ability of IPPB to generate enough revenue from its fee-based services and cross-selling of third-party products.

Way forward

- It should focus on creating more awareness and demand for its services among the customers through effective marketing, communication and education campaigns.

- It should leverage its unique strengths such as its brand value, trust factor, physical presence, human touch, etc. to differentiate itself from its competitors and create customer loyalty.

- It should explore new avenues of revenue generation such as offering micro-credit, micro-insurance, micro-pension, etc. to its customers in collaboration with its partners.

- It should enhance its digital capabilities and offerings by adopting new technologies such as artificial intelligence, blockchain, cloud computing, etc. to improve its efficiency, security and customer experience.

- It should strengthen its governance and management structure by appointing qualified and experienced professionals, establishing clear roles and responsibilities, ensuring accountability and transparency, etc.

Conclusion

- IPPB is a game-changer in the Indian banking sector that has the potential to transform the lives of millions of Indians who are still excluded from the formal financial system. By leveraging the postal network and the digital platform, IPPB can bridge the gap between the banked and the unbanked and contribute to the socio-economic development of the country.

Must Read Articles:

India Post Payments Bank: https://www.iasgyan.in/daily-current-affairs/india-post-payments-bank

|

PRACTICE QUESTION

Q. How does India Post Payments Bank contribute to financial inclusion in rural areas through its services? What specific measures does it take to ensure accessibility to banking facilities in remote regions? Highlight the impact of the postal network in extending financial services to the underserved population.

|