Copyright infringement not intended

Picture Courtesy: INDIANEXPRESS

States are advocating for a larger share in central tax revenues and greater fiscal autonomy, intensifying debates on fiscal federalism, especially in light of their reduced GST revenues compared to the pre-GST era.

|

Read all about: GST Reform l GST Slab Rationalisation |

It refers to the financial relationship and the division of resources and responsibilities between different levels of government within a federal system.

Fiscal federalism under Indian Constitution

Articles 268 to 281 in Part XII of the Constitution outline the distribution of financial powers.

The Seventh Schedule, under Article 246, demarcates taxation powers into three lists: the Union List (e.g., income tax, corporate tax, customs), the State List (e.g., state excise on alcohol, property tax), and the Concurrent List.

Finance Commission, a constitutional body established under Article 280, recommends the formula for sharing tax revenues between the Centre and the states.

The Goods and Services Tax (GST) Council, established under Article 279A, serves as a platform for cooperative federalism in indirect taxation.

Tax Devolution (Revenue Sharing)

As per Article 270, the Finance Commission recommends the distribution of the net tax proceeds collected by the Union.

For the 2021-26 period, the 15th Finance Commission recommended that states receive 41% of the central divisible pool of taxes.

Grants-in-Aid: The Centre provides financial assistance to states through:

Borrowing Powers: Article 293 governs the borrowing powers of states.

Vertical Imbalance

The Central government has greater revenue-raising capacity, while states bear a disproportionately larger share of expenditure responsibilities, especially for social and economic services.

States generate about 40% of total revenue but account for roughly 60% of total expenditure, leading to heavy reliance on central transfers for public services and development projects. (Source: PRSIndia)

Horizontal Imbalance and Regional Disparities

Economic disparities, often a "North-South divide," exist among states. Wealthier southern states claim current devolution criteria unfairly disadvantage them despite their greater national GDP contribution.

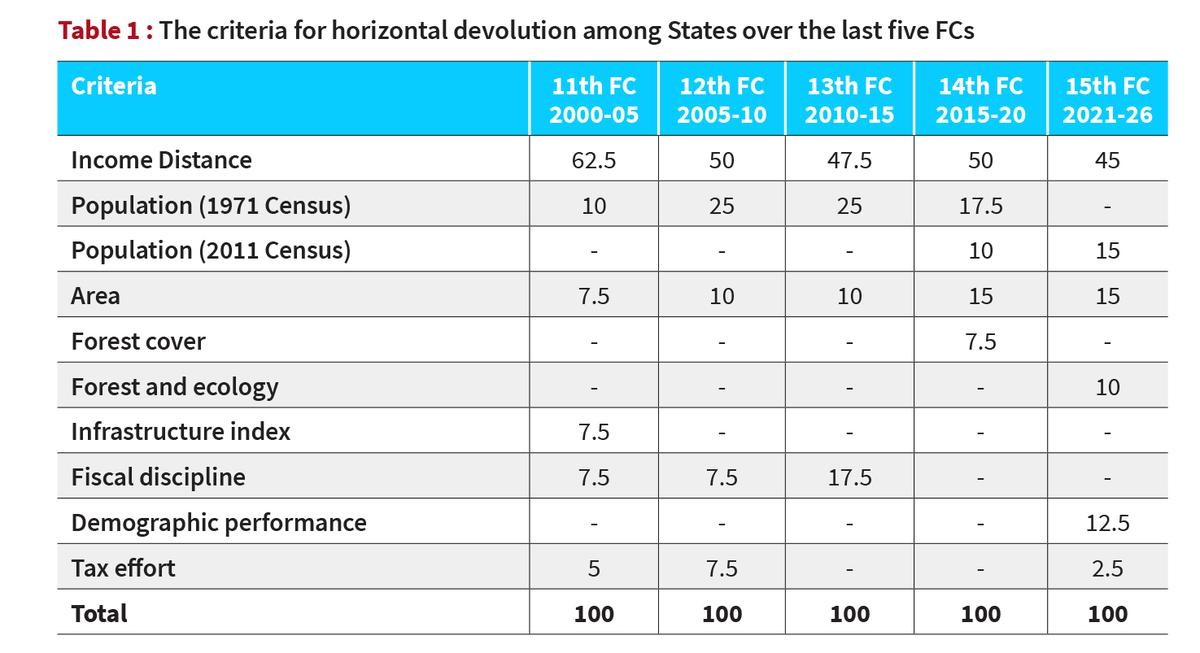

The 15th Finance Commission's formula, which gives 45% weight to "income distance" and 12.5% to "demographic performance," aims for equity but dissatisfies states that have controlled population growth and achieved higher economic growth.

Impact of Goods and Services Tax (GST)

The 2017 introduction of GST streamlined indirect taxation and created a common national market but also curtailed states' autonomy in setting tax rates.

States initially faced revenue shortfall, and the abolition of the GST compensation cess has heightened concerns about their fiscal space and potential revenue losses.

Role of Centrally Sponsored Schemes (CSS)

Schemes like Ayushman Bharat or MGNREGA aim for national development but often come with conditionalities and prescribed funding ratios (e.g., 50:50), limiting states' flexibility in resource allocation according to local needs.

An RBI report (2024-25) states that "too many central government schemes are diluting the spirit of co-operative fiscal federalism." State expenditure on CSS surged from ₹5.21 lakh crore in 2015-16 to ₹14.68 lakh crore in 2023-24, indicating growing dependence.

Increasing Reliance on Cesses and Surcharges

The Central government's growing reliance on cesses and surcharges is problematic as these levies do not form part of the divisible tax pool shared with states, shrinking the divisible pool and undermining cooperative fiscal federalism.

Borrowing Limits and State Debt

The Centre limits state borrowing (around 3% of GSDP for FY 2023-24, per the 15th Finance Commission). Article 293(3) requires central approval for new state loans if central loans are outstanding, hindering states' ability to fund projects.

Reduced Financial Transfers and Political Centralization

States report a drop in their share of gross tax revenue (from 35% in 2015-16 to 30% in 2023-24) and declining grants-in-aid. (Source: PRSIndia)

Opposition-ruled states allege political bias in fund allocation, raising concerns about the Union government's role becoming "extractive" rather than "enabling."

Weak Fiscal Health of Local Bodies

Despite constitutional amendments, local self-governments (Panchayats and Municipalities) suffer severe financial constraints, relying heavily on state grants due to limited own-source revenue. The 15th Finance Commission recommended ₹4.36 lakh crore for local bodies.

Empower the 16th Finance Commission

The Commission should consider raising states' tax share above 41% and revising devolution criteria. New indicators like climate change mitigation, migration, and the human development index could better address state-specific issues and disparities.

GST Reforms and Rationalization

The GST Council should address anomalies, simplify rates, and integrate petroleum and alcohol to broaden the tax base and ensure stable state revenue. Timely and adequate compensation for states' revenue losses is crucial.

Rationalize Centrally Sponsored Schemes

The Centre should restructure CSS for greater flexibility, giving states more autonomy in scheme design or shifting to block grants, to align spending with local priorities, reduce fiscal burden, and increase spending flexibility through state collaboration.

Ease Borrowing Restrictions with Fiscal Discipline

The Union government should reconsider strict borrowing limits, particularly during economic difficulties or for capital projects that build future assets.

States, in return, need to borrow transparently and sustainably, adhering to FRBM targets for enduring fiscal well-being.

Enhance States' Own Revenue Generation and Autonomy

Revisiting Article 246 and the Seventh Schedule to empower states with more autonomy over local revenue sources is crucial.

Proposals like sharing the personal income tax base or allowing states to 'top-up' income tax rates could reduce fiscal dependence.

Empower Local Governments

True fiscal federalism requires robust local self-governments through consistent devolution of funds, functions, and functionaries from states

States must strengthen State Finance Commissions with adequate resources and expertise. Devolving specific taxation powers to local bodies will reduce reliance on grants and foster genuine fiscal autonomy.

Reduce Cesses and Surcharges

The Union government should reduce its reliance on cesses and surcharges. Including a portion of these levies in the divisible pool would ensure more equitable and transparent distribution of tax revenues, augmenting states' resources.

Promote Cooperative and Competitive Federalism

Centre-state collaboration through NITI Aayog and the GST Council is essential. Promoting competitive and cooperative federalism, and increasing transparency in inter-governmental transfers by reducing discretionary grants, will drive national progress.

Conclusion

Fiscal federalism faces challenges like financial imbalances, reduced state autonomy due to GST, and rising debt. Reforms are needed, including increasing states' tax share, streamlining Centrally Sponsored Schemes, refining GST to protect state autonomy, and encouraging fiscal prudence.

Source: INDIANEXPRESS

|

PRACTICE QUESTION Q. Analyze the impact of the Goods and Services Tax (GST) regime on the fiscal autonomy of Indian states. 150 words |

Fiscal federalism is the financial arrangement between Union government and state governments, which involves the division of taxing powers, expenditure responsibilities, and resource transfers. It seeks to balance the states' need for financial autonomy with the central government's responsibility for national-level policy and equitable development.

The Finance Commission is a constitutional body that determines the formula for sharing central taxes with states (vertical devolution) and allocating that share among the states (horizontal devolution). Its recommendations also cover grants-in-aid and measures to supplement state resources for local bodies.

The introduction of the GST has unified India's indirect tax system under one framework, creating the GST Council for collaborative decision-making between the Centre and states. However, it has also reduced states' taxation autonomy and led to concerns about revenue shortfalls and the end of the GST compensation cess.

© 2026 iasgyan. All right reserved