Copyright infringement not intended

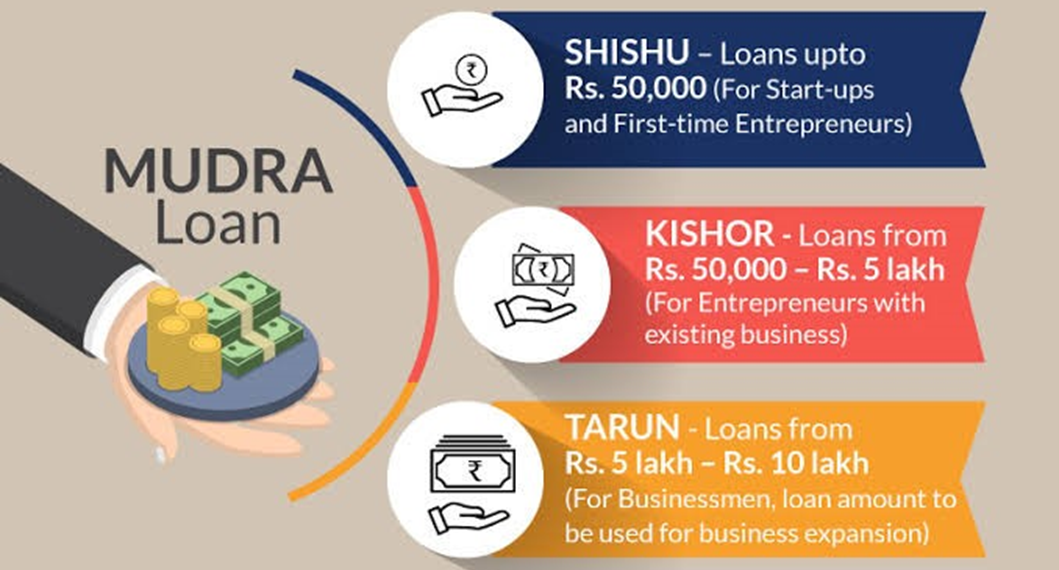

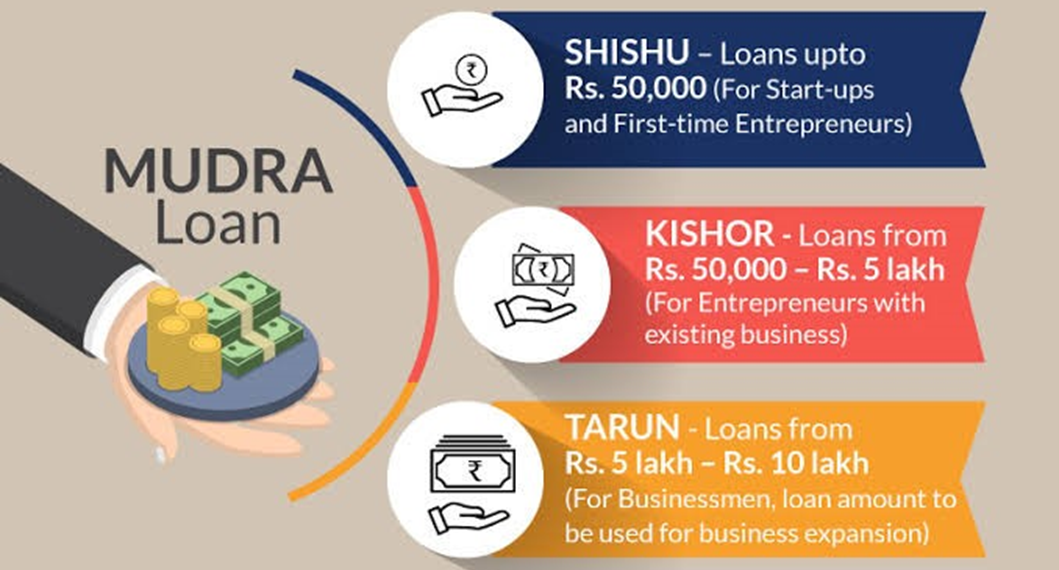

Context: More than 40.82 crore loans valued at Rs 23.2 lakh crore have been approved since the start of the Pradhan Mantri MUDRA Yojana (PMMY).

Details

Objectives

Credit Sources

Present Status

Keywords

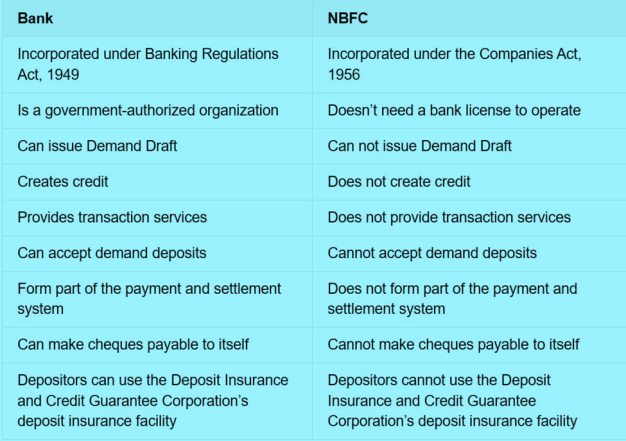

Nonbank Financial Companies (NBFCs)

Must Read Articles:

Pradhan Mantri Mudra Yojana: https://www.iasgyan.in/daily-current-affairs/mudra-loan

|

PRACTICE QUESTION Q. Consider the following Statement about the Pradhan Mantri Mudra Yojana; 1. The Scheme was launched for providing loans up to Rs 10 crores to non-corporate, non-farm small/micro enterprises. 2. Borrowers need to furnish some form of collateral to procure credit under the scheme. 3. Credit under the scheme is only given by Commercial Banks. Which of the following Statement is/are incorrect? (A) 1 and 2 only (B) 2 and 3 only (C) 1 and 3 only (D) 1, 2 and 3 Answer: D Explanation: Statement 1 is incorrect: The scheme launched in 2015 for providing loans up to 10 lahks to non-corporate, non-farm small/micro enterprises. Statement 2 is incorrect: The borrowers do not need to furnish any form of collateral to procure these loans. Hence, you don't need to risk your personal or business property to secure some funds. Statement 3 is incorrect: These loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs. |

© 2026 iasgyan. All right reserved