Description

Disclaimer: Copyright infringement not intended.

Context

- Index funds charge a far lower management fees than actively managed fund. Warren Buffett, a famous investor, says that index funds are a safe way to save for retirement.

Index Fund

- An index fund is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index.

- Thus, an index fund tracks the performance of an underlying index, like the Nifty or the Sensex. These funds stick to their benchmark index regardless of what happens in the market.

- Their main goal is to make a portfolio that looks like an index of the stock market. A fund that tracks an index holds the same stocks in the same amounts as the index. Indian index funds are based on gold, Nifty, Midcap index, etc.

The way Index Funds work

- Indexing is a passive way to manage investments. Instead of picking stocks to invest in and planning when to buy and sell them, a fund portfolio manager builds a portfolio whose holdings match those of an index. The idea is that if the fund mimics the profile of the index—either the whole stock market or a large part of it—its performance will be the same as that of the index.

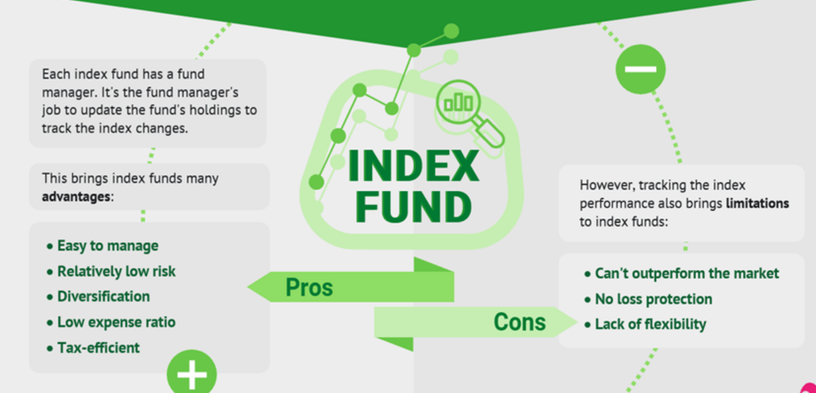

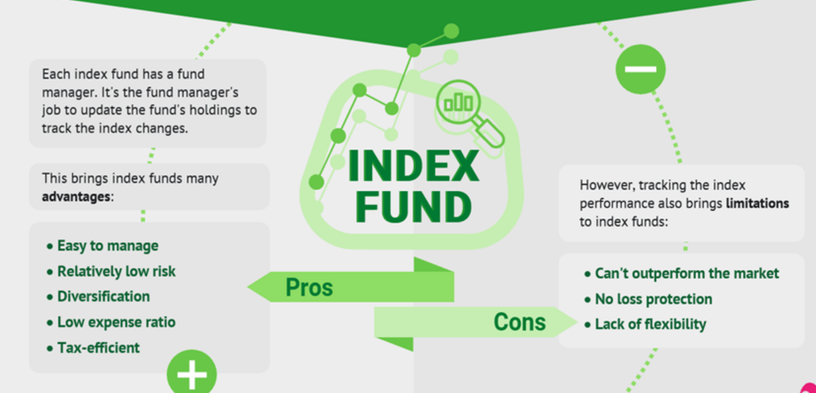

Index Funds as compared to actively managed funds

- Passive investing is one way to look at investing in index funds. The opposite of passive investing is active investing, which is what actively managed mutual funds with a portfolio of securities and market timing do.

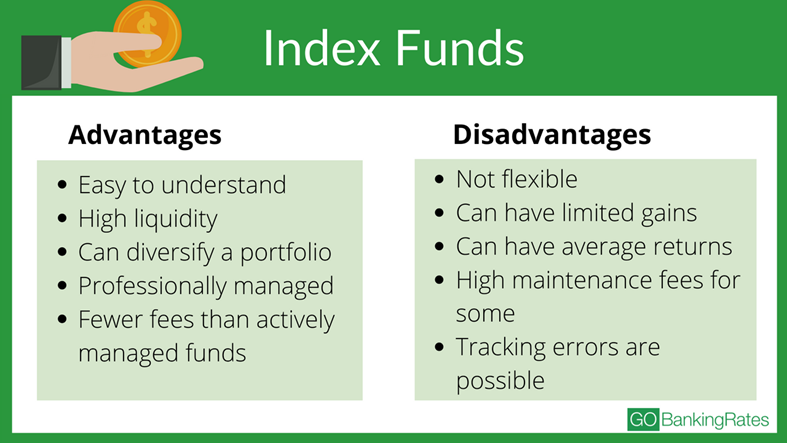

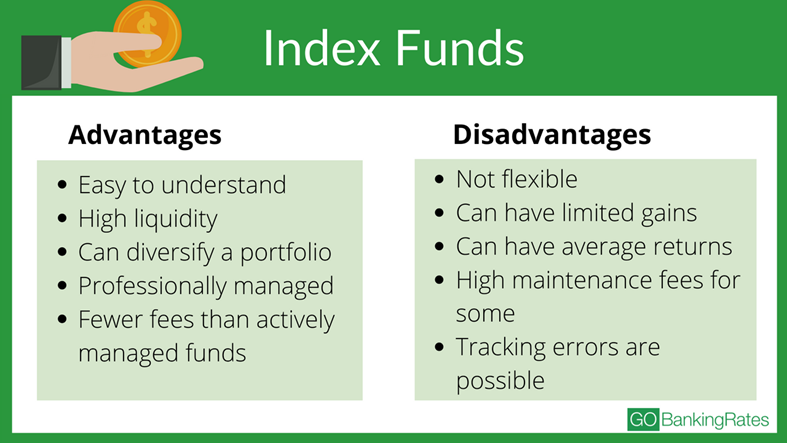

Reduced Costs

- The lower management expense ratio is one of the main reasons why index funds are better than actively managed funds.

- The expenditure ratio of a mutual fund, also called the management expense ratio, includes all of the fund's operating costs, such as the pay of its advisers and managers, transaction fees, taxes, and accounting fees.

- Since index fund managers just copy the performance of a benchmark index, they don't need the help of research analysts and other people who help choose stocks. The fewer managers of index funds change their holdings, the less they have to pay in transaction fees and commissions. On the other hand, actively managed funds have bigger staffs and more transactions, which raises the cost of doing business.

- The expense ratio shows how much more it costs to run a fund and passes those costs on to investors. So, inexpensive index funds usually cost less than 1 percent, usually between 0.2 percent and 0.5 percent, and some companies offer expense ratios of 0.05 percent or less. On the other hand, Actively managed funds charge much higher fees, usually between 1 percent and 2.5 percent.

Risks of Index Fund

- Index funds have the same level of safety as the index they follow. Index funds show the volatility of the market right away. So, these funds are as safe as the market as a whole. It is a way to invest in immediate markets, not managed and spread out.

Significance

- Index funds are known for providing diversified exposure with lower management costs.

- Index funds are generally seen as good core holdings for retirement plans.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=G9RA4FT57.1&imageview=0