Description

Disclaimer: Copyright infringement not intended.

Context:

- Reserve Bank of India launched a new Unified Payments Interface (UPI) payments solution - ‘UPI123Pay’ for feature phone users.

- So, UPI service, which was limited to smartphones till date, will be now available for feature phones without internet.

About UPI Service:

- Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India (NPCI).

- It facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions.

- The system powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- NPCI launched Unified Payments Interface (UPI) with member banks in 2016.

Features of UPI Service:

- Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- Single mobile application for accessing different bank accounts.

- Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines, yet provides for a very strong feature of seamless single click payment.

- Virtual address of the customer for Pull & Push provides for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

- Merchant Payment with Single Application or In-App Payments.

- Utility Bill Payments, Over the Counter Payments, QR Code (Scan and Pay) based payments.

- Donations, Collections, Disbursements Scalable.

- Raising Complaint from Mobile App directly.

Participants in UPI:

|

Payment System Player (PSP) —new concept in the UPI world. This is not the same thing as a Payment Bank. This is someone who facilitates payments i.e. can move money.

|

- Payee PSP

- Remitter Bank

- Beneficiary Bank

- NPCI

- Bank Account holders

- Merchants

As mentioned earlier UPI service, which was limited to smart phones until now, will be now available for feature phones without internet with the launch of ‘UPI123Pay’. So,

Was there no banking solution for non-internet based mobile devices until now?

Well, there was..

- *99#, a USSD based mobile banking service of NPCI was initially launched in 2012.

|

USSD (Unstructured Supplementary Service Data) is a Global System for Mobile Communications (GSM) protocol that is used to send text messages. USSD is similar to Short Message Service (SMS). USSD uses codes made up of the characters that are available on a mobile phone.

|

- The service *99# had limited reach and only two (Telecom Service Providers) TSPs were offering this service i.e. MTNL & BSNL.

- With the wider ecosystem (11 TSPs), *99# was dedicated to the nation in 2014, as part of Pradhan Mantri Jan Dhan Yojna.

- UPI thus became available for non-internet based mobile devices (smartphone as well as basic phones ) in the form of dialing option (*99# ) and is known as USSD 2.0 .This functionality i.e. USSD 2.0 was launched along with BHIM in 2016.

- *99# service wanted to take the banking services to every common man across the country.

- Banking customers can avail this service by dialing *99# on their mobile phone and transact through an interactive menu displayed on the mobile screen.

Features of *99# Service

- Uses USSD as the access channel that works across all GSM handsets (Smartphones or otherwise) making it reach the last mile user.

- Supports menu-based applications that are easy to maneuver for the users.

- Does not require data connectivity (works on signaling channel) that makes it high availability service.

- Round the clock availability (works even on holidays).

- Accessible through a common code *99# across specific GSM Operators and mobile handsets.

- Additional channel for using BHIM app and key catalyst for financial inclusion.

What was the need for ‘UPI123Pay’ (recently launched) then?

- According to RBI *99# Service is not popular.

- The USSD-based *99# process is considered cumbersome, with users required to send multiple messages and charged for the same, and not supported by all mobile service providers.

- UPI123Pay will materially improve the options for such users to access UPI.

The new ‘UPI123Pay’- How it works?

- UPI123Pay is a three-step method to initiate and execute services for users.

- It includes calling an IVR (interactive voice response) number, app functionality in feature phones, missed call-based approach.

- The missed call feature would allow phones to access their bank accounts and perform routine transactions, such as receiving or transferring funds, regular purchases, bill payments, etc.

- A user just has to give a missed call on the number displayed at the merchant outlet. The customer will then receive an incoming call to authenticate the transaction by entering the UPI pin.

- The scan-and-pay function of UPI, available on smartphones, is not there on UPI123Pay.

Significance:

- The service is expected to benefit 40 crore feature phone users and is likely to increase digital financial inclusion, especially in the rural parts of the country.

- The initiative is envisioned to accelerate the process of digital adoption in India, by creating a richer and inclusive ecosystem that can accommodate larger sections of population.

- The RBI estimates that overall volumes on UPI will touch Rs 100 crore soon and UPI123Pay could play a significant part in it.

|

National Payments Corporation of India (NPCI)

It is an umbrella organization for operating retail payments and settlement systems in India. It is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

It has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013).

The ten core promoter banks are State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC. In 2016 the shareholding was broad-based to 56 member banks to include more banks representing all sectors.

NPCI is the firm that handles RuPay payments infrastructure, i.e. similar to Visa and MasterCard.

|

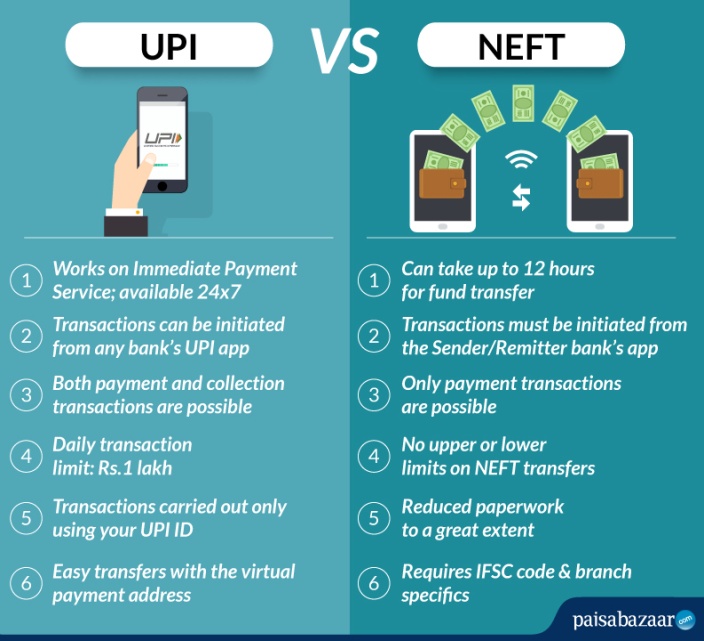

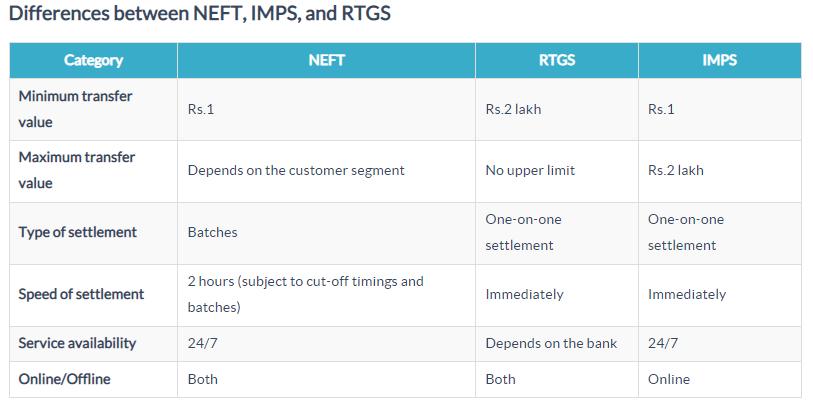

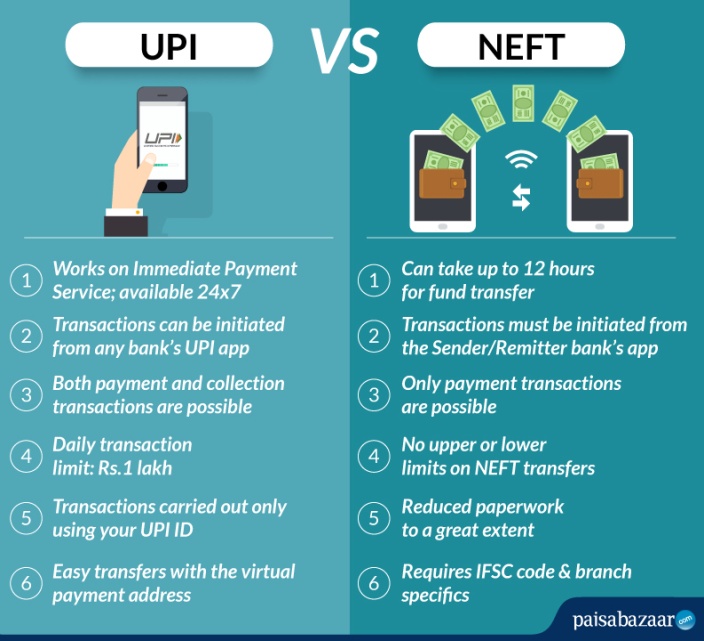

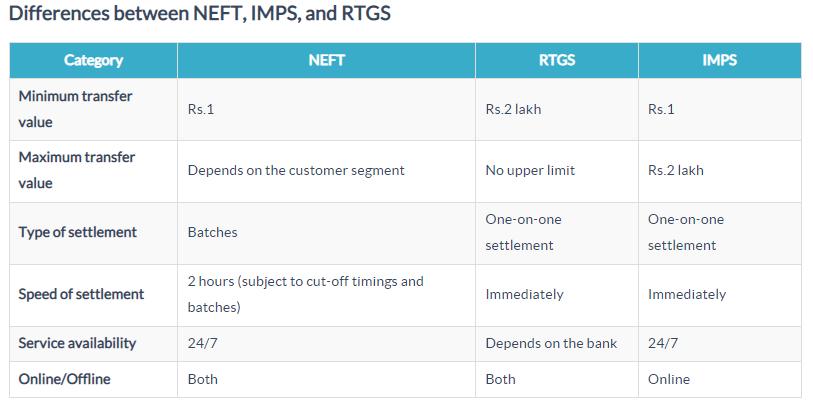

Some Key Differences:

https://indianexpress.com/article/explained/explained-upi123pay-rbi-payments-service-feature-phones-7814631/