Disclaimer: Copyright infringement not intended.

Context:

- At least 14.6 lakh micro, small and medium enterprises (MSMEs) accounts were saved from slipping into NPA due to the Emergency Credit Line Guarantee Scheme (ECLGS).

- Thus, it saved millions of jobs till November, 2022, according to estimates made by a State Bank of India research report.

ECLGS Scheme:

- India’s Finance Ministry introduced the Emergency Credit Line Guarantee Scheme (ECLGS) in May 2020, intending to provide financial assistance to this pandemic hit economy.

- The Government’s aim through this scheme was to provide unsecured loans to MSMEs and companies across the country to mitigate the losses suffered due to COVID-19 induced lockdowns.

- This scheme aimed to aid firms to meet their working capital needs and other operational costs as well.

Types of ECLGS:

Following are the Emergency Credit Line Guarantee Scheme types –

- Emergency Credit Line Guarantee Scheme 1.0

- Emergency Credit Line Guarantee Scheme 2.0

- Emergency Credit Line Guarantee Scheme 3.0

- Emergency Credit Line Guarantee Scheme 4.0

- Emergency Credit Line Guarantee Scheme 1.0

This scheme offered full guarantee credit for the businesses whose credit line went up to Rs. 50 crore. The scheme is provided to the firms that outshine all other companies regarding credit loan applications.

- Emergency Credit Line Guarantee Scheme 2.0

Unlike Emergency Credit Line Guarantee Scheme 1.0, this scheme is diversified to 26 other sectors that the Kamath Committee recognized as of September 4, 2020. This scheme is primarily available for businesses that are outstanding in terms of funds only. Usually, the candidate has to apply for funds over Rs. 50 crore and less than Rs. 500 crore.

- Emergency Credit Line Guarantee Scheme 3.0

This is the final extended part of the Emergency Credit Line Guarantee Scheme, Emergency Credit Line Guarantee Scheme 3.0. In this scheme, the sectors included are hospitality, tourism and travel, and sports. This scheme is highly beneficial for businesses that are looking for credit above Rs. 500 crore.

The primary purpose of this scheme is to offer complete guarantee coverage for the credit line up to 20% of the available loan by February 20, 2020, in the Covid crisis. The percentage varies from sector to sector. For instance, the 100% guarantee coverage for the Hospitality, Travel & Tourism, and sports sectors are up to 40%.

- Emergency Credit Line Guarantee Scheme 4.0

In order to support Covid-hit MSMEs further, the Govt of India announced a three-month extension of Rs 3 lakh crore Emergency Credit Line Guarantee Scheme from June 30, 2021, to September 30, 2021, or till guarantees for an amount of Rs 3 lakh crore are issued under the fourth revision of the scheme.

For most sectors, the scheme loans are given under the extended schemes (ECLGS 1.0, ECLGS 2.0, ECLGS 3.0, ECLGS 4.0) by reliable banks and financial authorities.

Features of Emergency Credit Line Guarantee Scheme (ECLGS):

- ECLGS is a term loan whose application validity date is October 31, 2020. This means the businesses who had applied for the loans under the Guaranteed Emergency Credit Line will only avail of the scheme loans.

- As informed by the Indian Government, the maximum amount of credit available for the Emergency Credit Line Guarantee Scheme is Rs. 3,00,000 crores.

- The Government announced that the primary reason to present the scheme is to help micro and small businesses to sustain themselves financially in this pandemic era.

- ECLGS scheme was presented by the National Credit Guarantee Trust Company Ltd or simply NCGTC.

- ECLGS scheme tenure is of 4 years or 48 months. In the first year, the business has to pay only an interest amount. Yet, in the following years, the companies are requested to pay both interests and the principal amount.

- ECLGS scheme is provided for the MSMEs, small companies, trusts, registered companies, and the individuals who set up various businesses.

.jpeg)

Eligibility for Emergency Credit Line Guarantee Scheme

- The borrower should compulsorily be a member of the GST or Goods and Services Tax registrar. These are the main criteria that need to be fulfilled before applying for the Emergency Credit Line Guarantee Scheme.

- The candidates with SMA 2 or NPA aren’t eligible to avail of this scheme. Though there are no added eligibility requirements, these are the two primary factors to consider for scheme availability.

- The Majority of the scheme plans are offered to businesses with partnerships, registered companies, trusts, and other authorized small companies.

- Due to February 29, 2020, the candidate’s accounts should be at least 60 days older.

Additional Details of Emergency Credit Line Guarantee Scheme

Credit Limit:

- As discussed earlier, the credit limit would be 20% for the businesses. At the same time, it’s extended up to 40% for the hospitality, travel & tourism, leisure & sports sectors.

Interest Rate:

- The maximum annual interest rate is around 14%.

Government Guarantee:

- The Government guarantee coverage is 100% under this scheme for a given credit limit.

Repayment:

- The amount has to be paid within four years or 48 months. Usually, in the first year, only interest has to be paid. In the next three years, the borrowers should pay both interest and principal amounts to the banks they borrowed the credit from.

- The net amount is paid to the lending institutions in equal installments by the borrowers for 36 months, i.e., three years.

Evaluation of ECLGS Scheme: Recent SBI Report:

- In absolute terms, MSME loan accounts worth Rs 2.2 lakh crore have improved since the inception of ECLGS for the entire banking industry. This means that around 12 percent of the outstanding MSME credit has been saved from slipping into NPA because of the ECLG scheme.

- MSME units are becoming larger with several units crossing the threshold of Rs 250 crores turnover and turning mid-sized corporates by the new definition of MSME units.

- According to the SBI report, the cluster-based approach of MSME financing is enabling scaling up of the MSME sector through technology upgradation among other things.

Path Forward:

- There is an urgent need to revamp the Credit Guarantee Scheme for the MSME sector.

- The U.S. Small Business Administration (US-SBA) could be the template for evolving Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) as a friend-philosopher-guide-mentor for MSMEs proliferation, credit linkage, scaling and integration into the value chain

- The report also advocated phasing out or reducing the annual guarantee fees to 0.50% of the loan amount across all the slabs and making CGTMSE coverage mandatory for all SME loans up to Rs 2 crore.

- The maximum loan amount for coverage under CGTMSE may be increased from Rs 2 crore to Rs 5 crore for all activities under manufacturing, services and trade sectors, the report said.

- Guarantee coverage for the units having women promoters should be increased to 100% to give fillip to women entrepreneurship.

- Need of the hour: Increasing claims settlement to the extent of 10 times of the guarantee fee paid by the banks and complete end-to-end digital platform to ensure real-time sanction, disbursement, and claim settlement for the guaranteed portfolio.

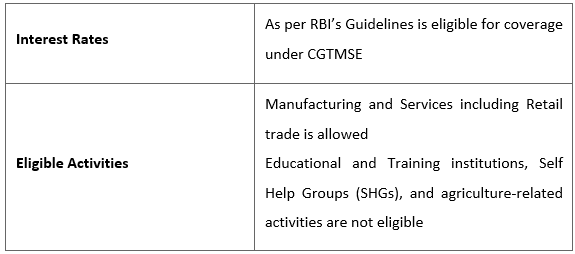

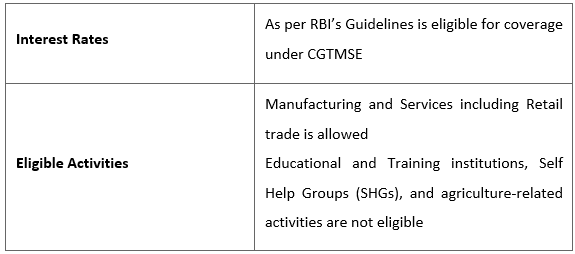

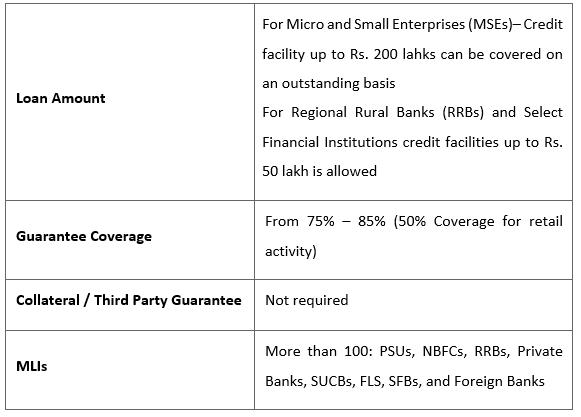

CGTMSE Scheme

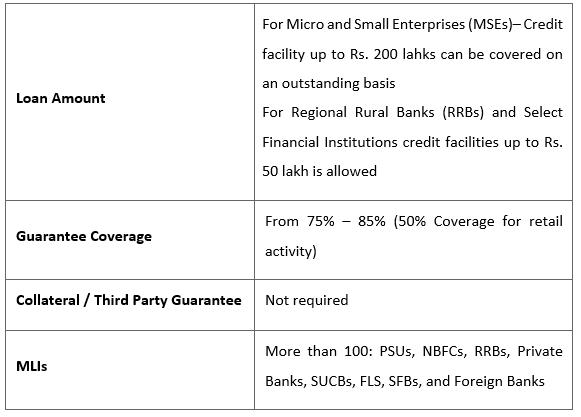

- Credit Guarantee Funds Trust for Micro and Small Enterprises (CGTMSE) is a trust established by the Government of India, under the Ministry of Micro, Small and Medium Enterprises (MoMSME) and Small Industries Development Bank of India (SIDBI).

- Launched in 2000, the CGTMSE scheme offers credit guarantees to financial institutions that offer credit facilities up to Rs. 2 crores. CGTMSE scheme offers credit guarantees from 75% to 85% to MSEs across India. Let’s further discuss various aspects of the CGTMSE scheme in detail:

Features of CGTMSE Scheme – 2023

Credit Guarantee under CGTMSE Scheme

- Credit Guarantee refers to a situation where the loan to the applicant is backed by a party without the need for any external collateral or third-party guarantee. Here, the loan sanctioned by the member lending institution is backed by the scheme which provides the guarantee cover for a large portion of the loan amount.

- Under the CGTMSE scheme, both new and existing micro and small enterprises, including manufacturing and service enterprises are eligible for a credit facility of up to Rs. 2 crores.

https://indianexpress.com/article/business/economy/eclgs-bailed-out-14-6-lakh-msmes-says-sbi-report-8400224/