Disclaimer: Copyright infringement not intended.

Context

- The Reserve Bank of India’s Monetary Policy Committee (MPC) highlighted the challenges posed by food price pressures in disrupting the ongoing disinflation process, thereby hindering the descent of inflation to the target of 4%.

Persisting Retail Food Inflation

- In February, retail food inflation stood at 8.7%, surpassing the overall year-on-year consumer price increase of 5.1%.

- This elevated level of food inflation has persisted for eight consecutive months since July 2023.

Hope for Softening Food Inflation

- Despite the current scenario, there is optimism regarding the softening of food inflation in the upcoming months, which could potentially allow the MPC to consider reducing the central bank’s benchmark interest rates. Two primary drivers contribute to this optimism:

Influence of International Prices

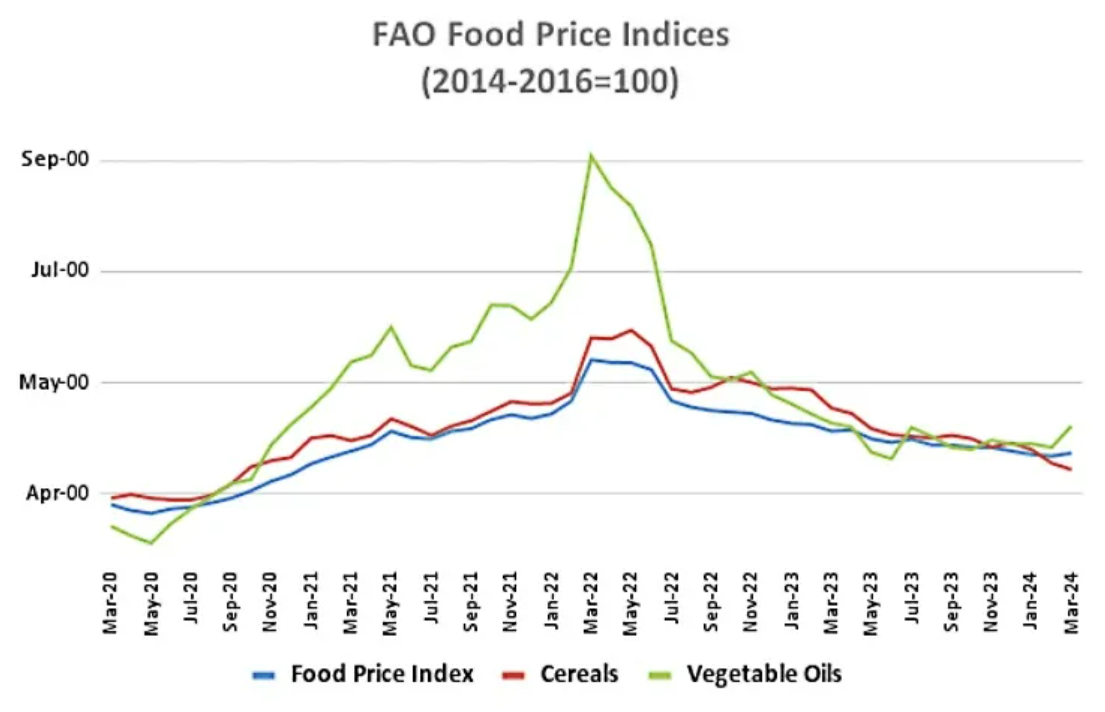

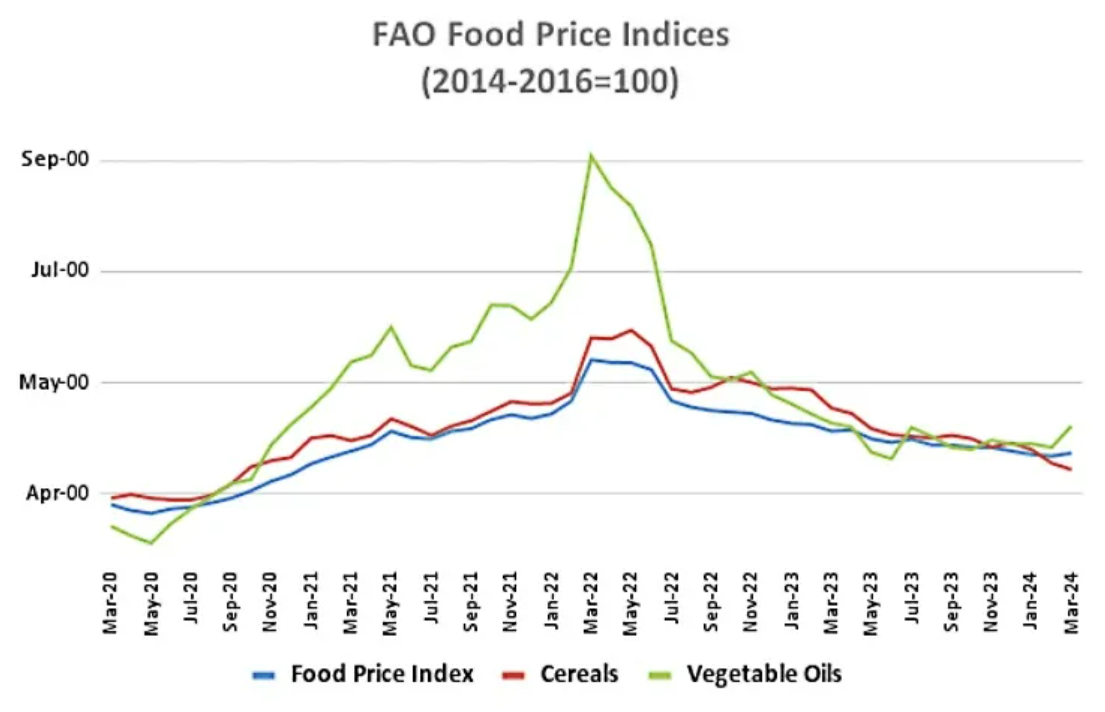

- The Food and Agriculture Organization's food price index averaged 118.3 points in March 2024, marking a significant decline of 7.7% from the previous year.

- This index is substantially lower (26.2%) than the all-time high of 160.3 points recorded in March 2022, following Russia’s invasion of Ukraine.

- The vegetable oils index witnessed a notable increase from 120.9 points to 130.6 points, contributing to the overall rise in the food price index.

- Despite this increase, the vegetable oils index remains significantly below its peak of 251.8 points observed in March 2022.

- Conversely, the cereal price index has continued its downward trend, with the March index at 110.8 points, reflecting a 20% decrease from the previous year and a 36.1% decline from its peak in May 2022.

Easing Global Food Prices: Facilitating Imports

- The recent decline in global food prices, attributed to favorable harvests in key producing nations and the restoration of supply lines post disruptions induced by Covid-19 and the Ukraine War, has created a conducive environment for imports.

Wheat Stocks and Harvest Outlook

- As of April 1, estimated wheat stocks stood at approximately 7.6 million tonnes, marking a 16-year low and nearing the minimum buffer norm of 7.46 million tonnes.

- Anticipation regarding the new crop, whose harvesting has commenced, suggests a decrease in size by 3-4% in Rajasthan, 7-8% in Madhya Pradesh, 15-20% in Gujarat, and 25% in Maharashtra.

- The delayed onset of winter, characterized by above-normal temperatures in November-December, accelerated flowering and shortened the crop's vegetative growth phase in various regions of central India.

Regional Harvest Conditions

- Despite these challenges, wheat in Punjab, Haryana, Uttar Pradesh, and Bihar appears to be in good condition, potentially mitigating the overall impact on the country's production.

Favorable Export Price Dynamics

- Export price quotes for Russian and European wheat have significantly decreased to $200-215 per tonne free-on-board, compared to the highs of $400-450 observed between March and May 2022, following the outbreak of the Ukraine War.

- Taking into account freight and other charges of $40-50, the landed cost of imported wheat is estimated to be around $260 per tonne or Rs 2,170/quintal, which is lower than the government's minimum support price of Rs 2,275/quintal for domestically-grown wheat.

Potential Import Decision and Future Outlook

- A decision on wheat imports, involving a reduction in the current customs duty of 40%, is more likely after elections.

- By then, Indian farmers would have marketed their wheat, coinciding with the availability of the new crop from Russia and Ukraine for harvesting in July-August.

The convergence of these factors suggests a potential shift towards importing wheat to meet domestic demand while capitalizing on favorable global market conditions.

Impact of La Niña on Pulses Imports and Production

Surge in Pulses Imports

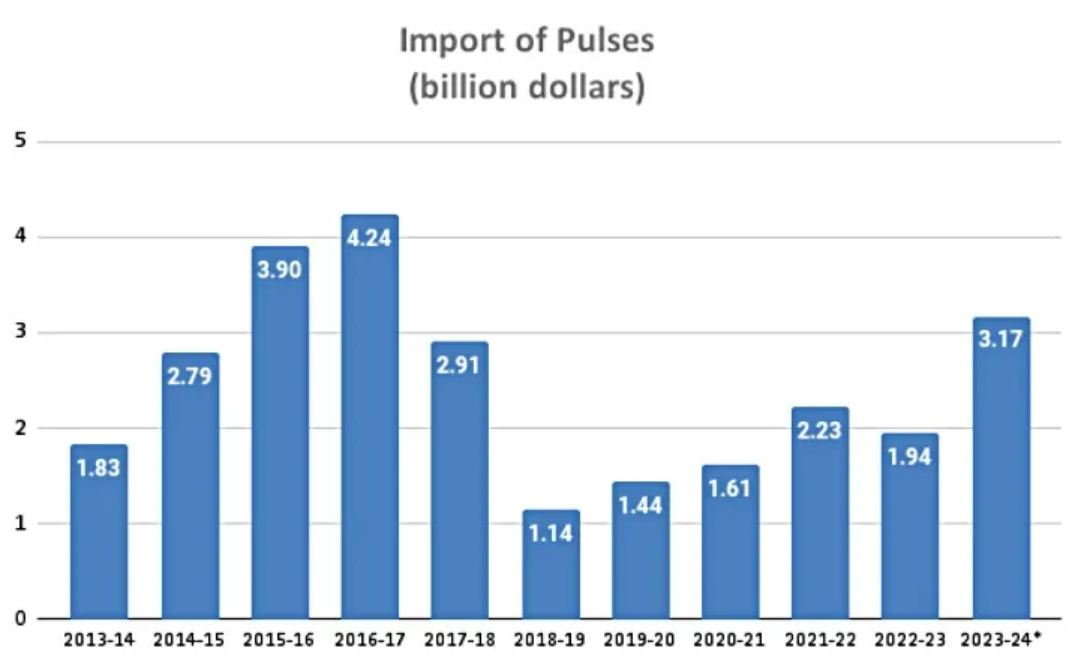

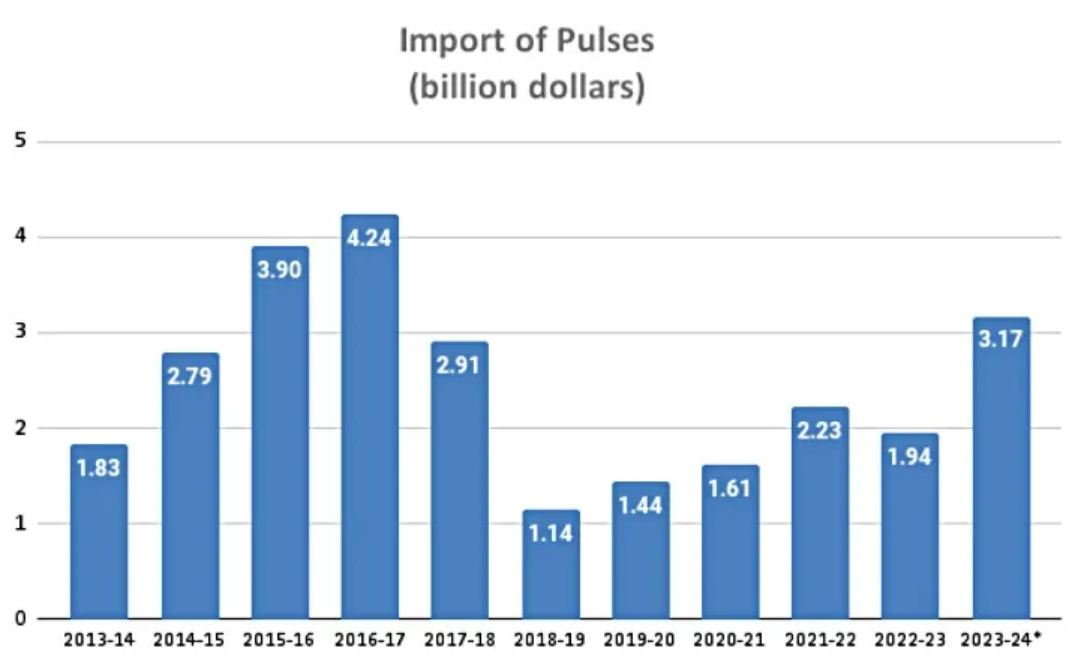

- During April-February 2023-24, India's pulses imports surged to $3.17 billion, representing an increase of over 80% compared to the corresponding period in 2022-23.

- The fiscal year ending March 2024 is expected to witness total imports nearing $3.5 billion, the highest since 2015-16 and 2016-17.

Influence of El Niño on Pulses Production

- The surge in imports was primarily attributed to El Niño, characterized by abnormal warming of the central and eastern equatorial Pacific Ocean waters, which typically leads to suppressed rainfall in India.

- In 2023, the southwest monsoon, northeast monsoon, and winter seasons experienced patchy rainfall, adversely affecting pulses-growing states like Karnataka and Maharashtra.

- Consequently, the Union Agriculture Ministry estimated a decline in the country's pulses output to 23.4 million tonnes in 2023-24, down from 26.1 million tonnes and 27.3 million tonnes in the preceding two years.

Impact on Prices and Inflation

- Despite increased imports, retail inflation in pulses remained high at 18.9% in February, indicating persistent price pressures.

- Unlike vegetable oils, which witnessed disinflation (-14%) due to a global price crash and record imports, pulses prices remained elevated.

Outlook: Transition to La Niña

Weakening of El Niño

- The latest Oceanic Niño Index (ONI) for January-March 2024 recorded a deviation of 1.5 degrees Celsius, indicating weakening El Niño conditions.

- The US National Oceanic and Atmospheric Administration predicts an 83% probability of ONI transitioning to a neutral range by April-June 2024.

Potential for La Niña

- There is a 62% chance of La Niña developing during June-August 2024, with probabilities increasing to 75% for July-September and 82% for August-October.

- Historically, La Niña is associated with surplus rainfall in India, raising hopes of a bountiful agricultural year in 2024-25.

Implications for Food Inflation and Government Policy

- A favorable agricultural year in 2024-25, facilitated by La Niña, could help mitigate food inflation pressures.

- The potential easing of inflationary concerns would be advantageous for the government post the Lok Sabha election results in June 2024.

The evolving La Niña conditions offer a glimmer of hope for India's agricultural sector, potentially alleviating pressures on food prices and contributing to economic stability in the post-election period.

Food Inflation Metrics in India

Consumer Food Price Index (CFPI)

- CFPI monitors changes in retail prices of food products consumed by specific population groups in defined areas.

- Released monthly by the Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation (MOSPI), it covers rural, urban, and combined categories nationwide.

- Like the Consumer Price Index (CPI), CFPI is calculated monthly, employing 2012 as the base year.

Wholesale Price Index (WPI) Food Index

- Launched as part of the revised WPI series on May 12, 2017, with the base year 2011-12.

- Reflects fluctuations in food item prices using quotations from producers, distinguishing it from the CPI Food Price Index, which relies on retailer quotations.

- Aggregated from WPI for "Food Products" under "Manufacture Products" and "Food Articles" under "Primary Article" using weighted arithmetic mean.

- Historically, WPI has been the primary measure for gauging inflation in India.

Global Food Price Index

- Compiled by the Food and Agriculture Organization of the United Nations (FAO), it tracks monthly shifts in international prices of a basket of food commodities.

- Comprised of average price indices for five commodity groups: Cereal, Vegetable Oil, Dairy, Meat, and Sugar.

Base Effect

- Refers to comparing current year price levels to those of the previous year.

- High inflation in the prior year factors into current calculations, resulting in relatively lower inflation rates for similar price increases in the current year.

- Conversely, low inflation in the previous year can lead to higher current inflation rates, even with minor price index rises.

Understanding these indices and the base effect aids policymakers, economists, and analysts in interpreting food inflation trends and crafting effective strategies to manage inflationary pressures within the economy.

|

PRACTICE QUESTION

Q. Examine the causes of food inflation in India and assess the efficacy of government interventions in managing it. Propose policy reforms to mitigate the impact of food inflation on the economy.

|