Disclaimer: Copyright infringement not intended.

Context:

Trading:

Understanding commodities:

Commodity Trading in India:

Commodity trading exchanges in India:

One can trade in commodities – comprising livestock and meat, agro products, metals and energy – across six commodity exchanges in the country:

– Multi Commodity Exchange of India Limited (MCX)

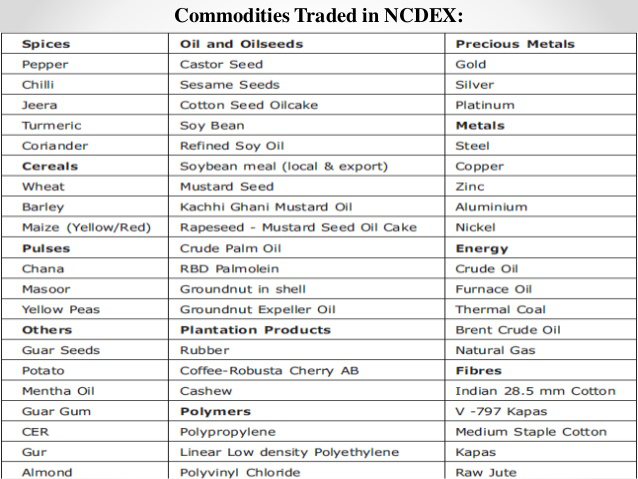

– National Commodity & Derivatives Exchange Limited (NCDEX)

– National Multi-Commodity Exchange (NMCE)

– Indian Commodity Exchange (ICEX)

– Ace Derivatives and Commodity Exchange Limited (ACEX)

– Universal Commodity Exchange (UCX)

Out of these commodity exchanges, the NCDEX and NCME focus primarily on agricultural commodities trading.

Regulator for commodities trading:

Understanding trading in agricultural commodities:

Benefits of trading in agricultural commodities:

List of the top agricultural commodities traded in India:

There are 29 agricultural-based products which are traded across commodity exchanges. Here is a list of the top products:

How does the derivatives trade in commodities work?

|

NCDEX National Commodity & Derivatives Exchange Limited (NCDEX) is an Indian online commodity and derivative exchange based in India. It is under the ownership of Ministry of Finance. It has an independent board of directors and provides a commodity exchange platform for market participants to trade in commodity derivatives. It is a government company, incorporated on 23 April 2003 under the Companies Act, 1956. It facilitates deliveries of commodities through a network of over 594 accredited warehouses through eight warehouse service providers, with holding capacity of around 1.5 million tonnes and offers average deliveries of 1 lakh MT at every contract expiry. NCDEX has offices in Mumbai, Delhi, Ahmedabad, Indore, Hyderabad, Jaipur, and Kolkata. Multi Commodity Exchange of India Ltd (MCX) Multi Commodity Exchange of India Ltd (MCX) is a commodity exchange based in India. It is under the ownership of Ministry of Finance. It was established in 2003 and is currently based in Mumbai, Maharashtra . It is India's largest commodity derivatives exchange. MCX offers options trading in gold and futures trading in non-ferrous metals, bullion, energy, and a number of agricultural commodities (mentha oil, cardamom, crude palm oil, cotton, and others). Commodities traded include - § Metal - Aluminium, Copper, Lead, Nickel, Zinc § Bullion - Gold, Gold Mini, Gold Guinea, Gold Petal, Gold Petal ( New Delhi), Gold Global, Silver, Silver Mini, Silver Micro, Silver 1000. § Agro Commodities - Cardamom, Cotton, Crude Palm Oil, Kapas, Mentha Oil, Castor seed, RBD Palmolien, Black Pepper. § Energy - Crude Oil, Natural Gas. SEBI permitted stock exchanges to launch 'Option in goods' in their commodity derivatives segment, in addition to existing 'options on commodity futures'. MCX has launched Gold Mini Options with Gold Mini (100 grams) bar as the underlying, and plans to launch Silver Mini 5 Kg 'option in goods' contract soon. MCX also provides live feeds for all traded commodities. |

What are the Agri Commodities in which futures trading has been banned by SEBI?

Why were they banned? Since when has the ban been in force?

What have been the impact of the ban?

Has the move affected commodity exchanges?

Why are farmers protesting against the ban?

Note: Read Basic Books of Economy to understand concepts like Derivatives, Future Trade, Speculation etc.

© 2026 iasgyan. All right reserved