Description

.jpg)

Disclaimer: Copyright infringement not intended.

Context:

- Inflow in Gold Exchange Traded Funds (ETFs) plunged by 90% to ₹459 crore in 2022 due to rising prices of gold, increasing interest rate structure coupled with inflationary pressures.

Gold ETF:

- A Gold ETF is an exchange-traded fund (ETF) that aims to track the domestic physical gold price. They are passive investment instruments that are based on gold prices and invest in gold bullion.

- In short, Gold ETFs are units representing physical gold which may be in paper or dematerialised form. One Gold ETF unit is equal to 1 gram of gold and is backed by physical gold of very high purity. Gold ETFs combine the flexibility of stock investment and the simplicity of gold investments.

- Gold ETFs are listed and traded on the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd. (BSE) like a stock of any company. Gold ETFs trade on the cash segment of BSE & NSE, like any other company stock, and can be bought and sold continuously at market prices.

- Buying Gold ETFs means one is purchasing gold in an electronic form. One can buy and sell gold ETFs just as one would trade in stocks. When one actually redeems Gold ETF, she does not get physical gold, but receives the cash equivalent. Trading of gold ETFs takes place through a dematerialized Account (Demat) and a broker, which makes it an extremely convenient way of electronically investing in gold.

.jpeg)

How does a Gold ETF work?

Purity & Price:

- Gold ETFs are represented by 99.5% pure physical gold bars. Gold ETF prices are listed on the website of BSE/NSE and can be bought or sold anytime through a stock broker. Unlike gold jewellery, gold ETF can be bought and sold at the same price Pan-India.

Where to buy:

- Gold ETFs can be bought on BSE/NSE through the broker using a demat account and trading account. A brokerage fee and minor fund management charges are applicable when buying or selling gold ETFs.

RISKS:

- Gold ETFs are subject to market risks impacting the price of gold. Gold ETFs are subject to SEBI Mutual Funds Regulations.

- Regular audit of the physical gold bought by fund houses by a statutory auditor is mandatory.

Advantages of Gold ETF:

- Purity of the gold is guaranteed and each unit is backed by physical gold of high purity.

- Transparent and real time gold prices.

- Listed and traded on stock exchange.

- A tax efficient way to hold gold as the income earned from them is treated as long term capital gain.

- No wealth tax, no security transaction tax, no VAT and no sales tax.

- No fear of theft - Safe and secure as units held in Demat. One also saves on safe deposit locker charges.

- ETFs are accepted as collateral for loans.

- No entry and exit load.

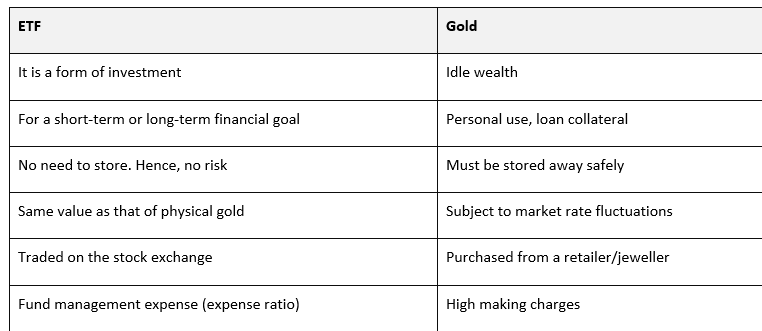

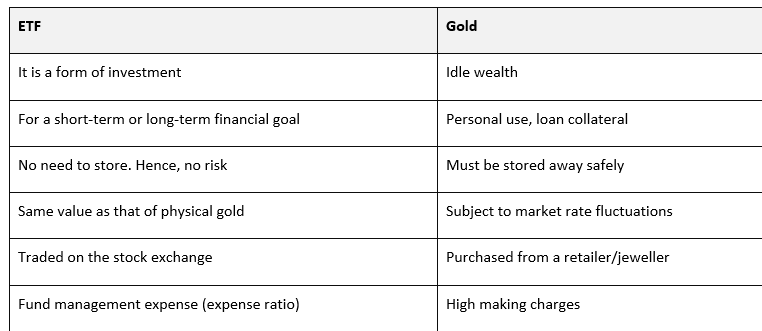

Gold versus Gold ETFs:

https://www.livemint.com/market/stock-market-news/gold-etf-inflows-slump-as-prices-rise-11674411170048.html

.jpg)

.jpg)