Disclaimer: Copyright infringement not intended.

Context

- The recent agitations by the governments of Kerala and Karnataka, and the support extended by several State governments, have highlighted many disquieting issues in the practice of fiscal federalism in India.

- These agitations show that the newly constituted 16th Finance Commission (FC) would have to proceed seriously and innovatively to justly address complaints of increasing vertical and horizontal inequalities in devolution.

Details

Issues in Fiscal Federalism

Vertical Devolution Concerns:

- Sharing of Resources: Vertical devolution pertains to sharing resources between the Union and States.

- Trends in Devolution:

- Union Government retaining an increasing share of proceeds outside the divisible pool, limiting resources available for States.

- Failure to devolve States' mandated shares of net proceeds as per successive Finance Commissions.

Need for Redressal:

- Increasing Inequalities: Trends in devolution contribute to vertical and horizontal inequalities among States.

- Urgent Action Required: The 16th Finance Commission must take serious and innovative steps to address these concerns.

Proposed Initiatives:

- Correcting Historical Wrongs: The 16th FC should initiate corrective measures to rectify past injustices in vertical devolution.

- Compensatory Measures: Consider compensating States for historical imbalances through vertical devolution.

- Innovative Approaches: Implement innovative strategies to ensure fair and equitable sharing of resources between the Union and States.

- Addressing Grievances: Justly address complaints of increasing inequalities in devolution through meaningful reforms.

Role of the 16th Finance Commission:

- Serious Consideration: The 16th FC must give due attention to the grievances raised by States and take proactive steps to address them.

- Justice and Equity: Ensure that devolution mechanisms promote justice, equity, and balanced development across States.

- Collaborative Approach: Engage in dialogue and consultation with States to understand their concerns and develop inclusive solutions.

- Long-Term Vision: Formulate recommendations that lay the foundation for sustainable and harmonious fiscal federalism in India.

The Shrinking Divisible Pool

Evolution of the Divisible Pool:

- Historical Context: Initially, only income taxes and excise duties were shared with States, while corporation taxes and customs duties were fully retained by the Union.

- Constitutional Amendment (2000): All taxes of the Union were added to the net proceeds, except for cesses and surcharges under Article 270 and Article 271.

- Composition of Net Proceeds: Currently, the net proceeds consist of gross tax revenue minus cesses, surcharges, and tax collection costs.

Proliferation of Cesses and Surcharges:

- Recent Trends: Over the past decade, the Union government introduced numerous cesses and surcharges.

- GST Implementation: Despite expectations of cesses being subsumed into the GST system, new cesses and surcharges continued to be introduced, exacerbating the exclusion of tax revenue from the divisible pool.

- Conflicting Information: Government data on the proportion of cesses and surcharges in gross tax revenue presents discrepancies.

Analysis of Cesses and Surcharges:

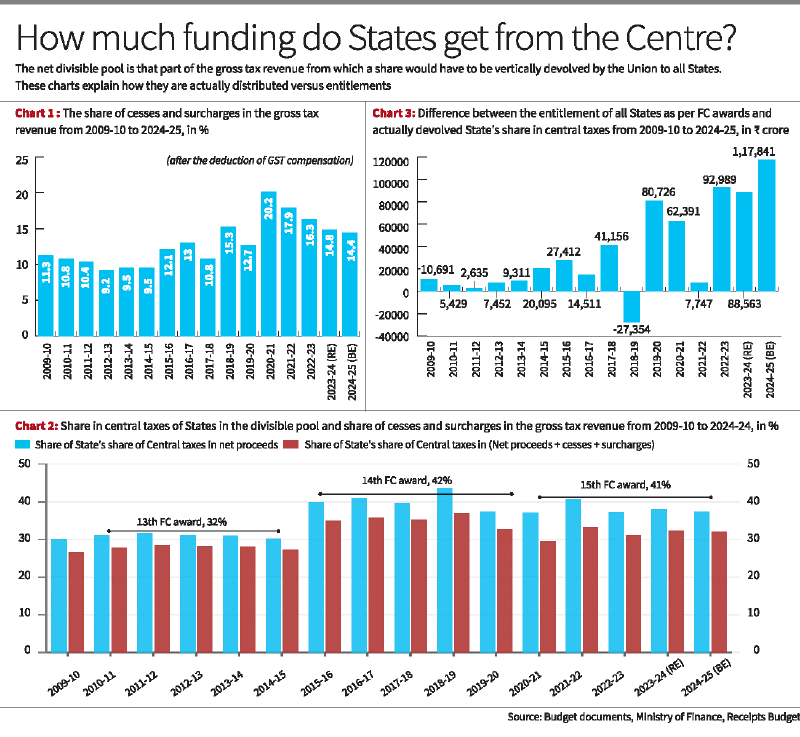

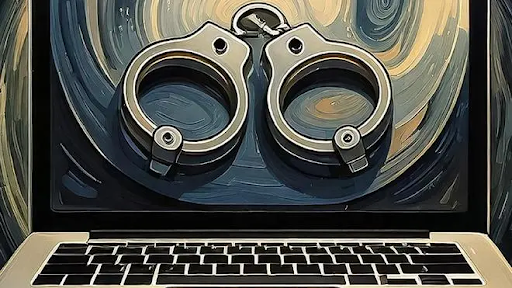

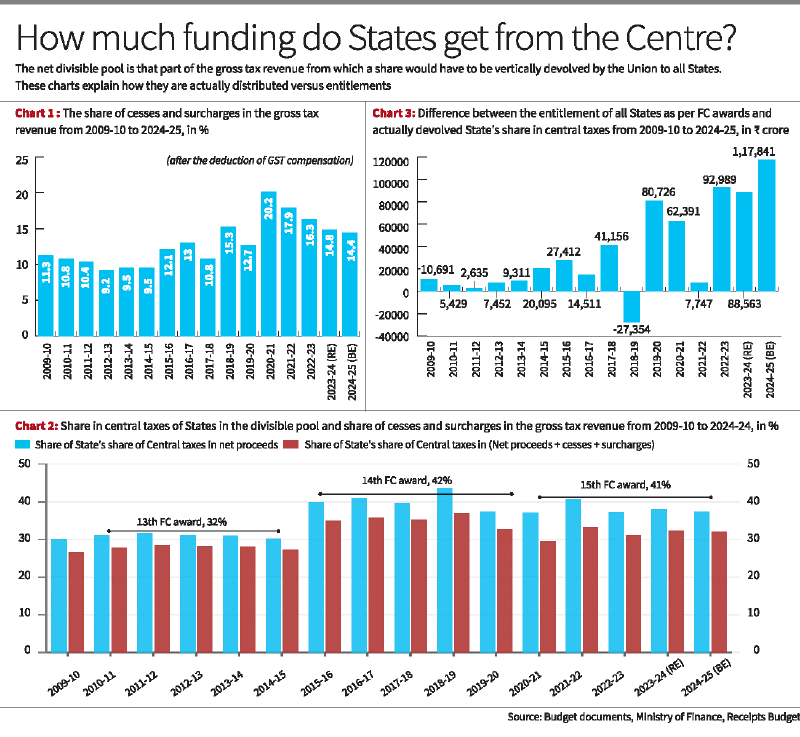

- Disaggregated Data: Disaggregated budget documents from 2009-10 to 2024-25 provide insights into the collection of cesses and surcharges.

- Collection Trends: Total collections rose significantly from ₹70,559 crore in 2009-10 to ₹6.6 lakh crore in 2023-24 (RE) and ₹7 lakh crore in 2024-25 (BE).

- Impact on Gross Tax Revenue: As a share of gross tax revenue, cesses and surcharges declined from 11.3% in 2009-10 to 9.5% in 2014-15, then surged to 20.2% in 2020-21, before stabilizing at 14.8% in 2023-24.

Unshared Revenue:

- Cumulative Collection: Between 2009-10 and 2023-24, the Union government amassed ₹36.6 lakh crore from cesses and surcharges.

- Future Projections: An additional ₹5.5 lakh crore is anticipated to be collected in 2024-25, all retained by the Union government without sharing with States.

Rise in Tied Transfers: Challenges in Fiscal Federalism

Nature of Transfers:

- Central Schemes Financing: Union government allocates funds for centrally sponsored schemes and central sector schemes, along with non-plan grants or capital transfers to States.

- Tied Nature: Unlike devolution of State’s share in central taxes, these transfers come with conditions and obligations.

Challenges Faced by States:

- Financial Burden on States: In centrally sponsored schemes, States bear about 40% of the costs, often needing to contribute significantly more to ensure effective implementation.

- Credit Usurpation: Despite significant State contributions, Union government tends to claim credit, evident in instances like labelling controversies in projects like Ayushman Bharat wellness centres.

- Conditional Grants: Many grants are contingent upon fulfilling certain conditions, including mandatory labelling, tying States' hands in utilizing funds.

Loan-based Capital Transfers:

- Debt Burden: Most capital transfers to States are in the form of loans, adding to the debt burden, as these must be repaid to the Union government.

Implications of Tied Transfers:

- Centralizing Tendency: Tied transfers reinforce a centralizing tendency in fiscal matters, shifting the Union-State relationship towards a patron-client dynamic.

- Lack of Flexibility: Conditionalities imposed on transfers restrict States' autonomy and flexibility in addressing context-specific needs.

- Risk of Resource Denial: Deviation from guidelines or failure to meet conditionalities can result in denial of resources, further exacerbating States' financial challenges.

Concerns with Substitution:

- Impact on Fiscal Federalism: Substituting untied transfers with central schemes doesn't address the loss but instead introduces rigidities in Union-State relations.

- Dilution of Cooperative Federalism: Such practices dilute the spirit of cooperative fiscal federalism, hindering genuine collaboration and partnership between the Union and States.

The CAG Indictments

Non-Compliance with Transfer Regulations:

- CAG Reports Findings: Comptroller and Auditor General (CAG) reports have highlighted instances of non-transfer or short transfer of collected cesses to respective reserve funds in the Public Account of India.

- Health and Education Cess: In 2021-22, only 60% of the collected ₹52,732 crore towards Health and Education Cess was transferred to the reserve fund of Prarambhik Shikha Kosh.

- Research and Development Cess: Between 1996-97 and 2017-18, only 9.6% (₹779 crore) of the total collection of ₹8,077 crore was transferred to the Fund for Technology Development and Application.

- Swachh Bharat Cess: Short transfers to the Rashtriya Swachhata Kosh amounted to ₹4,891 crore between 2015–16 and 2017–18.

- Road Cess and Clean Energy Cess: Short transfers amounted to ₹72,726 crore and ₹44,505 crore respectively between 2010–11 and 2017–18.

Implications of Non-Transfers:

- Defeating Collection Logic: Non-transfers and short transfers undermine the purpose of cesses and surcharges, diverting funds away from their intended use.

- Questionable Practices: The findings suggest a pattern of diversion of funds, raising concerns about the transparency and accountability of cess collection and utilization.

- Impact on Divisible Pool: Short transfers contribute to the reduction of resources available in the divisible pool, impacting the fiscal autonomy of States.

Cesses as Financial Instruments:

- Ruse for Fund Diversions: The findings reinforce the perception that cesses and surcharges serve as mechanisms to redirect funds from the divisible pool to meet other financial requirements of the Union government.

- Need for Transparency: There is a pressing need for greater transparency and accountability in the collection and utilization of cesses and surcharges to ensure their intended purpose is fulfilled.

Deviations from FC Recommendations: Implications for Fiscal Federalism

Finance Commission Recommendations:

- 13th FC (2010-2015): Recommended a 32% share of net proceeds to be shared with all States.

- 14th FC (2015-2020): Recommended a 42% share of net proceeds to be shared with all States.

- 15th FC (2020-2025): Recommended a 41% share of net proceeds to be shared with all States.

Analysis of Share of Devolution:

- Comparison with FC Recommendations: Union government has consistently failed to share the FC-recommended shares of net proceeds with the States.

- Shortfalls in Share of Devolution: States' share of central taxes as a percentage of net proceeds fell below FC recommendations, averaging 31.1% during the 13th FC period, 40.3% during the 14th FC period, and 38.1% during the 15th FC period.

- Widest Shortfall in 15th FC Period: Shortfall in devolution was most pronounced during the ongoing 15th FC period.

Impact of Cesses and Surcharges:

- Revised Divisible Pool: Including cesses and surcharges further reduces the share of devolution, with average share falling to 28% during the 13th FC period, 35.1% during the 14th FC period, and 31.7% during the 15th FC period.

- Quantum of Shortfalls: Cumulative amount not devolved to States between 2009-10 and 2024-25 (BE) amounted to ₹5.61 lakh crore.

- Period-wise Shortfalls: ₹44,922 crore during the 13th FC period, ₹1.36 lakh crore during the 14th FC period, and ₹3.69 lakh crore during the 15th FC period (including 2024-25 BE).

Constitutional Impropriety:

- Failure to Devolve Funds: Non-devolution of funds to States constitutes a significant constitutional impropriety, undermining the principles of fiscal federalism and cooperative governance.

Restoring Fiscal Equity

- Compensations to States: The 16th Finance Commission (FC) must rectify historical disparities in vertical devolution by providing compensations to States.

- Accuracy in Budget Estimates: FC should mandate the Union government to publish accurate estimates of "net proceeds" in budget documents, ensuring transparency and accountability.

- Untied Grants: FC should arrange to provide lump sum untied grants to States to compensate for shortfalls in devolution over the last decade, ensuring fair distribution of resources.

- Strict Limits on Collection: Union government must legislatively enforce strict limits on the collection of cesses and surcharges to prevent misuse and ensure fiscal discipline.

- Automatic Expiry: Cesses and surcharges should automatically expire after a short period, preventing their perpetual existence, and should not be rechristened under another name.

- Equitable Horizontal Devolution: FC must address legitimate concerns regarding inequalities in horizontal devolution, ensuring fair distribution of resources among States.

- Critical to Fiscal Federalism: The stance of the 16th FC on vertical devolution is crucial for the sustenance of fiscal federalism in India, underscoring the need for equitable resource sharing among Union and States.

Conclusion

Restoring fiscal equity requires concerted efforts from both the 16th Finance Commission and the Union government. By addressing historical disparities, ensuring transparency, rectifying devolution shortfalls, and enacting legislative reforms, India can uphold the principles of fiscal federalism and promote equitable development across all regions.

MUST READ ARTICLES:

https://www.iasgyan.in/blogs/abc

https://www.iasgyan.in/daily-current-affairs/16th-finance-commission

|

PRACTICE QUESTION

Q. The proliferation of cesses and surcharges has led to a significant exclusion of tax revenue from the divisible pool, exacerbating challenges in fiscal federalism. Critically Analyse. (150 words)

|