Context

- India is expected to withdraw sugar export subsidies from the new season beginning October as a sharp rise in global prices makes it easier for Indian mills to sell the sweetener on the world market, a top government official said.

Historical Background

- India has a long tradition of manufacturing sugar.

- References of sugar making by the Indians are found even in the Atharva Veda.

- India is rightly called the homeland of sugar. But in ancient times, gur and khandsari were made.

- Also, Cane was cut in pieces - crushed under heavy weight - juice thus obtained was boiled and stirred, till it turned solids.

- Solids of uneven shape and size were called sarkaran, a Sanskrit term of 'gravel'.

- Modern word 'sugar' is derived from the word Sarkara.

- Thus, India has been the original home for sugarcane as well as sugar manufacture.

- Modem sugar industry came on the Indian scene only in the middle of the 19th century, when it was introduced by the Dutch in North Bihar in about 1840.

Legislations

- “Sugar Industry Protection Act” was passed by the Indian Legislature in 1932.

- Under this act, protection was granted to the indigenous sugar industry.

- With enforcement of Sugar Protection Act, within a period of four years country became self-sufficient in sugar by 1935.

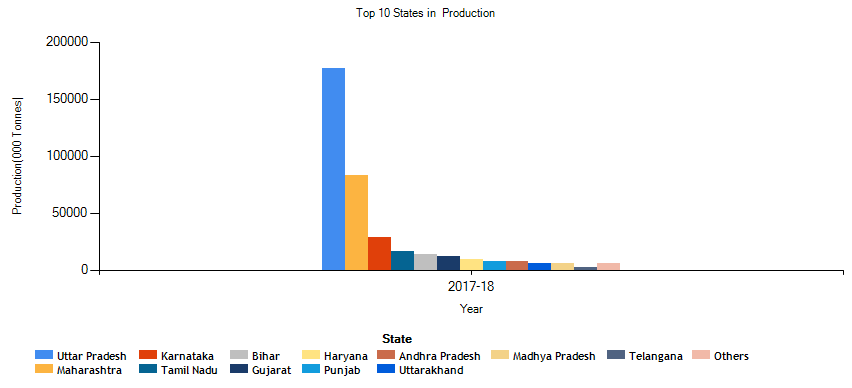

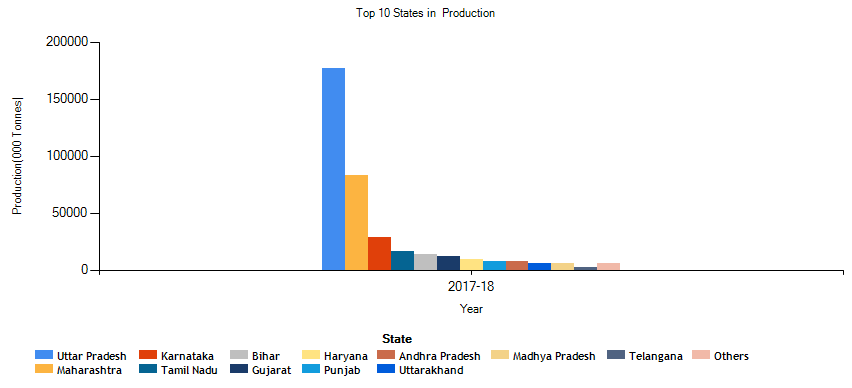

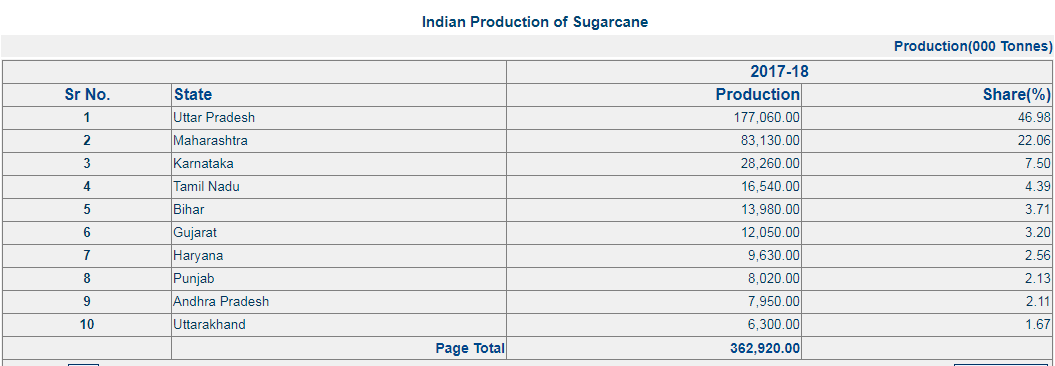

Geographical Distribution of Sugar Industry in India

- Uttar Pradesh: It is the leading producer of sugar in India and one of the largest sugar industries in the Indian economy.

- Bihar, Punjab, Haryana, Maharashtra, Karnataka

- Tamil Nadu: This state is responsible for 10% of the total sugar production in India.

- Andhra Pradesh: Along with Sugar Production it is regarded as the ‘granary of the south’ and once it was called as 'Rice Bowl of India'.

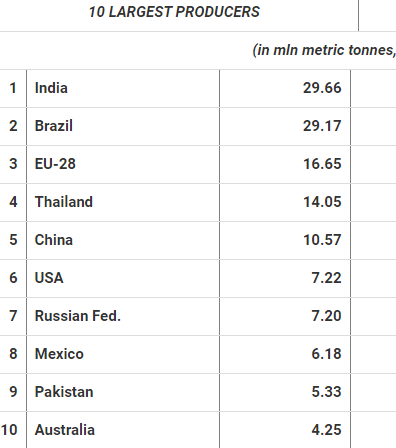

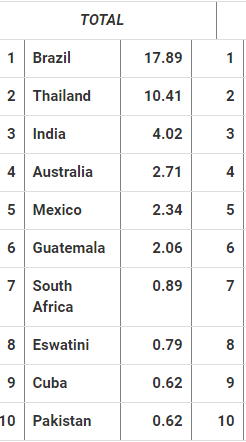

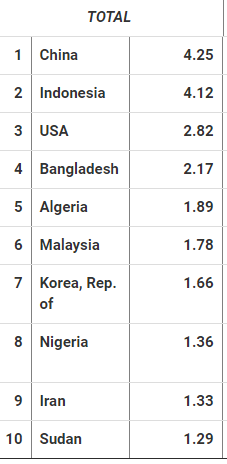

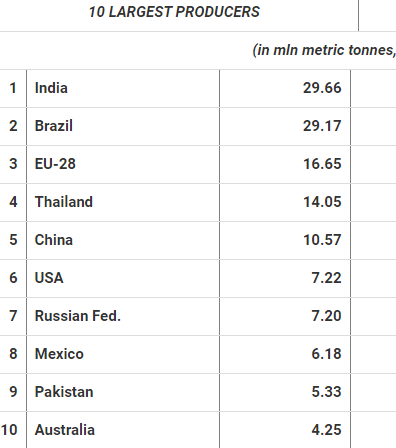

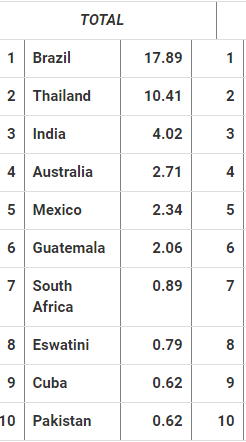

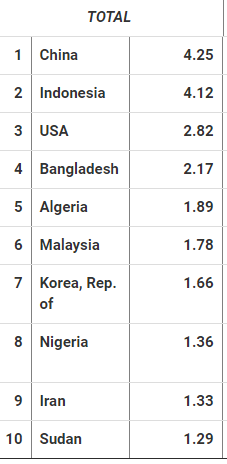

World Trade (2019)

Largest Exporter Largest importer

North India vs. South India Sugar Industry

- A brief description of differences between the sugar industry of the northern and peninsular India is given below:

- Peninsular India has tropical climate which gives higher yield per unit area as compared to north India.

- The sucrose content is also higher in tropical variety of sugarcane in the south.

- The crushing season is also much longer in the south than in the north.

For example, crushing season is of nearly four months only in the north from November to February, whereas it is of nearly 7-8 months in the south where it starts in October and continues till May and June.

- The co-operative sugar mills are better managed in the south than in the north.

- Most of the mills in the south are new which are equipped with modern machinery.

Problems of Sugar Industry:

- Sugar industry in India is plagued with several serious and complicated problems which call for immediate attention and rational solutions. Some of the burning problems are briefly described as under:

Low Yield of Sugarcane:

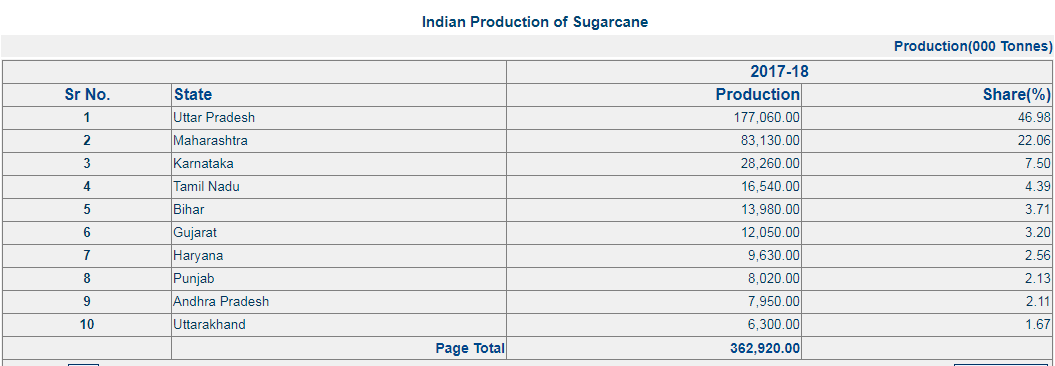

- Although India has the largest area under sugarcane cultivation, the yield per hectare is extremely low as compared to some of the major sugarcane producing countries of the world.

- For example, India’s yield is only 64.5 tones/hectare as compared to 90 tonnes in Java and 121 tonnes in Hawaii.

- This leads to low overall production compared to capacity or potential.

Short crushing season:

- Manufacturing of sugar is a seasonal phenomenon with a short crushing season varying normally from 4 to 7 months in a year.

- The mills and its workers remain idle during the remaining period of the year, thus creating financial problems for the industry as a whole.

Fluctuating Production Trends:

- Sugarcane has to compete with several other food and cash crops like cotton, oil seeds, rice, etc.

- Consequently, the land available to sugarcane cultivation is not the same and the total production of sugarcane fluctuates.

- This affects the supply of sugarcane to the mills and the production of sugar also varies from year to year.

Low rate of recovery:

- The average rate of recovery in India is less than ten per cent which is quite low as compared to other major sugar producing countries.

- For example recovery rate is as high as 14-16 per cent in Java, Hawaii and Australia.

High cost of Production:

- High cost of sugarcane, inefficient technology, uneconomic process of production and heavy excise duty result in high cost of manufacturing.

- The production cost of sugar in India is one of the highest in the world.

Small and uneconomic size of mills:

- Most of the sugar mills in India are of small size with a capacity of 1,000 to 1,500 tonnes per day.

- This makes large scale production uneconomic. Many of the mills are economically not viable.

Old and obsolete machinery

- Most of the machinery used in Indian sugar mills, particularly those of Uttar Pradesh and Bihar is old and obsolete, being 50-60 years old and needs rehabilitation.

- But low margin of profit prevents several mill owners from replacing the old machinery by the new one.

Competition with Khandsari and Gur

- Khandsari and gur have been manufactured in rural India much before the advent of sugar industry in the organised sector.

- Since khandsari industry is free from excise duty, it can offer higher prices of cane to the cane growers.

- Further, cane growers themselves use cane for manufacturing gur and save on labour cost which is not possible in sugar industry.

- It is estimated that about 60 per cent of the cane grown in India is used for making khandsari and gur and the organised sugar industry is deprived of sufficient supply of this basic raw material.

Regional imbalances in distribution

- Over half of sugar mills are located in Maharashtra and Uttar Pradesh and about 60 per cent of the production comes from these two states.

- On the other hand, there are several states in the north-east, Jammu and Kashmir and Orissa where there is no appreciable growth of this industry. This leads to regional imbalances which have their own implications.

Low per capita consumption

- The per capita annual consumption of sugar in India is only 3 kg as against 48.8 kg in the USA., 53.6 kg in U.K., 57.1 kg in Australia and 78.2 kg in Cuba.

- The world average of about 21.1 kg. This result in low market demand and creates problems of sale of sugar.

FRP vs SAP

- The central government declares a min price of sugarcane that called Fair Remunerative Price (FRP) and state

Governments have also right to declare their own price which is called State Advisory Price (SAP).

Generally SAP is more than FRP which pose the conflict that which is fair price for both farmers and mills.

Falling Sugar Prices

- According to the Indian Sugar Mills Association, the FRP of sugarcane rose 50.9% from Rs 139.12 per quintal in 2010-11 to Rs 210 per quintal in 2013-14.

- However, sugar prices fell 21% from Rs 3,765 per quintal in January 2010 to Rs 2,962 per quintal in August 2014.

- Lower margins have made companies heavily dependent on debt.

Min Distance Criterion

- To ensure decent supply of sugarcane to each sugar mill, the central government has prescribed a minimum radial distance of 15 km between any two sugar mills.

- But this criterion help to create the monopoly of mill owner over a large area as 15 km radial distance is large in number and ultimately led to exploitation of farmers especially where landholding is smaller.

- Also this regulation prohibits innovation and investment by entrepreneurs.

Unpaid dues to Farmers

- India’s sugarcane dues accruing to farmers have remained stubbornly high despite. The sugarcane growers are being exploited by not paying their due arrears.

- For instance, in Uttar Pradesh, sugarcane farmers have not been paid for 20200. Further they get ‘zero price’ receipts for 2021.

High Export prices

- Exporting the surplus from India is not easy because of the burden of very high cost of sugarcane, pushing up the costs of sugar.

- For a comparison, Indian cane prices are 70-80% higher than that in Brazil.

Measures to resolve the issues

Implementing Rangarajan Committee Recommendations:

- Removing Distance Norm: In order to increase competition and ensure a better price for farmers, the Committee recommended that the distance norm be reviewed. Removing the regulation will ensure better prices for farmers and force existing mills to pay them the cane price.

- Reviewing Revenue Sharing Policy: States should not declare their own SAP. The pricing shall be done on basis of scientific and economically viable principles. The committee suggested that sharing of revenue generated under sugarcane supply chain shall be divided on basis of 70:30 to farmers and mill owners respectively. This method will be applicable for by products as well. The payment shall be paid to farmers in two installments:

- First Floor or FRP should be paid to farmers at time of purchase of sugarcane,

- Second, balance should be paid after final price of sugar decided and sold by mill.

- Duties: Import and export duty should not be more than 10%.

- Long term agreements: States should encourage development of market-based long-term contractual arrangements, and phase out cane reservation area.

- Exports and Byproducts: No more outright bans on sugar exports. No restrictions on sale of by-products and prices should be market determined.

Other suggestions:

- Price Rationalization: Cane-pricing policies need immediate rationalization and brought in tune with global practices, for Indian sugar industry to export the surplus successfully.

- Ethanol Blending: The new national policy on Biofuels 2018, expands the scope of raw material for ethanol production by allowing use of Sugarcane Juice. Ethanol production should be promoted. Such diversion will cut oil import bills and bring profits for sugar industry. A win–win situation. Brazil, the world’s biggest sugarcane producer, depends on ethanol, and not sugar, as the main revenue source from sugarcane and blends 27 per cent ethanol with petrol.

|

|

|

The new Biofuel Policy 2018 has fixed a target of achieving 20 per cent ethanol blending with petrol by 2030.

|

|

- R&D: Intense Researches should be funded for developing high yielding, early maturing, frost resistant and high sucrose content varieties of sugarcane.

- Crushing Season: Increase the crushing season by sowing and harvesting sugarcane at proper intervals in different areas adjoining the sugar mill. This will increase the duration of supply of sugarcane to sugar mills.

- Yield: Intense research is required to increase the sugarcane production in the agricultural field.

- Production Cost: Production cost can be reduced through proper utilisation of by- products of the industry.

For example, bagasse can be used for manufacturing paper pulp, insulating board, plastic, carbon cortex etc. Molasses comprise another important by-product which can be gainfully used for the manufacture of power alcohol.

- Technology: There is a dire need of Technological upgradation in age old mills to improve efficiency in production.

- Export promotion: Tweaking of policies to boost exports when Domestic consumption is less than production.

- Diversification: Mills should be incentivized to produce more alcohol and its export should be deregulated. This will improve the economic situation of the mills.

- SSI: More steps like Sustainable Sugarcane Initiative. SSI provides practical options to farmers for improving the productivity of their land, water and labour, all at the same time. SSI is a set of practices based on principles for producing ‘More with Less’ in agriculture. Example: Reducing overall pressure on water resources -- Highly relevant for water guzzling Sugarcane crop.

Conclusion

- Mere infusion of capital will not revive the ailing Industry. The need of the hour is to reform the Sugar industry fundamentally but bringing long term solutions and addressing structural issues.

https://economictimes.indiatimes.com/news/economy/agriculture/india-likely-to-withdraw-sugar-export-subsidies-from-new-season/articleshow/85398478.cms