Description

Copyright infringement not intended

Picture Courtesy: The Hindu

Context:

In the financial year 2024-25, microfinance institutions in India experienced a sharp rise in loan delinquencies, reflecting growing repayment challenges among borrowers.

Current status of Microfinance loan:

- According to the latest Sa-Dhan Bharat Microfinance Report, the percentage of microfinance loans overdue by more than 30 days surged to2% from 2.1% in the previous year, while loans overdue by more than 90 days rose to 4.8%. (Source: The Hindu)

- Among all states, Bihar stood out as the worst performer, with the highest outstanding loan amounts totalling Rs 57,712 crore and the highest delinquency rates—2% overdue by more than 30 days and 4.6% by over 90 days. (Source: The Hindu)

- The overall microfinance industry grew by 18% in March 2024 compared to March 2023. (Source: SIDBI)

- At the end of June 2025, the microfinance industry's total portfolio stood at ₹3.07 lakh crore. However, this figure represents a significant contraction compared to March 2025, according to a July 2025 report. (Source: SIDBI)

What are Microfinance loans?

Microfinance loans are small loans provided to low-income individuals or groups who typically lack access to traditional banking services. These loans are aimed at helping them start or expand small businesses, improve their livelihoods, or meet urgent financial needs.

Evolution of Microfinance Institution in India:

|

Year / Period

|

Key Developments

|

|

Pre-1990s

|

Informal credit systems: chit funds, moneylenders, and self-help groups (SHGs) dominate rural lending.

|

|

1992

|

NABARD launches SHG-Bank Linkage Programme (SBLP) linking SHGs with formal banking.

|

|

Mid-1990s

|

Emergence of NGO-MFIs focusing on group lending and microcredit for poor, mainly women.

|

|

2000s

|

Commercialization: MFIs expand rapidly, convert to NBFCs, introduce Joint Liability Groups (JLGs).

|

|

2010

|

Andhra Pradesh microfinance crisis due to over-lending and coercive recovery; sector faces backlash.

|

|

2011-2014

|

RBI begins regulating NBFC-MFIs, sets interest rate caps, transparency rules, and borrower protection.

|

|

2015 onwards

|

MFIs mature, adopt technology, many convert to Small Finance Banks; self-regulatory bodies strengthen.

|

|

2020-2022

|

COVID-19 pandemic causes loan repayment stress; moratoriums and restructuring introduced.

|

|

2024-25

|

Rising loan delinquencies reported, especially in Bihar and rural areas; renewed focus on financial literacy and sustainable lending.

|

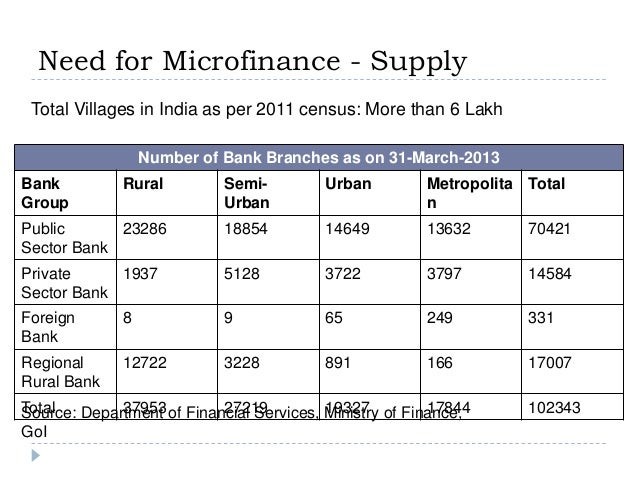

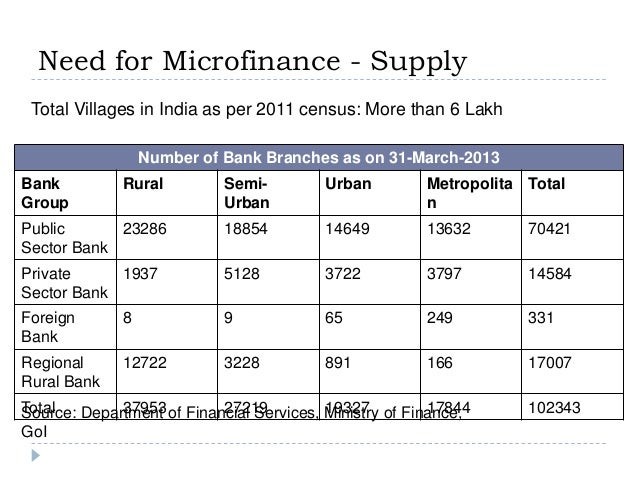

Source: Department of Financial Services, MOF

Multi-Dimensional Analysis of Rising Microfinance Loan Delinquencies:

- Slowdown in Rural Economy: The rural economy, heavily dependent on agriculture and informal sectors, faced disruptions due to erratic monsoons, rising input costs, and supply chain challenges, reducing borrowers’ repayment capacity. India's agriculture is highly sensitive to monsoon variability, with an estimated 60% of the country's net sown area being rain-fed. In 2024, unseasonal rains in Maharashtra destroyed crops in nearly 35,000 hectares. (Source: The Economics Times)

- Inflation and Rising Living Costs: Increased inflationary pressures strained household budgets, limiting disposable income available for loan repayment. The consumer price inflation rate accelerated to 2.07% annually, up from 1.61% in July. This was the first monthly increase in ten months.

- Over-Indebtedness: Borrowers often take multiple loans from different sources, leading to debt traps and increased chances of default. According to a 2021 study, multiple borrowing can distort capital allocation and investment decisions. (Source: Science Direct)

- Lack of Financial Literacy: Borrowers may lack adequate understanding of loan terms, interest rates, and repayment schedules, leading to mismanagement of finances. The Financial literacy rate of rural India is 51.3% in 2021–22. (Source: ET)

- Rural vs. Urban Divide: Rural borrowers showed higher delinquency rates compared to urban counterparts, reflecting the vulnerability of rural economies and limited access to alternative credit sources.

- Impact of COVID-19 Pandemic Aftereffects: Lingering effects of the pandemic on livelihoods and health disrupted repayment behaviour.

- Migration and Labour Market Shifts: Migration patterns changed, affecting income stability among migrant-dependent households.

- Interest Rate Caps and Operational Constraints: Regulatory caps on interest rates may restrict MFIs’ ability to manage risks and operational costs, indirectly impacting loan recovery.

Malegam Committee Recommendations on Microfinance Institutions

- Regulatory Framework: Recognized NBFC-MFIs as a distinct category under RBI regulation and proposed a tiered regulatory approach based on the asset size of MFIs.

- Loan Amount and Borrower Limits: Individual loan limit capped at ₹50,000 and Total borrowing limit for a borrower capped at ₹100,000 across all MFIs to prevent over-indebtedness.

- Interest Rate Guidelines: Suggested an interest rate cap based on the margin cap of 10-12% over the cost of funds and Total interest rate ceiling proposed at 26% per annum.

- Transparency and Disclosure: MFIs must clearly disclose the Annual Percentage Rate (APR) of interest as well as Requirement of transparent loan terms and conditions to borrowers.

- Grievance Redressal: Recommended establishment of a robust grievance redressal mechanism for borrowers and suggested linking microfinance institutions with RBI’s Integrated Ombudsman Scheme.

- Recovery Practices: Prohibited coercive and aggressive recovery methods.

- Operational Norms: MFIs should have minimum net owned funds of ₹5 crore. Encouraged MFIs to maintain a capital adequacy ratio similar to other NBFCs.

- Borrower Protection and Financial Literacy: Emphasized financial literacy initiatives to empower borrowers. Encouraged MFIs to assess borrower’s repayment capacity before lending.

Way Forward:

- Data-driven risk assessment tools and early warning systems to identify stress-prone portfolios.

- Conduct targeted financial education programs for rural and low-income borrowers.

- Monitor loan disbursal practices of MFIs and NBFC-MFIs to prevent predatory lending.

- Link microfinance to income-generating activities, like dairy, handicrafts, or agri-processing, to improve repayment capacity.

- Promote insurance-linked microloans to cushion repayment shocks due to health, crop failure, or disasters.

- Use mobile-based platforms for reminders, repayments, and customer service.

Source: The Hindu

|

Practice Question

Q. Examine the role of microfinance institutions in rural credit delivery. How has the recent rise in delinquencies, especially in states like Bihar, impacted the sustainability of this model? (250 words)

|

Frequently Asked Questions (FAQs)

Microfinance loans are small-value loans offered to low-income individuals or groups, especially in rural and semi-urban areas, to promote financial inclusion and support income-generating activities.

A loan is considered delinquent when the borrower fails to repay on time.

- Rural economic stress

- Rising inflation and living costs

- Over-borrowing and multiple loans

- Poor monsoon and agri-income shocks