Description

Copyright infringement not intended

Picture Courtesy: THE HINDU

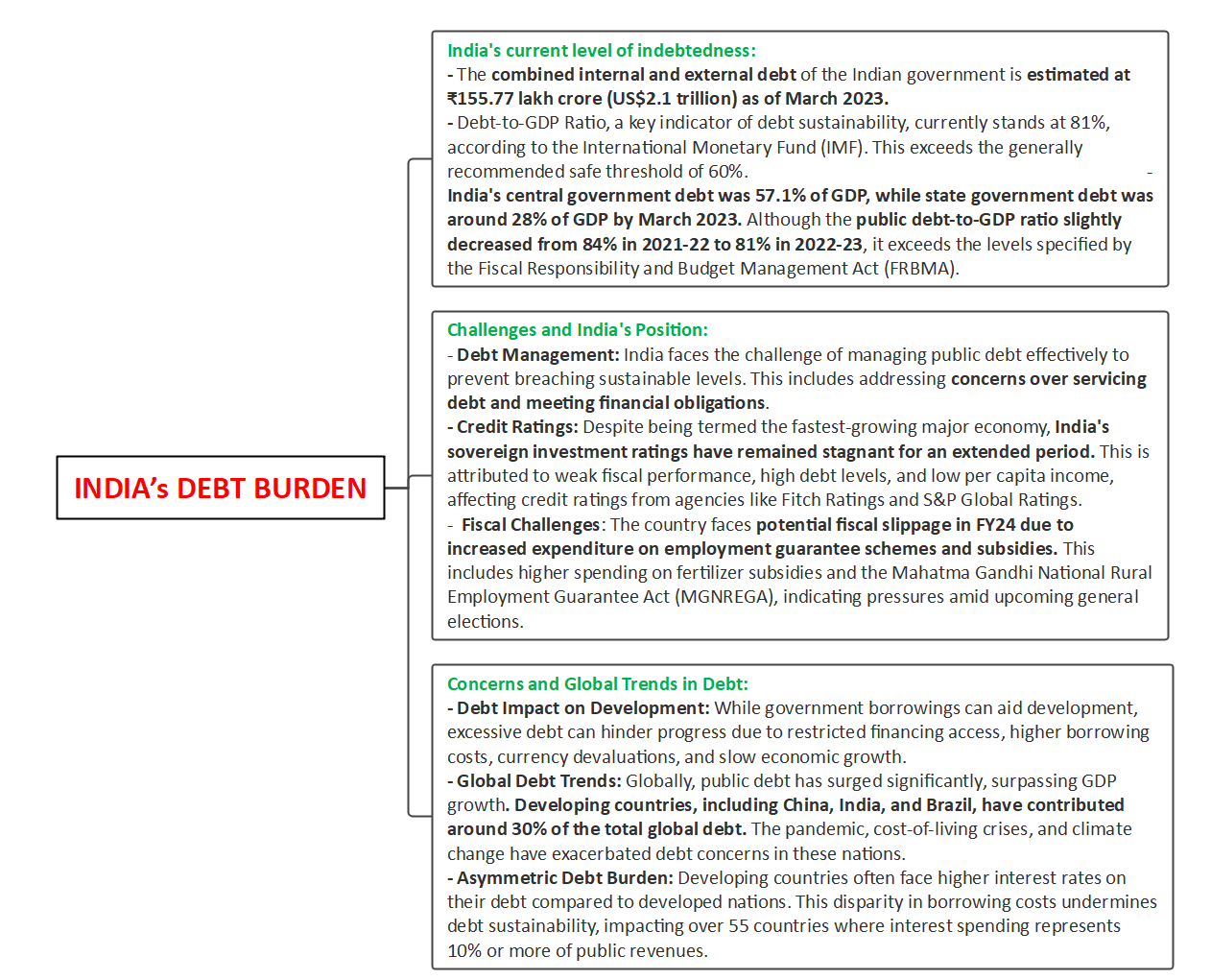

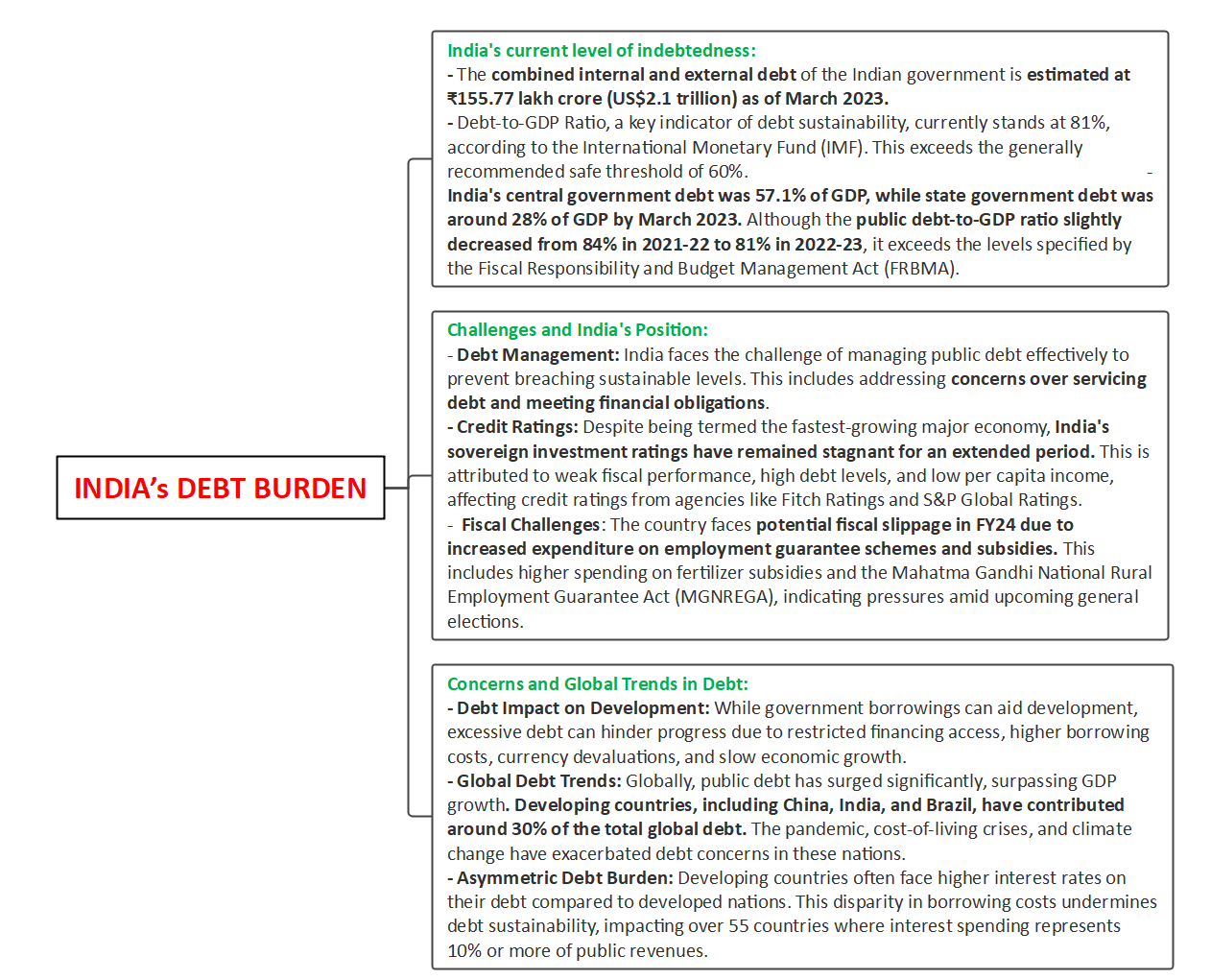

Context: The Union Finance Ministry recently responded to the International Monetary Fund's (IMF) scenario-based assessment, which warned of the potential for India's government debt to reach 100% of GDP by 2027-28 under adverse circumstances.

IMF's Assessment

- Medium-term Consolidation Efforts: The IMF's Directors had recommended "ambitious medium-term consolidation efforts" due to India's elevated public debt levels and contingent liability risks.

- Scenario-Based Assessment: The IMF presented a scenario where, under extreme conditions like a once-in-a-century event (such as the COVID-19 pandemic), India's general government debt could reach 100% of the debt-to-GDP ratio by 2027-28.

Finance Ministry's Response

- Clarification of Factual Position: The Finance Ministry emphasized that certain presumptions and interpretations about India's indebtedness levels are based on possible scenarios, which do not accurately reflect the factual position.

- Comparison with Other Countries: The Ministry highlighted that similar IMF reports for other countries show much higher extreme scenarios. For instance, the U.S., U.K., and China could face debt-to-GDP ratios of 160%, 140%, and 200%, respectively, under adverse shocks.

- Relative Performance: The Ministry shared a cross-country comparison, asserting that India's general government debt had decreased from about 88% in 2020-21 to around 81% in 2022-23. It emphasized that India has done relatively well and is still below the debt level of 2002.

- Worst-Case Scenario: The Ministry clarified that the IMF's assessment talks about a worst-case scenario, not a definitive outcome. It pointed out that the same report indicates the possibility of the debt-to-GDP ratio declining to below 70% under favourable circumstances.

- Global Shocks: The statement acknowledged that the shocks experienced by India in this century were global in nature (global financial crisis, Taper Tantrum, COVID-19, Russia-Ukraine War), affecting the global economy. Therefore, any adverse global shock is expected to impact economies universally.

Conclusion

- The Finance Ministry's response aims to provide context and clarification regarding the IMF's scenario-based assessment. By emphasizing the extreme nature of the scenario and comparing India's situation with other countries, the Ministry seeks to prevent misinterpretation and assure stakeholders that the mentioned debt level is a worst-case possibility, not a predetermined outcome. It also underscores India's relative fiscal performance in the global context.

|

PRACTICE QUESTION

Q. How is India managing the challenges posed by its increasing national debt, and what strategies are being considered to address this issue in the long term?

|