e-RUPI: DIGITAL CURRENCY PUSH

Disclaimer: Copyright infringement not intended.

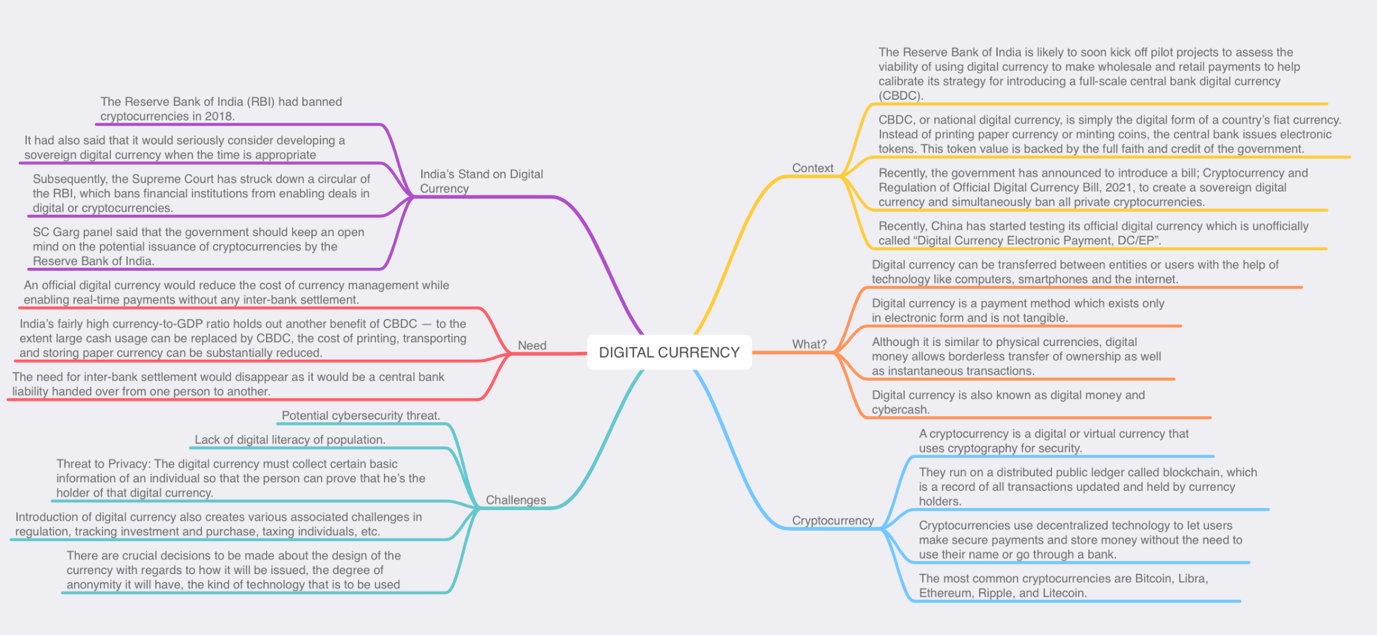

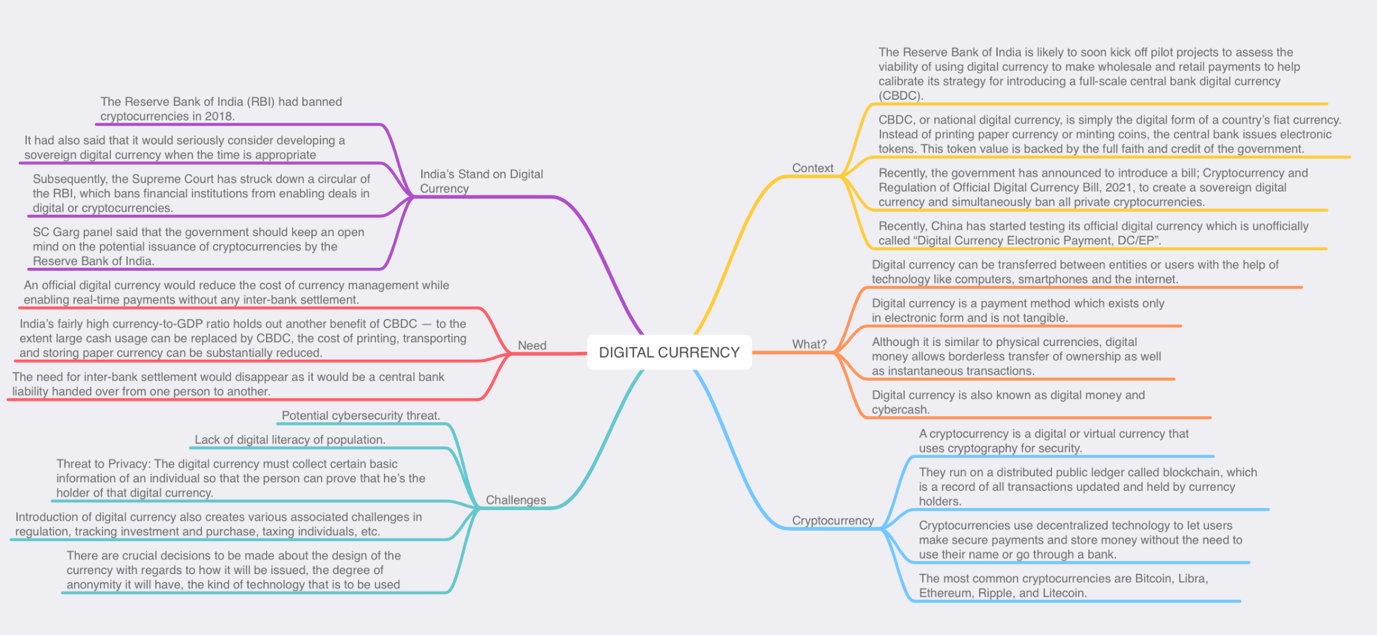

Context:

- The Reserve Bank of India (RBI) indicated that it will soon commence limited pilot launches of the much-awaited e-rupee, or central bank digital currency (CBDC), for specific use cases.

What Is Digital Currency?

Digital Currency Benefits:

- Faster payments.Using digital currency one can complete payments much faster than current means, which can take days for financial institutions to confirm a transaction.

- Less expensive international transfers.International currency transactions are very expensive; individuals are charged high fees to move funds from one country to another, especially when it involves currency conversions. Digital assets are disrupting this marketing by making it faster and less costly.

- 24/7 access.Existing money transfers often take more time during weekends and outside normal business hours because banks are closed and can’t confirm transactions. With digital currency, transactions work at the same speed 24 hours a day, seven days a week.

- Support for the unbanked and underbanked. With CBDC, unbanked individuals could access their money and pay their bills without extra charges.

- More efficient government payments. could send payments like tax refunds, child benefits and food stamps to people instantly, rather than trying to mail them a check or figure out prepaid debit cards.

- Dawn of decentralization: Decentralization provides financial freedom that can remain unaffected by the vicissitude of the banks and government. As there is no third-party involvement, it can offer more transparency and better transactional security. Networks built on blockchain do not require any trust or knowledge of others. Decentralized finance (Defi) as a system can easily replace the conventional financial processes for obvious reasons.

- Peer to peer transaction: ‘Save extra cost’, is the utmost persuading factor for all. Earlier, the presence of middlemen in the financial blockchain incurred extra cost on the transactions. The appeal of P2P is that one can transfer wealth or ownership of commodities without the involvement of a third party. A peer-to-peer transaction is transparent, secured and less complicated. In short, peer-to-peer transactions offer privacy and no additional cost on the transfer.

- Ease of use: The advent of digital currencies is paving the way for endless opportunities. The undebatable advantage of digital currencies is its ease of use. Having a smart device allows us to be your own bank and make transactions much easier and time saving.

- Fraud proof/ transparent: Digital currency is dedicated to focus on user privacy, so data breaches would be rare since it contains limited personal details. All transactions are encrypted between “digital wallets” and will result in an exact parity calculation on the ledger. Essentially, blockchain technology is poised to disrupt every aspect of our existence with this type of security.

- Global acceptance: Earlier, people had to pour in more money to send or receive payments across borders. By transcending global borders, digital currency promises flexibility and economic growth. Adding to the big picture, it also would be inexpensive, easy and fast. Digital currencies can boost trade and open up multiple opportunities to strengthen the financial health of the countries.

Digital Currency Disadvantages:

- Too many currencies to navigate at the moment.The current popularity of cryptocurrency is actually a downside. There are so many digital currencies being created across different blockchains that all have their own limitations. It will take time to determine which digital currencies may be appropriate for certain use cases, including whether some are designed to scale for mass adoption.

- Takes effort to learn how to use them.Digital currencies require work on the part of the user to learn how to perform fundamental tasks, like how to open a digital wallet and properly store digital assets securely. For digital currencies to be more widely adopted, the system needs to get simpler.

- Blockchain transactions can be expensive.Cryptocurrencies use the blockchain, where computers must solve complex equations to verify and record transactions. This takes considerable electricity and gets more expensive as there are more transactions. These would probably not exist for a CBDC, however, since it would likely be controlled by the central bank and the complex consensus processes are not needed.

- Large swings in digital currency prices.Cryptocurrency prices and value can change suddenly. Cunha believes this is why businesses are reluctant to use it as a medium of exchange.

What is Digital Rupee?

- The Central Bank Digital Currency (CBDC) can be defined as the legal tender issued by the Reserve Bank of India, according to the concept note. Touted as Digital Rupee or e-Rupee, RBI's CBDC is the same as a sovereign currency and is exchangeable one-to-one at par with the fiat currency.

Features of Digital Rupee:

1) CBDC is a sovereign currency issued by central banks in alignment with their monetary policy.

2) It appears as a liability on the central bank’s balance sheet.

3) It must be accepted as a medium of payment, legal tender, and a safe store of value by all citizens, enterprises, and government agencies.

4) CBDC is freely convertible against commercial bank money and cash.

5) CBDC is a fungible legal tender for which holders need not have a bank account.

6) CBDC is expected to lower the cost of issuance of money and transactions.

How will e-RUPI work?

- e-RUPI is a cashless and contactless digital payments medium.

- This will essentially be like a prepaid gift-voucher that will be redeemable at specific accepting centres without any credit or debit card, a mobile app or internet banking.

- e-RUPI will connect the sponsors of the services with the beneficiaries and service providers in a digital manner without any physical interface.

How will these vouchers be issued?

- The system has been built by NPCI on its UPI platform, and has onboarded banks that will be the issuing entities.

- Any corporate or government agency will have to approach the partner banks, which are both private and public-sector lenders, with the details of specific persons and the purpose for which payments have to be made.

- The beneficiaries will be identified using their mobile number and a voucher allocated by a bank to the service provider in the name of a given person would only be delivered to that person.

Global examples of a voucher-based welfare system:

- In the US, there is the system of education vouchers or school vouchers, which is a certificate of government funding for students selected for state-funded education to create a targeted delivery system.

- These are essentially subsidies given directly to parents of students for the specific purpose of educating their children.

- In addition to the US, the school voucher system has been used in several other countries such as Colombia, Chile, Sweden, Hong Kong, etc.

Types of CBDC that could be introduced:

- The Central Bank Digital Currency can be classified into two types — general purpose or retail (CBDC-R) and wholesale (CBDC-W).

Retail CBDC:

- Retail CBDC can be used by all including the private sector, non-financial consumers, and businesses. Wholesale CBDC is designed for restricted access to select financial institutions.

- Retail CBDC can provide access to safe money for payment and settlement as it is a direct liability of the central bank.

Wholesale CBDC:

- While retail CBDC is an electronic version of cash primarily meant for retail transactions, the wholesale CBDC is designed for the settlement of interbank transfers and related wholesale transactions.

- Wholesale CBDC has the potential to transform settlement systems for financial transactions and make them more efficient and secure. Going by the potential offered by each of them, there may be merit in introducing both CBDC-W and CBDC-R.

How is Digital Rupee different from money in digital form?

- A CBDC would differ from existing digital money available to the public because a CBDC would be a liability of the Reserve Bank, and not of a commercial bank."

Why is RBI introducing CBDC?

- CBDC is aimed to complement, rather than replace, current forms of money and is envisaged to provide an additional payment avenue to users, not to replace the existing payment systems.

- RBI believes that the digital rupee system will "bolster India’s digital economy, enhance financial inclusion, and make the monetary and payment systems more efficient."

Pointing out the motivations for India to consider issuing CBDC, RBI mentioned these reasons:

- a) Reduction in cost associated with physical cash management

- b) To further the cause of digitisation to achieve a less cash economy.

- c) Supporting competition, efficiency, and innovation in payments

- d) To explore the use of CBDC for improvement in cross-border transactions

- e) Support financial inclusion

- f) Safeguard the trust of the common man in the national currency vis-à-vis proliferation of crypto assets

In May 2020, China started testing its Digital Yuan-- Digital Renminbi (RMB). Several other nations have also started research and pilot projects related to CBDC such as Canada, USA and Singapore. Also, China and USA are battling to gain the supremacy across markets with the introduction of new-age financial products and India may get caught up in this digital proxy war. Furthermore, there's a wide disconnect between the number of bank accounts and mobile phone connections in India, and CBDC can possibly bridge this gap.

- The Digital Rupee provides India with the opportunity to establish the dominance of Digital Rupee as a superior currency for trade with its strategic partners, thereby reducing its dependency on the dollar.

- It will also help India in addressing the malpractices such as tax evasion, terror funding, money laundering, etc., as the central bank can keep a check on every unit of the digital currency.

- CBDC will empower RBI to control monetary policies. These effects of monetary policies can be immediately reflected instead of relying on commercial banks to make changes when they deem fit.

- It will also empower RBI to monitor transactions and credit flow across the Indian economy, weeding out scams, frauds instantly, thereby protecting depositors' money.

- CBDC will also help in distracting the investors from investing in the current crypto assets that are highly risky.

- It will also turn every large technology company in a fintech company nullifying the need for permission or partnership with a bank. It will create incentives for the companies and provide financial assistance to those who have been at the mercy of banks.

- It will also make loans, insurance, stocks and other financial products a natural extension using programmable smart contracts.

Digital Proxy War:

- The Dollar has been unchallenged as the world's reserve currency, giving the US an advantage over the world's financial system, enabling it to impose sanctions against other nations. In view of the recent trade war with the US, China is pushing for a more advanced financial system using Digital Renminbi (RMB).

- The Digital Rupee will help RBI in achieving financial inclusion, shift to a cashless society, reducing the cost of printing and handling cash. Thus, there's a need for the introduction of a Digital Rupee as it will not only empower the citizens but will also enable them in expanding digital economy, putting an end to the current banking system.

What are the use cases of e-RUPI?

- e-RUPI is expected to ensure a leak-proof delivery of welfare services.

- It can also be used for delivering services under schemes meant for providing drugs and nutritional support under Mother and Child welfare schemes, TB eradication programmes, drugs & diagnostics under schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertiliser subsidies etc.

- The government also said that even the private sector can leverage these digital vouchers as part of their employee welfare and corporate social responsibility programmes.

Benefit for MSMEs:

- This may allow MSMEs to send money to beneficiaries including employees and non-employees to ensure it is used for the required purpose, for instance, skill development courses and social welfare measures as well.

- It will see higher adoption rate in rural and distant areas effectively that are currently a hub of small businesses.

- e-RUPI has a significant potential to support small businesses in taking direct benefit from a multitude of governments schemes as well. For Example, under the Make in India initiative, financial assistance to MSMEs in ZED Certification (Zero Defect and Zero Effect practices) is being offered that can be passed on to them using this platform.

- The digital voucher can potentially be utilized to manage the working capital gap of the MSMEs such as enabling them to make GST or Provident Fund or Employee State Insurance payments utilizing e-RUPI and hence, shortening the working capital cycle significantly.

- Quicker receipt of financial subsidies and benefits under various schemes will result in improved working capital management & better financial liquidity for the small enterprises.

Benefits for Corporates:

- Corporates can enable well-being of their employees

- End to end digital transaction and doesn’t require any physical issuance hence leading to cost reduction

- Voucher redemption can be tracked by the issuer

- Quick, safe & contactless voucher distribution

Benefits for Hospitals:

- Easy & Secure - Voucher is authorized via a verification code

- Hassle free & Contactless payment collection - Handling of cash or cards is not required

- Quick redemption process - The voucher can be redeemed in a few steps and lesser decline due to pre-blocked amount

Benefits to the Consumer:

- Contactless - Beneficiary should not carry a print out of the voucher

- Easy redemption - 2 step redemption process

- Safe and Secure - Beneficiary doesn’t need to share personal details while redemption hence privacy is maintained

- No digital or bank presence required - Consumer redeeming the voucher need not have a digital payment app or a bank account

Capturing the unbanked and helping underprivileged: This initiative seems like one of the ways the government is trying to digitalize, while at the same time provide opportunities and resources for the underprivileged.

Move towards a Digital Currency?

- The government is already working on developing a central bank digital currency and the launch of e-RUPI could potentially highlight the gaps in digital payments infrastructure that will be necessary for the success of the future digital currency.

- In effect, e-RUPI is still backed by the existing Indian rupee as the underlying asset and specificity of its purpose makes it different to a virtual currency and puts it closer to a voucher-based payment system.

Final Thoughts:

- The Digitized Money will help RBI in achieving financial inclusion, shift to a cashless society, reducing the cost of printing and handling cash. Thus, there's a need for the introduction of a Digital Rupee as it will not only empower the citizens but will also enable them in expanding digital economy, putting an end to the current banking system.

- Digitized money will spur global trade since it will be more convenient and better risk mitigation due to the verifiable nature of transactions in block chain. This will lead to emergence of a new universal currency and newer markets. A new segment of investment sources will arise such as game finance and decentralized finance.