.jpg)

The COVID-19 pandemic has had far reaching effects on the Indian Economy, not only in terms of lay-offs, loss of livelihood, small and medium sized enterprises running out of business, but has also brought to the forefront the “rise of shadow entrepreneurship."

Recently, a professor at a business school allegedly misused his faculty position to provide fake certificates to students whom he had compelled to attend an online course that he taught. He took advantage of India’s rising pre-pandemic gig economy in education.

This is a cautionary tale for the global rise of shadow entrepreneurship, not just in education but other sectors such as finance (for easy loans), the betting economy (online games) and healthcare (e-pharmacies).

| The gig economy is based on flexible, temporary, or freelance jobs, often involving connecting with clients or customers through an online platform. |

Shadow entrepreneurs are defined as individuals who manage a business that sells legitimate goods and services but they do not register their businesses.

This means that they do not pay tax, operating in a shadow economy where business activities are performed outside the reach of government authorities.

Gimmicks under the title shadow entrepreneurship go by various names:

In 2014, Researchers at Imperial College Business School found that a large number of shadow entrepreneurs are operating in India who aren’t registering their businesses with official authorities, hampering economic growth.

In a study of 68 countries, it was found that after Indonesia, India has the second highest rate of shadow entrepreneurs.

A shadow economy does not happen by accident. It is a recognized consequence of imperfections in the economic system and inadequacies in economic policy.

Major reasons being:

Identifying the fundamental causes of a shadow economy is a precondition for designing efficient instruments and policy measures to tackle it.

Size of Tax Burden

Increasing the tax burden makes it more cost-effective to operate in the informal sector.

Size of the tax burden on income (particularly regarding social security contributions) is a major cause of the shadow economy in the field of wages, as well as of the corresponding tax gap.

Fiscal Burden on Labour

When informal businesses are formalised by moving into the formal sector they typically introduce salaries close to the minimum wage. If the tax burden is high at these wage levels, it is a clear obstacle to formalisation on the labour demand side. On the side of labour supply, the productivity of lower-qualified workers in lower-paid, labour-intensive sectors is low; so for many of them their salary is borderline ‘cost-effective’ when compared to the alternatives, such as social welfare or work in the informal economy.

Inefficiency of the Tax Administration in Collecting Taxes

The greater the probability of detecting tax evasion—all other considerations being equal—leads to a reduction in the shadow economy.

The Penalties for Tax Evasion

The penalties for tax evasion correlate negatively with the extent of the shadow economy and tax evasion: greater penalties, all other things being equal, bring about a reduction in the volume of the shadow economy and tax evasion.

Fairness of Tax system

Personal income from various sources is taxed differently, so that individuals with high income from capital are taxed at a lower rate than those with high income from work. There are many tax breaks available to business entities so that entities in different segments pay different levels of tax on the same amount of profit. The real or perceived lack of fairness in taxation is a major driver of resistance to paying taxes.

Tax Compliance Costs

Tax compliance costs are, along with high tax burden, one of the major elements of expenses associated with tax compliance. When costs (time and money) associated with assessing, declaring, and paying taxes are high due to complicated procedures, taxpayers are more incentivised to operate in the informal sector.

Labour Market Regulations

Labour market regulation (particularly hiring and firing rules or more generally, employment protection legislation) is one of the major causes of the shadow economy.

Low Productivity

Low productivity, coupled with other factors, causes a vicious circle in which low productivity makes business entities turn to the informal sector, which, as a rule, decreases productivity further. In these circumstances, the business model of many companies means they can be profitable (or, indeed, even survive) only if they fail to comply with their tax obligations, either wholly or in part.

‘Phoenix companies’

‘Phoenix companies’ most often do business with small and medium-sized businesses and cause them substantial liquidity problems. To be able to survive, the victims of ‘phoenix companies’ themselves rely on moving part of their operations into the shadow economy.

High Administrative Burden

According to experts, entrepreneurs base their decision as to whether or not to enter the informal sector more on their desire to avoid bureaucracy (and corruption) than to evade paying taxes. The administrative burden is considered to be one of the major causes of the shadow economy.

In all parts of the world, the shadow economies share the following characteristics:

Most of the people who work or do business in the shadow economy are not classified as unemployed.

Other benefits

Other downsides

Where proper economic and political frameworks are in place, individuals are more likely to become formal entrepreneurs and register their business because doing so enables them to take advantage of laws and regulations that protect their company, such as trade marking legislation.

There also needs to be an associated harmonization of activities between authorities of governments (in India’s case the Ministry of Corporate Affairs in regulating shadow entrepreneurship and government departments in healthcare, education or finance).

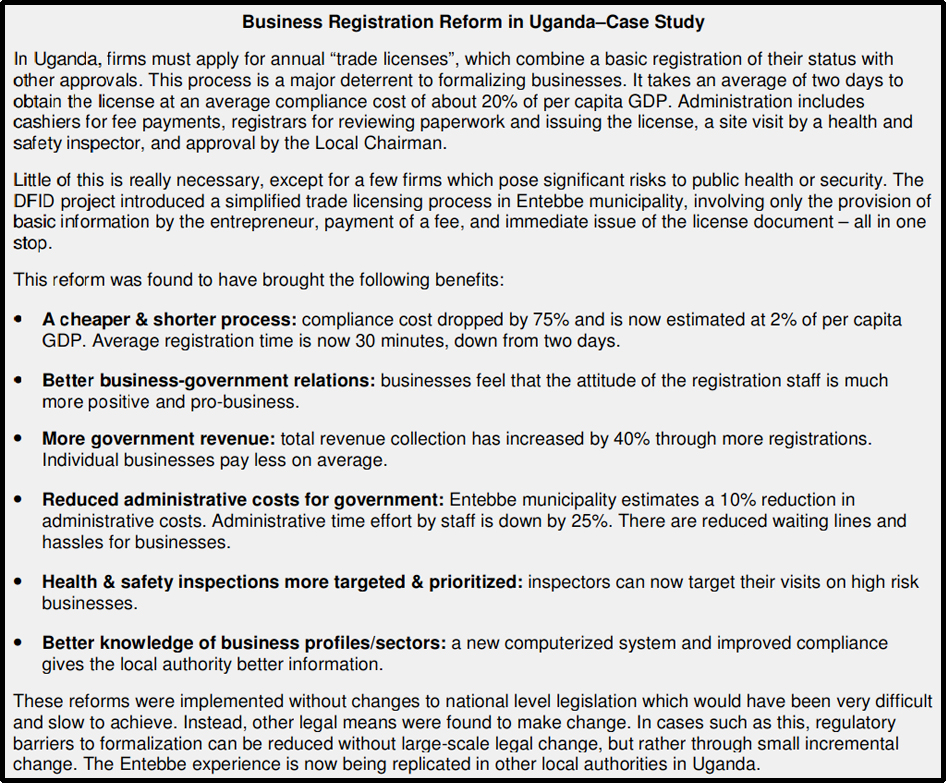

Reducing barriers to Formalization

Other Recommendations

© 2026 iasgyan. All right reserved